NEW FROM US– Ebang: Yet Another Crypto “China Hustle” Absconding With U.S. Investor Cash

(1/x)

hindenburgresearch.com/Ebang/ $EBON

(1/x)

hindenburgresearch.com/Ebang/ $EBON

$EBON is a China-based crypto company that has raised ~$374 million from U.S. investors in 4 offerings since going public in June 2020.

We think a majority of that investor capital has been diverted out of the company and is never coming back.

We think a majority of that investor capital has been diverted out of the company and is never coming back.

Before going public on NASDAQ, $EBON twice applied to list on the Hong Kong Stock Exchange.

Multiple media outlets reported that Ebang’s Hong Kong IPO plans were suspended following involvement in an alleged sales inflation scheme with a company called Yindou.

Multiple media outlets reported that Ebang’s Hong Kong IPO plans were suspended following involvement in an alleged sales inflation scheme with a company called Yindou.

Yindou was a massive Chinese P2P online lending scheme that defaulted on its 20,000 retail investors in 2018, with $655M “vanish(ing) into thin air”.

Its ultimate beneficial owner “fled the country”, and Chinese prosecutors have been pursuing other suspects associated w/ Yindou

Its ultimate beneficial owner “fled the country”, and Chinese prosecutors have been pursuing other suspects associated w/ Yindou

While $EBON represented that it would use the majority of its numerous capital proceeds to develop its business operations, our research discovered it instead directed much of the cash out of the company through a series of opaque deals w/ insiders & questionable counterparties.

$EBON directed $103M, representing ~$11M more than its entire IPO proceeds, into bonds linked to its U.S. underwriter AMTD (Chaired by Calvin Choi), which has a track record including (a) fraud and self-dealing allegations and (b) listings that have subsequently imploded.

AMTD entered into similar bond transactions with another company it recently took public in January 2020 called Molecular Data $MKD.

That company is down 70% since, has seen 6 board members and its co-founder resign, and had its auditor decline to stand for re-election.

That company is down 70% since, has seen 6 board members and its co-founder resign, and had its auditor decline to stand for re-election.

In November 2020, $EBON tapped the market for its first secondary offering, announcing a $21M raise. It claimed proceeds would go “primarily for development”.

Around the same time, the company directed $21 million to repay related-party loans to Chairman/CEO Dong Hu’s relative.

Around the same time, the company directed $21 million to repay related-party loans to Chairman/CEO Dong Hu’s relative.

$EBON claims to be a “leading bitcoin mining machine producer”, yet our research indicates this extraordinary claim is backed by no evidence.

Ebang released its final miner in May 2019 and has since seen its sales dwindle to near-zero, delivering only 6,000 total miners in 1H20.

Ebang released its final miner in May 2019 and has since seen its sales dwindle to near-zero, delivering only 6,000 total miners in 1H20.

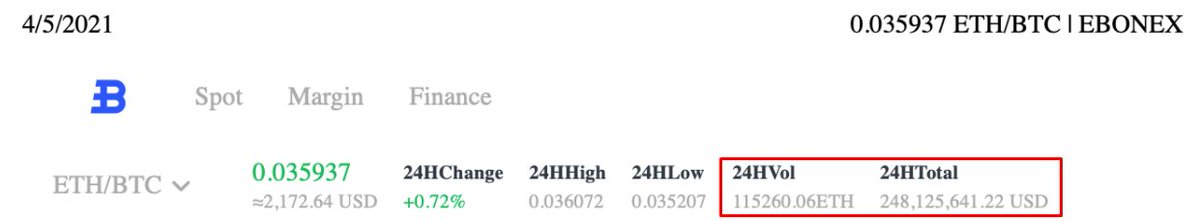

With its mining machine business failing, $EBON has pivoted the story to a cryptocurrency exchange launch called “Ebonex”.

Announcements about the exchange added as much as $922 million market capitalization to Ebang.

Announcements about the exchange added as much as $922 million market capitalization to Ebang.

We found that $EBON's exchange appears to be purchased from a white-label crypto exchange provider called Blue Helix that offers out-of-the-box crypto exchanges for as little as no money up-front.

$EBON’s exchange looks remarkably similar to other exchanges related to Blue Helix, like a popular exchange called Huobi.

We found numerous mentions of “Bhex” throughout the source code of $EBON’s exchange.

We found numerous mentions of “Bhex” throughout the source code of $EBON’s exchange.

Ebonex reports what appear to be fictitious volumes. Despite just launching and having virtually no online presence, Ebonex volume data implies it is one of the largest spot exchanges in the world.

Yet its trading metrics are absent from well known crypto exchange trackers.

Yet its trading metrics are absent from well known crypto exchange trackers.

$EBON is yet another cautionary tale for inexperienced investors.

As is common with other China-based schemes, the co. will likely keep selling shares as long as investors are willing to keep buying them. We think this is a clear one-way street & the capital isn’t coming back.

As is common with other China-based schemes, the co. will likely keep selling shares as long as investors are willing to keep buying them. We think this is a clear one-way street & the capital isn’t coming back.

• • •

Missing some Tweet in this thread? You can try to

force a refresh