One of my favorite things about @themotleyfool is the transparency

All employees & contractors (like me!) are required to disclose our holdings at all times

Here's how to find them⬇️

All employees & contractors (like me!) are required to disclose our holdings at all times

Here's how to find them⬇️

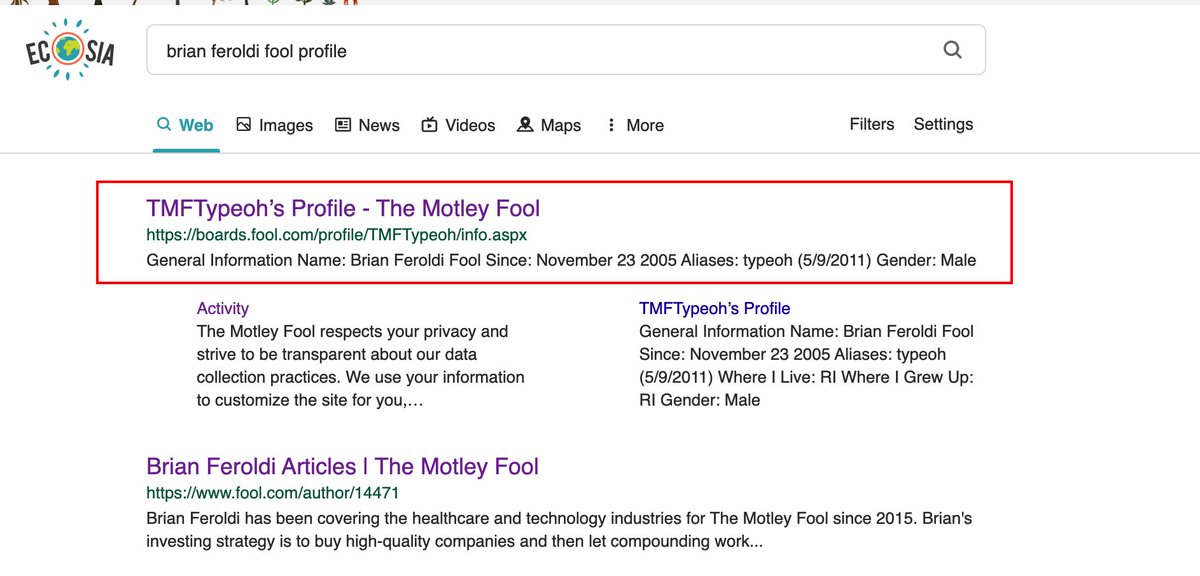

1⃣Enter the person's name & "fool profile" into a search engine

2⃣Click on the link that starts with "boards.fool.com"

2⃣Click on the link that starts with "boards.fool.com"

5⃣All Fools have to go through this process to buy/sell

1⃣Not mention stock publically for 2 business days

2⃣Check w/ legal

3⃣Buy/Sell

4⃣Update profile

5⃣Notify legal of the transaction

6⃣Not mention stock publically stock for 2 business days

1⃣Not mention stock publically for 2 business days

2⃣Check w/ legal

3⃣Buy/Sell

4⃣Update profile

5⃣Notify legal of the transaction

6⃣Not mention stock publically stock for 2 business days

• • •

Missing some Tweet in this thread? You can try to

force a refresh