1/ Honored to bring Grab public w/ @altcap @Chris_Conforti on the Altimeter Capital Markets platform.

This is an iconic ~$40B company and we're so excited to be partners to @AnthonyPY_Tan in their journey!

grab.com/sg/press/other…

This is an iconic ~$40B company and we're so excited to be partners to @AnthonyPY_Tan in their journey!

grab.com/sg/press/other…

2/ Southeast Asia is home to 670M people, one of the fastest growing economies, and still early innings in digitizing.

Online GDP penetration remains single digits in the region – a fraction of the US and China.

And Grab is by far the market leader.

Online GDP penetration remains single digits in the region – a fraction of the US and China.

And Grab is by far the market leader.

3/ Grab is THE daily super app used by 25M people – and touches everyday lives across transport, food and payments.

They have built the clear market leader w/ 70%+ share in ride hail and 50% share in food delivery.

They have built the clear market leader w/ 70%+ share in ride hail and 50% share in food delivery.

4/ Their super app results in a flywheel that drives superior economics.

Consumers use Grab to order breakfast, commute to work, shop for groceries, and pay their bills.

Lower cost of acquisition + higher lifetime value.

Cohorts by Year 5 are spending 3.6x more.

Consumers use Grab to order breakfast, commute to work, shop for groceries, and pay their bills.

Lower cost of acquisition + higher lifetime value.

Cohorts by Year 5 are spending 3.6x more.

5/ Grab plays a key role in driving Southeast Asia forward.

They provide flexible employment to millions, fuel entrepreneurship in the region, and democratize financial access.

Through covid - Grab has been instrumental in distributing vaccines / government relief funds.

They provide flexible employment to millions, fuel entrepreneurship in the region, and democratize financial access.

Through covid - Grab has been instrumental in distributing vaccines / government relief funds.

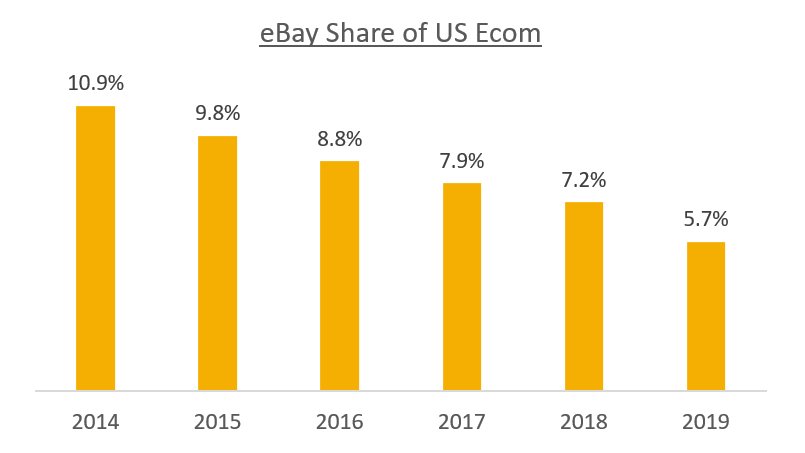

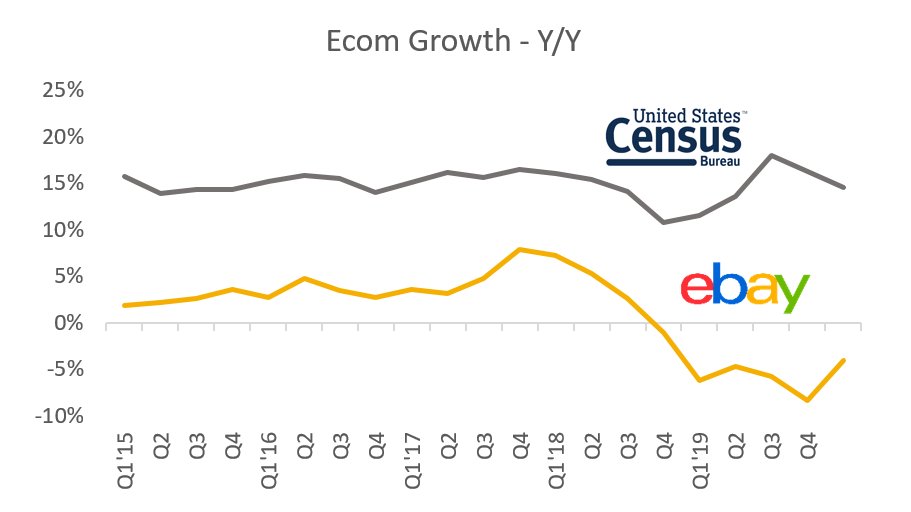

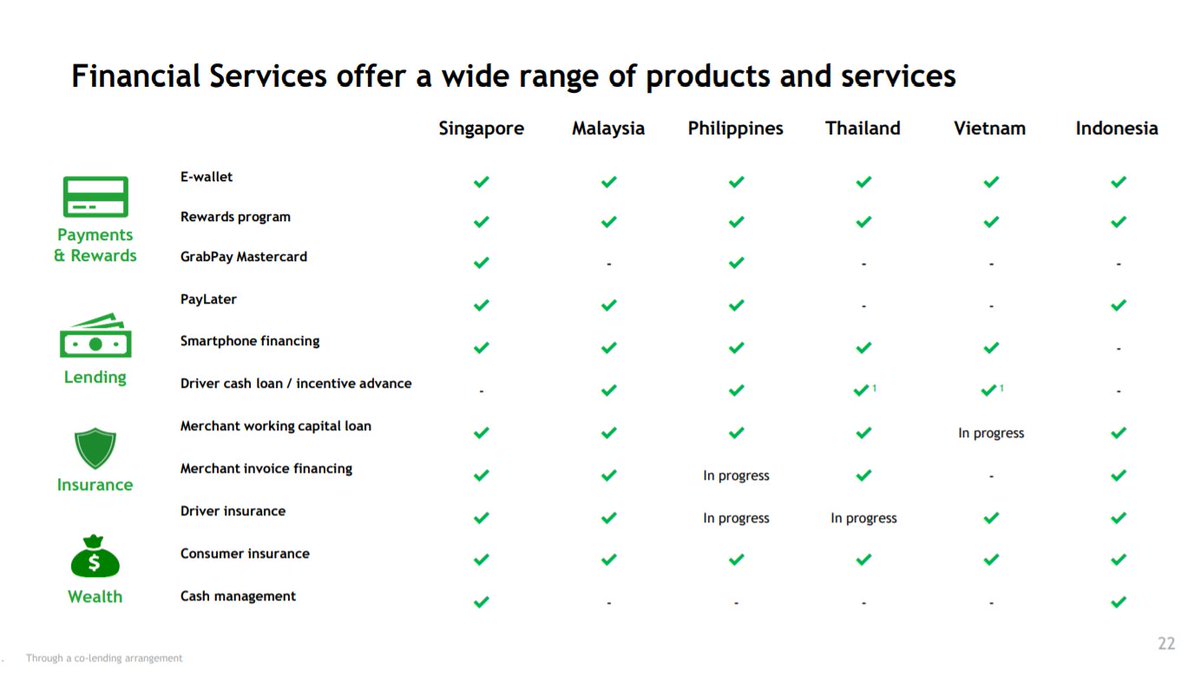

6/ Grab is just scratching the surface in financial services – a massive opportunity.

70%+ of the population lacks access to traditional banks.

They are the leader in payments, insurance, lending and investments - with the most licenses across 6 diverse countries.

70%+ of the population lacks access to traditional banks.

They are the leader in payments, insurance, lending and investments - with the most licenses across 6 diverse countries.

7/ Importantly, exceptional teams emerge stronger from crises – and Grab certainly did.

Covid patterns like delivery, digital payments are turning into post covid habits.

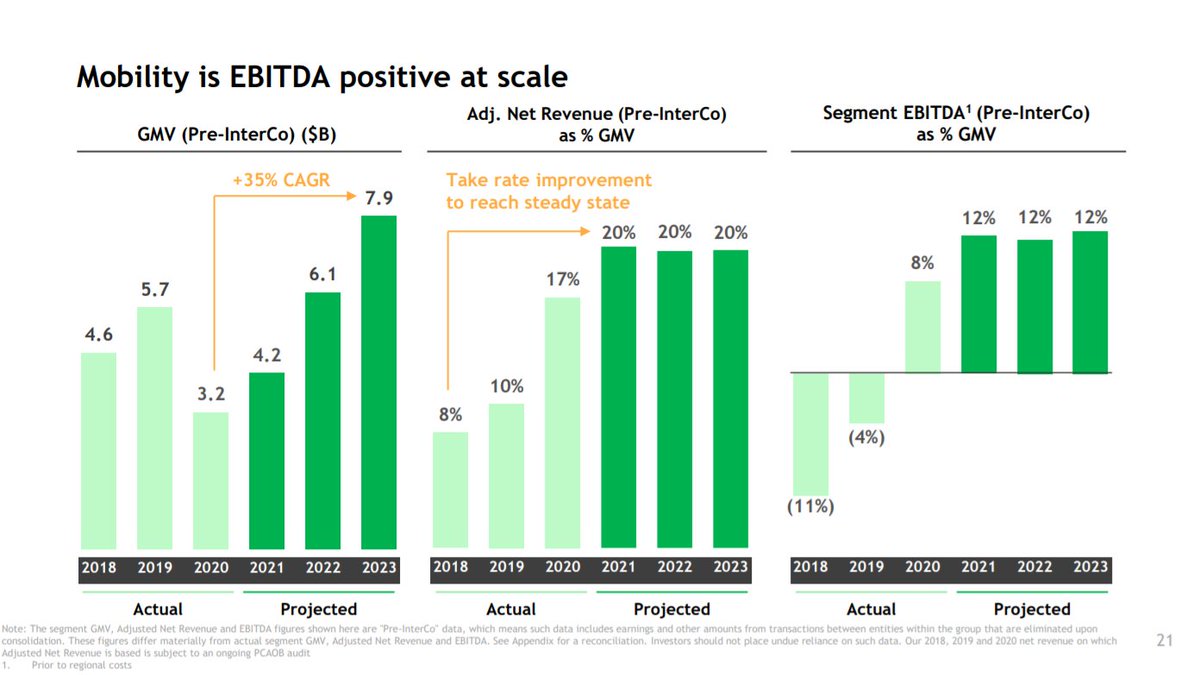

Ride hail is rapidly recovering – and incredibly profitable with 60% margins (well above peers like Uber).

Covid patterns like delivery, digital payments are turning into post covid habits.

Ride hail is rapidly recovering – and incredibly profitable with 60% margins (well above peers like Uber).

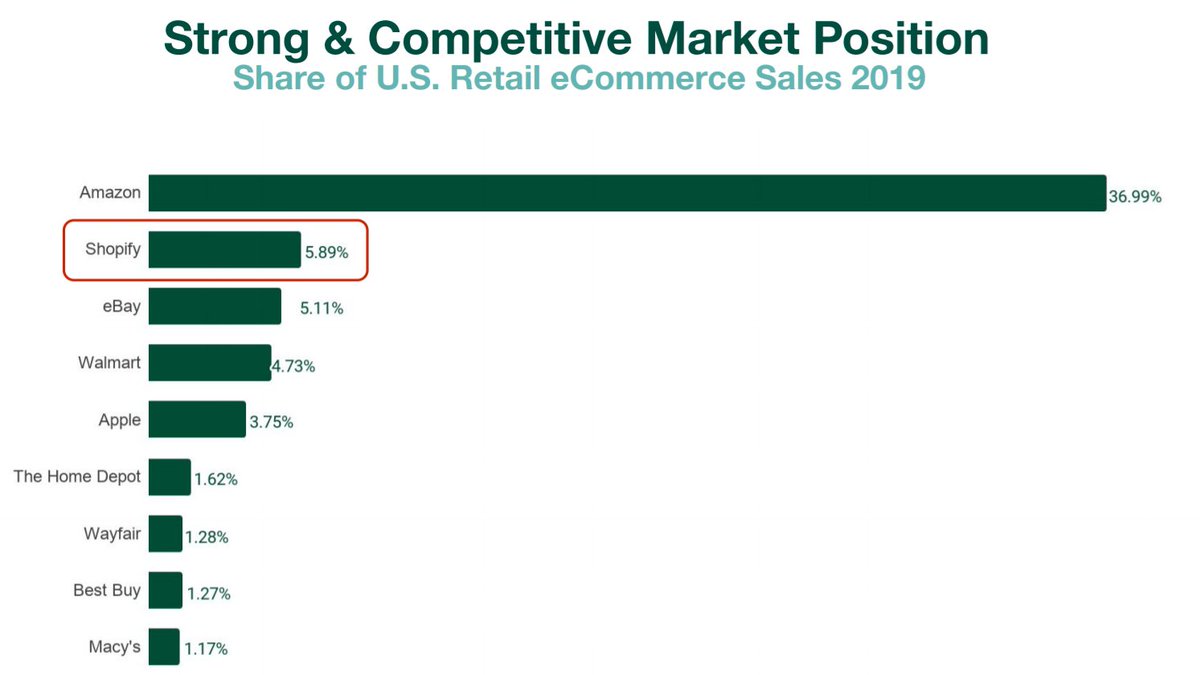

8/ In Grab – we see the best of Uber, DoorDash, Square and Ant Financial - with a tremendous opportunity ahead.

Hyper growth at scale with a powerful ecosystem, excellent cohorts, leading margins.

+ Massive new markets to light up in financial services / local commerce.

Hyper growth at scale with a powerful ecosystem, excellent cohorts, leading margins.

+ Massive new markets to light up in financial services / local commerce.

9/ At Altimeter – we’ve worked with Grab to assemble a set of world class, Day 1, public shareholders.

$4B+ PIPE

$750M from Altimeter

+ leading mutual / sovereign funds

Thrilled to be long-term partners to Anthony / Grab, and excited for the journey ahead!

$4B+ PIPE

$750M from Altimeter

+ leading mutual / sovereign funds

Thrilled to be long-term partners to Anthony / Grab, and excited for the journey ahead!

• • •

Missing some Tweet in this thread? You can try to

force a refresh