There’s a lot of bad advice out there on how to pitch your startup.

Last year, I invested $1M+ and heard 200 companies pitch.

Every great pitch I've heard nails 5 ingredients.

In this thread, we'll go through each to help maximize your chances when fundraising

Let's dig in👇

Last year, I invested $1M+ and heard 200 companies pitch.

Every great pitch I've heard nails 5 ingredients.

In this thread, we'll go through each to help maximize your chances when fundraising

Let's dig in👇

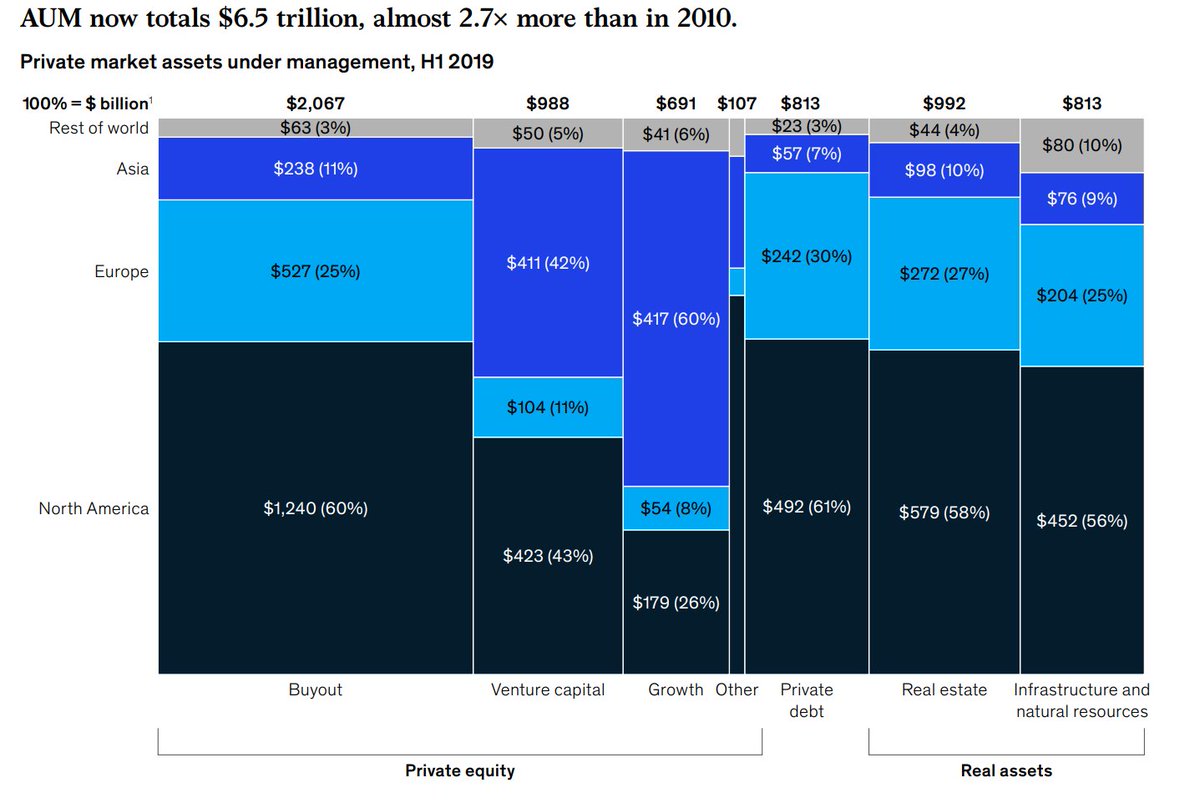

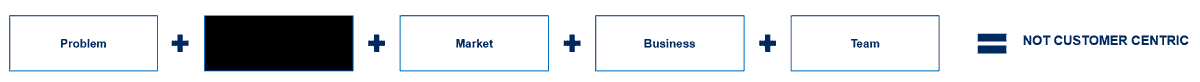

1/ Every pitch should have 5 ingredients:

- Problem: Is this an issue

- Solution: Do you have the fix

- Market: Is this a big enough issue

- Business: Can you make money

- Team: Are you the people to do it

The best pitches nail all 5. Good ones hit 4. Subpar hit 3 or less.

- Problem: Is this an issue

- Solution: Do you have the fix

- Market: Is this a big enough issue

- Business: Can you make money

- Team: Are you the people to do it

The best pitches nail all 5. Good ones hit 4. Subpar hit 3 or less.

2/ PROBLEM

The problem statement is an explanation of why a set of circumstances is painful for a set of users.

There’s one word in that sentence that is most important: painful.

If your problem is not painful enough, it's a vitamin.

The best startups are pain killers.

The problem statement is an explanation of why a set of circumstances is painful for a set of users.

There’s one word in that sentence that is most important: painful.

If your problem is not painful enough, it's a vitamin.

The best startups are pain killers.

3/ SOLUTION

The solution statement is an explanation of how you address the pain felt by your users. If you don’t have the right solution, you won’t get customer traction.

Customers don’t buy your thesis on the pain point. They buy the actual thing that solves their pain point.

The solution statement is an explanation of how you address the pain felt by your users. If you don’t have the right solution, you won’t get customer traction.

Customers don’t buy your thesis on the pain point. They buy the actual thing that solves their pain point.

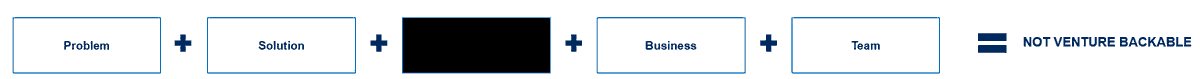

4/ MARKET

In tech, only businesses that have outsized potential get funded.

To have outsized potential, you have to either be in a:

(a) small, but rapidly growing market or

(b) large existing market that can be resegmented

If not, the business is not venture backable.

In tech, only businesses that have outsized potential get funded.

To have outsized potential, you have to either be in a:

(a) small, but rapidly growing market or

(b) large existing market that can be resegmented

If not, the business is not venture backable.

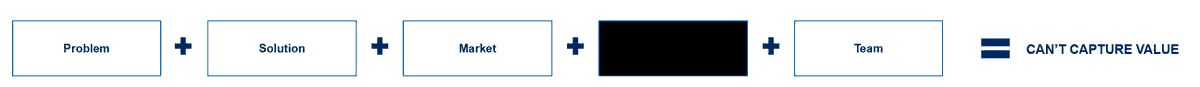

5/ BUSINESS

The business model defines how you print $$$.

What is the key insight you’ve figured out that other people haven’t?

You don’t need to reinvent the wheel on everything to be a compelling business. Just explain your secret sauce that helps you capture the value.

The business model defines how you print $$$.

What is the key insight you’ve figured out that other people haven’t?

You don’t need to reinvent the wheel on everything to be a compelling business. Just explain your secret sauce that helps you capture the value.

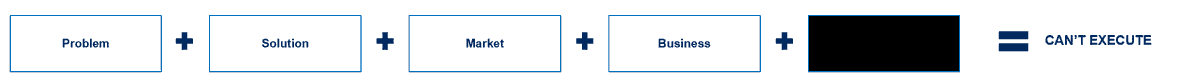

6/ TEAM

Everything else is academic if you can’t execute.

Ultimately the Investor is betting on your team’s ability to bring out reality in the insights around the problem, solution, market and business.

Communicate why you are the best in the world to build the business.

Everything else is academic if you can’t execute.

Ultimately the Investor is betting on your team’s ability to bring out reality in the insights around the problem, solution, market and business.

Communicate why you are the best in the world to build the business.

7/ Once you feel good about these 5, think through the connection points.

Every topic that comes up in convesation will be a function of a connection point. For example,

- Problem-Market = Industry Dynamics

- Solution-Market = Competition

- Market-Business = Unit Economics

Every topic that comes up in convesation will be a function of a connection point. For example,

- Problem-Market = Industry Dynamics

- Solution-Market = Competition

- Market-Business = Unit Economics

8/ Time and time again, I see Founders struggling to keep it simple. When you pitch:

- Understand the 5 core ingredients

- Think through how they relate to one another

- Communicate with clarity

- Don't assume Investors understand your business.

Happy fundraising :)

- Understand the 5 core ingredients

- Think through how they relate to one another

- Communicate with clarity

- Don't assume Investors understand your business.

Happy fundraising :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh