Brentford’s 2019/20 financial results covered a season when they narrowly missed out on promotion, finishing 3rd in the Championship before losing the play-off final to Fulham. Some thoughts in the following thread #BrentfordFC

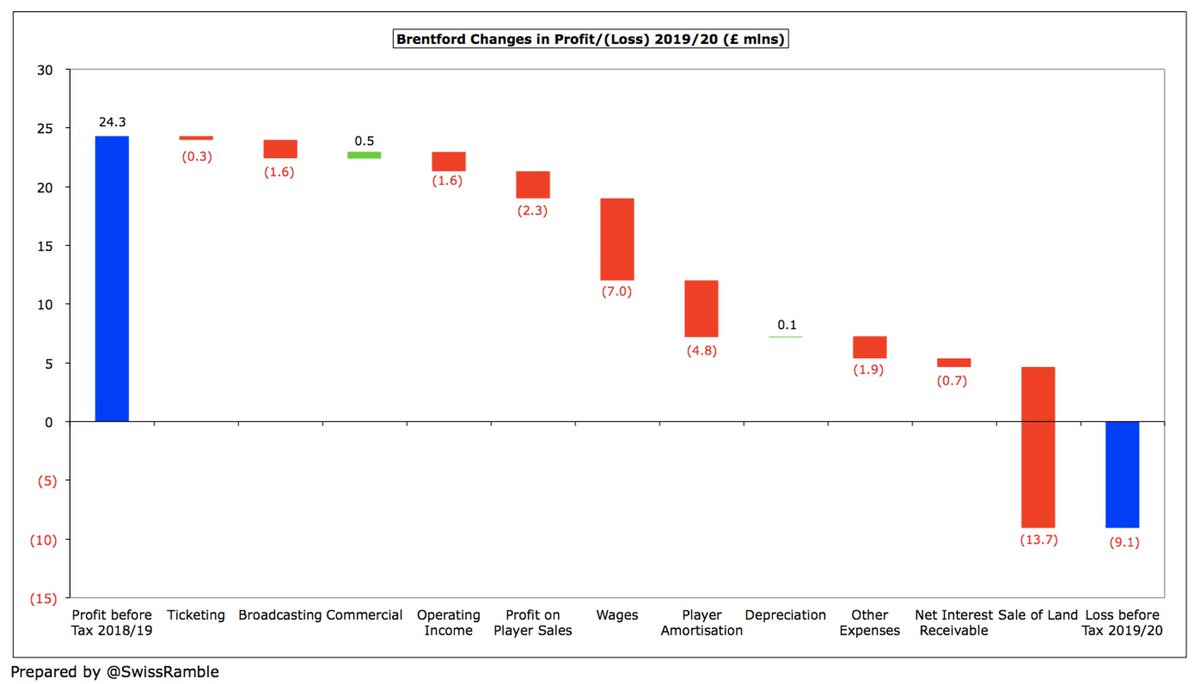

#BrentfordFC swung from £24m profit before tax to £9m loss, as last year benefited from £14m sale of land. Revenue dropped £1.3m (9%) from £15.2m to £13.9m, while profit on player sales fell £2m to £25m. Investment in the squad meant expenses increased £14m. Loss after tax £10m.

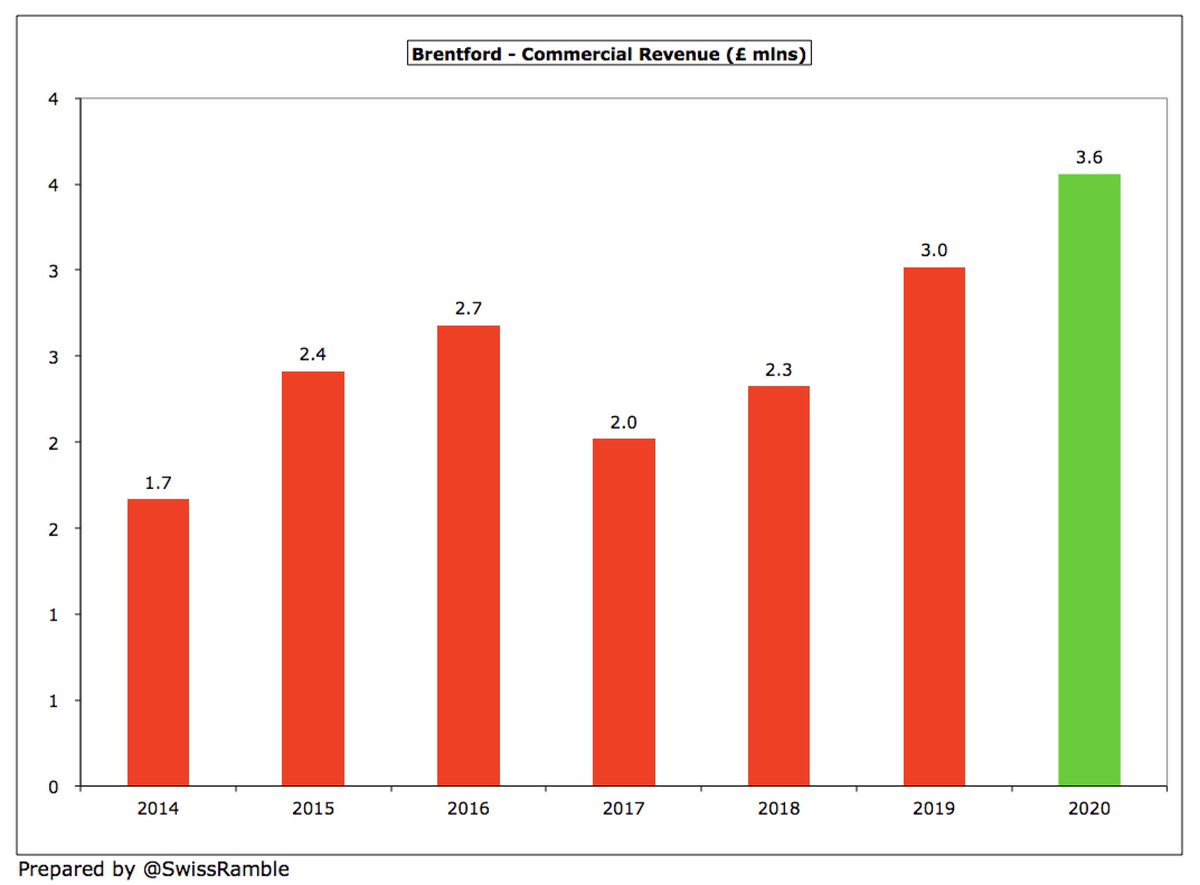

Main driver of COVID-impacted #BrentfordFC revenue decrease was broadcasting, down £1.6m (18%) to £7.3m, while ticketing also fell £0.3m (9%) to £3.1m, partly offset by commercial rising £0.5m (18%) to £3.6m. Other income fell £1.6m to £1.0m, including job retention scheme £635k.

#BrentfordFC investment resulted in increases in wage bill, up £7m (37%) from £19m to £26m, and player amortisation, up £4.8m (73%) to £11.5m, while other expenses were up £1.9m (20%) to £11.1m. Net interest receivable fell £0.7m, due to unwinding of discount on transfers.

#BrentfordFC loss of £9m is actually one of the better financial results to date in the 2019/20 Championship, only surpassed by Hull City’s £3m profit. Even before the pandemic, many clubs lost more than £20m, while #LUFC and #Boro reported losses of £62m and £36m last year.

It is also worth noting that some clubs’ figures were boosted by the sale of stadiums, training grounds and land, especially #DCFC £40m, #SWFC £38m and #AVFC £36m, so underlying figures were even worse than reported. #BrentfordFC prior year included £14m from sale of land.

Excluding property sales, only two Championship clubs are profitable (might only be one when all 2019/20 accounts are published). The sad reality is that almost all clubs in this division lose money, as they strive to remain competitive in pursuit of promotion to the top flight.

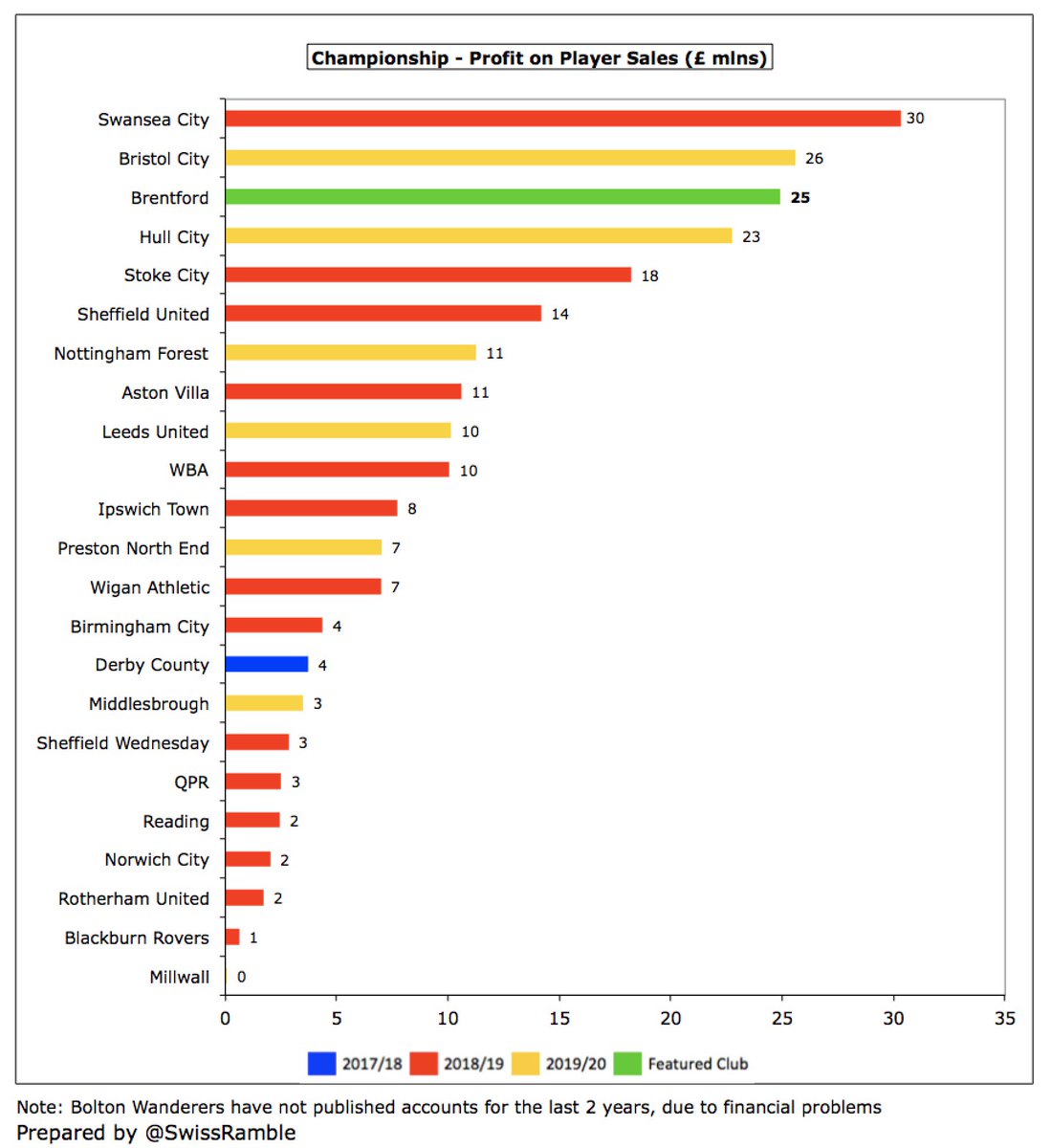

#BrentfordFC benefited from £25m profit on player sales, mainly Neal Maupay to #BHAFC and Ezri Konsa to #AVFC. This was £2m lower than prior year’s £27m, but second highest in the Championship to date, behind Bristol City £26m, and almost twice as high as club’s £14m revenue.

#BrentfordFC have only made a profit once in the last 10 years: £24m in 2019, boosted by £14m from the land sale. However, they have managed to limit the size of their losses, e.g. only £1m in 2017 and £4m in 2018, which is no mean feat, given their small turnover.

This is largely due to player trading, which chief executive Jon Varney described as “an incredibly important part of us becoming a sustainable football club”. #BrentfordFC have made an impressive £94m profit from player sales in the last 5 seasons (£52m in last 2 years alone).

This season will see further gains with around £50m of sales, including Ollie Watkins to #AVFC and Said Benrahma to #WHUFC. According to Transfermarkt, #BrentfordFC have sold players costing £22m for £171m in the last 6 years (including 2020/21), thereby adding £148m of value.

There’s no doubt that #BrentfordFC have become the “smooth operators” of the transfer market, though there must be a concern that prices will be depressed by COVID-19, which would have a big impact on the club, as this activity is “fundamental to the business model”.

#BrentfordFC operating losses (i.e. excluding player sales and interest payable) widened from £17m to £34m. This is obviously not great, but in fairness almost every Championship club posts substantial operating losses, i.e. half of them above £30m.

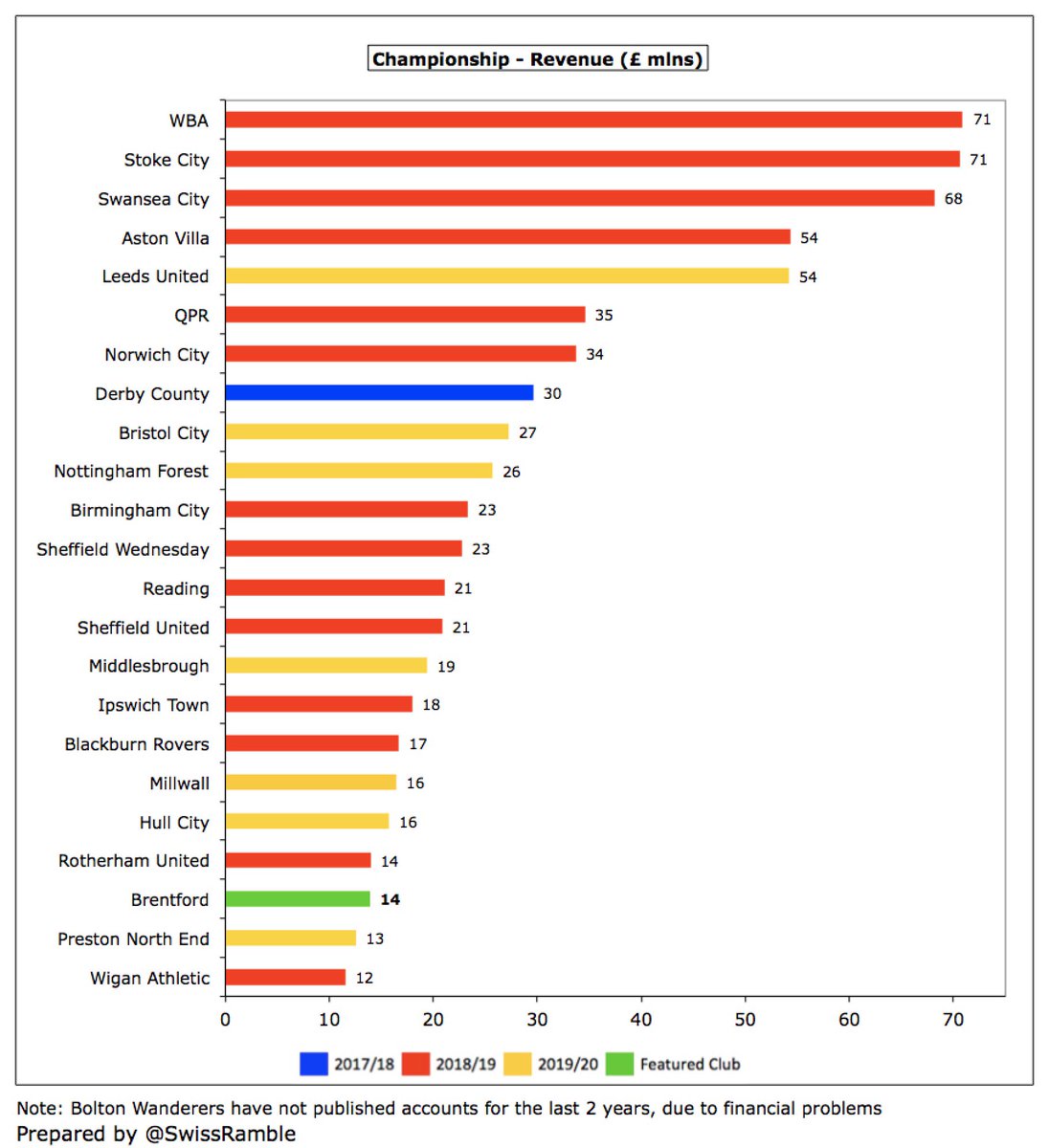

Despite the fall in 2020, #BrentfordFC £13.9m revenue is still club’s second highest ever, having grown by nearly a third in last four years, rising from £10.6m in 2016. Majority of growth (£2.4m) due to TV with other £0.9m coming from commercial – up to 26% of total revenue.

The #BrentfordFC financial challenge is highlighted by the fact that their £14m revenue was third lowest in the Championship, only above Preston £13m and Wigan £12m, so they hugely punched above their weight. For context, only around 20% of clubs with parachute payments (£71m).

#BrentfordFC CEO Jon Varney complained that PL parachute payments “completely destabilise the Championship”, making it difficult to compete. Seven clubs benefited in 2019/20, led by Cardiff City, #FFC £42m and #HTAFC (£42m), followed by Stoke City, Swansea City and WBA (£34m).

If parachute payments were excluded, #BrentfordFC £14m would still be a long way below the leading clubs. The gap to the highest placed club Leeds United (£54m) would be reduced, but it would still be a hefty £40m.

#BrentfordFC broadcasting income fell £1.6m (18%) from £8.8m to £7.3m, as some revenue only recognised in 2020/21 due to season finishing after 30th June. Most Championship clubs earn £7-10m, but big gap to clubs with parachute payments (over £50m for WBA, Swansea and Stoke).

#BrentfordFC ticketing revenue fell £0.3m (9%) to £3.1m, as 6 home games (including play-off semi-final) were played behind closed doors due to the pandemic. One of the lowest match day incomes in the Championship, only around a quarter of Leeds United’s £11m.

#BrentfordFC average attendance increased from 11,265 to 11,696 (for games played with fans) in their last season at Griffin Park, but still one of the lowest in the Championship. Small £10 increase in ticket prices in 2019/20 after being frozen for the previous four years.

#BrentfordFC moved to the new 17,250 capacity stadium at Lionel Road last summer. Varney described this as a “game changer”, as 2,000 premium seats and a better match day experience should “generate significantly more revenue”.

#BrentfordFC commercial income rose £0.5m (18%) to £3.6m, a new club record, but fifth lowest in the Championship, miles behind #LUFC £34m. However, Varney said, “We are confident that by the time we have finished our first season at the new stadium, we will be in the top six.”

#BrentfordFC had new sponsors in 2019/20: stadium developer EcoWorld London (since replaced in 2020/21 by Utilita); while they signed a 4-year kit supplier deal with Umbro, who took over from Adidas; and University of West London became sleeve sponsor.

#BrentfordFC wage bill shot up £7m (37%) from £19m to £26m, as headcount increased from 137 to 171 to strengthen the playing squad and build up support staff for new stadium. Wages up £8m in last 4 years, while revenue has only grown £3m in the same period.

Despite the increase, #BrentfordFC £26m wage bill is still firmly in the bottom half of the Championship. In stark contrast, #LUFC wages were three times as much at £78m, though included estimated £20m promotion bonus. Brentford deferred £2.2m payment but accrued this in 2019/20.

#BrentfordFC wages to turnover ratio worsened from 124% to 186%, the highest to date in the Championship in 2019/20. This is clearly not desirable, but is not that unusual in this division, where 19 of the 24 clubs are over 100%, well above UEFA’s recommended 70% upper limit.

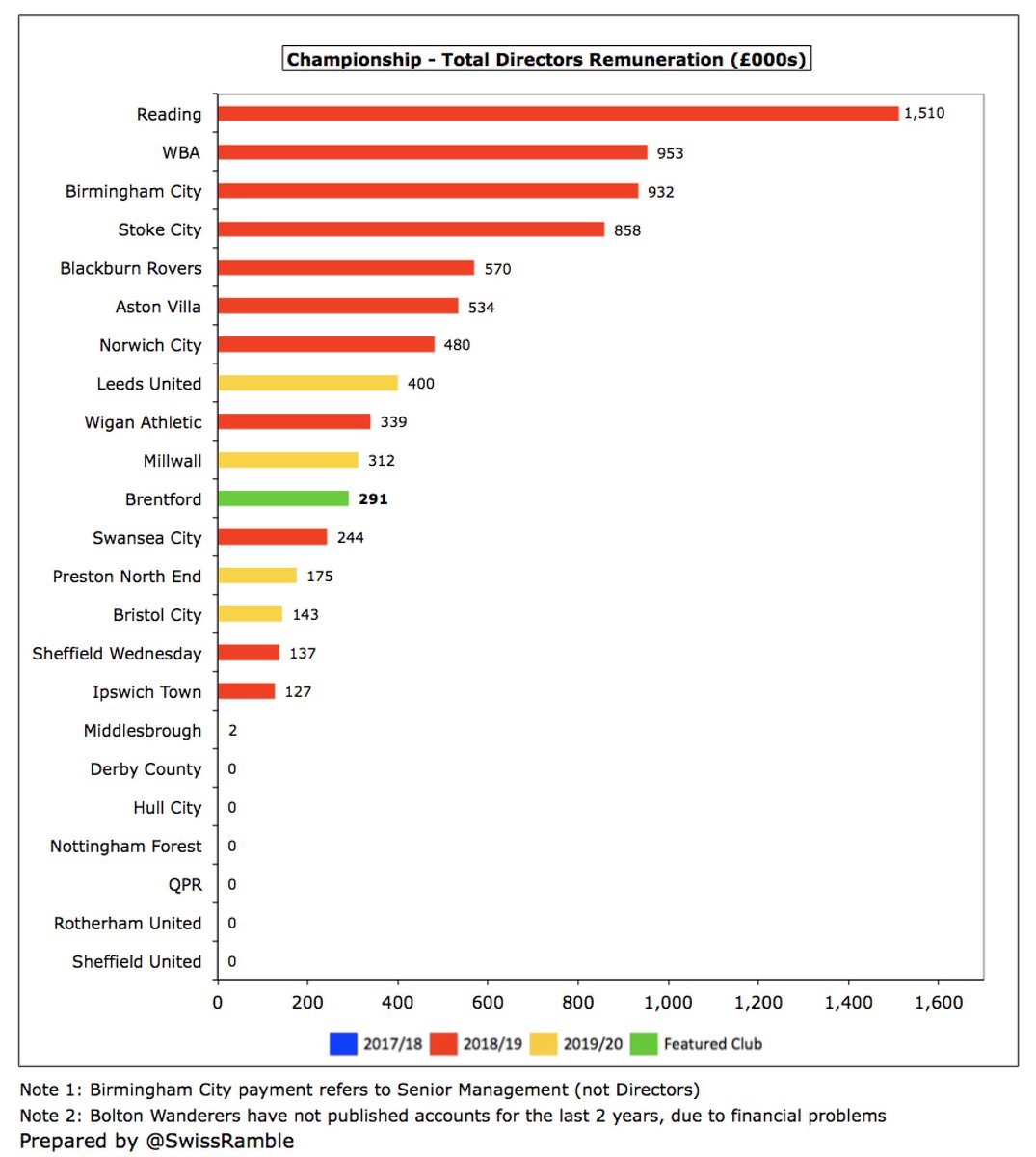

#BrentfordFC total directors remuneration was cut 40% from £487k to £291k, around mid-table in the Championship, a lot less than the likes of Reading £1.5m, WBA £953k, Birmingham City £932k and Stoke City £858k. Included payments to Smartodds, owner Matthew Benham’s company.

#BrentfordFC player amortisation, the annual charge to write-off transfer fees over a player’s contract, rose £4.8m (73%) from £6.6m to £11.5m, towards the upper end of the Championship, though a fair way below the really big spenders.

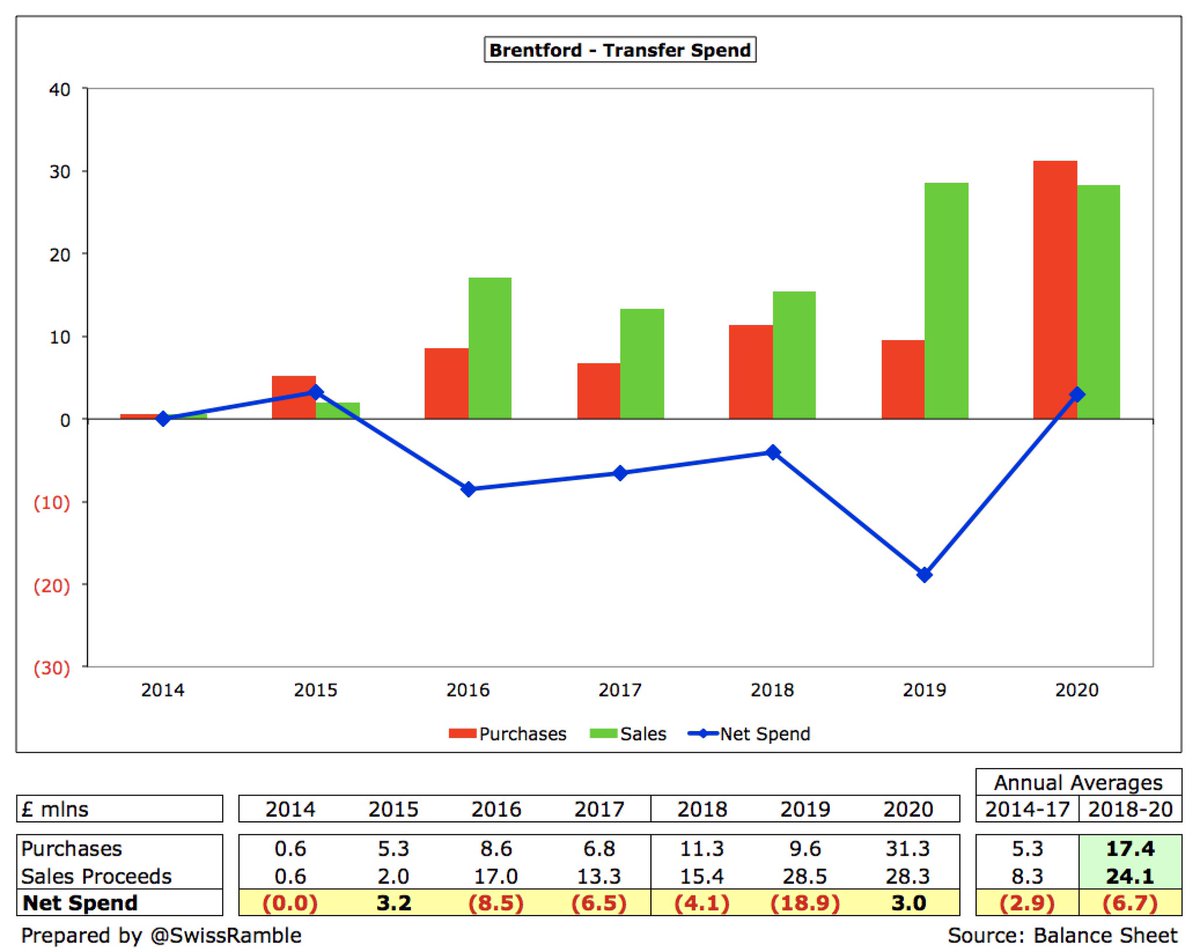

#BrentfordFC spent £31m on players, including Mbeumo, Jansson, Jensen, Nörgaard, Pinnock, Raya, Dervisoglu, Valencia and Fosu. More than the previous 3 seasons combined. Second only to #LUFC to date in Championship, though many clubs yet to publish accounts in 2019/20.

For many years #BrentfordFC spent little on player recruitment, but have averaged £17m in last 3 seasons, though player sales increased even more to £24m, leading to £7m net sales. However, not much spent this season, only really Ivan Toney and Charlie Goode.

#BrentfordFC gross debt rose £17m from £57m to £74m, with the majority owed to owner Matthew Benham (£60m), though the club also has £15m liabilities for cash advances on player sales (charge 6.3% to 6.5%).

#BrentfordFC £74m debt was 6th highest in the Championship, though a long way below the likes of #BRFC £142m, Stoke City £141m and #Boro £116m. . However, like almost all debt in this division, most has been provided interest-free by the owner, so is of the “soft” variety.

As a result, #BrentfordFC only had to pay £237k interest. Although many Championship clubs have a lot of debt, very little interest is actually paid, e.g. only 3 clubs over £1m: Hull City £1.7m, Middlesbrough £1.3m and Bristol City £1.1m.

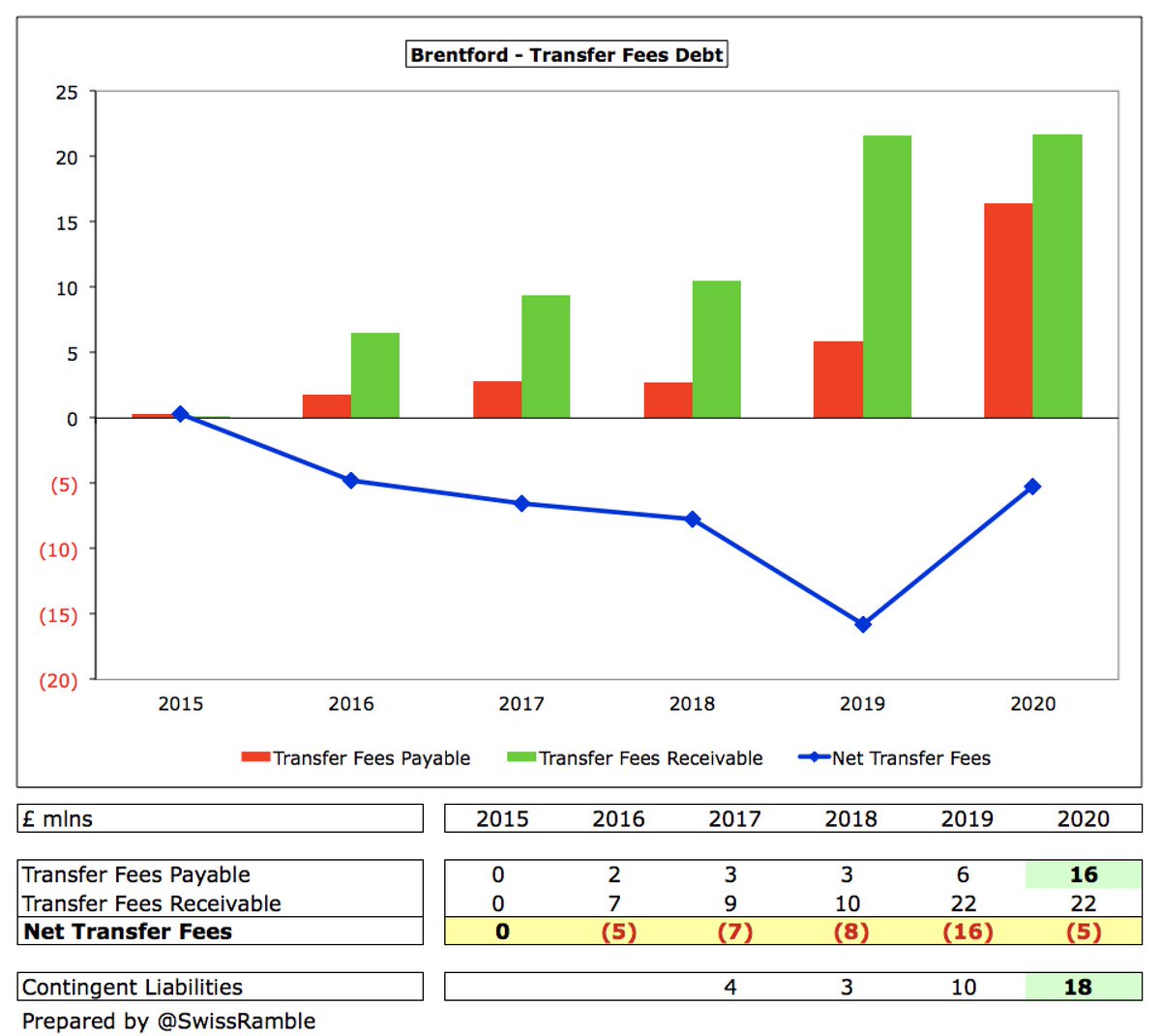

#BrentfordFC outstanding payments on transfer fees increased from £6m to £16m, but the amount owed to the Bees by other clubs is £22m, so they have £4m net receivables. Also contingent liabilities (based on appearances and promotion) of £18m.

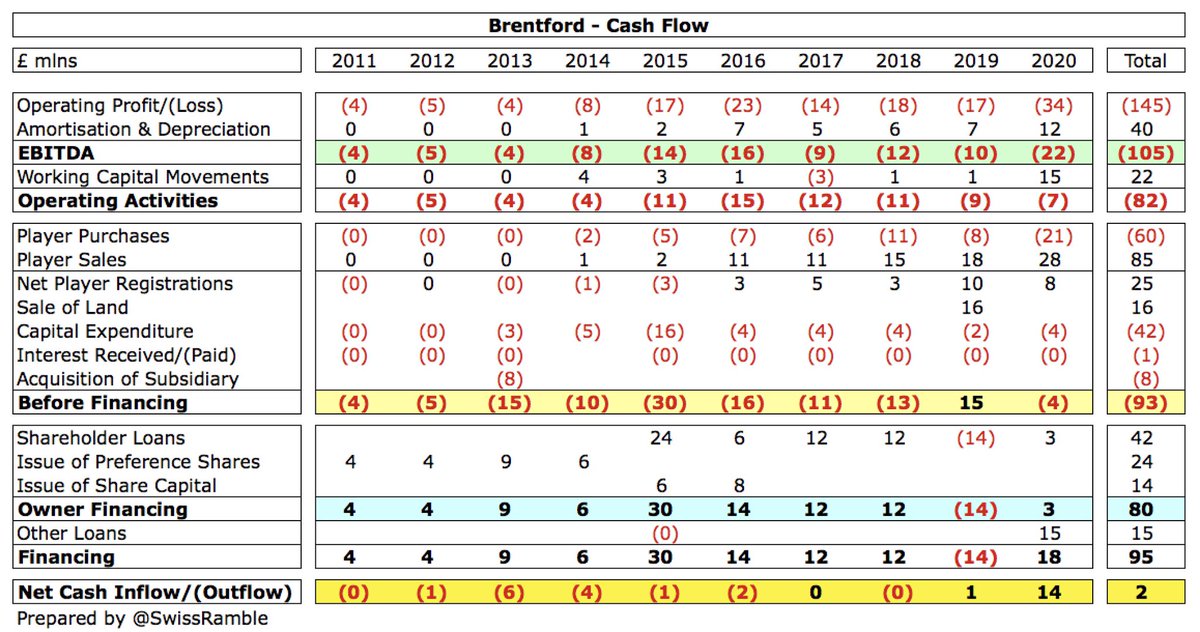

#BrentfordFC £34m operating loss improved to £7m negative cash flow by adding back £12m amortisation/depreciation and £15m working capital movements. Spent £4m on capex. Funded by £8m net player sales (sales £28m, purchases £21m) and £18m loans (owner £3m, external £15m).

As a consequence, #BrentfordFC cash balance rose from £2m to £16m, one of the highest in the Championship, thanks to the factoring of player receivables. This is a good buffer in the current environment, given that most clubs in this division had less than £2m cash in the bank.

Since 2011 #BrentfordFC major source of funds has been money put in by Benham, boosted by player sales and the land disposal. Largely used to cover operating losses (£82m) with £42m spent on infrastructure investment (stadium & training ground) and £8m on acquiring a subsidiary.

Matthew Benham’s commitment to #BrentfordFC is now £100m, comprising £65m loans (up £3m in 2019/20) and £38m share capital. Includes £21m specifically in relation to new stadium. As Varney said, “We have a brilliant owner who is incredibly supportive.”

#BrentfordFC have no problems with Financial Fair Play (FFP), as total losses are well within the FFP limit for the 3-year monitoring period, even before deducting allowable expense for academy, community and infrastructure.

Although #BrentfordFC revenue is among the lowest in the Championship, chairman Cliff Crown said, “our prudent financial approach and overall business model has put us in perhaps better shape than many.” Once fans are allowed back, the club will also benefit from the new stadium.

• • •

Missing some Tweet in this thread? You can try to

force a refresh