It has been 3 months since China issued its Blocking Statute yet it has never been used. But this may change now.

At a press con held on Mar 25, MOFCOM spokesperson mentioned, in response to a question on the US sanctions on Iran, that China would:

At a press con held on Mar 25, MOFCOM spokesperson mentioned, in response to a question on the US sanctions on Iran, that China would:

https://twitter.com/henrysgao/status/1347745529447342086

"firmly safeguard the normal economic and trade cooperation between China and Iran and its legitimate rights and interests"

"If the extraterritorial application of relevant foreign laws and measures violates international law and basic norms of international relations,

"If the extraterritorial application of relevant foreign laws and measures violates international law and basic norms of international relations,

and damages the legitimate rights and interests of Chinese citizens, legal persons or other organizations, China will carry out relevant work in accordance with relevant legal provisions, and firmly safeguard national sovereignty, security & development interests"

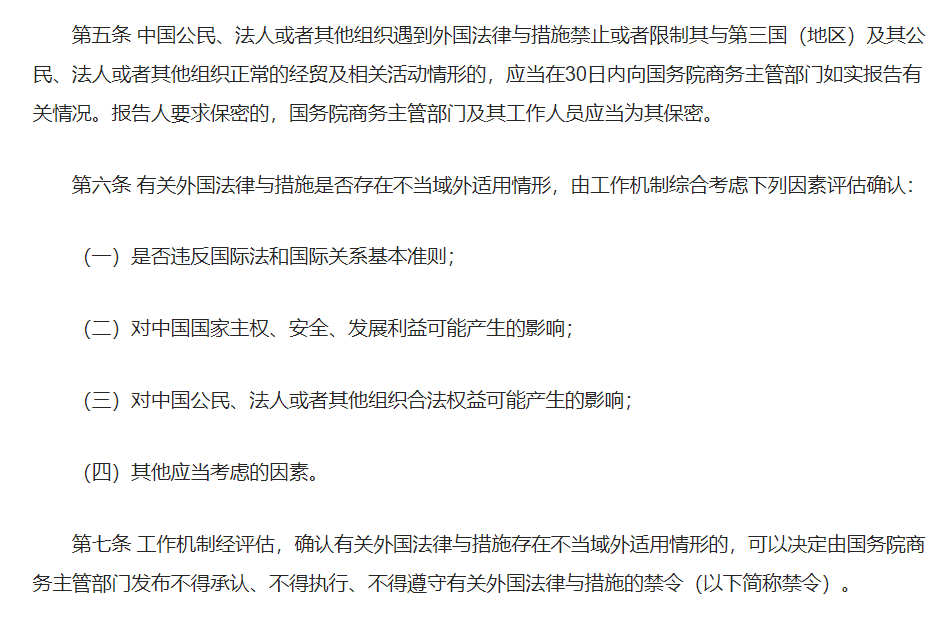

Two days after the press con, China signed a 25-year comprehensive cooperation agreement with Iran, which includes deals on Iranian oil subject to US sanctions. This would be a classical situation envisaged in China's Blocking Statute, i.e.:

"The extraterritorial application of foreign laws violates int'l law & basic norms of int'l relations, and unduly prohibits or restricts Chinese citizens, legal persons or other organizations from conducting normal economic, trade and related activities with third countries".

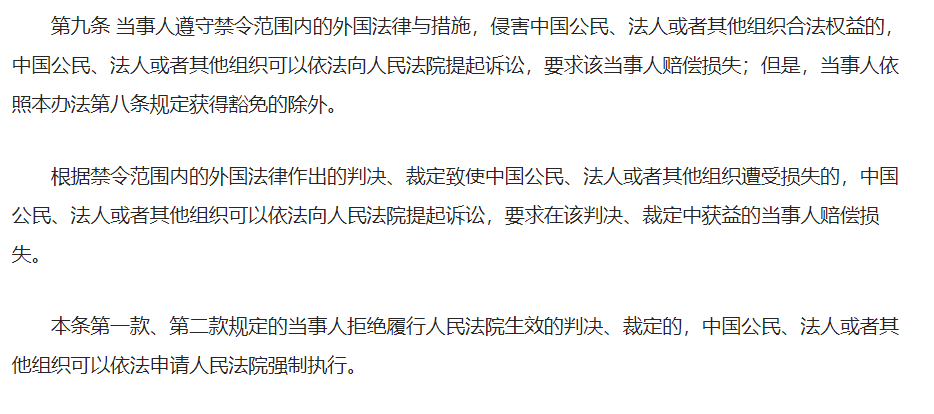

If the Blocking Statute is invoked this time, many big companies will be put between a rock and a hard place, as I mentioned in my @nytimes interview on the Blocking Statute when it first came out.

nytimes.com/2021/01/09/bus…

nytimes.com/2021/01/09/bus…

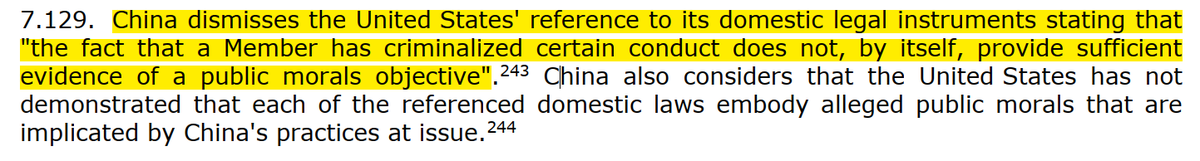

As I mentioned in same interview, China wanted to use the Blocking Statute to deter the new administration from behaving like Trump, but as Biden started to unveil trade policies, such hopes are dashed, as many of the Trump-era policies were maintained or even strengthened.

For example, @USTradeRep's 2021 National Trade Estimate Report issued on Mar 31 praised Trump-made “Phase 1 Agreement" as "an (sic) historic economic and trade agreement" with "a strong dispute resolution system that ensures prompt and effective implementation and enforcement"

This is also confirmed by @AmbassadorTai's interview with the @WSJ on Mar 28, where she confirmed that “no negotiator walks away from leverage", but “every good negotiator retains his or her leverage to use it"!

wsj.com/articles/new-t…

wsj.com/articles/new-t…

So if the US is retaining Trump-era trade restrictions as leverage, they shouldn't be surprised that China starts to use its Blocking Statute as leverage.

• • •

Missing some Tweet in this thread? You can try to

force a refresh