I was burned out in finance, working on someone else's schedule, tired of having my time tied to $.

So I started investing in cash-flowing biz's.

Not sexy startups, but boring businesses.

One of my fav small deals netted $67k a year, $100k at close... w/ quarters

A thread:

So I started investing in cash-flowing biz's.

Not sexy startups, but boring businesses.

One of my fav small deals netted $67k a year, $100k at close... w/ quarters

A thread:

I asked myself:

How could I work when I want, where I want and on what I want.

Problem:

I'm not smart enough to create the next Tesla, Bitcoin, FB, etc.

How could I work when I want, where I want and on what I want.

Problem:

I'm not smart enough to create the next Tesla, Bitcoin, FB, etc.

But I can model like a MF'er and I'm pretty good at DD

Solution: Maybe I should just buy a boring cash-flowing biz?

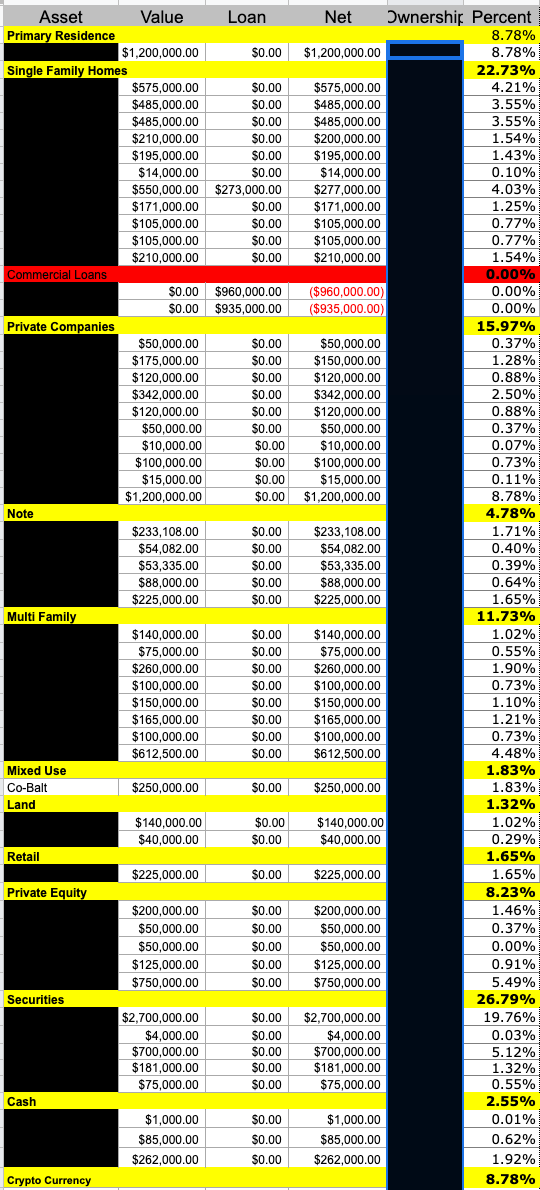

Now I own 7 that I'm active in and many more that I passively invest in.

Now I ask myself: how do I get more people in the ownership/acquirer seat?

Solution: Maybe I should just buy a boring cash-flowing biz?

Now I own 7 that I'm active in and many more that I passively invest in.

Now I ask myself: how do I get more people in the ownership/acquirer seat?

Solution:

We figured out that one of the simplest and easiest places to start buying businesses is in laundromats. Why?

1) Simple - customers do the majority of the work

2) Little labor - means training, on-boarding, and labor is relatively minimal

We figured out that one of the simplest and easiest places to start buying businesses is in laundromats. Why?

1) Simple - customers do the majority of the work

2) Little labor - means training, on-boarding, and labor is relatively minimal

3) Upfront cash - customers pay upfront, makes accounting easier

4) Recession resistant -people always need clean clothes

5) Good ROI - laundry industry has a 20-35% ROI and nearly a 95% success rate, according to Speed Queen (eek, not sure on 95% but maybe directionally).

4) Recession resistant -people always need clean clothes

5) Good ROI - laundry industry has a 20-35% ROI and nearly a 95% success rate, according to Speed Queen (eek, not sure on 95% but maybe directionally).

5) Inventory. - Unlike a restaurant, convenience store, or grocery store, laundromats have very little physical inventory.

6) No Seasonality - Not seasonal or weather-dependent

7) There's a program and a roadmap to follow. There's a way to do it passively

6) No Seasonality - Not seasonal or weather-dependent

7) There's a program and a roadmap to follow. There's a way to do it passively

Cons:

Who the f*ck grew up wanting to be a laundromat owner or work in one? Not me.

Could we do it passively?

Turns out yes.

Who the f*ck grew up wanting to be a laundromat owner or work in one? Not me.

Could we do it passively?

Turns out yes.

Sound cool?

That's why we did a write-up and playbook with our friend who has bought 3 of these, for $900k in income and works about 10 hours a week on them.

That's why we did a write-up and playbook with our friend who has bought 3 of these, for $900k in income and works about 10 hours a week on them.

https://twitter.com/Codie_Sanchez/status/1378032046447202306

So follow along for the ride to hear more opportunities like these, input your email to learn more, and maybe this is your path to increased financial freedom as well.

Get on this list for more quarter grabbing, sudsy loving goodness 👉…oducts.unconventionalacquisitions.com/passiveincome

• • •

Missing some Tweet in this thread? You can try to

force a refresh