In November, @michaelnerby closed on 2 laundromats in CA

Used $25k cash to close on assets worth ~$1 Million

- 4,200 sqft w/ 114 washers & dryers

A thread on creating $250k in boring biz cash flow: (WARNING - no NFTs were used in the creating of this deal 🤣)

Used $25k cash to close on assets worth ~$1 Million

- 4,200 sqft w/ 114 washers & dryers

A thread on creating $250k in boring biz cash flow: (WARNING - no NFTs were used in the creating of this deal 🤣)

Got the property through a broker referral. (@BizBuySell)

Followed up to get the financials.

Financials looked good (aka clean and profitable)

Both locations bringing in 46k gross and approx $23k net.

Followed up to get the financials.

Financials looked good (aka clean and profitable)

Both locations bringing in 46k gross and approx $23k net.

Arranged a visit to walk the properties.

No branding. Terrible flooring & green paint job 🤢.

Hardly any marketing.

Absentee owner.

No credit card.

No drop-off services.

No website = GOLD.

Lots of room for improvement... Start getting excited.

No branding. Terrible flooring & green paint job 🤢.

Hardly any marketing.

Absentee owner.

No credit card.

No drop-off services.

No website = GOLD.

Lots of room for improvement... Start getting excited.

Asking price $1,250,000

Meh - no thx.

COVID headwinds, another location being remodeled nearby, the seller being absentee, they had some wiggle room.

He put in an offer at $900,000

Seller to carry 50% at 5% for 8 years (read that again)

Meh - no thx.

COVID headwinds, another location being remodeled nearby, the seller being absentee, they had some wiggle room.

He put in an offer at $900,000

Seller to carry 50% at 5% for 8 years (read that again)

Terms: $975k (pending DD)

Raised the rest of the capital from investors for the ~50% equity.

Ran the due diligence. Sat and counted coins (riveting)

Financial analysis aka checked w/the tax man on their filings

Turns out they didn't lie. So we signed on the dotted line.

Raised the rest of the capital from investors for the ~50% equity.

Ran the due diligence. Sat and counted coins (riveting)

Financial analysis aka checked w/the tax man on their filings

Turns out they didn't lie. So we signed on the dotted line.

DD = ways to bring the price down & make sure no shenanigans.

Countered to $900k again. (Old equipment, more repairs)

The seller countered to $925,000. Yup! BOUGHT.

Countered to $900k again. (Old equipment, more repairs)

The seller countered to $925,000. Yup! BOUGHT.

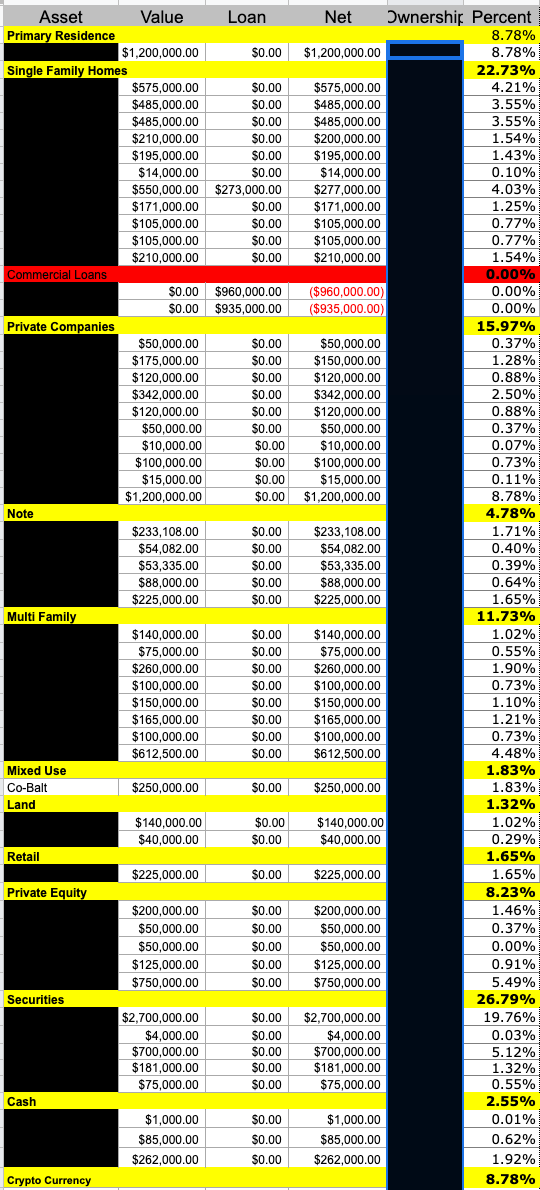

Here's the financial skinny:

Private capital = $575,000 (extra $100k for renovations and start up costs)

Seller = $450,000

Final purchase price = $925,000

His own $25k. That's it.

Private capital = $575,000 (extra $100k for renovations and start up costs)

Seller = $450,000

Final purchase price = $925,000

His own $25k. That's it.

Renovation plan:

- Change signage

- Rebrand

- Website and online presence

- Internet and print marketing campaign

- Flooring

- Paint

- Replace machines that needed it

- Wifi and Wifi add-ons

- Increase prices

- Implement drop off services

- Change signage

- Rebrand

- Website and online presence

- Internet and print marketing campaign

- Flooring

- Paint

- Replace machines that needed it

- Wifi and Wifi add-ons

- Increase prices

- Implement drop off services

Projections for year 1:

$550,000 = gross

$270,000 = expenses

$280,000 = NOI (~30%)

$68,328 = interest and principal

$211,672 = cash flow

$550,000 = gross

$270,000 = expenses

$280,000 = NOI (~30%)

$68,328 = interest and principal

$211,672 = cash flow

The plan is to hold for 3-5 years. Implement the take-over strategy. Seek out options to refinance to take out the seller finance and return a portion of the investor capital.

Then hold long-term for cash flow

Then hold long-term for cash flow

If you want to learn how to buy a laundromat and run it here’s the deal —> unconventionalacquisitions.com/event

• • •

Missing some Tweet in this thread? You can try to

force a refresh