So a little more on UiPath

It took UiPath 10 years to go from $0 to $1m in revenue. Yes, 10 years!

Then, it went from $1m to $600m the following 5 years

5+ Interesting Learnings: ⬇️⬇️⬇️⬇️⬇️

It took UiPath 10 years to go from $0 to $1m in revenue. Yes, 10 years!

Then, it went from $1m to $600m the following 5 years

5+ Interesting Learnings: ⬇️⬇️⬇️⬇️⬇️

First, note UiPath isn't >really< SaaS. Only a small fraction of its customers run in the Cloud

In fact, it might be first IPO in some time where a significant % of customers run the software on Windows!

But, it's priced & sold like SaaS

The definition of "SaaS" has broadened

In fact, it might be first IPO in some time where a significant % of customers run the software on Windows!

But, it's priced & sold like SaaS

The definition of "SaaS" has broadened

#1. NPS of 71 and 145% NRR

Yes, NPS can be a bit subjective. And yes, it seems like everyone has a high NPS these days

But having 145% NRR and 71 NPS go together like milk and cookies. They build on each other, into something powerful.

We'll see just how powerful shortly

Yes, NPS can be a bit subjective. And yes, it seems like everyone has a high NPS these days

But having 145% NRR and 71 NPS go together like milk and cookies. They build on each other, into something powerful.

We'll see just how powerful shortly

#2. Customer count growing 33%, revenue growing 65% — “Golden Ratio” for future growth

UiPath grew from 6,009 to 7,968 customers last yr, or +33%. And revenue grew 65%.

If you can grow new bookings AND upsell at about a 1:1 ratio that’s the golden ratio for future growth

UiPath grew from 6,009 to 7,968 customers last yr, or +33%. And revenue grew 65%.

If you can grow new bookings AND upsell at about a 1:1 ratio that’s the golden ratio for future growth

#3. Technology partners & integrators are key to growth. 3,700 total partners, 50 key elite ones

This is an important piece of UiPath story. Growth has been fueled by huge Cloud migration initiatives Deloitte, Accenture, etc. have. They charge 3x-10x more for end deployment

This is an important piece of UiPath story. Growth has been fueled by huge Cloud migration initiatives Deloitte, Accenture, etc. have. They charge 3x-10x more for end deployment

#4. UiPath uses the term “ARR” loosely

ARR used to mean true recurring revenues. Today, its definition has … loosened. Merely to revenue with 100%+ retention.

Most of UiPath’s revenue is in annual and multi-year software licenses & maintenance

ARR used to mean true recurring revenues. Today, its definition has … loosened. Merely to revenue with 100%+ retention.

Most of UiPath’s revenue is in annual and multi-year software licenses & maintenance

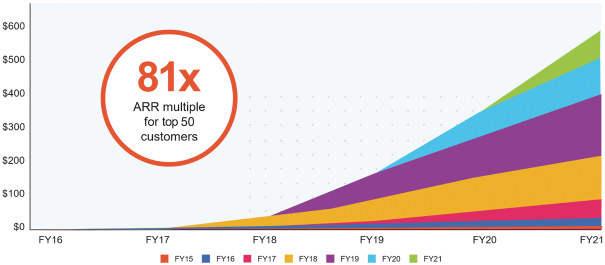

#5. Top 50 customers grew bookings a stunning 81x since 2016, and all 2016 customers together grew 57x.

Wow.

Now that’s the power of high NRR, when you see it this way.

140%+ NRR compounds to something truly awesome 5+ years out:

Wow.

Now that’s the power of high NRR, when you see it this way.

140%+ NRR compounds to something truly awesome 5+ years out:

Bet big on your early customers, especially.

These 2016 customers really bought more over time ... their first $400k of customers now pay $22.7 million!!!

From an acorn of happy customers, a might oak does grow

These 2016 customers really bought more over time ... their first $400k of customers now pay $22.7 million!!!

From an acorn of happy customers, a might oak does grow

A few bonus learnings:

#6. 35% of their revenue from $1m+ ACV customers, and 97% gross retention.

Your $1m+ customers really should stay forever. ServiceNow has 99% logo retention.

UiPath is 97%, very impressive, with 35% of its customers whales ($1m+)

#6. 35% of their revenue from $1m+ ACV customers, and 97% gross retention.

Your $1m+ customers really should stay forever. ServiceNow has 99% logo retention.

UiPath is 97%, very impressive, with 35% of its customers whales ($1m+)

#7. U.S. is only 36% of their ARR.

So not really a U.S. success story per se!

UiPath was originally founded in Romania, much later set up HQ in New York. But interesting, the U.S. is still a minority of their revenue.

You are your roots.

So not really a U.S. success story per se!

UiPath was originally founded in Romania, much later set up HQ in New York. But interesting, the U.S. is still a minority of their revenue.

You are your roots.

#8. CEO controls 91% of voting stock & still owns 30% of the company

Accel is the largest investor with 28%. But CEO Daniel Dines gave up zero control, with 91% of voting shares & 30% total ownership!

UiPath "almost bootstrapped" (1 small pre-growth round ). It can pay off

Accel is the largest investor with 28%. But CEO Daniel Dines gave up zero control, with 91% of voting shares & 30% total ownership!

UiPath "almost bootstrapped" (1 small pre-growth round ). It can pay off

• • •

Missing some Tweet in this thread? You can try to

force a refresh