Burnley’s 2019/20 financial results covered a season when they finished in 10th place, the club’s second highest Premier League finish, securing a fifth consecutive season in the top flight. Some thoughts follow #BurnleyFC #twitterclarets

After these accounts closed in December 2020 ALK capital acquired a majority (84%) shareholding in #BurnleyFC. Long-term local owners Mike Garlick and John Banaszkiewicz remain at Turf Moor as directors, working in partnership with new chairman Alan Pace.

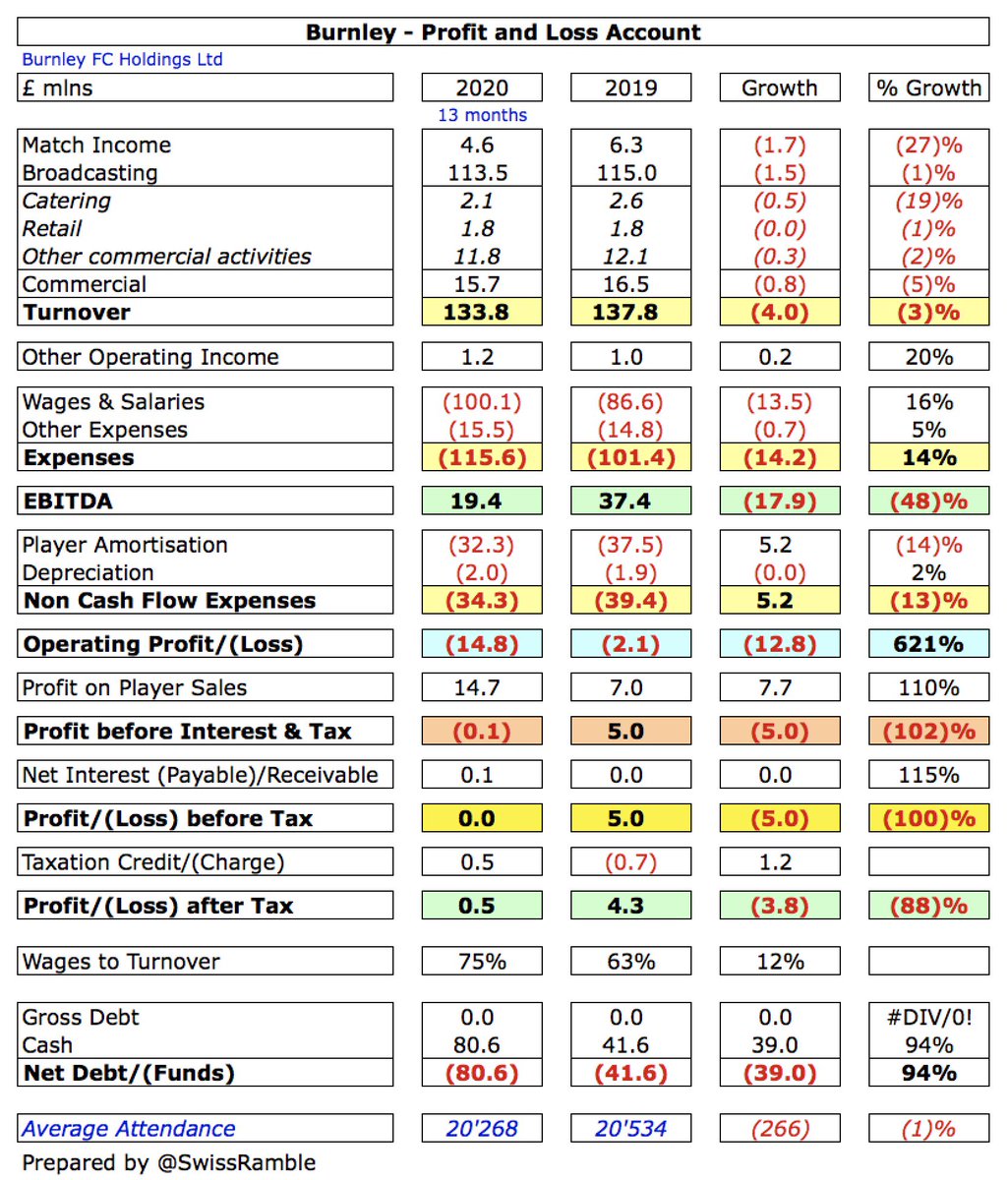

#BurnleyFC profit before tax dropped from £5m to break-even, mainly due to COVID impact, including an additional month of expenses. Revenue fell £4m (3%) from £138m to £134m and expenses increased £9m, though profit on player sales rose £8m to £15m. Profit after tax was £0.5m.

All three #BurnleyFC revenue streams decreased, due to the pandemic: match day was down £1.7m (27%) from £6.3m to £4.6m; broadcasting fell £1.5m (1%) from £115.0m to £113.5m; and commercial was £0.8m (5%) lower, slipping from £16.5m to £15.7m.

#BurnleyFC wage bill rose by £13m (16%) from £87m to £100m (including 13th month), though player amortisation decreased £5m (14%) from £37m to £32m. Other expenses were up £0.7m (5%) at £15.5m, while depreciation was flat at £2m.

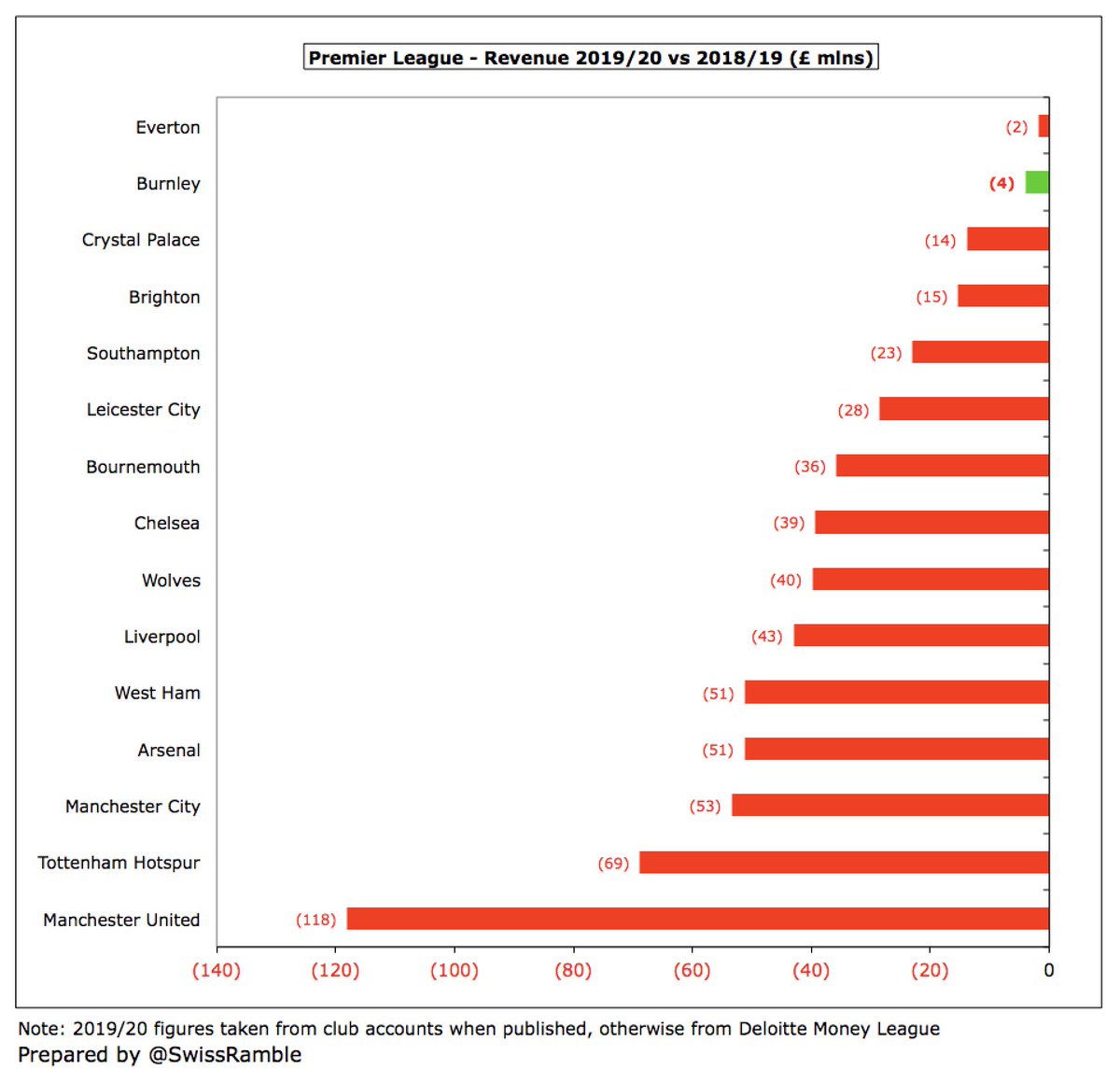

Despite the reduction, #BurnleyFC break-even is the fourth best result reported to date in the 2019/20 Premier League, only surpassed by #CFC £36m, #SUFC £19m and #NCFC £2m. This is pretty good, considering that no fewer than 8 clubs had losses above £50m.

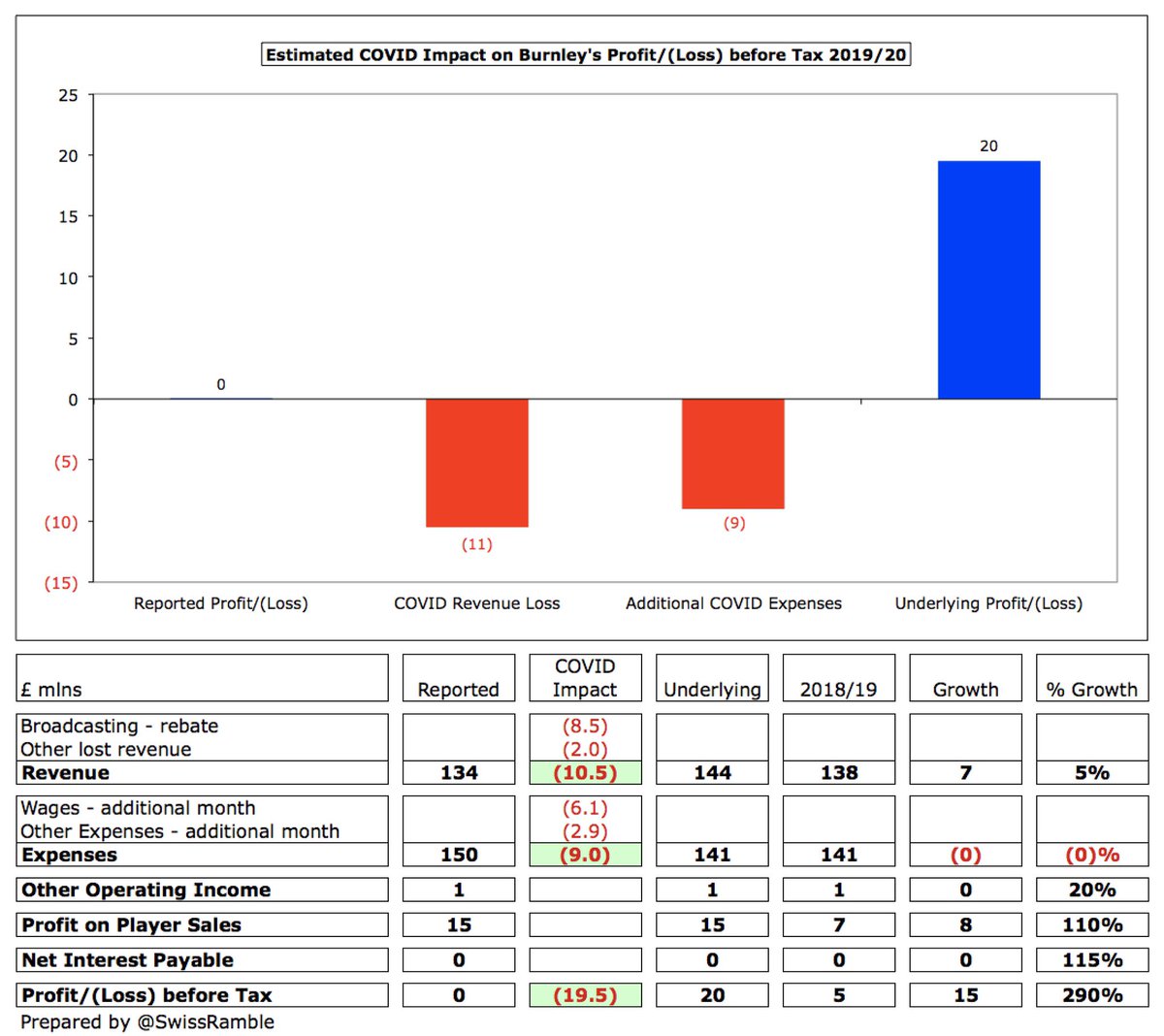

Without COVID, #BurnleyFC revenue would have been £10.5m higher at £144m, due to £8.5m broadcasting rebate and £2m other lost income. Along with £9m additional costs incurred for additional month (wages £6m), this would have resulted in an estimated profit of £20m.

It is worth noting that #BurnleyFC extended their financial reporting period to 31st July 2020, a period of 13 months, in order to account for the impact of Project Restart. This mitigated some of the impact of the COVID-19 pandemic on their accounts unlike most other clubs.

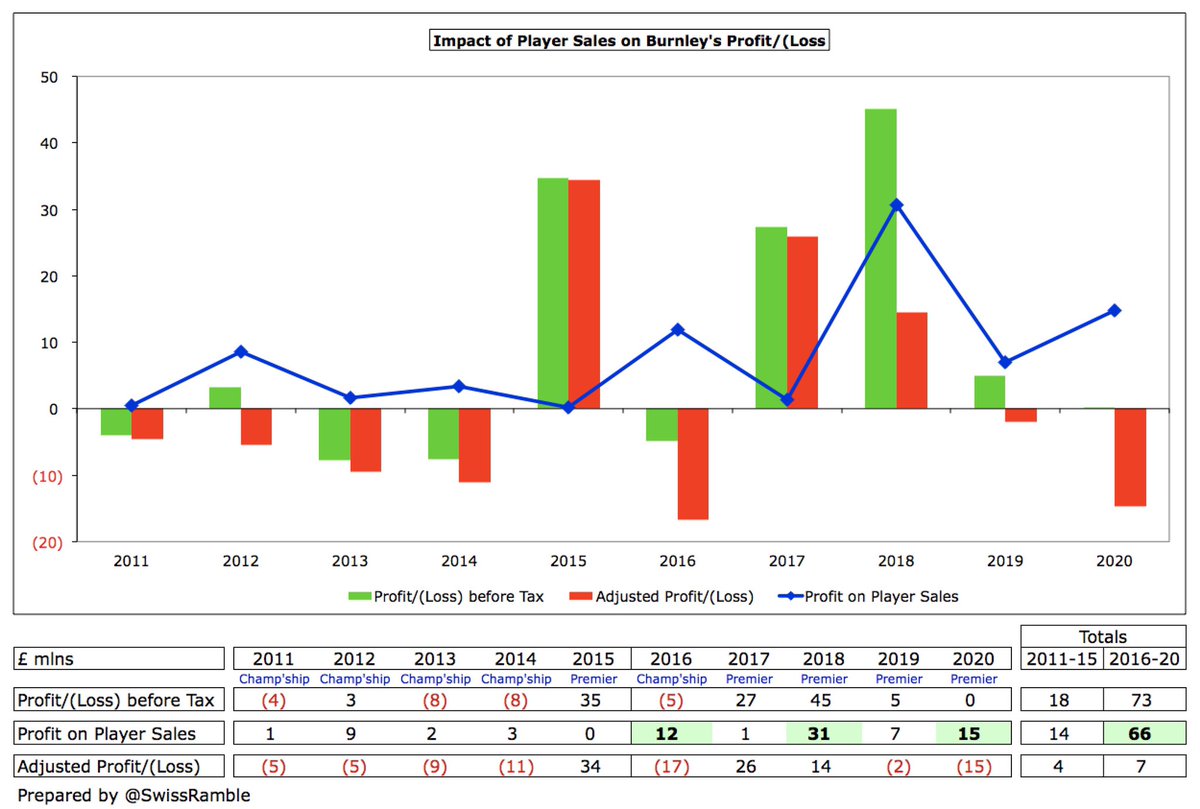

#BurnleyFC profit from player sales more than doubled from £7m to £15m, mainly Tom Heaton to #AVFC and Nakhi Wells to Bristol City. Despite the increase, this was still firmly in the bottom half of the top flight, way below the likes of #CFC £143m, #LCFC £63m and #AFC £60m.

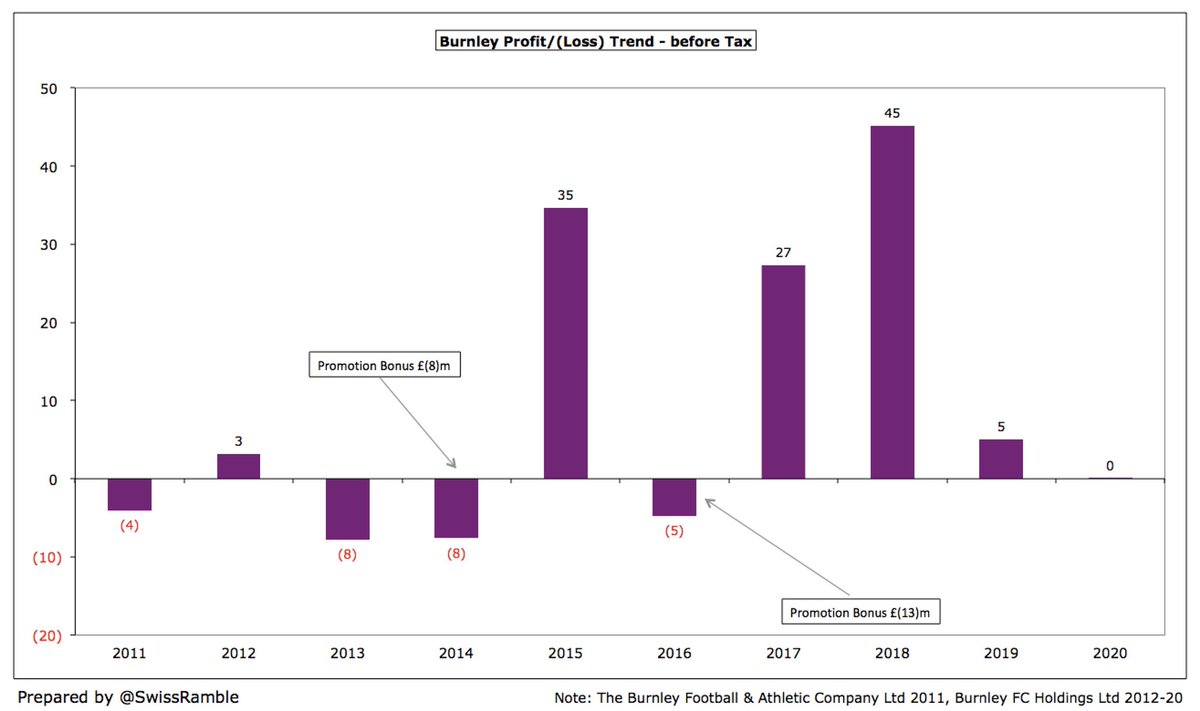

#BurnleyFC have made profits for four years in a row, aggregating £77m. In fact, they have been profitable each season in the Premier League, including 2010 and 2015. Losses reported in the Championship in 2014 and 2016 were driven by promotion bonuses.

#BurnleyFC have rarely made big money from player sales, though profits increased to £66m in last 5 years against £14m in previous 5-year period. Only generated more than £10m profit three times in last decade. Only free transfers in summer 2020 (Hendrick, Hart, Lennon).

#BurnleyFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, dropped from £37m to £19m, down from £50m peak three years ago. Mid-table in the Premier League, just behind #CFC £27m.

#BurnleyFC operating loss (i.e. excluding player sales and interest) widened from £2m to £15m, though this is actually one of the better results in 2019/20, a significantly lower loss than most other clubs, e.g. three were more than £100m: #EFC £175m, #LCFC £122m and #CFC £112m.

#BurnleyFC revenue fell for the second year in a row, but 2020 £134m is only £5m (4%) lower than club record £139m. The main reason for the decrease is the £8.5m broadcasting rebate linked to COVID delays, though this still accounts for 85% of total revenue.

#BurnleyFC £134m revenue is 14th highest in the top flight, though the gap to the Big Six is enormous, as they are more than £200m below #AFC £343m. Their 10th place in the Premier League highlights how much the club over-performed under manager Sean Dyche.

Most clubs’ revenue significantly down in 2019/20, due to COVID, averaging decreases of 13% and £39m, so #BurnleyFC 3% (£4m) reduction is one of the best performances. Helped by extending accounts to 31st July, whereas others with May/June closes had to defer revenue to 2020/21.

#BurnleyFC £134m revenue is theoretically enough for inclusion in top 30 of Deloitte Money League, which ranks clubs worldwide by revenue. However, they are not there, presumably because their revenue was pro-rated from 13 to 12 months, i.e. £124m, so just below £130m threshold.

#BurnleyFC broadcasting income fell £1.5m from £115m to £113.5m, as £8.5m rebate to broadcasters offset higher merit payment for finishing five places better. Other clubs deferred some revenue into 2020/21, as season extended beyond their 31st May & 30th June accounting close.

Much of Premier League TV deal is distributed equally, but part based on league position (merit payments, growth in overseas rights) & number of times shown live (facility fees). From 2019/20 each league place worth around £3m, so if #BurnleyFC fall from 10th, it will cost them.

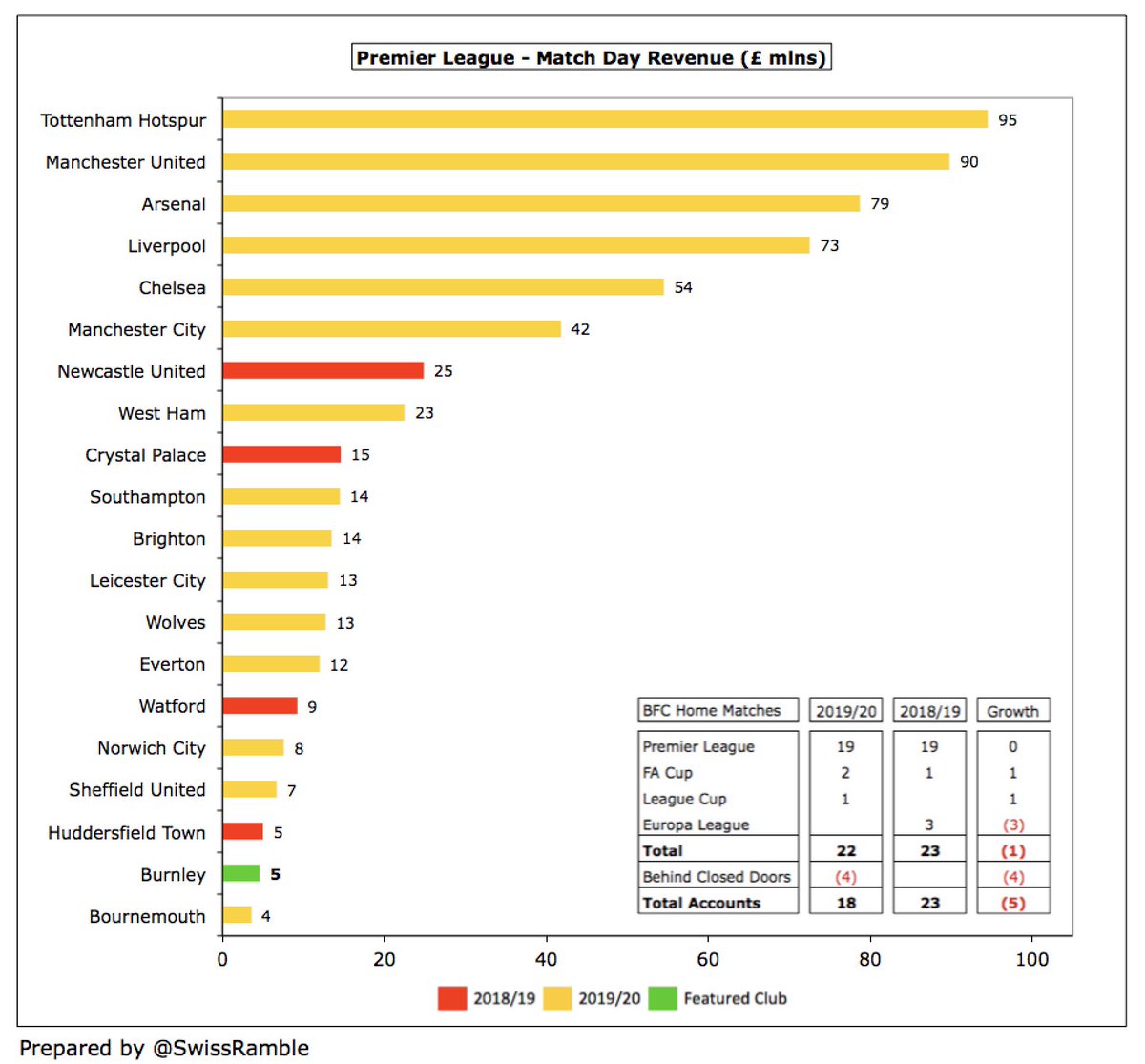

#BurnleyFC match day revenue fell £1.7m (27%) from £6.3m to £4.6m, as they played 4 home games behind closed doors due to COVID. This is the second lowest in the Premier League, only ahead of #AFCB, and just 5% of #THFC £95m after move to new stadium.

#BurnleyFC average attendance fell from 20,534 to 20,268 (for those games played with fans), which was 19th highest in the Premier League, only ahead of #AFCB, and also below 10 clubs in the Championship. Ticket prices were frozen for 2019/20 for the seventh year in a row.

#BurnleyFC commercial revenue fell £0.8m (5%) from £16.5m to £15.7m, comprising other commercial £11.8m, catering £2.1m and retail £1.8m. This was the club’s second highest ever for this revenue stream, but still only 17th in the Premier League.

In 2019/20 #BurnleyFC had new principal sponsors. LoveBet replaced LaBa360 and AstroPay for shirt and sleeve sponsorship respectively, for a reported £7.5m a year, while there was a new 3-year kit deal with Umbro, replacing Puma who have been club supplier since 2010.

#BurnleyFC wage bill rose £13m (16%) from £87m to £100m, due to higher bonuses for better Premier League finish, though this covered 13 months. The increase would have only been £7m to £94m if adjusted for 12 months. Up £39m (64%) since first season after promotion in 2017.

#BurnleyFC reported £100m wage bill was 14th in the Premier League, probably higher than most would expect. If adjusted to £94m, based on 12-month period, would drop to 16th place. Either way, around a third of #MUFC £284m and #CFC £283m.

#BurnleyFC wages to turnover ratio increased from 63% to 75%, though this would be 70% based on 12-month wages. If we further adjust for COVID £10.5m revenue iloss, the ratio would fall to 65%. In short, one of the better ratios in the Premier League.

None of the #BurnleyFC directors received remuneration in 2019/20 (or previous year). This is in stark contrast to other clubs, most notably #MUFC and #THFC, where Ed Woodward and Daniel Levy each trousered around £3m.

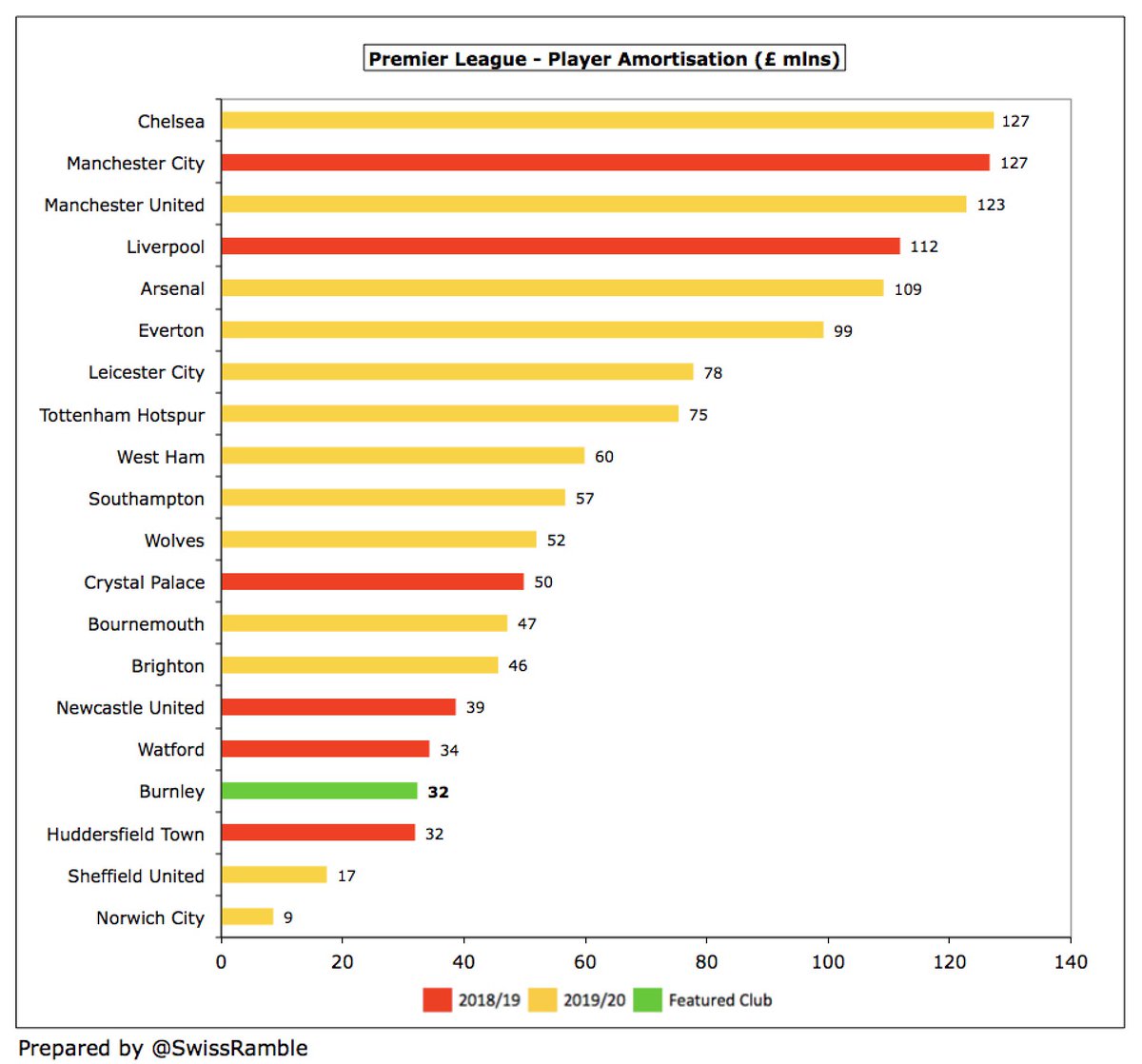

#BurnleyFC player amortisation, the annual charge to expense transfer fees over a player’s contract, fell £5m (14%) to £32m following player departures. Reinforced their position as one of the lowest in the Premier League, only ahead of promoted clubs #SUFC and #NCFC in 2019/20.

#BurnleyFC made £29m player purchases in 2019/20, slightly less than prior season’s £33m, including Jay Rodriguez from WBA, Josh Brownhill from Bristol City, Bailey Peacock-Farrell from #LUFC and Erik Pieters from Stoke. One of the lowest in the Premier League.

Nevertheless, #BurnleyFC have spent £170m in the last five years, a significant increase on the £27m outlay in the previous 5-year period. After sales of £76m, net spend was £95m. However, hardly any expenditure this season, only bringing in Dale Stephens and Will Norris.

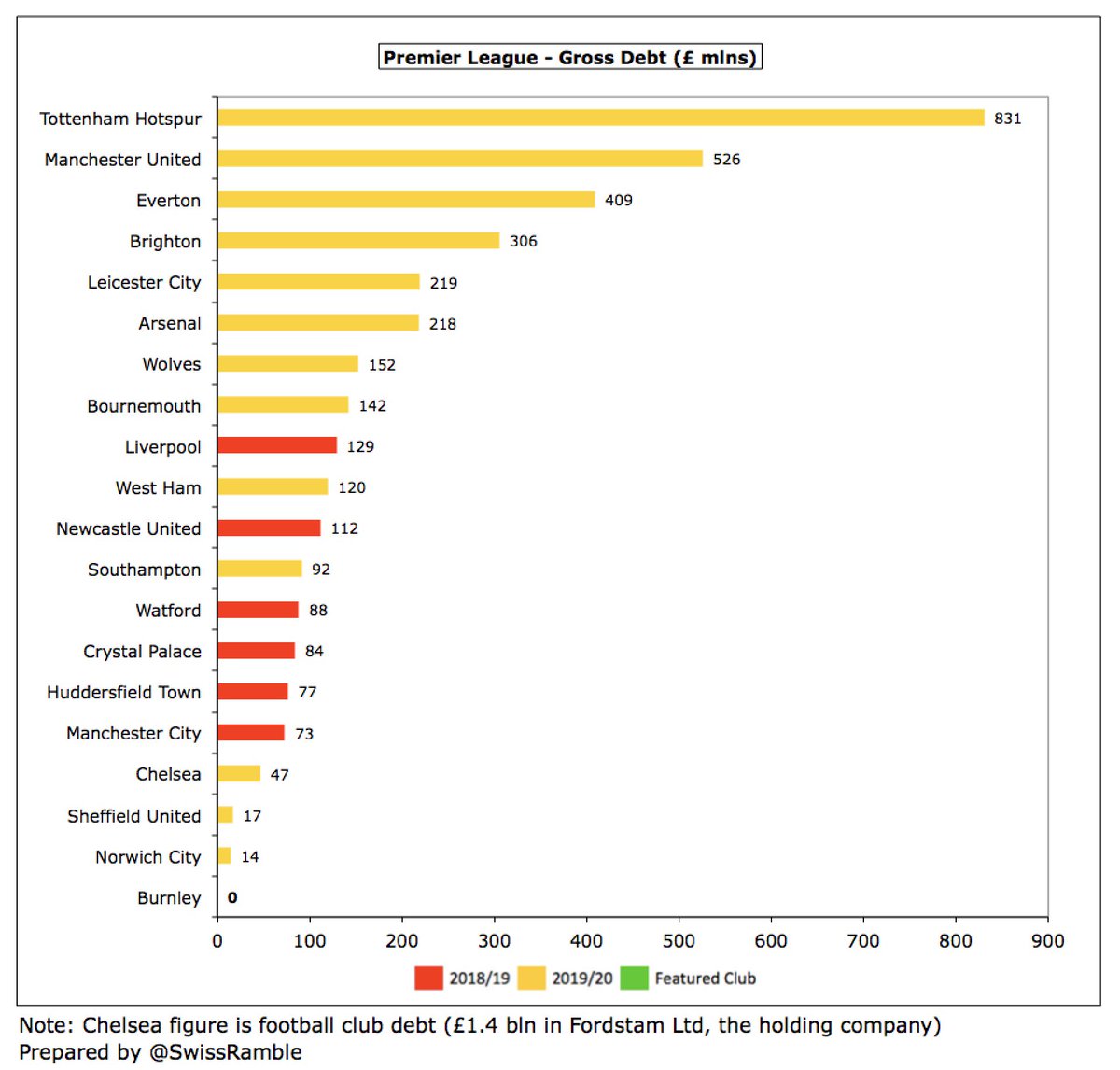

Before the takeover #BurnleyFC were completely debt-free, having used Premier League cash to repay previous loans. In fact, the club had £81m net funds, which is testament to their sound financial management.

#BurnleyFC were the only club in the Premier League without financial debt, which is in stark contrast to many clubs, e.g. six owe more than £200m: #THFC £831m, #MUFC £526m, #EFC £409m, #BHAFC £306m, #LCFC £219m and #AFC £218m (largely for stadium/training ground development).

Consequently, #BurnleyFC paid no interest in 2019/20, which gives them a competitive advantage against many of their rivals who have to pay interest on their loans. As an example, the highest payments were #MUFC £20m, #THFC £14m and #AFC £11m.

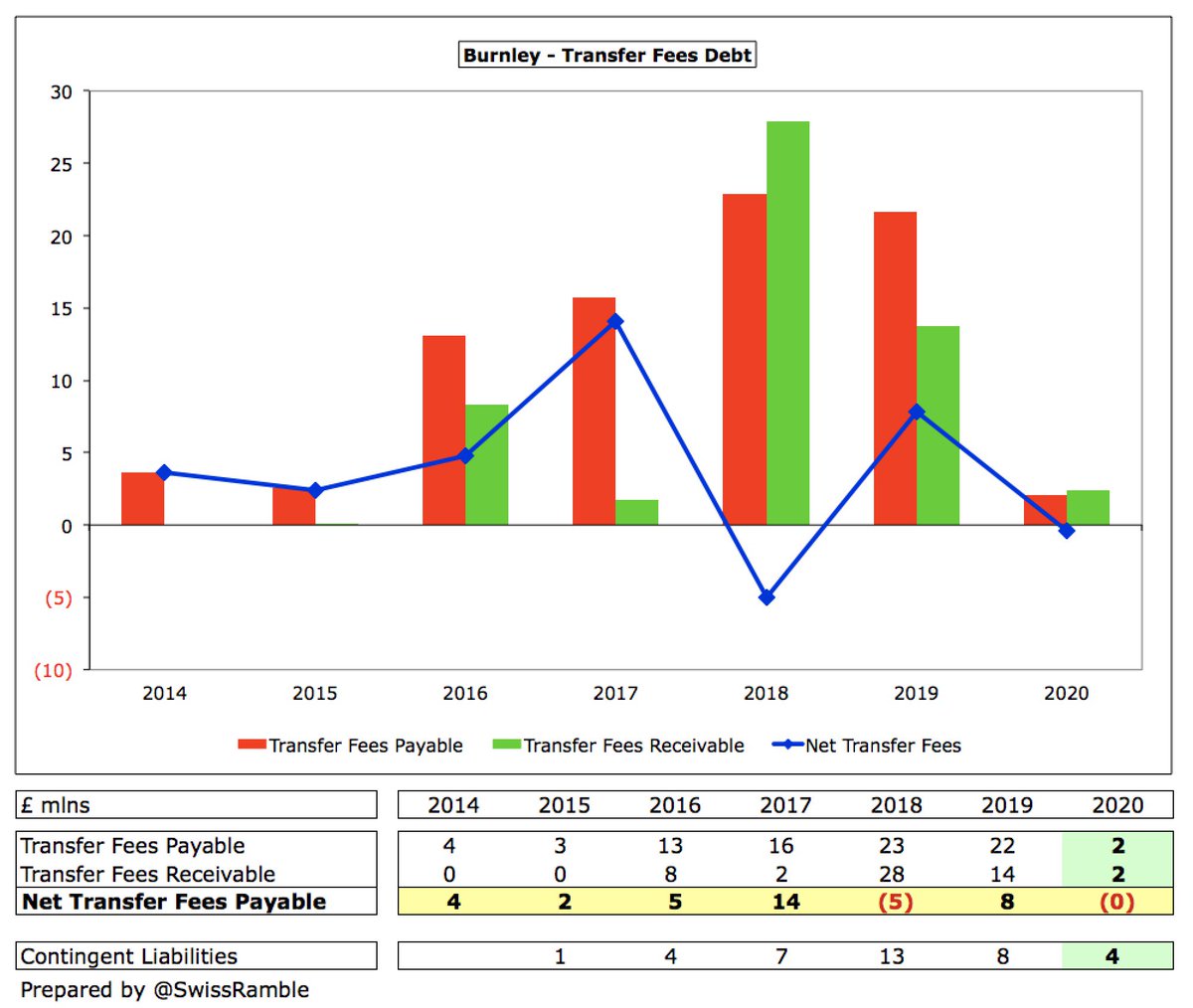

#BurnleyFC also managed to cut transfer debt from £22m to just £2m. In fact, the net amount is also zero, as £2m transfer fees are owed to them by other clubs. By far the lowest in the Premier League, e.g. #AFC owe £154m. Contingent liabilities only £4m.

Despite £15m operating loss, #BurnleyFC had £64m operating cash flow (adding back £34m amortisation/depreciation and £45m working capital movements), but then spent net £22m on players (purchases £46m, sales £24m) and £4m on infrastructure to give £39m net cash inflow.

Unlike many clubs, #BurnleyFC pay their own way. In the last decade they generated £243m from operations, including £204m in last 4 years. Most went on players £105m, while £30m was invested in infrastructure (mainly training ground), £16m tax and £15m interest/loan payments.

#BurnleyFC cash balance almost doubled from £42m to £81m, which is actually the 4th highest in the top flight to date in 2019/20, though this included an advance of TV money from the Premier League.

However, that was then, this is now. Media outlets have reported that new owners ALK Capital put in very little of their own money, acquiring the club via a leveraged buy-out, thus placing debt on the club and using #BurnleyFC cash balances, similar to the Glazers at #MUFC.

This arrangement has not been confirmed by #BurnleyFC, but the media reports suggest that the purchase was financed by a £60-80m loan from MSD (Michael Dell’s investment firm), similar to a mortgage, while also using £30-55m of the club’s cash.

Based on the 9% interest MSD has charged for loans to other football clubs, this might cost #BurnleyFC between £5m and £7m a year. New chairman Alan Pace said the terms were “absolutely reasonable and in line with what can be supported by this club.”

A statement from ALK Capital tried to provide reassurance: “The new owners of #BurnleyFC are committed to investing in this club, the team and facilities over the coming years. Their actions will speak louder than any words.” That sounds good, but time will tell.

It’s not difficult to understand why #BurnleyFC were acquired, as they were in very good shape, arguably the best run club in the Premier League, not only competitive despite financial challenges, but also running a sustainable business model with no debt, even in a pandemic.

• • •

Missing some Tweet in this thread? You can try to

force a refresh