How investing in startups is different from other kinds of investing.

(a tiny thread)

(a tiny thread)

1/ The biggest difference is in mindset.

With startups, you don’t think how they can fail because they almost certainly will fail.

Rather you think about their best case - how big they can get if everything goes right.

With startups, you don’t think how they can fail because they almost certainly will fail.

Rather you think about their best case - how big they can get if everything goes right.

2/ Another difference is in valuations.

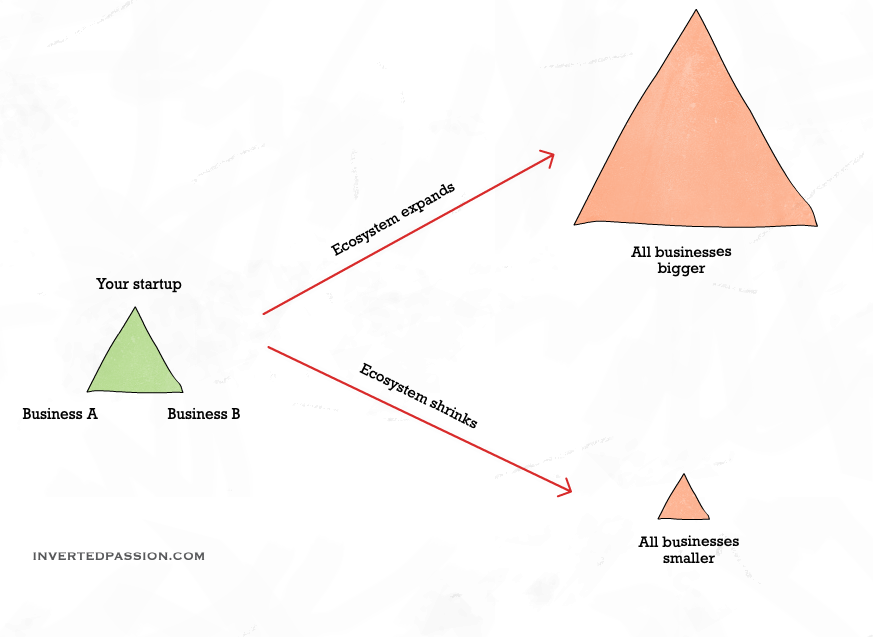

In a sense, a startup company should be defined by its ability to tell a growth story instead of its size.

In a sense, a startup company should be defined by its ability to tell a growth story instead of its size.

3/ This is why pre-revenue startups can have insane valuations while as soon as they start making revenue, valuation gets tied to reality.

4/ Startup valuation is entirely determined by the story a company is able to tell about its future.

This is why Tesla is on the moon, while many other companies get slapped with a P/E multiple.

This is why Tesla is on the moon, while many other companies get slapped with a P/E multiple.

5/ Because your investment in startup is almost guaranteed to fail, you take many bets.

Simulations show an ideal portfolio is 50-100 bets. With each additional bet, you increase your chances of doubling the money.

reactionwheel.net/2017/12/power-…

Simulations show an ideal portfolio is 50-100 bets. With each additional bet, you increase your chances of doubling the money.

reactionwheel.net/2017/12/power-…

6/ Another implication of high failure rate: if you don’t invest in the follow on rounds of the ones that don’t fail, you impact your total returns significantly.

This is why most early stage funds reserve half their total funds as a follow on.

This is why most early stage funds reserve half their total funds as a follow on.

7/ Fot your personal portfolio treat early stage investing as an asset class with high risk, high returns nature.

Many investors keep 10-15% of their portfolio for early stage investing but I’m sure people like @naval or @balajis would have much more aggressive allocation

Many investors keep 10-15% of their portfolio for early stage investing but I’m sure people like @naval or @balajis would have much more aggressive allocation

8/ You can see why startup investing is not for everyone:

- 10% portfolio

- 50 companies

- Reserve half for follow on

Taking minimum $10k as cheque size per startup, it means $10k * 2 * 50 * 10 = $1 million net worth.

- 10% portfolio

- 50 companies

- Reserve half for follow on

Taking minimum $10k as cheque size per startup, it means $10k * 2 * 50 * 10 = $1 million net worth.

9/ Which means if your net worth is less than this, it may not make sense to invest in startups.

Because of risk, startup investing is like “on” or “off” switch - you either commit to make a full portfolio or you avoid it.

Because of risk, startup investing is like “on” or “off” switch - you either commit to make a full portfolio or you avoid it.

10/ In contrast, public market index funds derisk at two levels:

- mature companies, less likely to fail

- inherent diversification

What’ll be really awesome is someone like @AngelList launches index funds for startups.

- mature companies, less likely to fail

- inherent diversification

What’ll be really awesome is someone like @AngelList launches index funds for startups.

11/ That’s it!

Hope it helped.

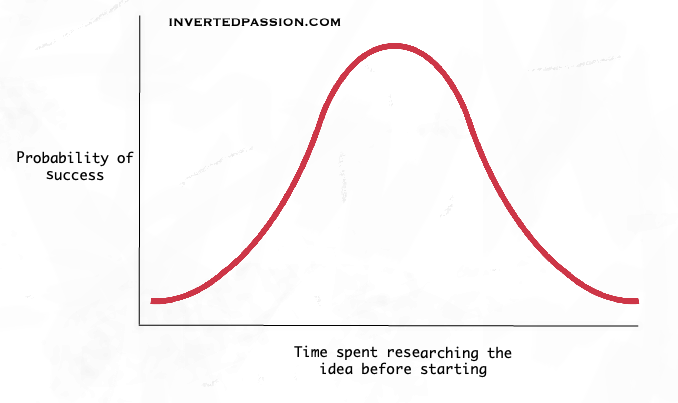

I’m building my own startup investing portfolio, hence my curiosity.

If you know any good startup raising funds, send them my way with answers to the five questions listed here: invertedpassion.com/about/

Hope it helped.

I’m building my own startup investing portfolio, hence my curiosity.

If you know any good startup raising funds, send them my way with answers to the five questions listed here: invertedpassion.com/about/

12/ Correction:

The math says minimum net worth $10 million, not $1 million.

(Taking minimum $10k as cheque size per startup, it means $10k * 2 * 50 * 10 = $10 million net worth.)

The math says minimum net worth $10 million, not $1 million.

(Taking minimum $10k as cheque size per startup, it means $10k * 2 * 50 * 10 = $10 million net worth.)

13/ Also obvious things:

- Kiss your invested money goodbye as this is highly illiquid investment

- Only invest what you can afford to lose (get health insurance first and make a nest egg that’s safe and liquid)

- I am not a financial advisor :)

- Kiss your invested money goodbye as this is highly illiquid investment

- Only invest what you can afford to lose (get health insurance first and make a nest egg that’s safe and liquid)

- I am not a financial advisor :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh