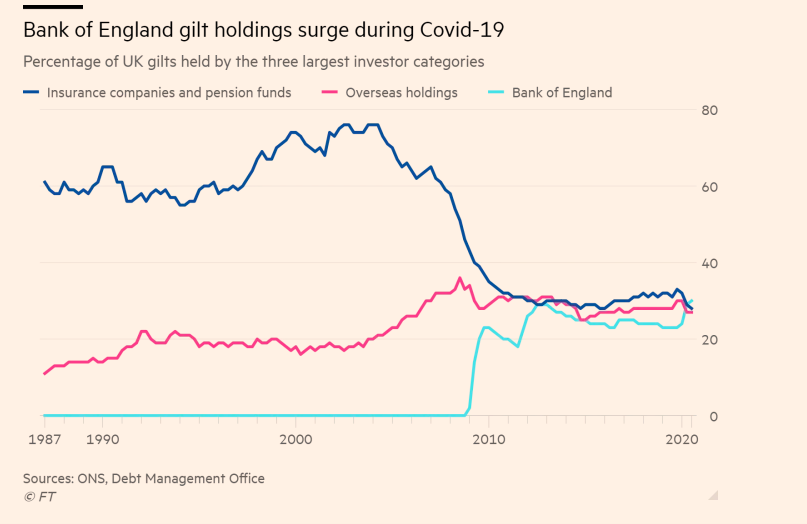

good morning to the Bank of England, who's showing us what a committed monetary financier looks like

and a reminder not all monetary financing is the same: this modern/new Keynesian entrenches weak framework for monetary-fiscal interactions, one that actively undermines both the rethink of fiscal rules, and fiscal support for the low-carbon transition.

osf.io/preprints/soca…

osf.io/preprints/soca…

music, music to the (post-Keynesian/MMT) ear: the ultimate driver of government financing costs is the central bank.

and for the MMT trolls that attack before reading -

central bank purchases in secondary markets recreate reserves destroyed by primary issuance, and matter for price/interest rate reasons.

central bank purchases in secondary markets recreate reserves destroyed by primary issuance, and matter for price/interest rate reasons.

• • •

Missing some Tweet in this thread? You can try to

force a refresh