10 Hard Truths About Getting Rich.

The things no one told me, that are the opposite of PC.. and turn out to be true... (a thread)

The things no one told me, that are the opposite of PC.. and turn out to be true... (a thread)

1) You need to know how it feels to lose, to win. You won’t take enough financial risk if you always play small.

So I hope you lose early, then you’ll see at once how it feels to survive & realize you aren't invincible.

So I hope you lose early, then you’ll see at once how it feels to survive & realize you aren't invincible.

2) There is a direct correlation between doing hard things AND making money.

The harder the problems you solve, the tougher the challenges you put in front of yourself, for some reason the universe rewards those.

The harder the problems you solve, the tougher the challenges you put in front of yourself, for some reason the universe rewards those.

3) Money is a cruel mistress.

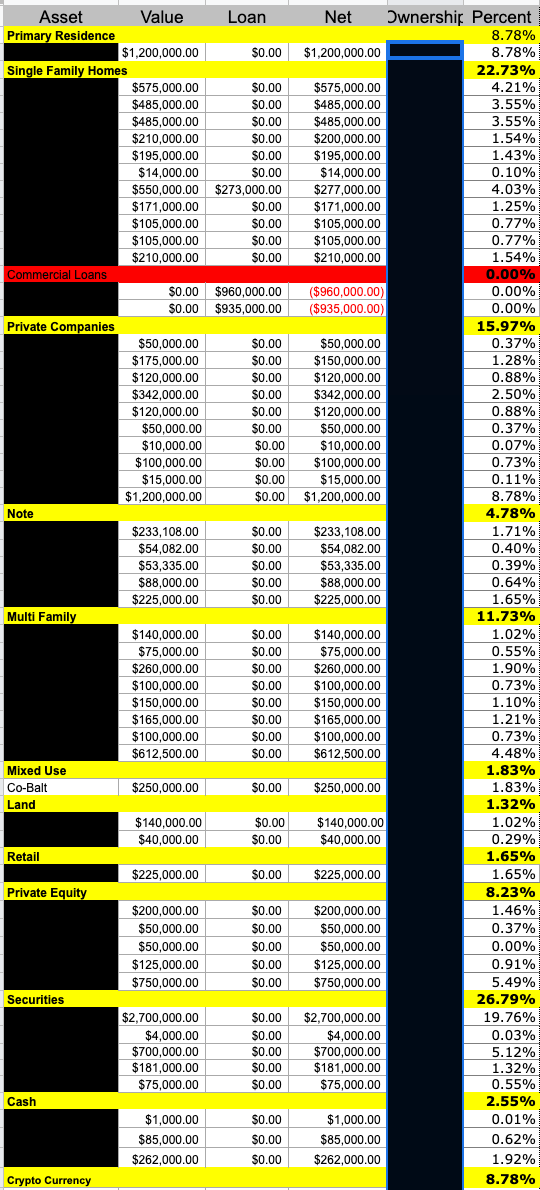

If you don’t pay attention to her, she’ll leave you for someone who will. Budget, track, and care for your wealth, or it'll leave you for the pool boy (or something like that).

If you don’t pay attention to her, she’ll leave you for someone who will. Budget, track, and care for your wealth, or it'll leave you for the pool boy (or something like that).

4) The government is not responsible for your financial freedom. You are.

Social security probably won’t exist when you retire. You are your own retirement plan.

Social security probably won’t exist when you retire. You are your own retirement plan.

5) When you lose money, it’s always your fault, even when it’s not.

I’ve been scammed, lied to, cheated, stolen from. It was all my fault. I got myself into those situations. Take responsibility and $$ follows.

I’ve been scammed, lied to, cheated, stolen from. It was all my fault. I got myself into those situations. Take responsibility and $$ follows.

6) Trading time for money, is playing someone else’s game.

It’s great to be an employee, if you’re learning, growing and like the work. But don’t trade your $ for time just thinking it'll get your rich one day.

It’s great to be an employee, if you’re learning, growing and like the work. But don’t trade your $ for time just thinking it'll get your rich one day.

7) You don’t have wealth until you earn while you sleep.

Until then you’re just well paid.

Until then you’re just well paid.

8) In the beginning learning > payments.

Getting greedy fighting over pennies when you could be downloading knowledge millions is where most young people mess up.

Getting greedy fighting over pennies when you could be downloading knowledge millions is where most young people mess up.

9) If you’re wearing a tax the rich shirt, you’ll probably never be wealthy. You hate the thing you’re seeking.

So it’ll elude you. (Unless you're already rich, then you're just virtue signaling).

So it’ll elude you. (Unless you're already rich, then you're just virtue signaling).

10) Money is just a tool.

More tools = more opportunity to build the world you want. That is a worthy goal.

More tools = more opportunity to build the world you want. That is a worthy goal.

• • •

Missing some Tweet in this thread? You can try to

force a refresh