Manchester City’s 2019/20 financial results covered a season when they finished runners-up in the Premier League, reached the semi-finals of the FA Cup and the quarter-finals of the Champions League, and won the League Cup. Some thoughts in the following thread #MCFC

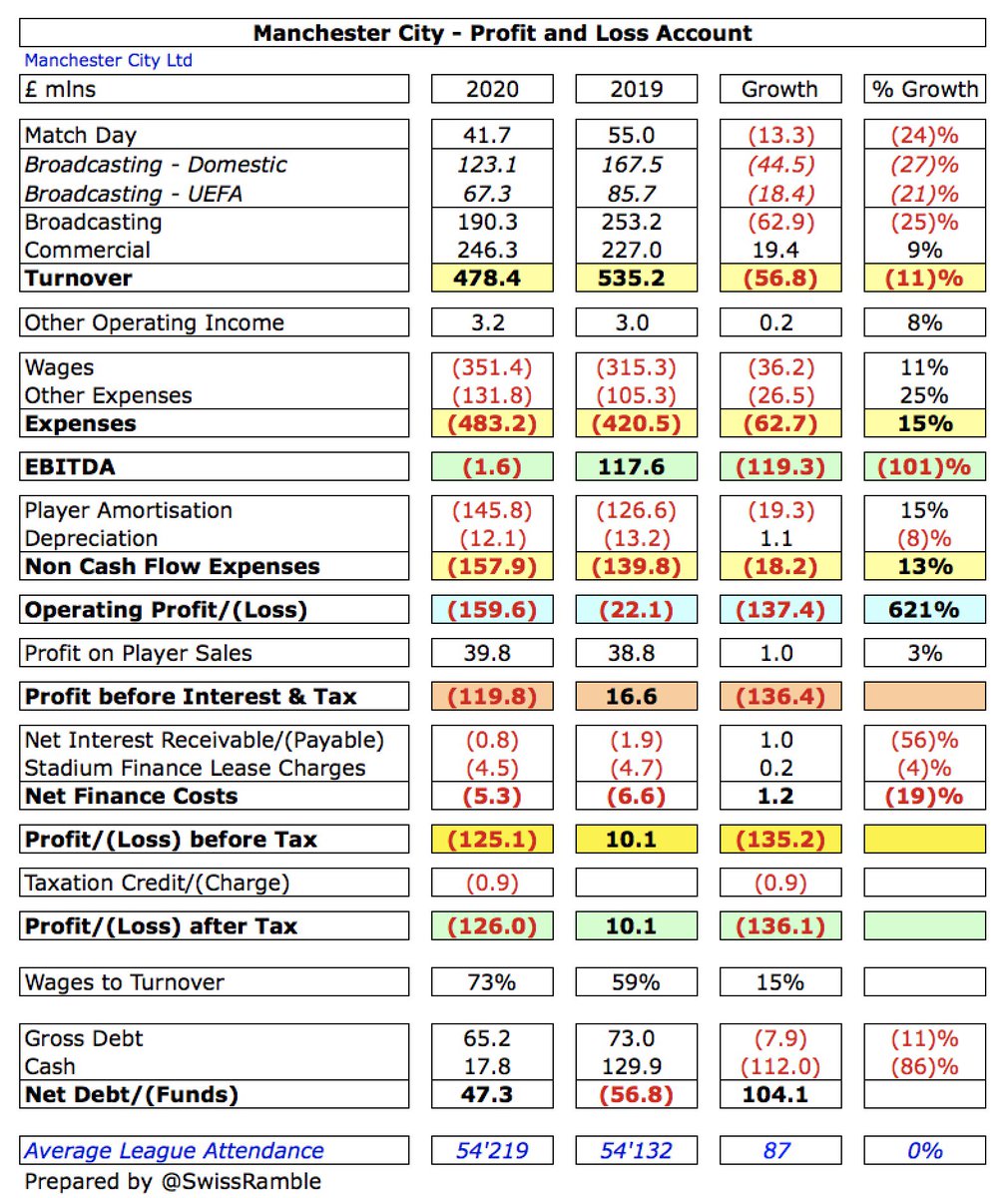

#MCFC swung from £10m profit before tax to £125m loss, as the impact of the COVID-19 pandemic resulted in revenue falling £57m (11%) from £535m to £478m, while expenses increased £81m (14%). Profit on player sales was up £1m to £40m. Loss after tax was £126m.

The main driver of the #MCFC revenue reduction was broadcasting, which fell £63m (25%) from £253m to £190m, while match day dropped £13m (24%) from £55m to £42m. This was partially offset by commercial rising £19m (9%) from £227m to £246m.

Despite the steep decline in revenue, #MCFC saw significant cost growth, as the wage bill shot up £36m (11%) from £315m to £351m and player amortisation rose £19m (15%) from £127m to £146m. Other expenses also increased £27m (25%) from £105m to £132m.

The #MCFC loss of £125m is obviously not great, but all clubs have been adversely impacted by COVID with no fewer than 9 in the Premier League posting losses above £50m to date in 2019/20. That said, only #EFC have reported a larger loss than City with £140m.

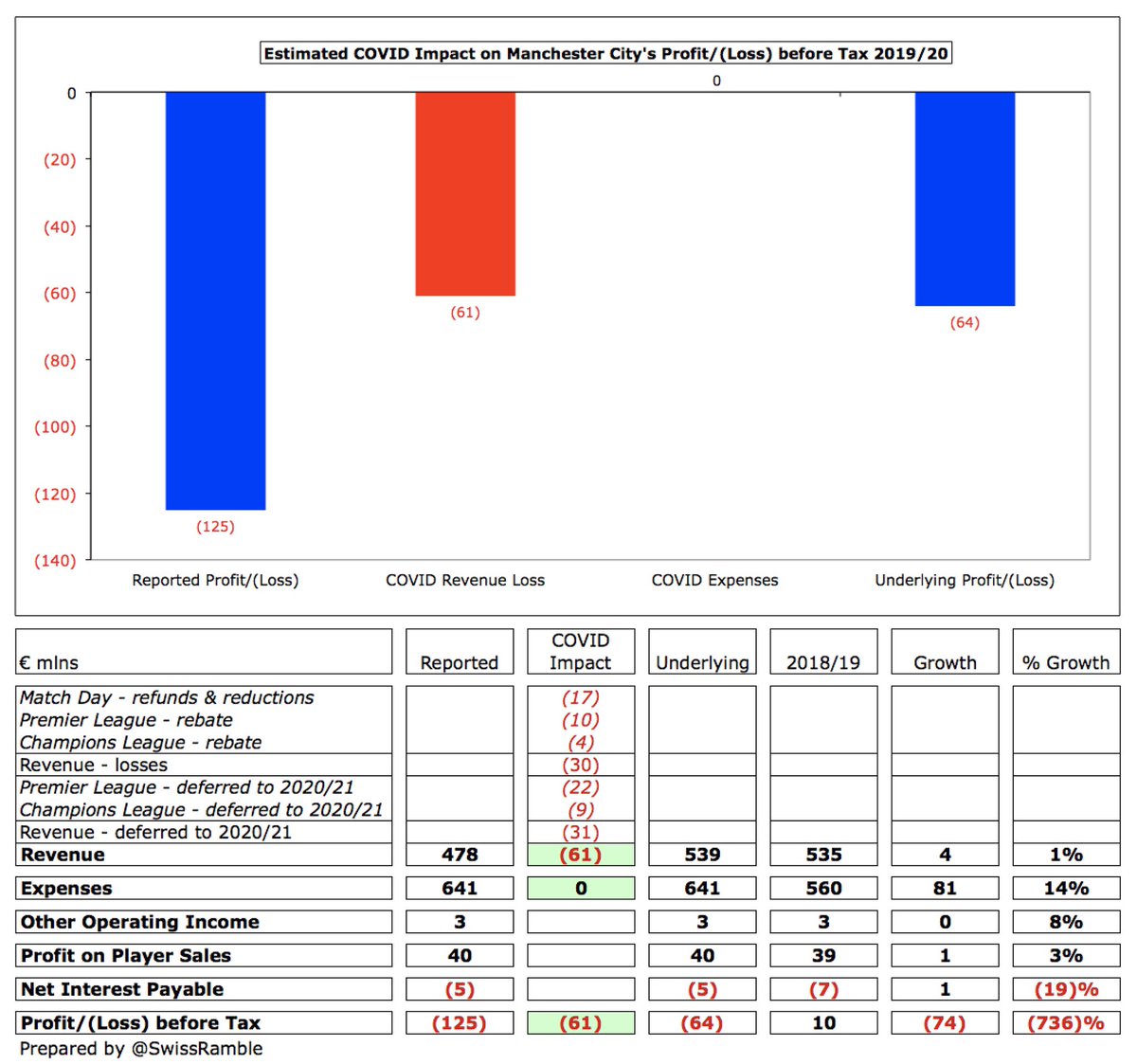

Clearly, these figures have been significantly hit by the pandemic, which has resulted in money lost from a rebate to broadcasters and games played behind closed doors, while revenue for games played after 30th June accounting close has been deferred to 2020/21 accounts.

My rough estimate is that COVID resulted in £61m reduction to #MCFC revenue, split between £30m lost (match day £17m, TV rebates £13m) and £31m broadcasting deferred to 2020/21. Without this, revenue would have been £539m (similar to prior year), but would still have lost £64m.

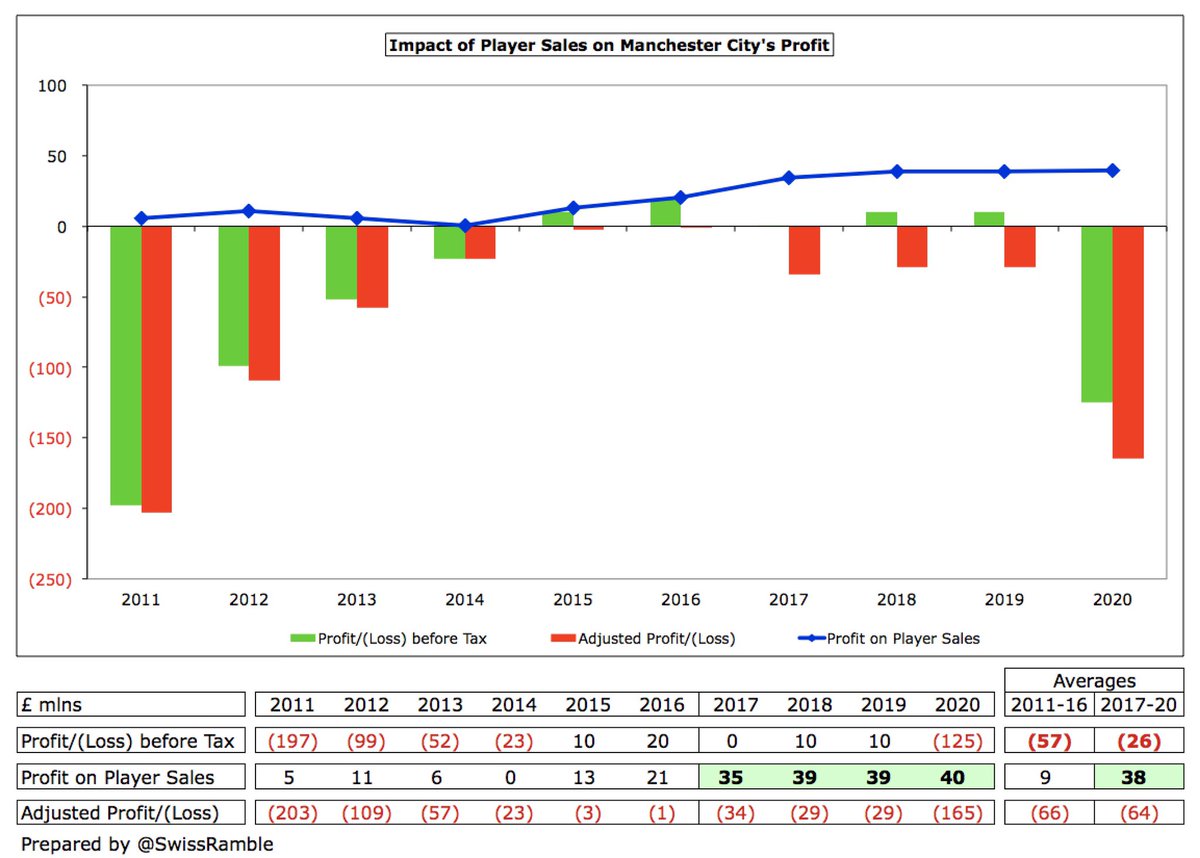

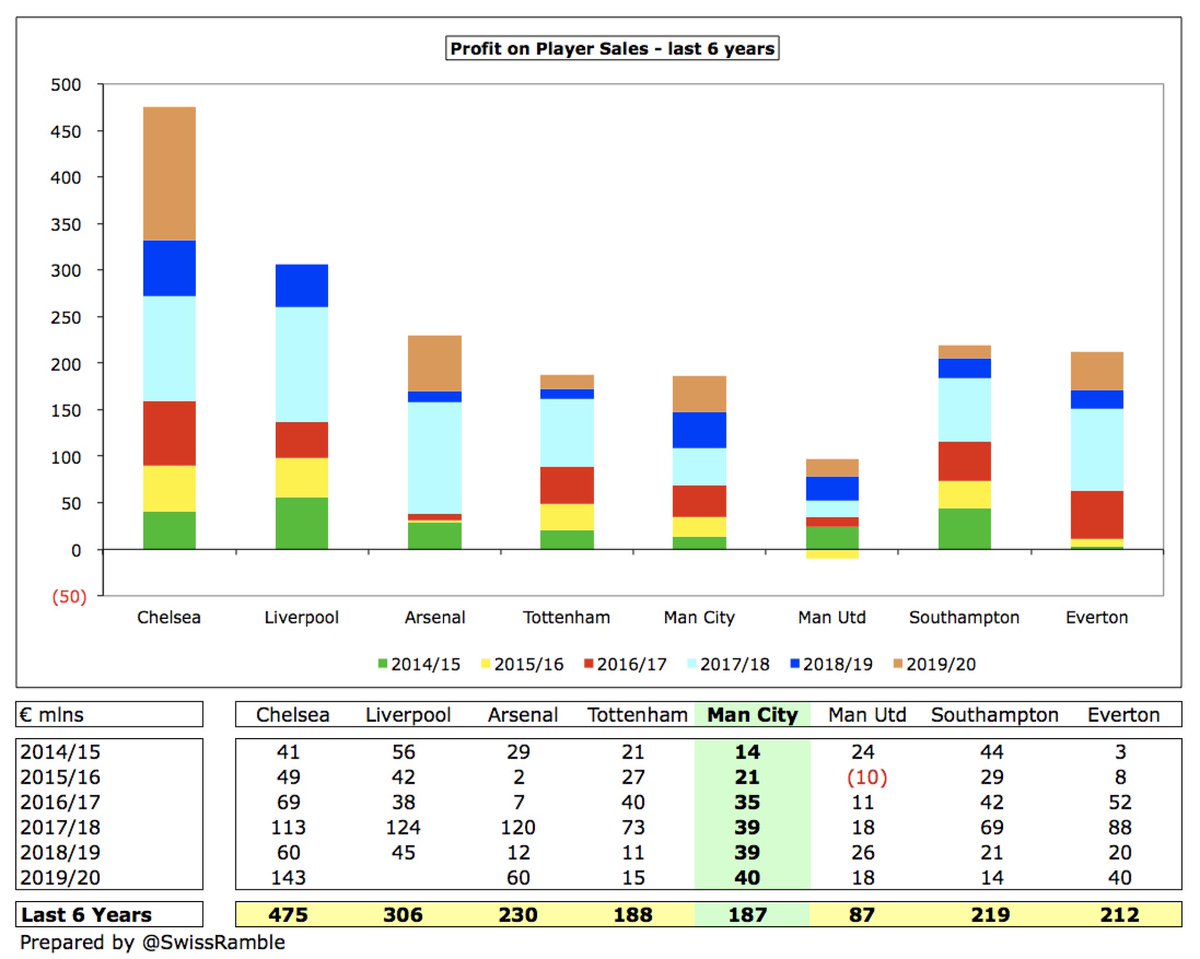

#MCFC benefited from £40m profit from player sales, up from prior year £39m, mainly from Danilo to Juventus, Douglas Luiz to #AVFC and Fabian Delph to #EFC. That’s pretty good, but a fair way below #CFC £143m, #LCFC £63m and #AFC £60m.

After five profitable years in a row, #MCFC once again made a loss, though the club expects to immediately return to profitability in 2020/21, as a result of a less COVID-impacted season and deferred 2019/20 revenue. That said, £125m loss is fourth highest ever in Premier League.

Although player sales are still not as high at #MCFC as many other clubs (e.g. #CFC £475m since 2015), they have become increasingly important, averaging £38m in last 4 years. This season will include big money sale of Leroy Sané to Bayern Munich plus Nicolas Otamendi to Benfica.

#MCFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, dropped from £118m to £(2)m, which is the lowest of the Big Six, a long way below #MUFC £132m and #THFC £106m.

#MCFC operating loss (i.e. excluding player sales and interest) widened from £22m to £160m, which is the worst to date in 2019/20 Premier League, though three other clubs had operating losses higher than £100m, namely #EFC £144m, #LCFC £122m and #CFC £112m.

Despite the decrease in 2019/20, #MCFC revenue has still grown by £87m (22%) in the last four years, largely due to commercial £68m, though broadcasting is also up £29m. Thanks to TV rebate and revenue deferral, commercial is now the largest revenue stream with 51%.

However, #MCFC £87m revenue growth since 2016 has been outpaced by both #LFC £188m and #THFC £182m in this period. That said, City have significantly closed the gap with their local rivals #MUFC from £128m in 2017 to only £31m in 2020.

#MCFC £478m revenue is the third highest in England, but they are within striking distance of both #MUFC £509m and #LFC £490m (who overtook them in 2019/20). There is then a fair gap to the following clubs: #CFC £407m, #THFC £392m and #AFC £343m.

Revenue at most clubs is significantly down in 2019/20, due to COVID. #MCFC 11% reduction is a bit better than average, though £57m one of the largest falls in absolute terms. Some clubs have benefited from 31st July accounting close, so no revenue deferred to 2020/21 accounts.

#MCFC remained 6th in the Deloitte Money League, which ranks clubs globally by revenue, though they are only £8m ahead of Paris Saint-Germain. Their £482m revenue (slightly higher than club’s accounts) is £145m below the Spanish giants, Barcelona and Real Madrid, both £627m.

#MCFC broadcasting income fell £63m (25%) from £253m to £190m, due to rebates and deferrals. Decreases in both domestic, down £45m (27%) from £168m to £123m, and Champions League, down £18m (21%) from £86m to £67m. However, still second highest in England, only surpassed by #LFC.

As the 2019/20 season was extended beyond the 30th June accounting close, #MCFC Premier League TV money was less than prior year, exacerbated by lower league position, though most of the revenue decrease has been deferred into the 2020/21 accounts, so is only a timing difference.

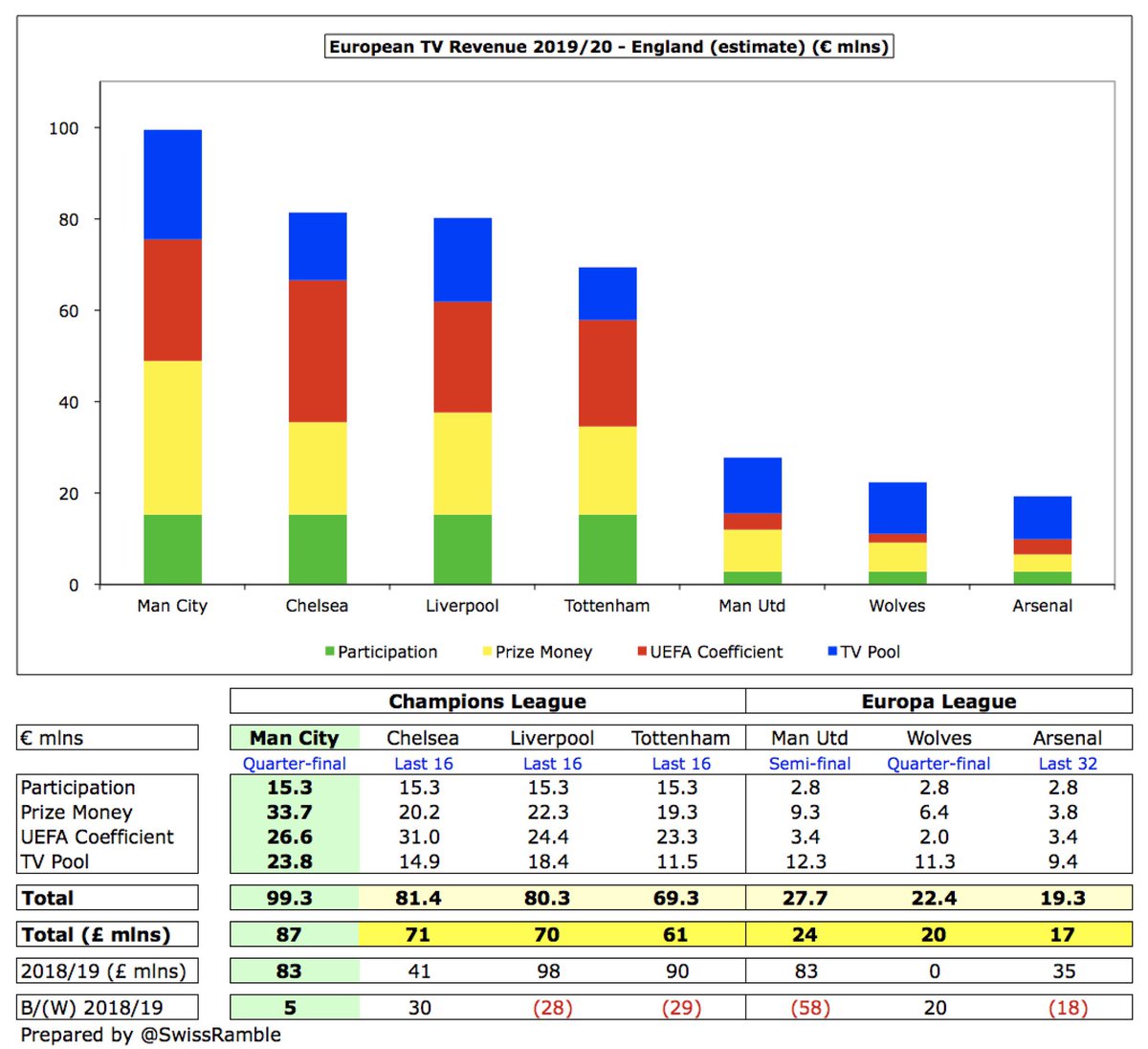

#MCFC earned (estimated) £87m (€99m) from Europe after reaching Champions League quarter-finals, the highest of all English representatives in Europe, though this was reduced in 2019/20 accounts for TV rebate, games played in August and €10m UEFA FFP fine (cut from €30m).

In fact, the Champions league has been a nice little earner for #MCFC with an impressive €390m received in the last five years, the highest of any English club, well ahead of #LFC €310m, #THFC €299m, #CFC €262m, #MUFC €248m and #AFC €214m.

#MCFC commercial income increased £19m (9%) from £227m to £246m, mainly thanks to two new deals: Puma kit supplier agreement with City Football Group is worth £65m, a big increase on Nike £20m, while Marathonbet signed as training kit partner for eight-figure sum.

As a result, #MCFC have the second highest commercial income in England, having narrowed the gap to #MUFC to just £33m. United’s commercial engine has stalled, hovering at around £275m for the last five years, though steep growth recently at #LFC and #THFC.

#MCFC benefit from Etihad shirt sponsorship worth £45m a season, while naming rights for stadium and campus is estimated at £15-20m. Nexen Tire sleeve sponsor is £10m. #MUFC current shirt sponsorship with Chevrolet is worth £64m, but will be replaced by TeamViewer at just £47m.

#MCFC match day revenue fell £13m (24%) from £55m to £42m, as they played 8 home games behind closed doors due to COVID (6 Premier League, 2 Champions League). This was 6th highest in the top flight, but less than half of #THFC £95m after the move to their new stadium.

#MCFC average attendance rose slightly from 54,132 to 54,219 (for those games played with fans), which was 5th highest in the Premier League, around 18,000 below their Manchester neighbours #MUFC 72,726. Season ticket prices increased by 3% in 2019/20,

#MCFC wage bill shot up £36m (11%) from £315m to £351m, due to a combination of new signings and contract extensions. This means that wages have increased by £154m (58%) in the last 4 years, comfortably the highest growth of the Big Six.

Following this increase, #MCFC £351m wages are once again the highest in the Premier League, for the first time since 2013. In fact, this is the highest ever wage bill reported in England, a fair way ahead of #LFC £310m (2018/19 figure), #MUFC £284m and #CFC £283m.

#MCFC wages to turnover ratio worsened from 59% to 73%, the club’s highest since 2013, though this was significantly impacted by the COVID-19 revenue reductions. In fairness, even this reported number is not too bad, being around mid-table in the Premier League.

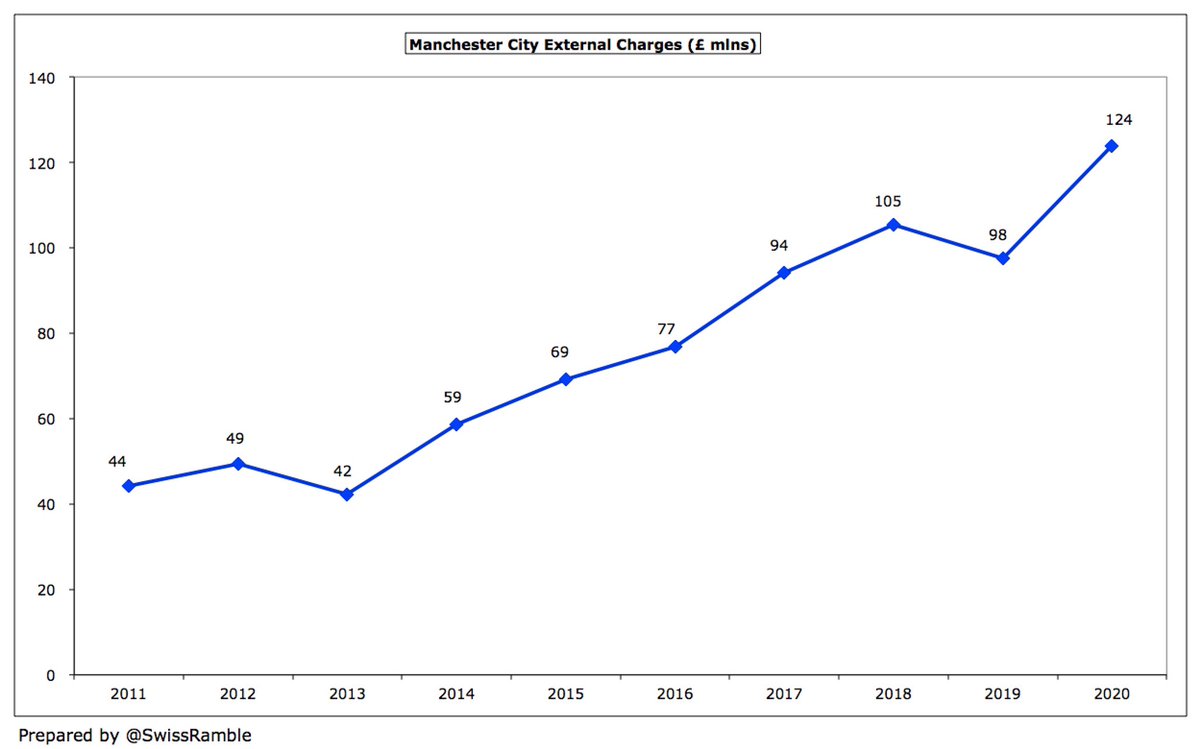

A few years ago #MCFC transferred some staff to other group companies, which then charge the club for services provided. This partly explains the large increase in external charges since 2013 from £42m to £124m. Significant £26m growth in 2019/20 with little explanation.

#MCFC do not provide details of their highest paid director, so we cannot say whether the remuneration is in the same ball park as Ed Woodward at #MUFC and Daniel Levy at #THFC, who both trousered around £3m.

#MCFC player amortisation, the annual charge to expense transfer fees over a player’s contract, rose £19m (15%) from £127m to £146m, which is not only the highest in the Premier League in 2019/20, £23m above #MUFC £123m, but the second highest ever in England.

#MCFC spent £180m on player purchases, just behind #MUFC £183m and #AFC £182m in 2019/20. Included the signings of Rodrigo from Atletico Madrid, Cancelo from Juventus, Angelino from PSV, Porro from Girona and Steffen from Columbus Crew.

This means that #MCFC have splashed out nearly a billion (£974m) on player recruitment in the last 5 years following £535m in the preceding 5-year period. Have also spent big this season on Ruben Dias, Nathan Aké and Ferran Torres plus a raft of promising youngsters.

In fact, #MCFC have the highest transfer expenditure in the Premier League over the last six years, though they are only just ahead of #MUFC. Since 2015 their £748m net spend compares to #MUFC £702m, while gross spend of £1, 072m is a whisker above #MUFC £1,053m.

#MCFC £65m debt is for leases on the Etihad stadium. This is one of the lowest in the Premier League, way below the likes of many clubs, e.g. six owe more than £200m: #THFC £831m, #MUFC £526m, #EFC £409m, #BHAFC £306m, #LCFC £219m and #AFC £218m.

Similarly, #MCFC have low annual interest payments of £0.8m, far below #MUFC £20m, #THFC £14m and #AFC £11m, the latter two due to stadium financing. Mansour’s funding via additional share capital (instead of debt) provides a competitive advantage here.

#MCFC cut transfer debt to £73m, around half £141m two years ago. Net payables just £7m, as £66m owed to City by other clubs. On the low side for PL, e.g. #AFC £154m. However, also have massive contingent liabilities of £158m, based on achievement of certain contractual clauses.

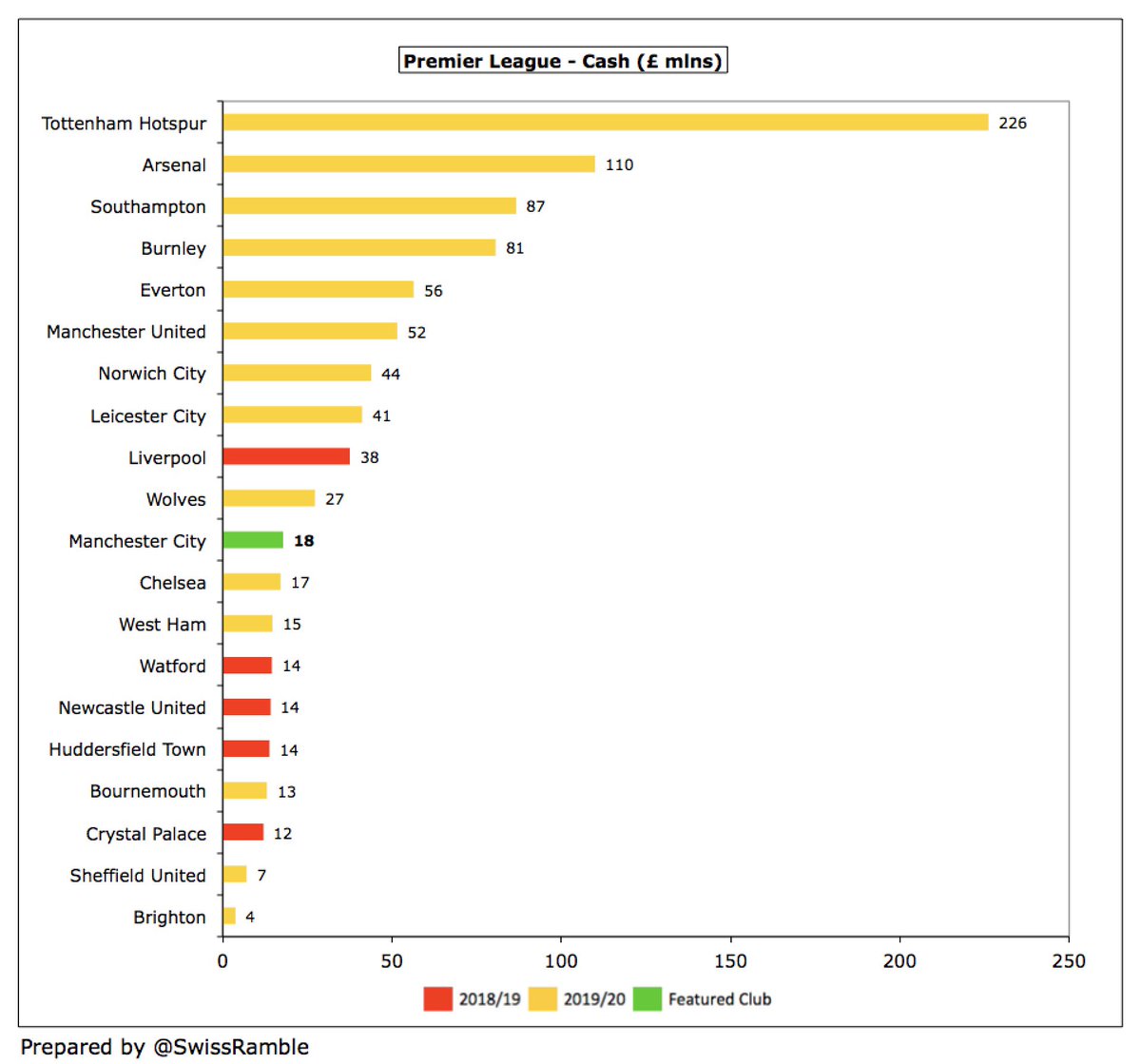

#MCFC cash balance dropped from £130m to £18m, again impacted by COVID. This is much lower than #THFC £226m, though the North London club’s bank balance was boosted by a £175m COVID loan from the government.

#MCFC have become largely self-sufficient (excluding the impact of COVID), so no additional share capital has been issued in the last two years (last time was £58m in 2017/18). To date, the owners have provided more than £1.3 bln of funding via new shares or loans.

Interestingly, #MCFC have not been the largest beneficiaries of owner funding in the last few years. For example, in the five years up to 2019 they only received £142m, well below the likes of #CFC £440m, #EFC £300m and #AVFC £193m.

#MCFC have had a few issues with UEFA’s FFP in the past, but the club is confident of meeting the more relaxed regulations with financial results currently assessed over two years to take into consideration the impact of COVID.

#MCFC CEO Ferran Soriano concluded, “Clearly the 2019/20 accounts in isolation are not the best representation of the reality of the season. A better financial picture of the COVID years will be provided at the end of 2020/21 when the two seasons are combined and normalised.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh