Aswath Damodaran (@AswathDamodaran) is the valuation GOAT.

In this thread, we'll break down his "Narrative & Numbers" presentation.

We'll see the power (& danger) of using only numbers, and how storytelling can create a more complete thesis.

Enjoy👇

people.stern.nyu.edu/adamodar/pdfil…

In this thread, we'll break down his "Narrative & Numbers" presentation.

We'll see the power (& danger) of using only numbers, and how storytelling can create a more complete thesis.

Enjoy👇

people.stern.nyu.edu/adamodar/pdfil…

1/ Setting The Stage

There's two types of investors: numbers (NUM) & storytellers (ST)

NUM believes EVERYTHING should focus on figures, stats, and $ amounts. To them, stories are distractions.

ST believe valuation is about great storytelling, and numbers are ignorant guises

There's two types of investors: numbers (NUM) & storytellers (ST)

NUM believes EVERYTHING should focus on figures, stats, and $ amounts. To them, stories are distractions.

ST believe valuation is about great storytelling, and numbers are ignorant guises

2/ The Numbers People

There are 4 building blocks to NUM investing ethos:

- Accounting

- Modeling

- Data

- Valuation

Each block stresses great detail and precise conclusions. Here, the greater detail you provide, the more valuable your write-up/pitch

There are 4 building blocks to NUM investing ethos:

- Accounting

- Modeling

- Data

- Valuation

Each block stresses great detail and precise conclusions. Here, the greater detail you provide, the more valuable your write-up/pitch

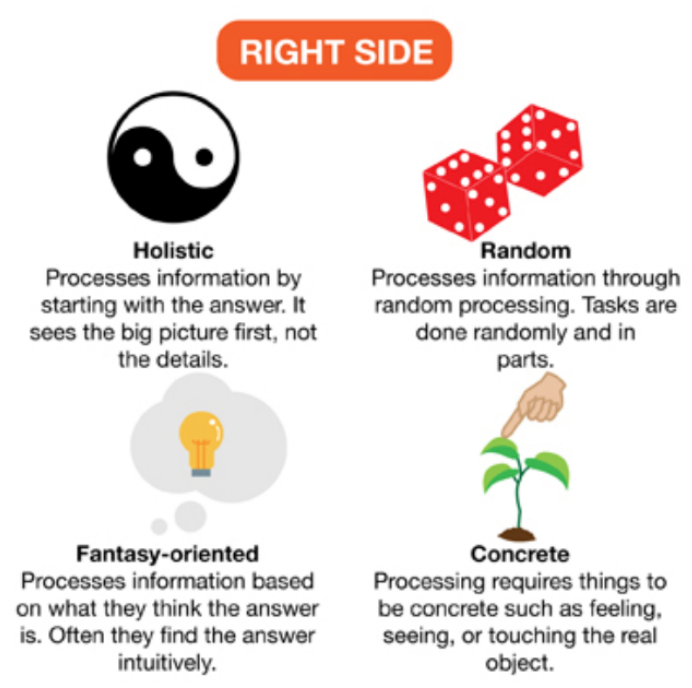

3/ The 3 Delusions of Numbers People

a) Illusion of Precision: More numbers = More precision

b) Illusion of No Bias: "Numbers don't lie, bro!"

c) Illusion of Control: If you assign a number to something, you can control it better (DCFs, growth rates, etc)

a) Illusion of Precision: More numbers = More precision

b) Illusion of No Bias: "Numbers don't lie, bro!"

c) Illusion of Control: If you assign a number to something, you can control it better (DCFs, growth rates, etc)

4/ The 3 Dangers of Numbers-only Valuation

a) Boring & unconvincing: All numbers valuation won't convince investors

b) Miss Internal Inconsistencies: Without a story, you may miss serious problems in valuation

c) Echo Chamber: Easy to find agreement w/ other numbers-people

a) Boring & unconvincing: All numbers valuation won't convince investors

b) Miss Internal Inconsistencies: Without a story, you may miss serious problems in valuation

c) Echo Chamber: Easy to find agreement w/ other numbers-people

5/ The Storytellers Game

Your pitch is all about the story. Tell a good enough one, with a good enough *hook* and you'll land investors.

Success = how well your story is structured and how well you tell it

Numbers, if they are used at all, are an afterthought to the story.

Your pitch is all about the story. Tell a good enough one, with a good enough *hook* and you'll land investors.

Success = how well your story is structured and how well you tell it

Numbers, if they are used at all, are an afterthought to the story.

6/ The Power of Stories

Humans LOVE stories. It's how we passed down history and ancestral folklore.

Storytelling is as old as humans have existed. Yet the Scientific Method is only ~300 years old.

When investing, a great story is always better than the best numbers model.

Humans LOVE stories. It's how we passed down history and ancestral folklore.

Storytelling is as old as humans have existed. Yet the Scientific Method is only ~300 years old.

When investing, a great story is always better than the best numbers model.

7/ What Makes A Great Story

It's all about emotion. This is no different when pitching investment ideas.

Hook the reader with emotion around the problem a product/service is solving.

Leverage an investor's 2 main emotions: greed (money) and nobility (changing the world).

It's all about emotion. This is no different when pitching investment ideas.

Hook the reader with emotion around the problem a product/service is solving.

Leverage an investor's 2 main emotions: greed (money) and nobility (changing the world).

8/ The 3 Delusions of Storytellers

a) Numbers people aren't creative: Creativity and Numbers are mutually exclusive

b) Creativity deserves a reward: If your story is good, the investment OUGHT TO workout

c) Experience is the best teacher: Story is better if you've done it b4

a) Numbers people aren't creative: Creativity and Numbers are mutually exclusive

b) Creativity deserves a reward: If your story is good, the investment OUGHT TO workout

c) Experience is the best teacher: Story is better if you've done it b4

9/ The 3 Dangers of Storytellers

a) Fantasy-land: Narrative with NO numbers to back up story

b) Echo Chamber: Storytellers love to discuss ideas with other storytellers that share their same narrative

c) No Measurement: If you don't use numbers, you can't judge the thesis

a) Fantasy-land: Narrative with NO numbers to back up story

b) Echo Chamber: Storytellers love to discuss ideas with other storytellers that share their same narrative

c) No Measurement: If you don't use numbers, you can't judge the thesis

10/ Bridging The Gap w/ Valuation

Valuation is the bridge that connects our two camps (numbers and storytellers).

It's a tool that allows you to construct a story around numbers ... and construct a quant model around a story.

The valuation takes the best from both sides.

Valuation is the bridge that connects our two camps (numbers and storytellers).

It's a tool that allows you to construct a story around numbers ... and construct a quant model around a story.

The valuation takes the best from both sides.

11/ 6 Steps To Bridge The Gap

1) Survey Biz Model: unit economics

2) Create Narrative For Future: a simple story

3) Check Narrative vs. History: channel checks

4) Connect Key Drivers: 1-2 things that matter

5) Value biz: basic DCF model

6) Keep feedback loop: red-team thesis

1) Survey Biz Model: unit economics

2) Create Narrative For Future: a simple story

3) Check Narrative vs. History: channel checks

4) Connect Key Drivers: 1-2 things that matter

5) Value biz: basic DCF model

6) Keep feedback loop: red-team thesis

12/ Why/How Narratives Change

A company's narrative can change at any time for any reason. Remember, price drives the narrative. A high price = rosy narrative (and visa versa).

Reasons for change:

- Earnings

- Corporate actions

- Management change

- Macro change

- Political

A company's narrative can change at any time for any reason. Remember, price drives the narrative. A high price = rosy narrative (and visa versa).

Reasons for change:

- Earnings

- Corporate actions

- Management change

- Macro change

- Political

13/ Concluding Thoughts

Good investment pitches tell a story. They squeeze emotions and hook the reader from the start.

We, humans, CRAVE a good story, so as investors, we should give them one. One that connects narratives to numbers.

Thank you, @AswathDamodaran!

Good investment pitches tell a story. They squeeze emotions and hook the reader from the start.

We, humans, CRAVE a good story, so as investors, we should give them one. One that connects narratives to numbers.

Thank you, @AswathDamodaran!

• • •

Missing some Tweet in this thread? You can try to

force a refresh