#ReadingFC 2018/19 financial results covered a season when the #Royals finished 14th in the Championship. Manager José Gomes was replaced in October 2019 by Mark Bowen, who has since been succeeded by Veljko Paunovic. Some thoughts in the following thread.

This was the third season that #ReadingFC were under the control of Chinese businessman Dai Yongge (and his sister Dai Xiu Li), who own 96% via Renhe Sports Management Co Ltd. Bowen said, “He has spent a hell of a lot of money on the club and still wants to spend money.”

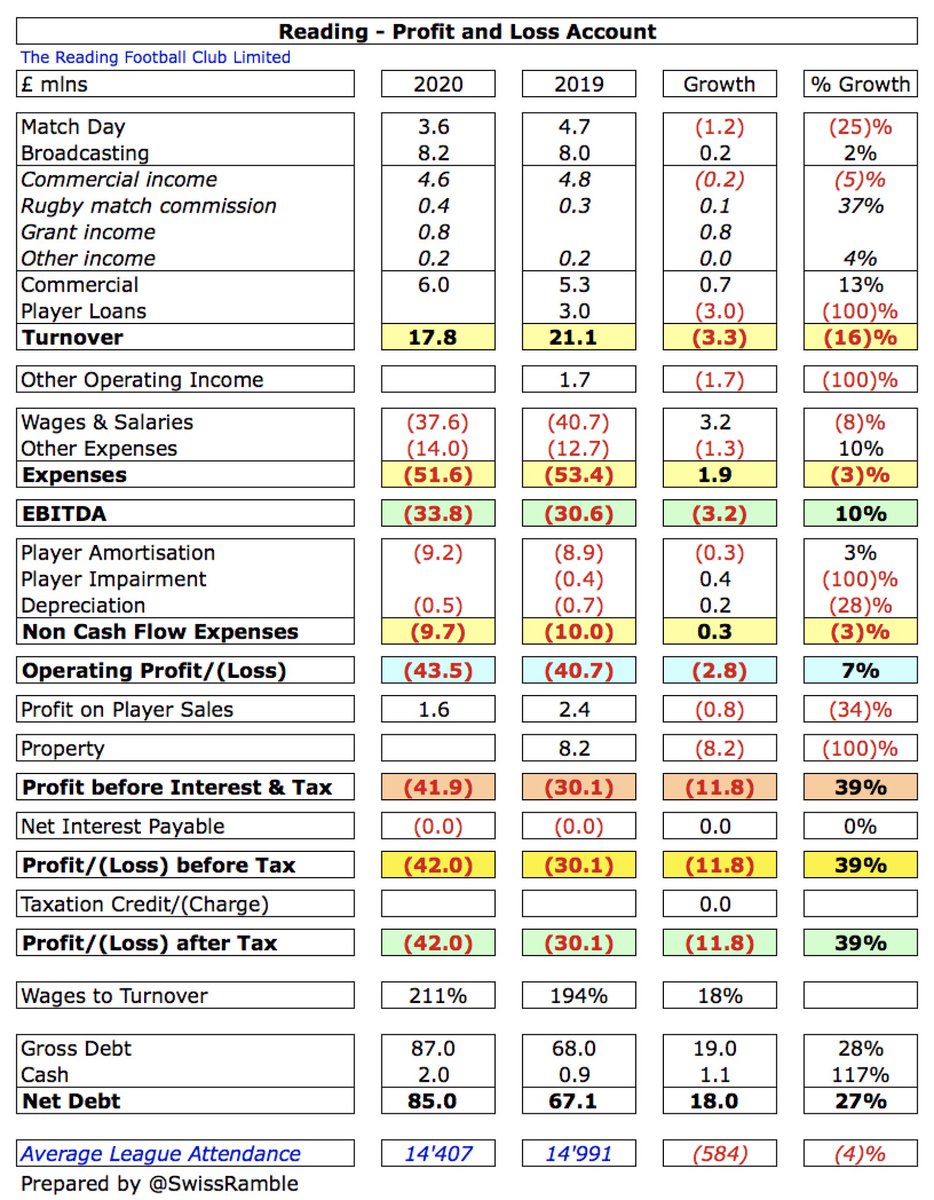

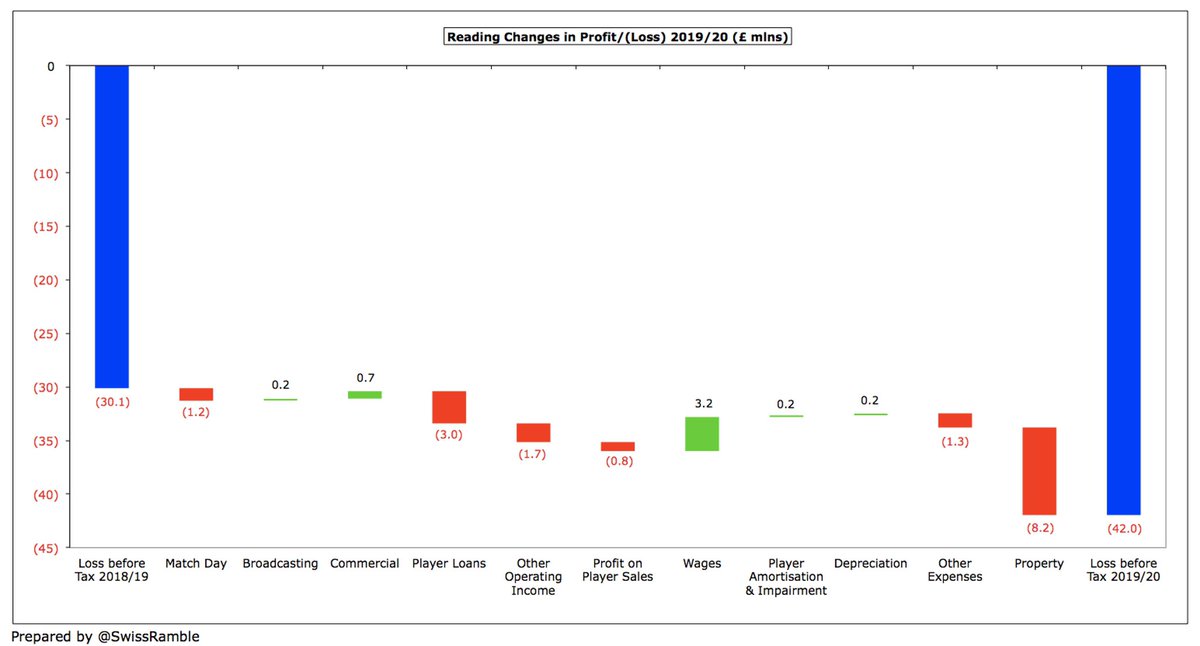

#ReadingFC loss increased from £30m to £42m, largely due to no repeat of prior year’s £8m from sale of the training ground and £2m other operating income. Revenue dropped £3m (16%) from £21m to £18m, while profit on player sales fell £0.8m to £1.6m. Expenses cut £2m (3%).

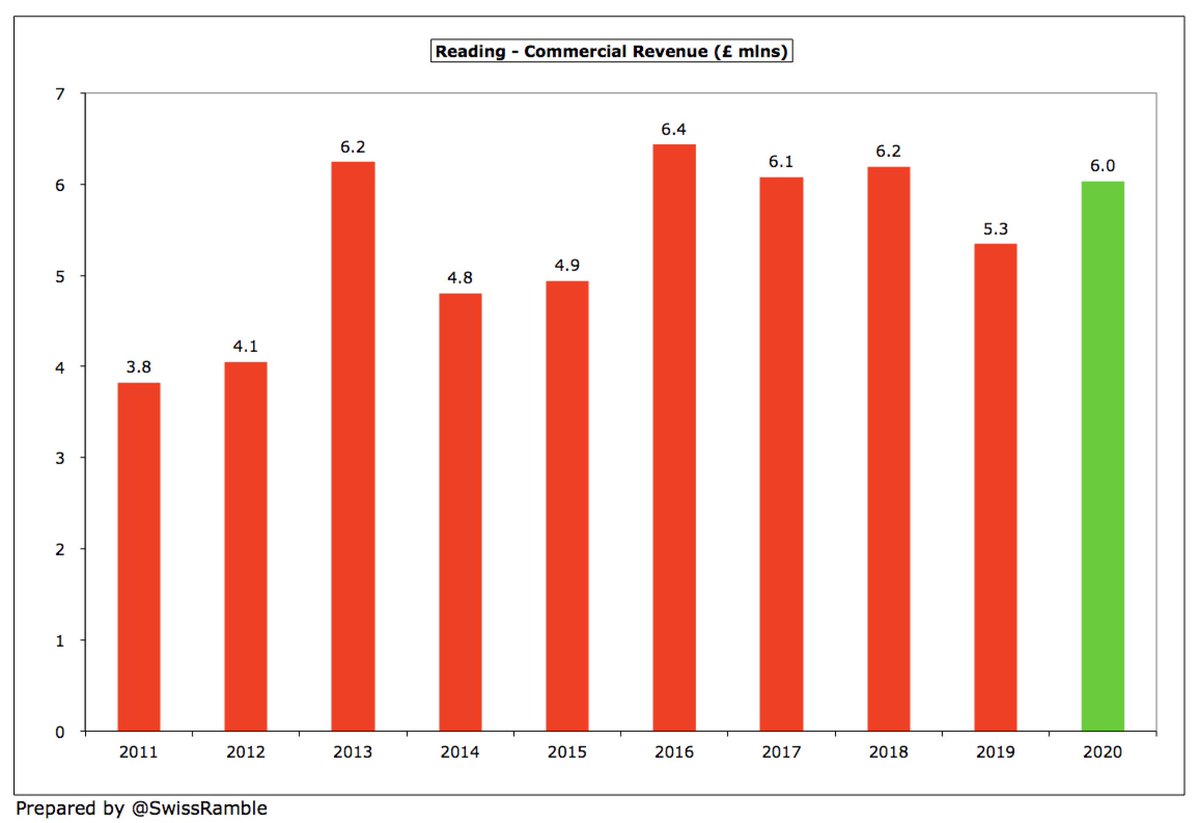

#ReadingFC revenue hit by no repeat of prior year’s £3m loan of Aluko to Chinese club controlled by owner Dai Yongge. Match day fell £1.2m (25%) to £3.6m, though growth in commercial, up £0.7m (13%) to £6.0m (including £0.8m furlough grant), and broadcasting, up £0.2m to £8.2m.

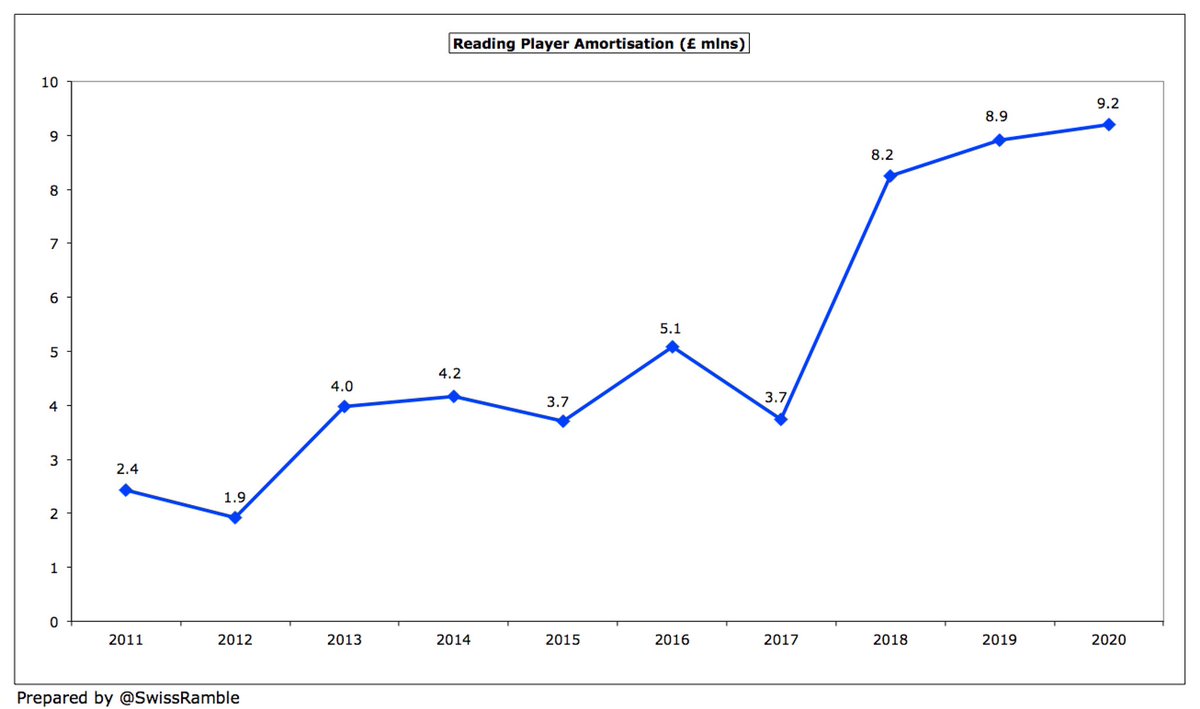

#ReadingFC wage bill decreased £3m (8%) from £41m to £38m, but other expenses were up £1m (10%) to £14m. Player amortisation rose £0.3m (3%) to £9.2m, though prior year also included £0.4m player impairment.

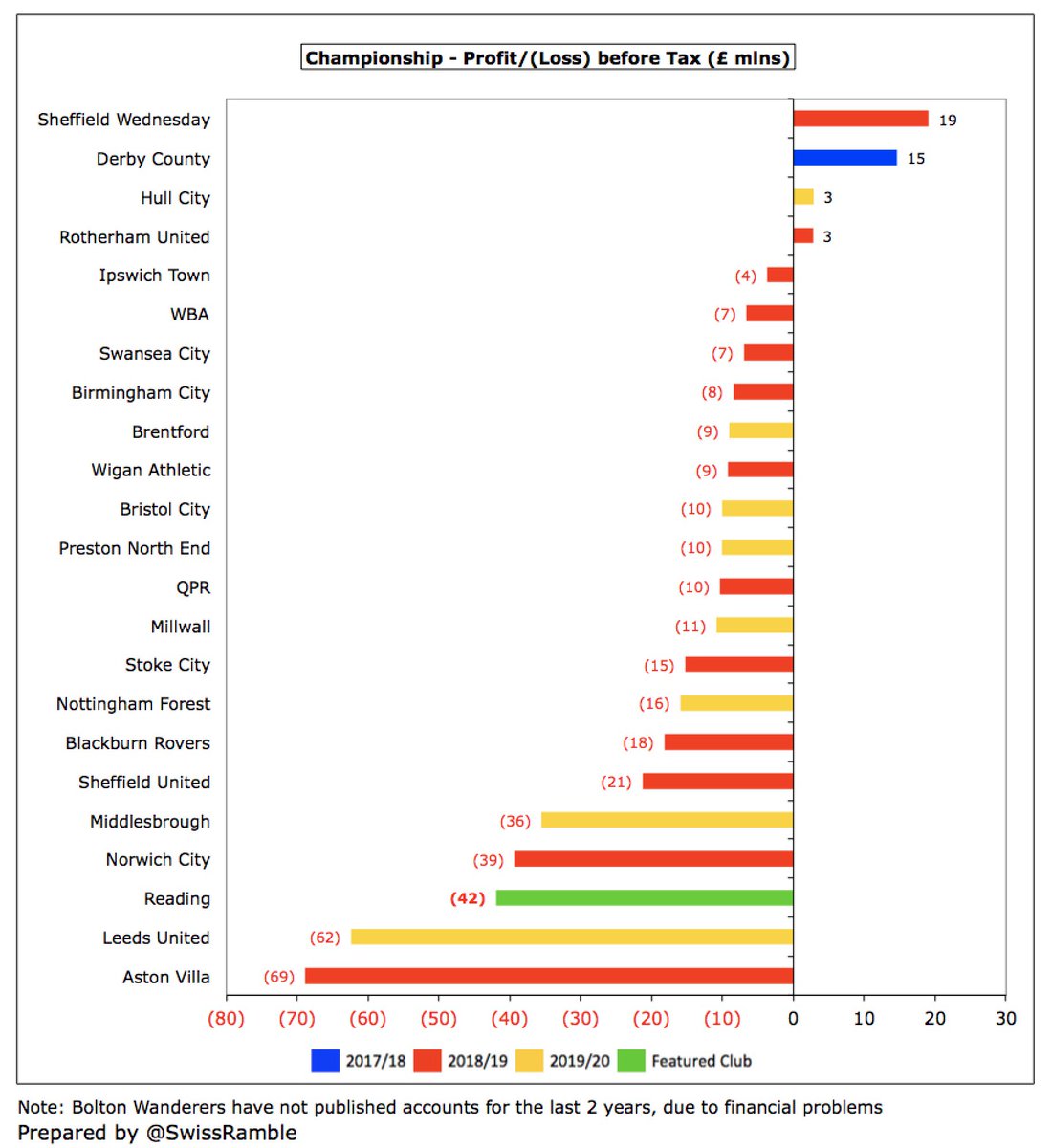

Most clubs in the Championship report large losses with many of them losing more than £20m a year even before the pandemic. However, #ReadingFC £42m loss is the second worst to date in 2019/20, only surpassed by #LUFC £62m, which included a £20m promotion bonus.

#ReadingFC prior year loss was reduced by £8m profit from sale of Hogwood Park training ground, which followed £7m profit from stadium sale the year before. Other clubs have also improved their figures in this way, especially #DCFC £40m, #SWFC £38m and #AVFC £36m.

Renhe Sports now owns the Madejski Stadium, though it has been leased back to the football club for £1.5m annual rent, while the training ground is owned by Sun Elegant Group. These sales are within the EFL rules, but this is still some fancy financial footwork by #ReadingFC.

Excluding such property sales, only two Championship clubs are actually profitable – just one (#HCAFC £3m) in 2019/20. The harsh reality is that almost all clubs in this division lose a lot of money, as they strive to remain competitive in pursuit of promotion to the top flight.

#ReadingFC did not detail the impact of the COVID-19 pandemic on these financials, though it is not likely to be very significant in 2019/20. I estimate around £2m for losses in match day and commercial income. Will be higher this season, as games still played without fans.

#ReadingFC bottom line not helped by only £1.6m profit on player sales, down from £2.4m, as many players released for nothing. Highest sale likely to be Jon Bodvarrson to Millwall. One of the lowest player gains in the Championship, far below Bristol City £26m & Brentford £25m.

#ReadingFC have posted losses in 8 of the last 10 seasons, even managing to lose money in the Premier League in 2013. Their annual losses have been increasing in the last 3 years (2018 £21m, 2019 £30m and 2020 £42m), amounting to an incredible £93m in this period.

Moreover, #ReadingFC losses would have been even higher without £53m once-off gains in past 8 years, including property sales £26m, grants received £10m, loan write-off £9m & investment disposals £8m. If the “questionable” £3m player loan is also included, impact would be £56m.

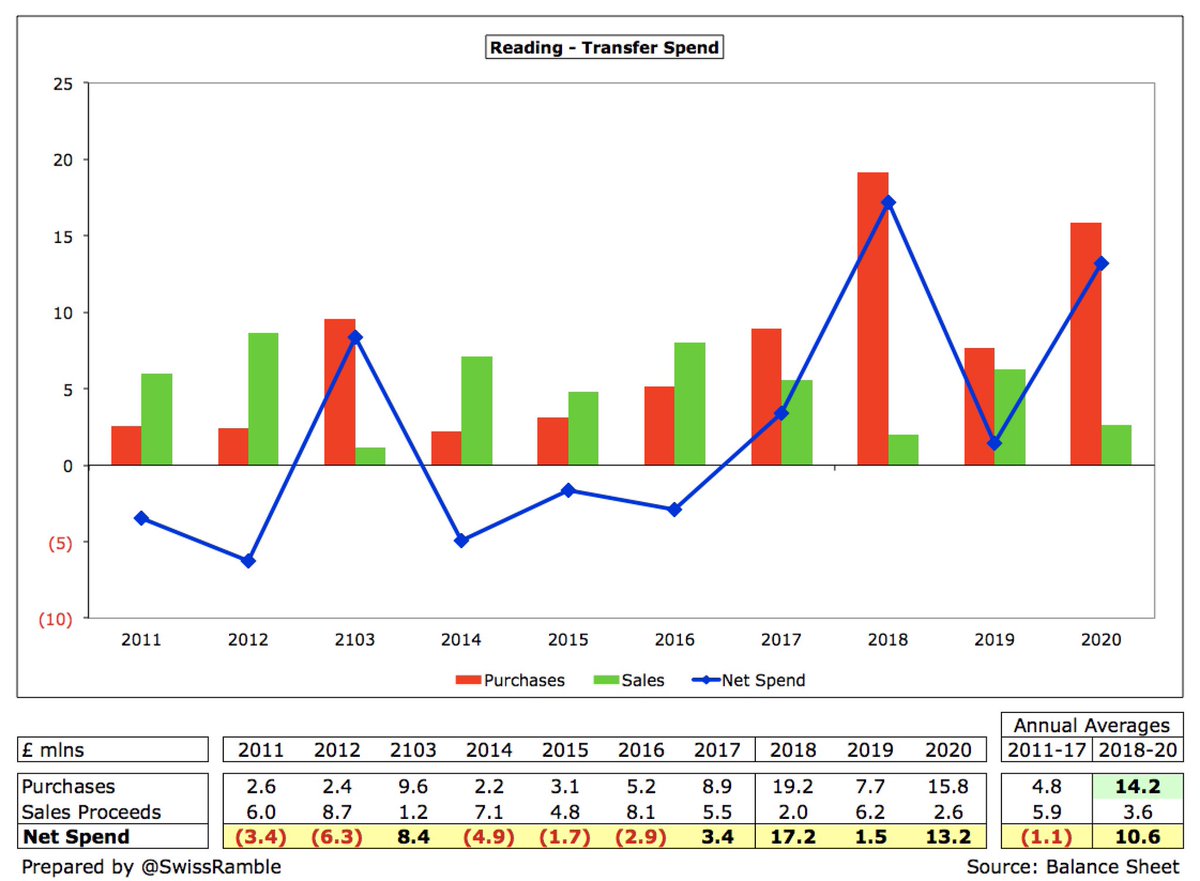

#ReadingFC have made very little from player sales, averaging only £4.2m a year since 2011. Much poor recruitment has resulted in numerous free transfers in order to get players with high wages off the books. 2020/21 will be no better, only really including Modou Barrow’s sale.

#ReadingFC operating loss (excluding player sales and interest) rose from £41m to £44m, the second worst to date in 2019/20 Championship. This is obviously not great, but in fairness almost every club in this division posts substantial operating losses, i.e. over half above £30m.

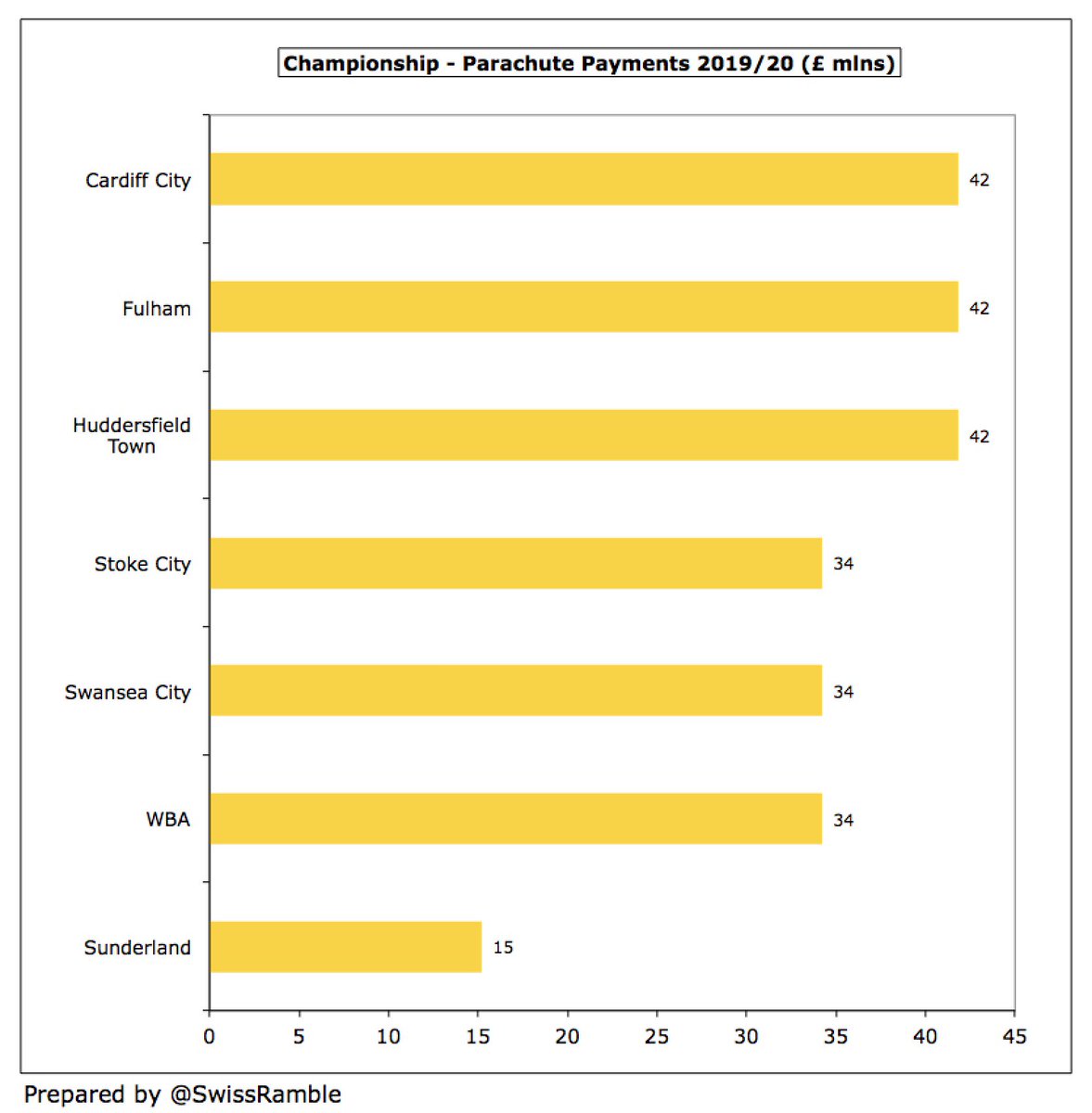

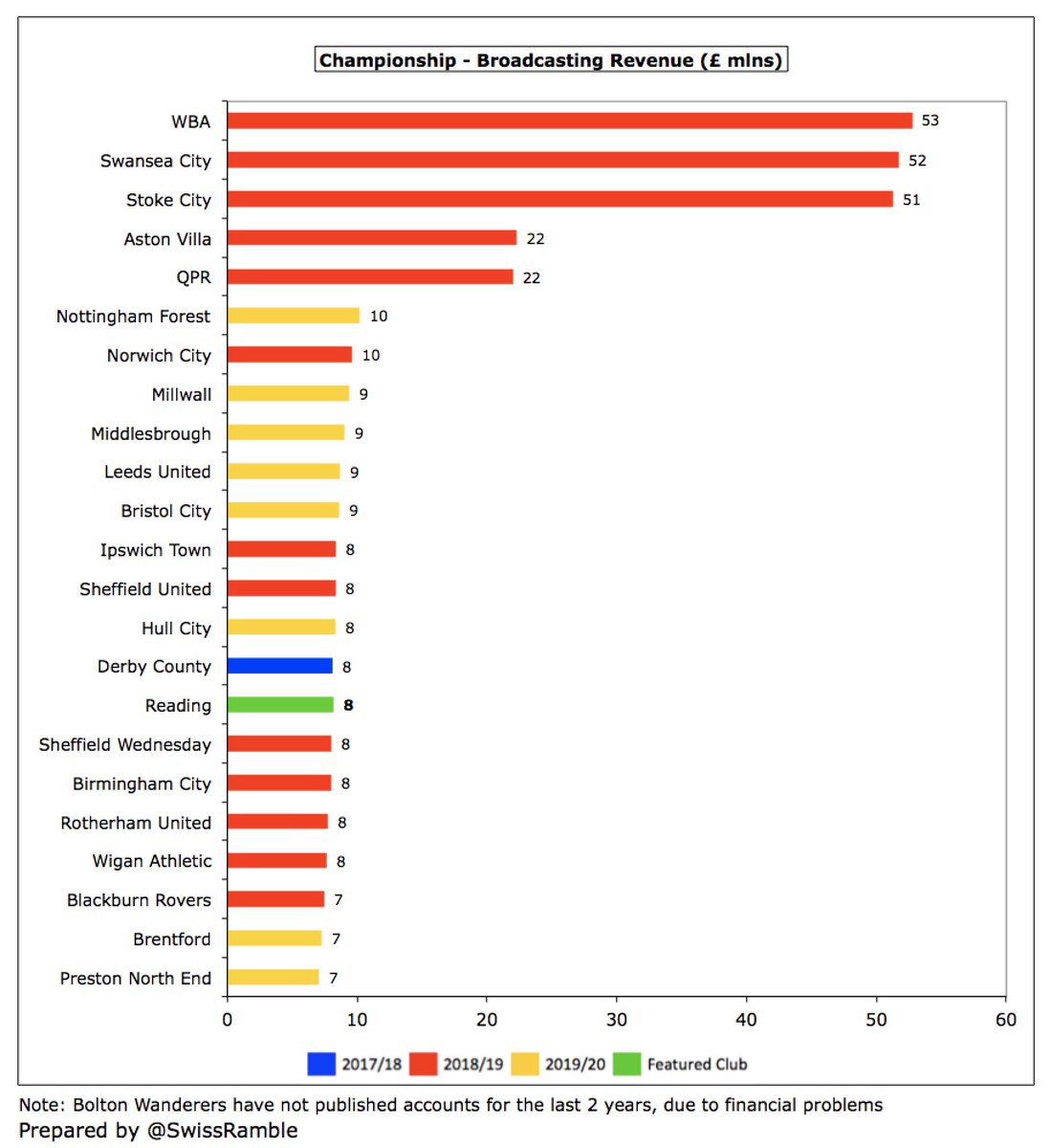

#ReadingFC revenue has fallen by £19m (52%) in the last 3 years from £37m to £18m, mainly due to parachute payments stopping. The club received £71m in parachutes between 2014 and 2017. Nevertheless, broadcasting still most important revenue stream with 46%.

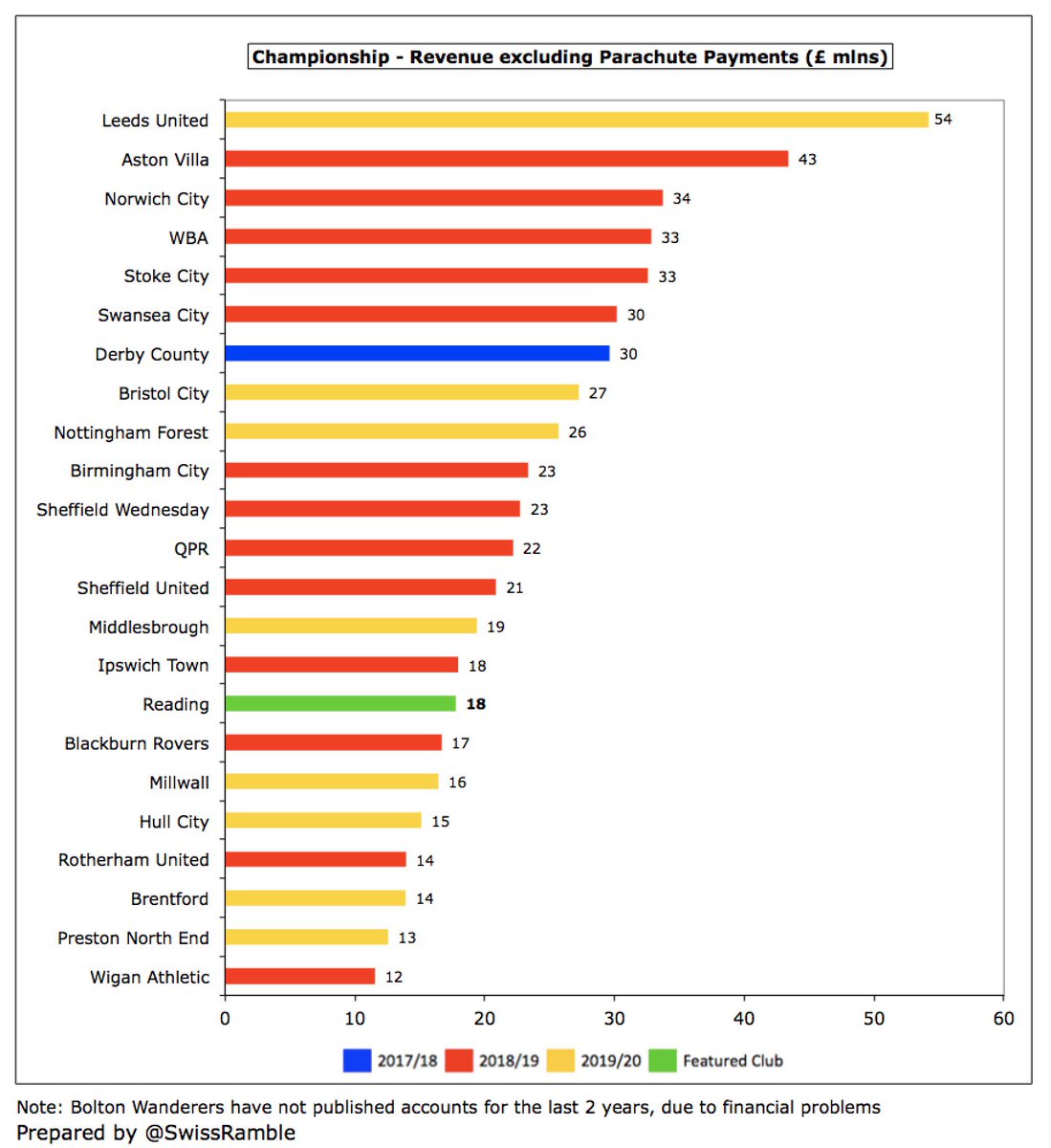

#ReadingFC revenue of £18m is firmly in the bottom half of the Championship. To highlight the magnitude of their challenge, this is around a quarter of the £71m earned by clubs in receipt of parachute payments following relegation from the Premier League.

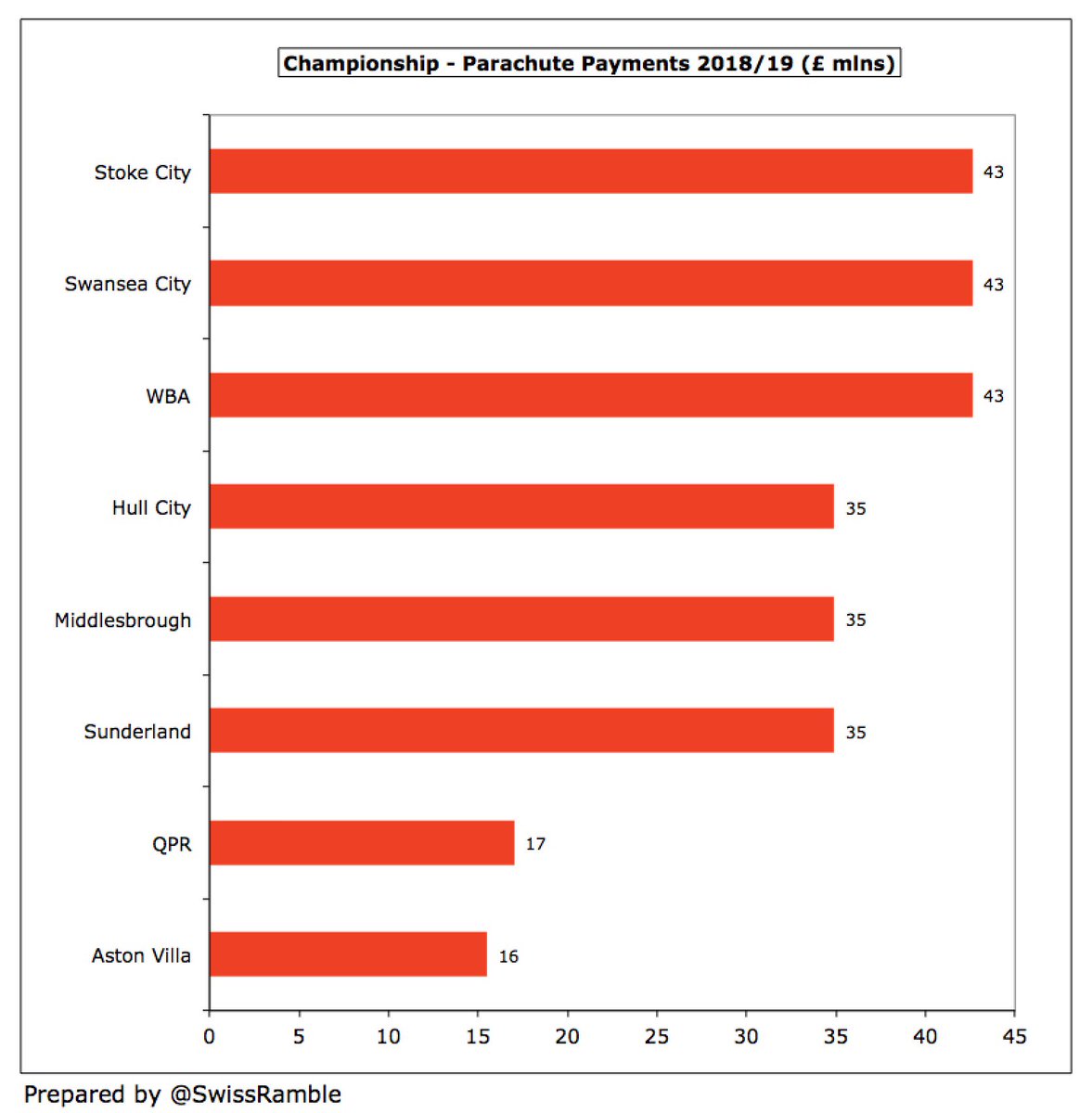

Championship revenue is hugely influenced by Premier League parachute payments, making it difficult for clubs like #ReadingFC to compete. Seven clubs benefited in 2019/20, led by Cardiff City, #FFC and #HTAFC (£42m), followed by Stoke City, Swansea City and WBA (£34m).

If parachute payments were excluded, #ReadingFC would still be 16th highest revenue in the Championship, though the gap to the top club (Leeds United £54m) would drop to £36m. That said, this would still be three times as much as the Royals’ £18m.

#ReadingFC broadcasting income rose £0.2m (2%) to £8.2m, still a long way below £44m they earned in the Premier League in 2013. Most Championship clubs earn £7-10m, but there is a significant gap to those with parachute payments (e.g. WBA, Swansea and Stoke received over £50m).

#ReadingFC match day fell £1.1m (25%) from £4.7m to £3.6m, as 5 home games were played behind closed doors due to the pandemic. The 2017 peak of £9.7m included money from the play-off final at Wembley. One of the lowest incomes in the Championship, around a third of #LUFC £11m.

#ReadingFC average attendance dropped from 14,991 to 14,407 (for games played with fans), which was 15th highest in the Championship. This is around 9,500 lower than the 24,000 crowds they attracted the last time they were in Premier League. Season ticket prices frozen in 2019/20

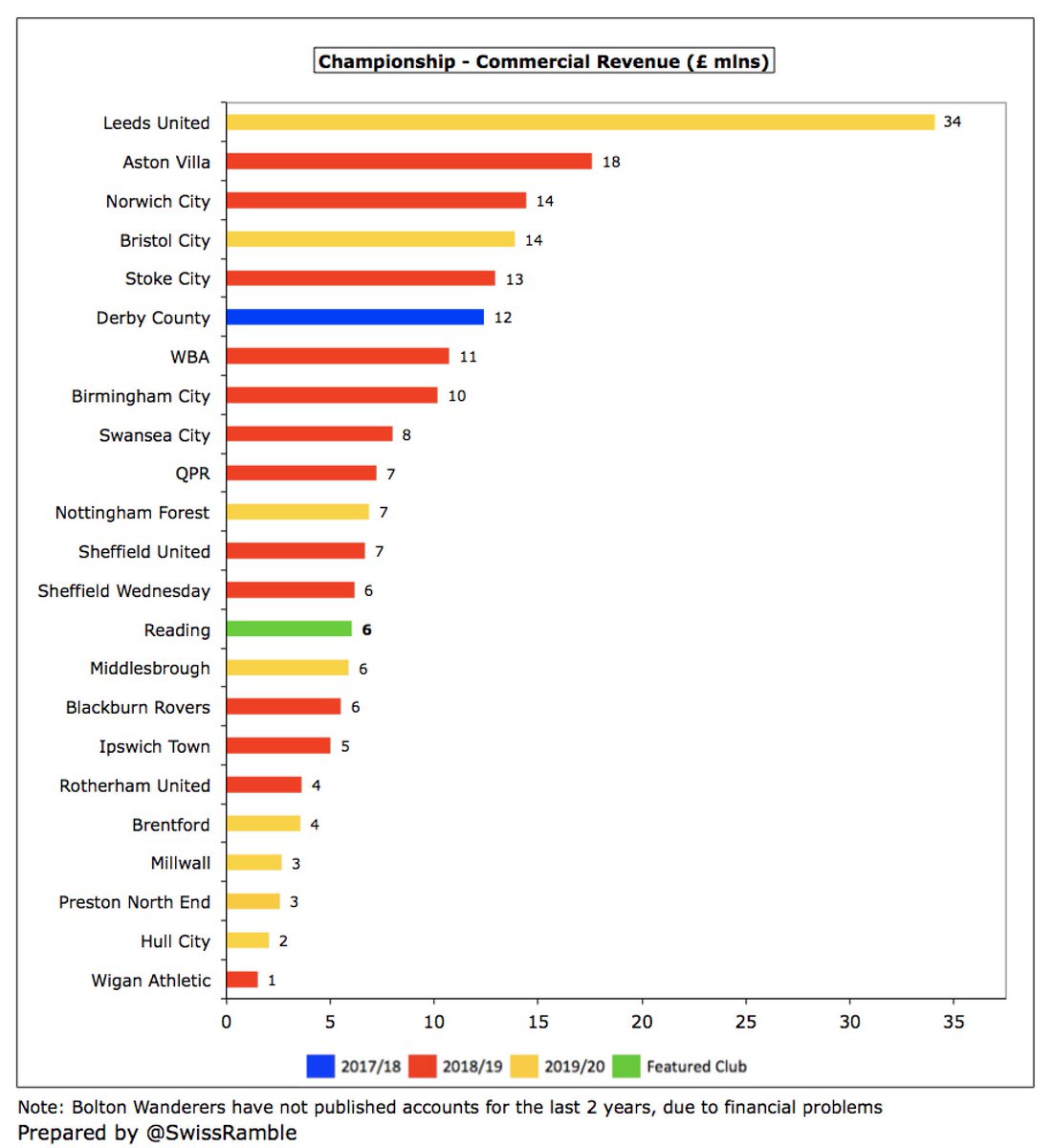

#ReadingFC commercial income rose £0.7m (13%) from £5.3m to £6.0m. Includes £0.4m from the ground share agreement with London Irish rugby club and £0.8m furlough grant. This is 14th highest in the Championship, less than half of Bristol City £14m. #LUFC £34m is in another league.

#ReadingFC had two new major sponsors in 2019/20: Carabao were replaced by online casino operator Casumo in a 2-year deal; while they signed a 3-year kit supplier deal with Macron, who succeeded Puma. From this season also have back-of-shirt sponsor, Rapidz.

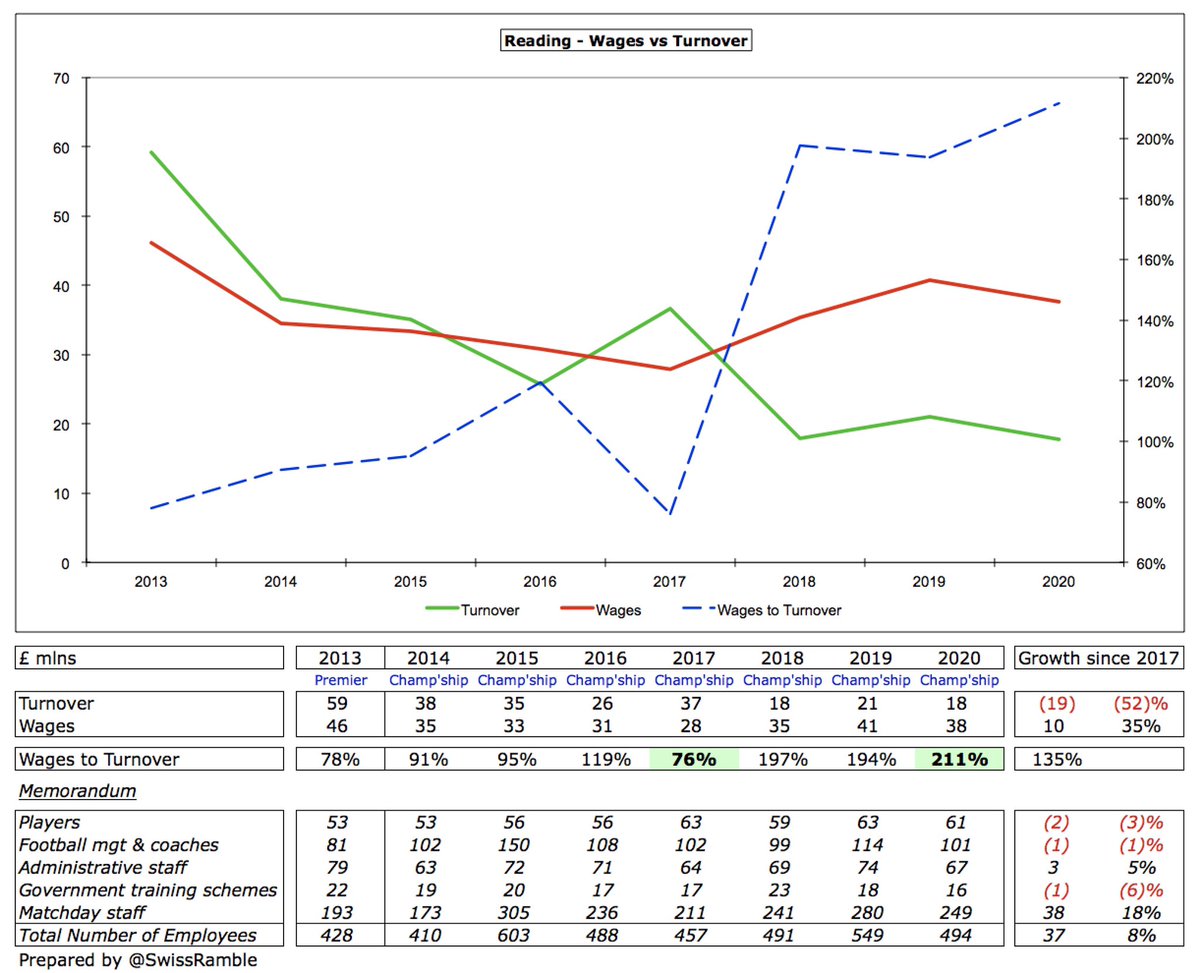

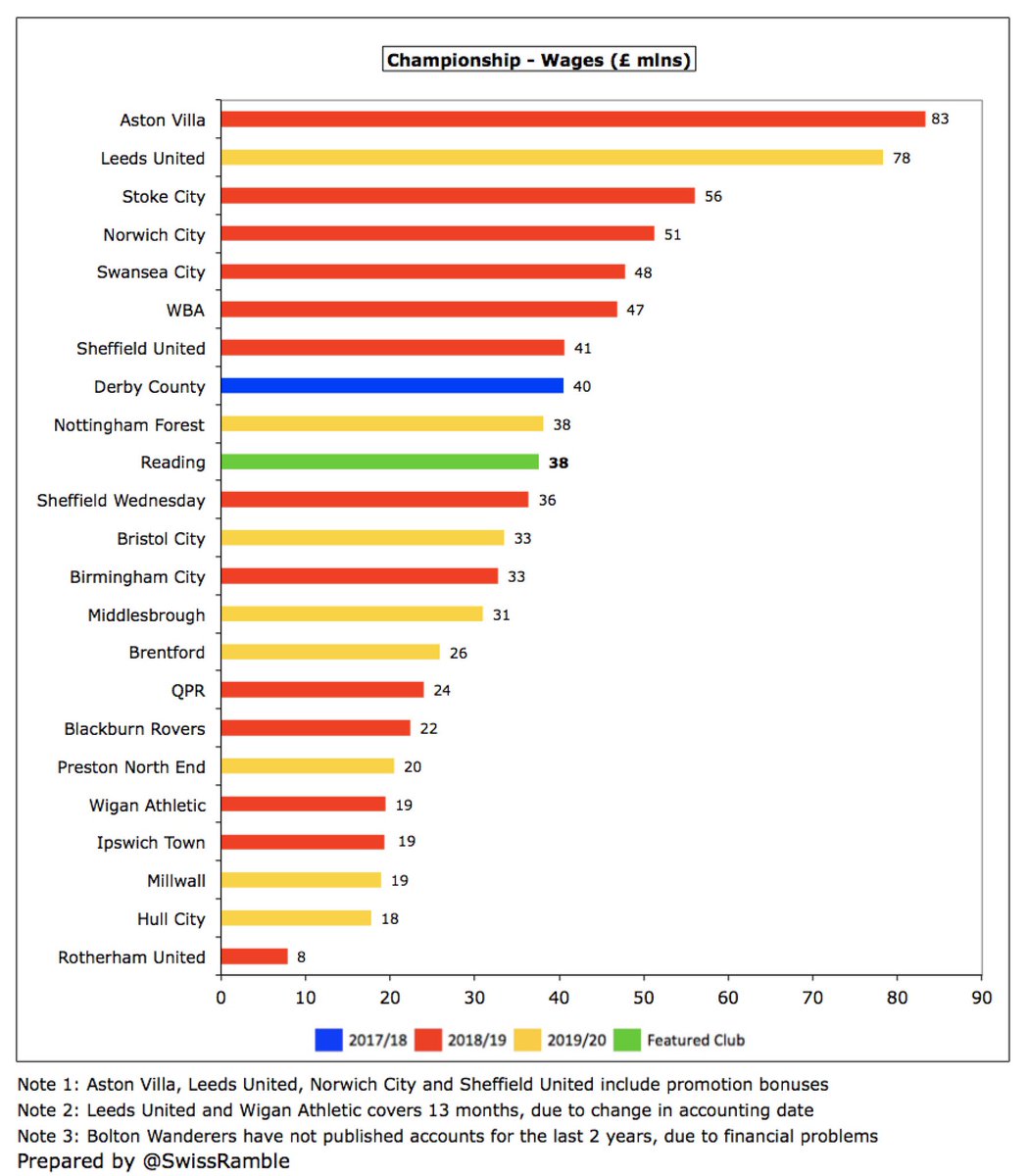

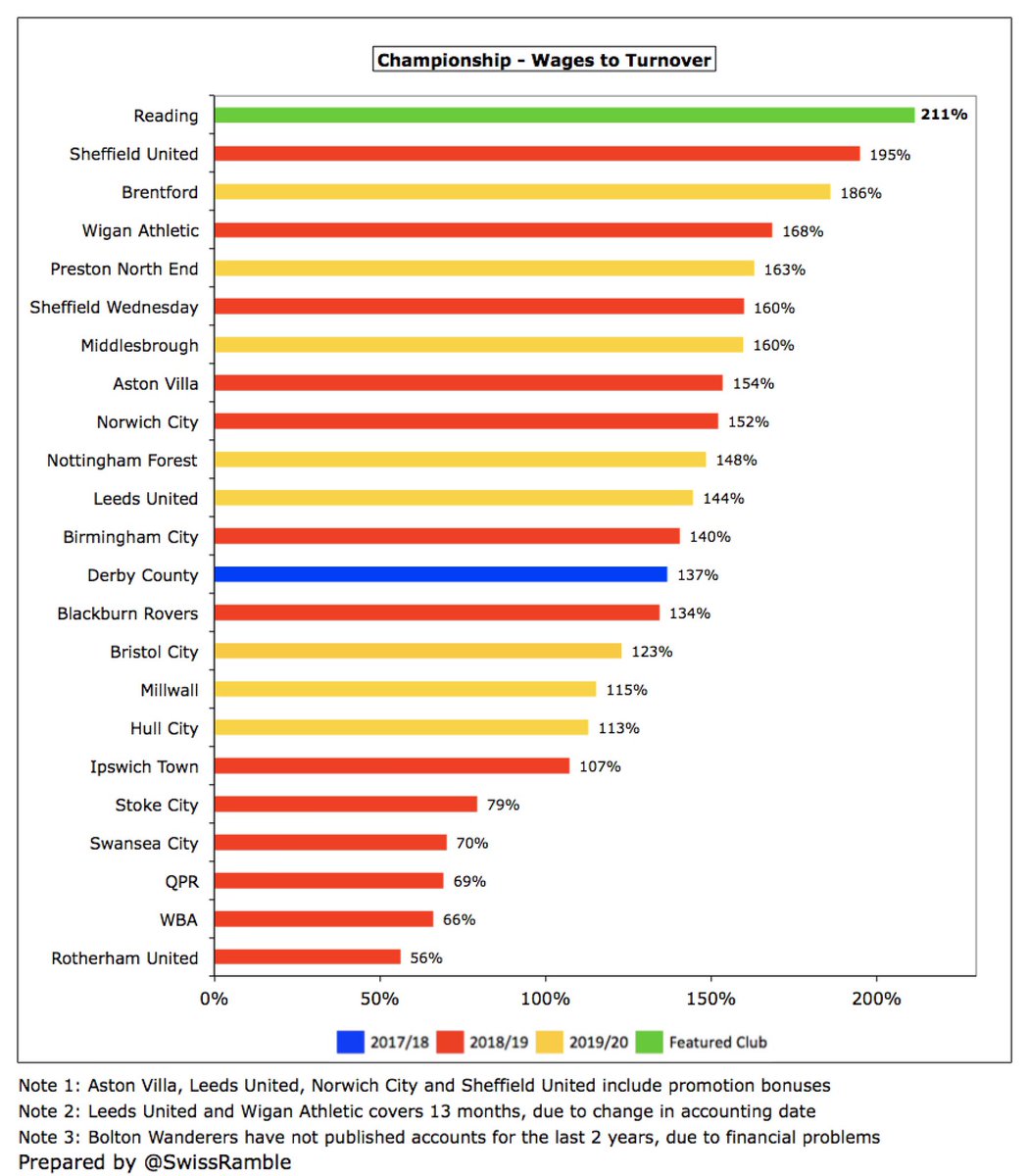

#ReadingFC wage bill fell £3m (8%) from £41m to £38m, but this is still 2nd highest since last time in the Premier League in 2013. Wages up by 35% (£10m) in the last 3 years, while revenue has decreased 52% (£19m) in the same period, increasing wages to turnover from 76% to 211%.

Despite the decrease, #ReadingFC £38m wage bill is 10th highest in the division, meaning the club has under-performed. That said, a fair bit lower than clubs with parachute payments. Likely to fall as players are released at end of this season to reduce a large squad.

#ReadingFC wages to turnover ratio increased from 194% to 211%, the worst to date in the 2019/20 Championship. In fairness, 19 of the 24 clubs in this division are over 100%, which is well above UEFA’s 70% upper limit, but Reading’s ratio is particularly poor.

Given the state of #ReadingFC finances, it no surprise that directors’ remuneration was cut by 61% from £1.5m to £583k, but this is still the highest to date in the 2019/20 Championship and only surpassed by 3 clubs the previous season. The highest paid director earned £497k.

#ReadingFC player amortisation, the annual charge to write-off transfer fees over a player’s contract, rose £0.3m (3%) from £8.9m to £9.2m, the 9th highest in the Championship, but only around a third of big-spending Stoke and Swansea. No repeat of prior year’s £0.4m impairment.

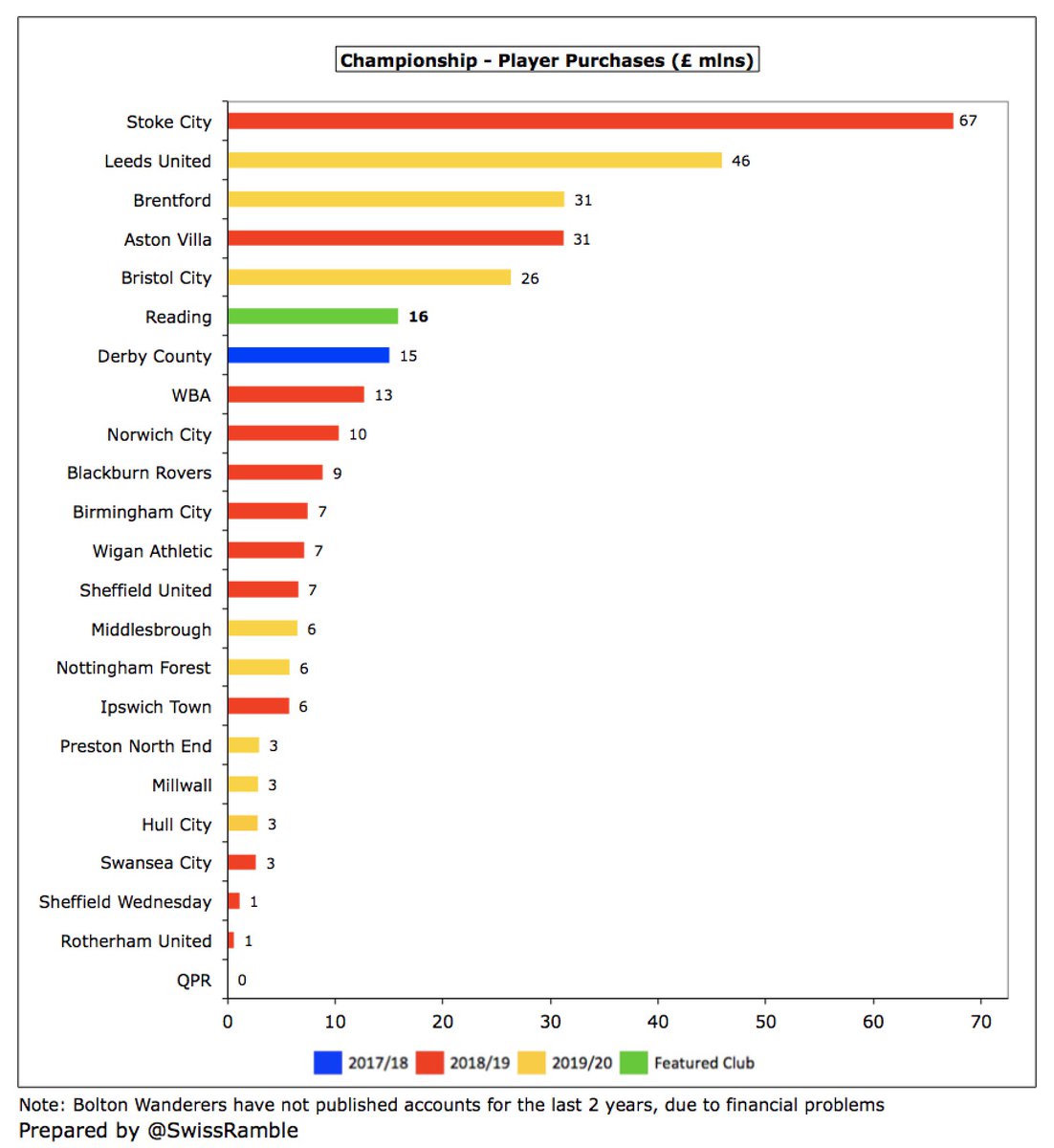

#ReadingFC spent £16m on player purchases in 2019/20, including George Puscas from Inter and Lucas Joao from #SWFC. Twice as much as previous season’s £8m and 4th highest in the Championship to date, but a long way below #LUFC £46m, Brentford £31m and Bristol City £26m.

For many years #ReadingFC spent little in transfer market, but averaged £14m in last 3 seasons. Accounts claim no player registrations acquired since these accounts, but reportedly spent £3.5m to bring in Ovie Ejaria from #LFC. Manager Paunovic has spoken of a transfer embargo.

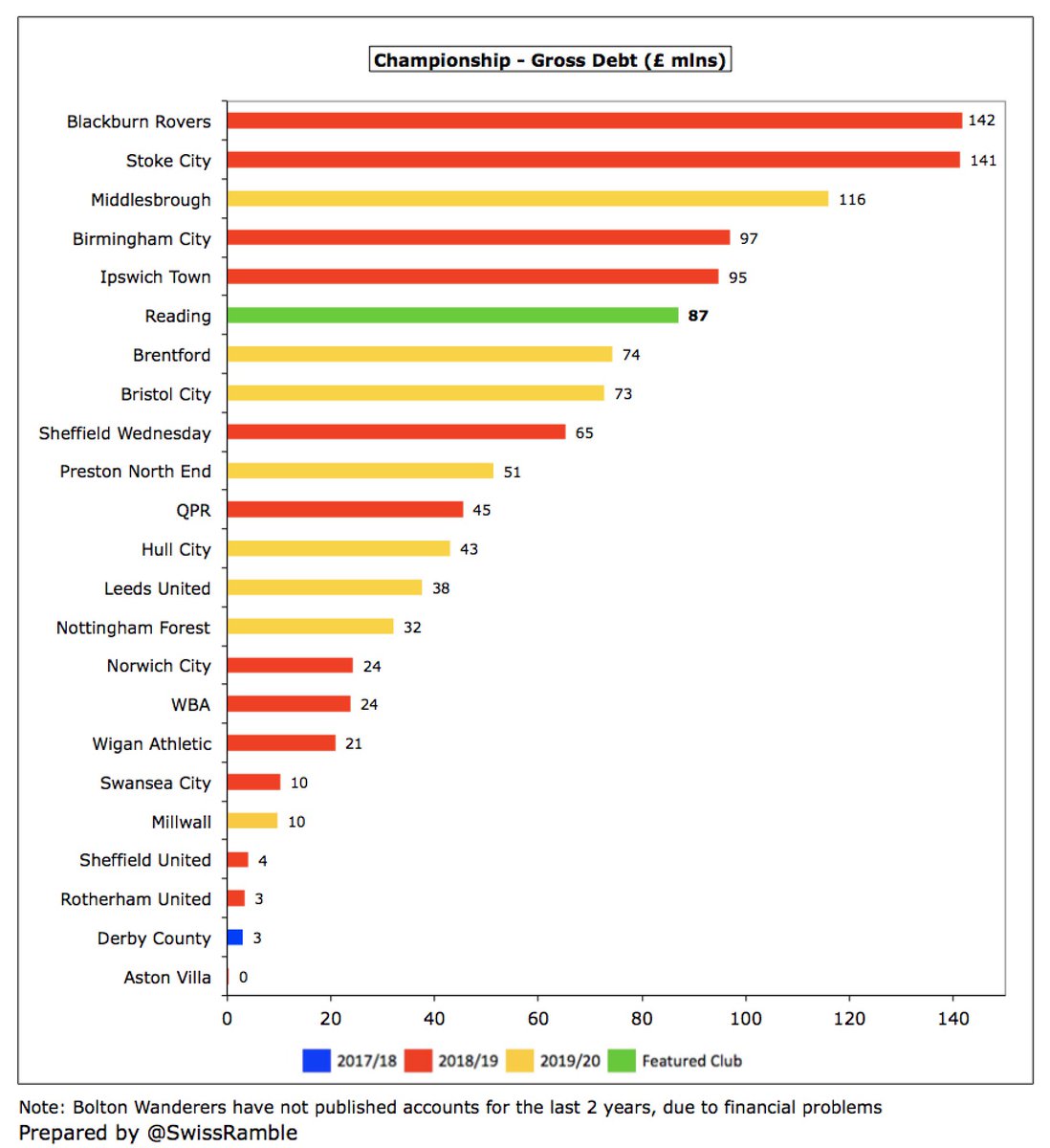

#ReadingFC gross debt rose £19m from £68m to £87m, almost entirely owed to the club’s owners. This has more than tripled from £25m in 2011. In fact, it would have been as high as £99m if the owners had not converted £12m of loans into capital last season.

As a result, #ReadingFC £87m debt is the 6th highest in the Championship, though far below the likes of #BRFC £142m, Stoke City £141m and #Boro £116m. However, almost all debt in this division has been provided interest-free by the clubs’ owners, so is of the “soft” variety.

In this way, #ReadingFC only paid £44k interest. Although many Championship clubs have a lot of debt, very little interest is actually paid, e.g. only 3 clubs had payments over £1m in 2019/20: Hull City £1.7m, Middlesbrough £1.3m and Bristol City £1.1m.

#ReadingFC transfer debt (for remaining stage payments on transfer fees) increased from £3m to £10m, so many of the player purchases have been on credit. On the other hand, contingent liabilities, dependent on team success and player appearances, was down from £8m to £5m.

#ReadingFC £44m operating loss improved to £23m negative cash flow by adding back £10m amortisation/depreciation and £11m working capital movements. Spent £13m net on players (purchases £16m, sales £3m) and £1m on infrastructure investment. Funded by £38m new loans from owners.

As a result, #ReadingFC cash balance increased from £1m to £2m. This is on the low side, but not bad for the Championship, where most clubs had less than £2m cash in the bank, emphasising the reliance on their owners.

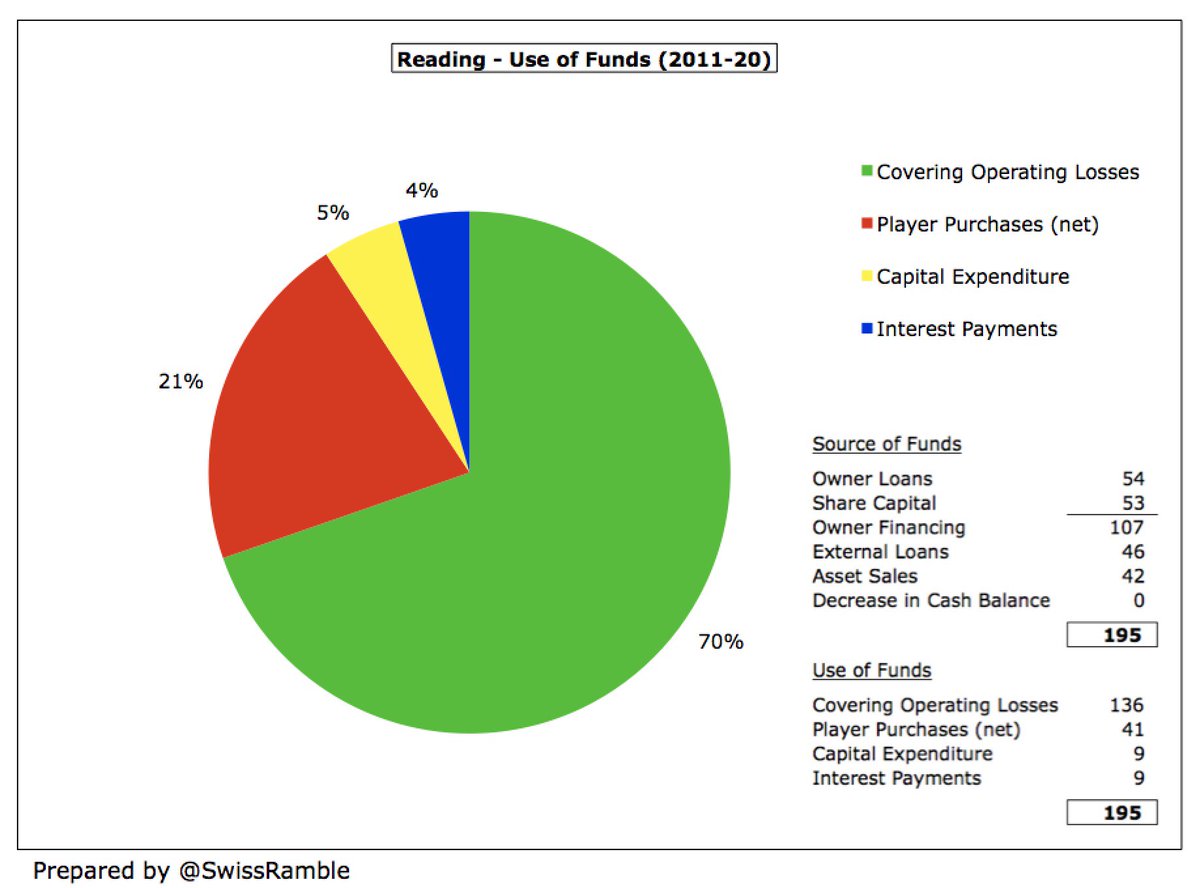

In the last decade #ReadingFC had £195m available cash: £107m from the owners (loans £54m, share capital £53m), external loans £46m and asset sales £42m. This has mainly been used to cover operating losses £136m, but also player purchases £41m (net), capex £9m and interest £9m.

My calculations suggest that #ReadingFC are a long way from being compliant with

FFP, even after excluding academy, community & infrastructure (estimated at £5m a year) plus £2m COVID impact, and including £15m profits from sale of stadium and training ground.

FFP, even after excluding academy, community & infrastructure (estimated at £5m a year) plus £2m COVID impact, and including £15m profits from sale of stadium and training ground.

#ReadingFC chief executive Nigel Howe neatly summarised the club’s FFP dilemma: “The only way that we can stay within the regulations is to sell some of the players that we have bought to help us succeed, so it’s a bit of a Catch-22.”

#ReadingFC stated objective is “to strive for promotion to the Premier League, without jeopardizing the club’s financial position.” Like many other Championship clubs, funding from the owners is vital, though this will not help meet FFP targets. It’s a tricky balancing act.

• • •

Missing some Tweet in this thread? You can try to

force a refresh