Ben is of course right - #WallStreetConsensus is a development paradigm invented for the Global South, but could easily travel up North to satisfy the portfolio glut's hunger for infrastructure assets.

https://twitter.com/BJMbraun/status/1381649835930042369

'give us infrastructure assets!' clamour institutional investors, who wont tell you that partnerships with private finance means the de facto privatization of infrastructure - you have to pay for it to access it, otherwise where are those handsome cash flows gonna come from?

and a visual guide to how the Biden Infrastructure Plan according to BlackRock would look like, with a nod to @KatharinaPistor

just to be clear - the derisking infrastructure approach is familiar to high-income countries, and has been critiqued here for a long time

https://twitter.com/mackaymiller/status/1382292476749344776?s=20

as we argued with @nssylla - #WallStreetConsensus as development paradigm for Global South has been opposed in France precisely because of the local experience with derisking PPPs

geopolitique.eu/en/2020/12/23/…

geopolitique.eu/en/2020/12/23/…

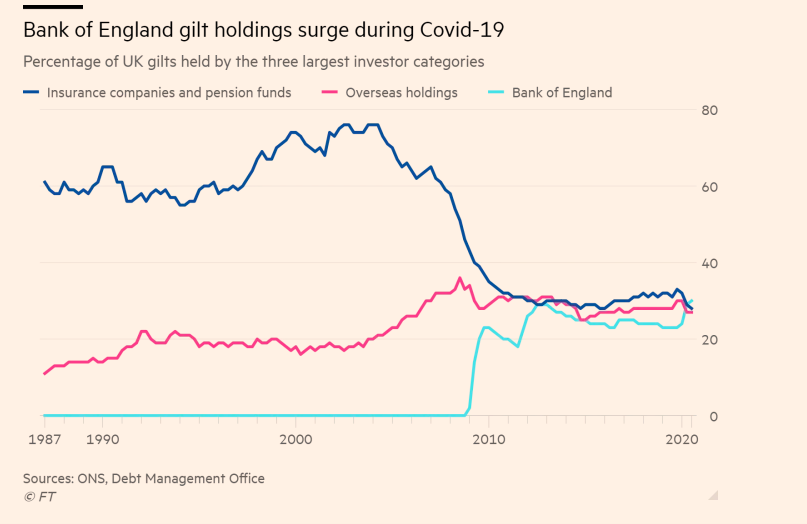

what is less known/new for the Global North Derisking State story is the institutional investor presence, and the question of @BJMbraun infrastructural power

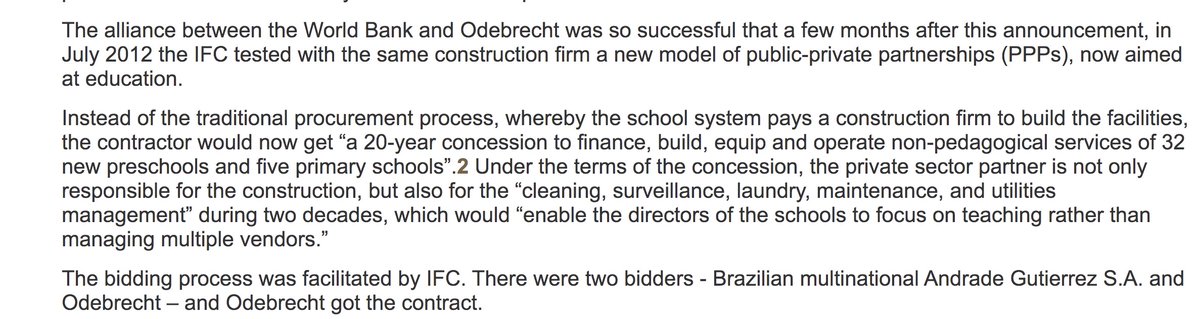

and my favourite story of how the World Bank experimented with #WallStreetConsensus in Latin America is - drum drum - Odebrecht!

socialwatch.org/node/17710

socialwatch.org/node/17710

• • •

Missing some Tweet in this thread? You can try to

force a refresh