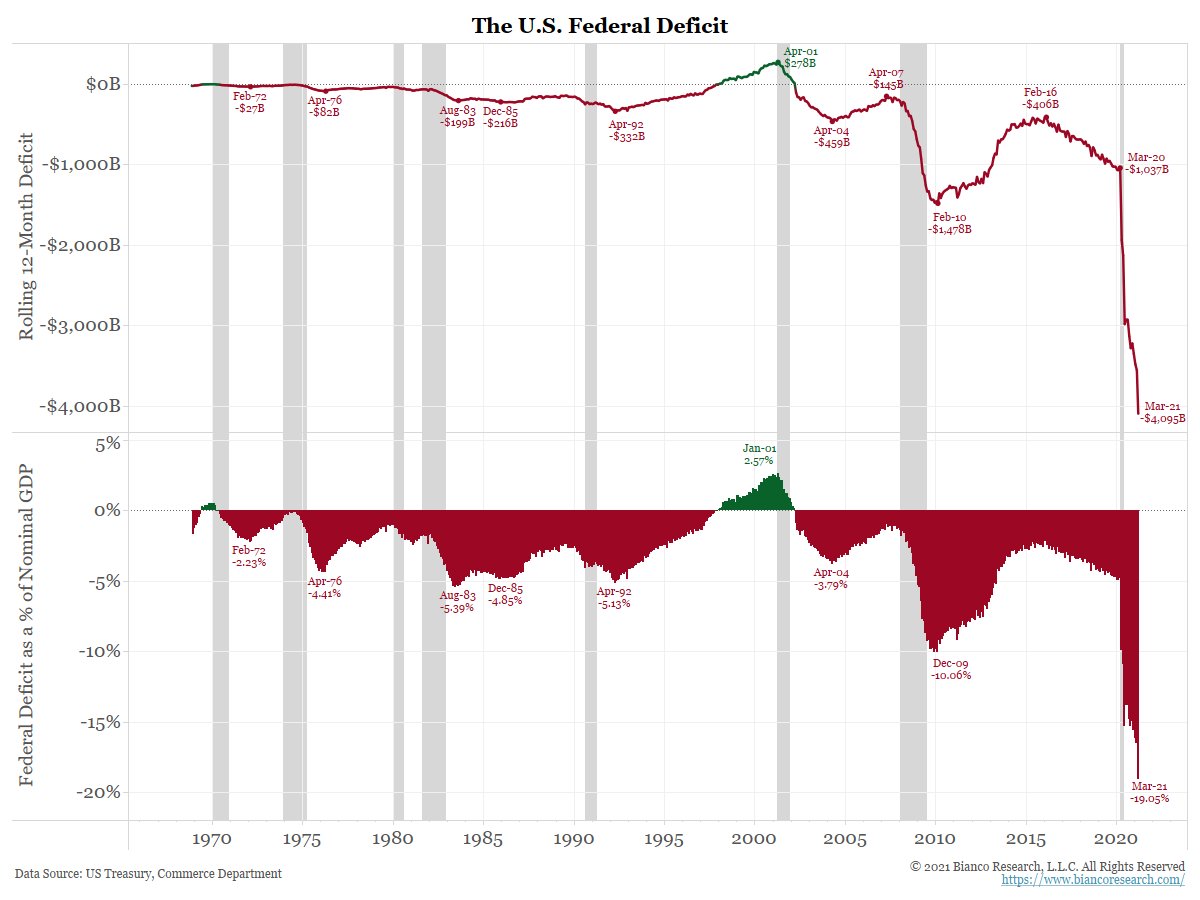

The broader service sector has an impediment that herd immunity/reopening might not solve.

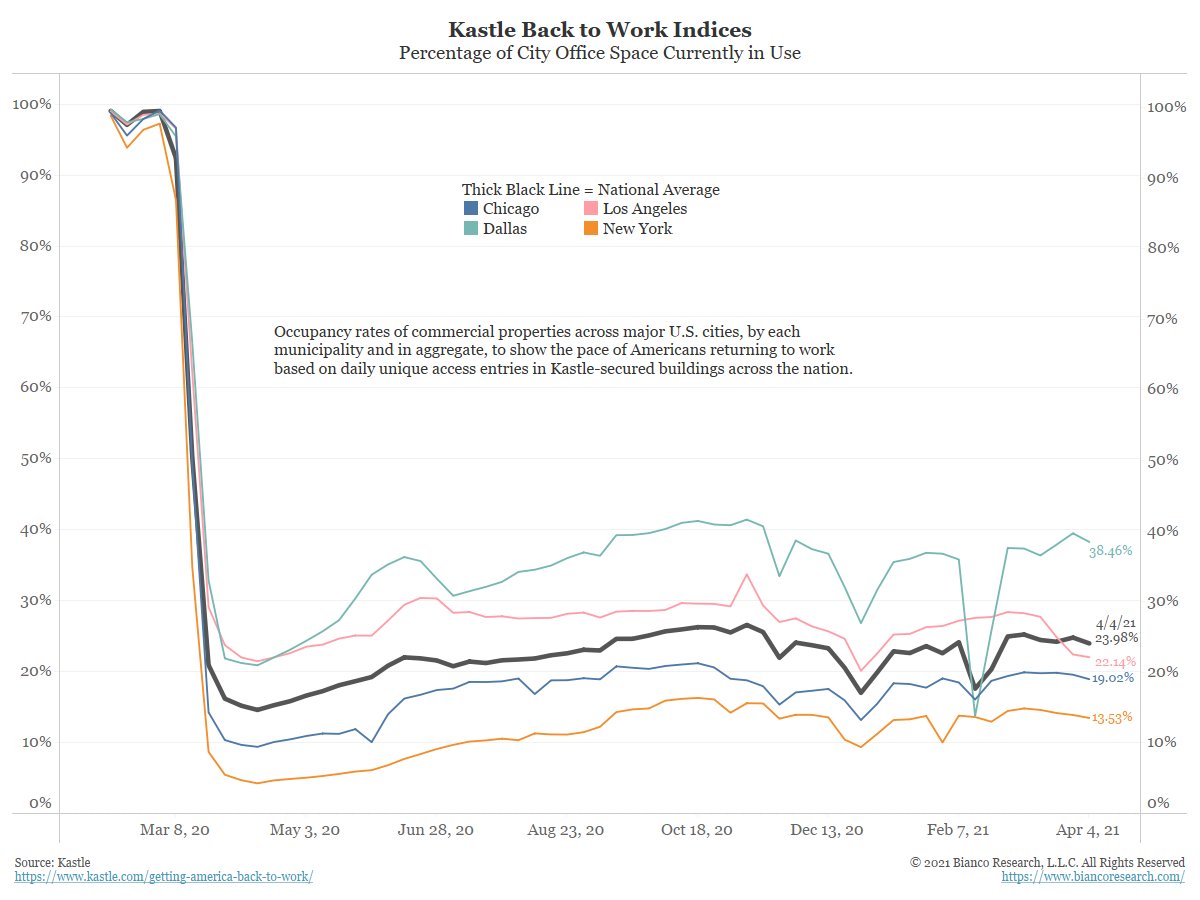

This chart shows the Kastle Indices of the percentage of major metropolitan office usage. It is still at just 25%.

(1/4)

This chart shows the Kastle Indices of the percentage of major metropolitan office usage. It is still at just 25%.

(1/4)

Why do we need to return to an office? How much a week? What is better served commuting in an office everyday versus the way we have it's been done the last year?

This is a nice way to say that comm real estate is in trouble and herd immunity might not fix it.

(2/4)

This is a nice way to say that comm real estate is in trouble and herd immunity might not fix it.

(2/4)

Airline travel is about 2/3s back to pre-pandemic levels. Leisure travel is near 100% back.

But, if we do not return to the office 8 hrs/5 days business travel is not returning to pre-pandemic levels anytime soon, unless leisure is about to soar to new highs.

(3/4)

But, if we do not return to the office 8 hrs/5 days business travel is not returning to pre-pandemic levels anytime soon, unless leisure is about to soar to new highs.

(3/4)

And this measure might never make it back to its previous peak if millions are not commuting everyday to large Manhattan office towers.

This loss of revenue will continually stress NYC finances (and all big cities as they run massive transportation deficits).

(4/4)

This loss of revenue will continually stress NYC finances (and all big cities as they run massive transportation deficits).

(4/4)

• • •

Missing some Tweet in this thread? You can try to

force a refresh