🇬🇧 New UK Reopening Idea 🇬🇧

Meet The Gym Group $GYM

GYM is a low-cost gym operator in the UK growing ~26% CAGR.

They boast solid unit economics at mature sites while expansion CAPEX hides the company's true owner earnings.

Let's dive in!

[THREAD] 👇

macro-ops.com/the-gym-group-…

Meet The Gym Group $GYM

GYM is a low-cost gym operator in the UK growing ~26% CAGR.

They boast solid unit economics at mature sites while expansion CAPEX hides the company's true owner earnings.

Let's dive in!

[THREAD] 👇

macro-ops.com/the-gym-group-…

1/ Different Types of UK Gyms

There are two types of gyms in the UK: private and public.

Public gyms are gov't sponsored and provide YMCA-type services.

Private gyms are commercial enterprises and bifurcate into two sub-categories: traditional & low cost.

What's the diff?

There are two types of gyms in the UK: private and public.

Public gyms are gov't sponsored and provide YMCA-type services.

Private gyms are commercial enterprises and bifurcate into two sub-categories: traditional & low cost.

What's the diff?

2/ The Traditional Gym Package

Traditional gyms offer a paid membership, fixed contracts, and tiered pricing based on several services offered.

These gyms provide everything you could imagine from tennis courts, swimming pools, saunas, and coffee/smoothie bars.

GBP 30-80/mth

Traditional gyms offer a paid membership, fixed contracts, and tiered pricing based on several services offered.

These gyms provide everything you could imagine from tennis courts, swimming pools, saunas, and coffee/smoothie bars.

GBP 30-80/mth

3/ The Low-Cost Gym Package

Low-cost gyms provide everything a gym-goer needs and nothing more.

Members can enjoy free-weights, cardio equipment, and other resistance machines without any bells and whistles like saunas, pools, or fresh juice bars.

You get what you pay for.

Low-cost gyms provide everything a gym-goer needs and nothing more.

Members can enjoy free-weights, cardio equipment, and other resistance machines without any bells and whistles like saunas, pools, or fresh juice bars.

You get what you pay for.

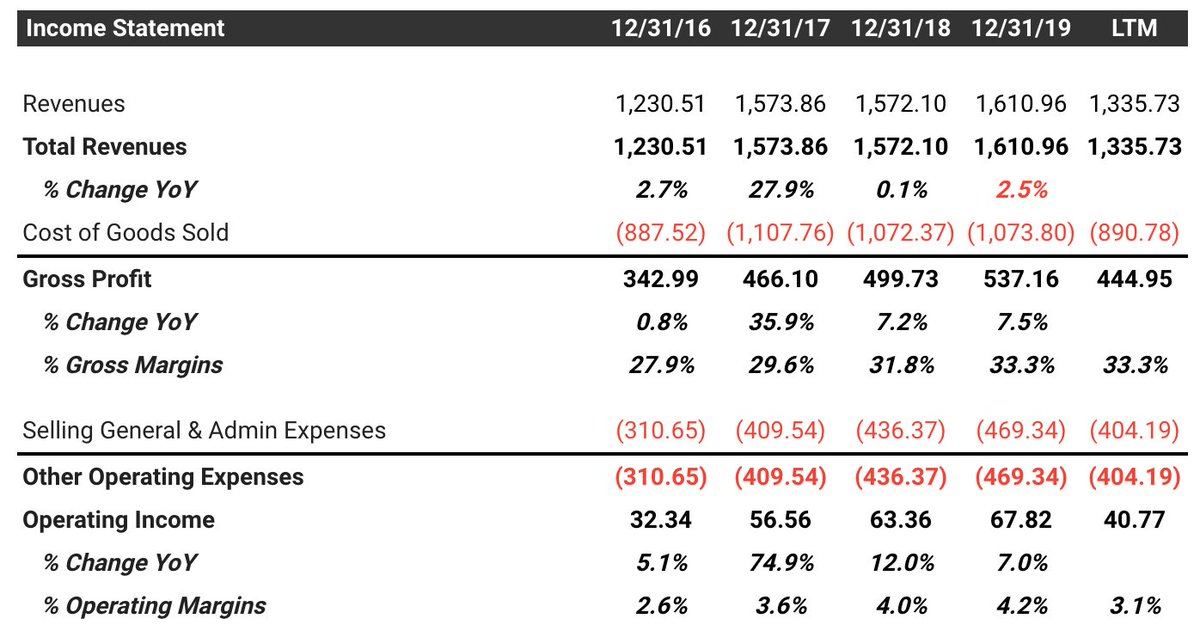

4/ Cost Structures & Margin Profiles

Mid-to-premium tier gyms sport significantly higher cost structures than their counterparts. They must charge more for more services offered.

By offering essentials, low-cost gyms can charge lower monthly rates & hold a better margin prof.

Mid-to-premium tier gyms sport significantly higher cost structures than their counterparts. They must charge more for more services offered.

By offering essentials, low-cost gyms can charge lower monthly rates & hold a better margin prof.

5/ Gyms Are Commoditized Goods

Weights weigh the same regardless of your monthly fee. Plus, it doesn’t matter where you squat as long as you have a bar and a rack.

There are two ways gym biz can differentiate in a commodity market:

- Price

- Amenities

Weights weigh the same regardless of your monthly fee. Plus, it doesn’t matter where you squat as long as you have a bar and a rack.

There are two ways gym biz can differentiate in a commodity market:

- Price

- Amenities

6/ Competing on Amenities An Inferior Game

Competing on amenities is a dangerous game for gym businesses and creates an uphill battle on costs.

More services = higher membership fees. Higher membership fees = fewer members + higher churn rates.

It's a rat race of lavishness.

Competing on amenities is a dangerous game for gym businesses and creates an uphill battle on costs.

More services = higher membership fees. Higher membership fees = fewer members + higher churn rates.

It's a rat race of lavishness.

7/ $GYM Plays The Easier Game

GYM wants to play the low-cost game. They *want* to keep the gym operating a commodity business as long as possible.

Why? Because in a commodity market, the lowest-cost wins every time.

Solid unit economics @ lowest prices = competitive edge

GYM wants to play the low-cost game. They *want* to keep the gym operating a commodity business as long as possible.

Why? Because in a commodity market, the lowest-cost wins every time.

Solid unit economics @ lowest prices = competitive edge

8/ Why Mid-Tier Gyms Are Screwed

Now you're probably thinking, "why don't mid-to-upper tier gyms cut prices?"

They can, they just can't do it for long.

So what do they do? They go back to the amenities game.

Mid/upper-tier gyms add more services to justify their price.

Now you're probably thinking, "why don't mid-to-upper tier gyms cut prices?"

They can, they just can't do it for long.

So what do they do? They go back to the amenities game.

Mid/upper-tier gyms add more services to justify their price.

9/ The Low-Cost Market is Growing Fast

As of 2019, nearly 16% of all UK residents are members of a health/fitness club. That’s up from 12% in 2007. Yet only 3% of residents belong to a low-cost gym

A 2019 PwC report estimated that low-cost gyms would account for 5-7% of gyms.

As of 2019, nearly 16% of all UK residents are members of a health/fitness club. That’s up from 12% in 2007. Yet only 3% of residents belong to a low-cost gym

A 2019 PwC report estimated that low-cost gyms would account for 5-7% of gyms.

10/ Why $GYM Can Continue Its Expansion Strategy

There are four reasons GYM is best-suited to capture this growth:

- High per-site ROICs

- Low leverage vs. peers

- Economies of scale drive lower build-out prices & favorable lease terms

More sites @ lower costs = higher ROICs

There are four reasons GYM is best-suited to capture this growth:

- High per-site ROICs

- Low leverage vs. peers

- Economies of scale drive lower build-out prices & favorable lease terms

More sites @ lower costs = higher ROICs

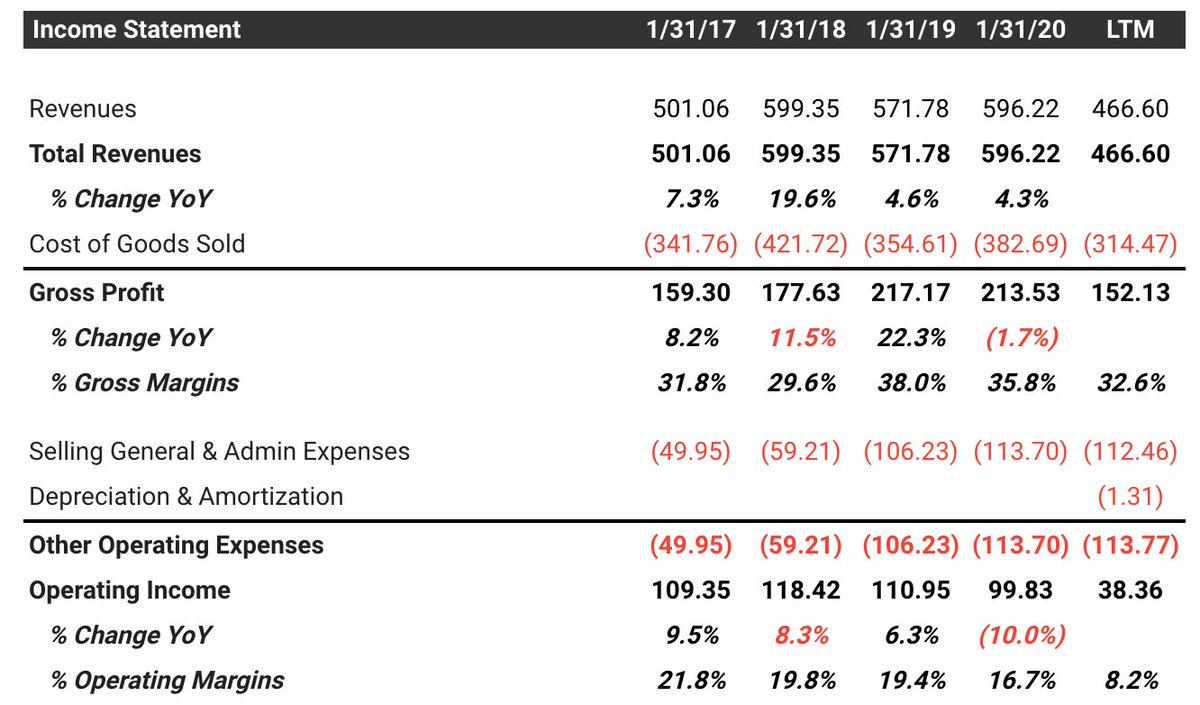

11/ Back-of-Envelope 2026 Estimate

Let's assume GYM grows sites ~5%p.a till 2026. That gives us 247 locations. We'll also assume each store averages 970K in revenue, 320K in EBITDA and 240K in EBIT.

We end 2026 w/ 240M in revenue, 77M in EBITDA and 55M in FCF (13% yield).

Let's assume GYM grows sites ~5%p.a till 2026. That gives us 247 locations. We'll also assume each store averages 970K in revenue, 320K in EBITDA and 240K in EBIT.

We end 2026 w/ 240M in revenue, 77M in EBITDA and 55M in FCF (13% yield).

12/ Concluding Thoughts

The competition will surely emerge, trying to eat away GYM’s mouth-watering ROIC and margin profile. But so far, they haven’t.

Each new gym the company opens further entrenches its competitive advantage in the market.

The low-cost model wins in gyms.

The competition will surely emerge, trying to eat away GYM’s mouth-watering ROIC and margin profile. But so far, they haven’t.

Each new gym the company opens further entrenches its competitive advantage in the market.

The low-cost model wins in gyms.

13/ Credit For Idea: Tollymore Investor Letter

Big thanks to Mark Walker (@walkertollymore) for his write-up. It kickstarted my research and provided excellent commentary.

You can read his thesis here: static1.squarespace.com/static/5bd16fb…

Big thanks to Mark Walker (@walkertollymore) for his write-up. It kickstarted my research and provided excellent commentary.

You can read his thesis here: static1.squarespace.com/static/5bd16fb…

14/ Seeking Alpha Research Post

I also used Jorge Robles SA post on the company to help guide my thesis.

You can read that here: seekingalpha.com/article/428852…

I also used Jorge Robles SA post on the company to help guide my thesis.

You can read that here: seekingalpha.com/article/428852…

15/ Subscribe To Read More Interesting Ideas!

If you enjoyed reading this, consider joining our newsletter at @MacroOps!

We send you interesting write-ups on off-the-radar companies every week.

Join here: macro-ops.com

If you enjoyed reading this, consider joining our newsletter at @MacroOps!

We send you interesting write-ups on off-the-radar companies every week.

Join here: macro-ops.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh