The week rule to prevent failure.

(a thread on this mental model)

🎊 It's the 13th chapter of my book: invertedpassion.com/the-week-rule-…

(a thread on this mental model)

🎊 It's the 13th chapter of my book: invertedpassion.com/the-week-rule-…

1/ Entrepreneurs are always in a hurry. They want the product to be out so that they can get customer feedback sooner.

This hurry is understandable yet misguided because it prioritizes getting the idea out in front of customers over everything else.

This hurry is understandable yet misguided because it prioritizes getting the idea out in front of customers over everything else.

2/ The initial excitement about an idea can easily lead to months of wasted development effort.

Imagine discovering major flaws in pricing, distribution, design, or market *after* all that effort.

Imagine discovering major flaws in pricing, distribution, design, or market *after* all that effort.

3/ Isn’t it much better to flesh out ideas with a few weeks of research than to spend months developing them?

4/ The suggestion to research an idea before launching is obvious and most people will agree with it.

However, in practice, the rush of bringing an exciting idea to life biases towards development and against research.

To prevent this, follow the week thumb rule.

However, in practice, the rush of bringing an exciting idea to life biases towards development and against research.

To prevent this, follow the week thumb rule.

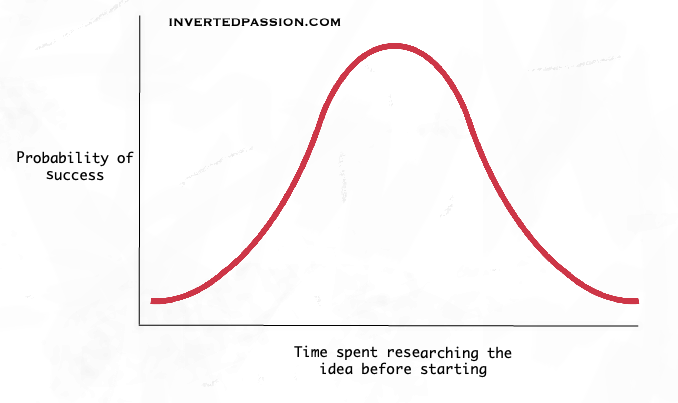

5/ The week thumb rule suggests that no matter how exciting an idea seems, rather than dive headlong into development, it’s wise to spend at least a few weeks researching the competition, customer needs, pricing, distribution channels, and development challenges.

6/ The more time that’s spent during research, the more obvious mistakes you’ll later prevent.

Why pivot after months when you can pivot within a week? So, be patient.

Why pivot after months when you can pivot within a week? So, be patient.

7/ But don’t be too patient.

Although it doesn’t happen often, it’s possible to do too much research.

Although it doesn’t happen often, it’s possible to do too much research.

8/ Entrepreneurship requires a dash of ignorance about the difficulty of solving some problems in the market.

Do too much research and you may get dissuaded to even take the first step.

Do too much research and you may get dissuaded to even take the first step.

9/ Most successful entrepreneurs would say that they wouldn’t have started if they knew how difficult it is going to be.

So, finding the right balance of doing just the right amount of research is important.

So, finding the right balance of doing just the right amount of research is important.

10/ In my experience, for most software / consumer products, research on the order of weeks is enough.

After all that research, if you’re still excited about the opportunity, go for it.

After all that research, if you’re still excited about the opportunity, go for it.

11/ 🧠

Remember: doing a thorough scan of customers and markets before development significantly increases the odds of success by helping drop non-viable ideas early on.

Remember: doing a thorough scan of customers and markets before development significantly increases the odds of success by helping drop non-viable ideas early on.

13/ I'm posting ~1 new mental model for entrepreneurs every week.

Here's the entire list of 60+ mental models that I'll cover in a year or so: invertedpassion.com/free-book-ment…

Make sure you sign up for email updates on the book page.

Here's the entire list of 60+ mental models that I'll cover in a year or so: invertedpassion.com/free-book-ment…

Make sure you sign up for email updates on the book page.

14/ Previous mental model is in this thread:

https://twitter.com/paraschopra/status/1368823894300184576

• • •

Missing some Tweet in this thread? You can try to

force a refresh