NORWAY - STATUS OF EV TRANSITION

NOTE : This is the short-form report - see separate thread with long-form analysis

1. Norway is rapidly advancing towards an EV-only sales environment for Passenger Cars

NOTE : This is the short-form report - see separate thread with long-form analysis

1. Norway is rapidly advancing towards an EV-only sales environment for Passenger Cars

2. In the process, sales of ICEVs are shrinking fast and may cease by 2023, ahead of government deadlines

- the Red bars in this chart show potential ICEV sales volumes for 2021 and 2022

- the Red bars in this chart show potential ICEV sales volumes for 2021 and 2022

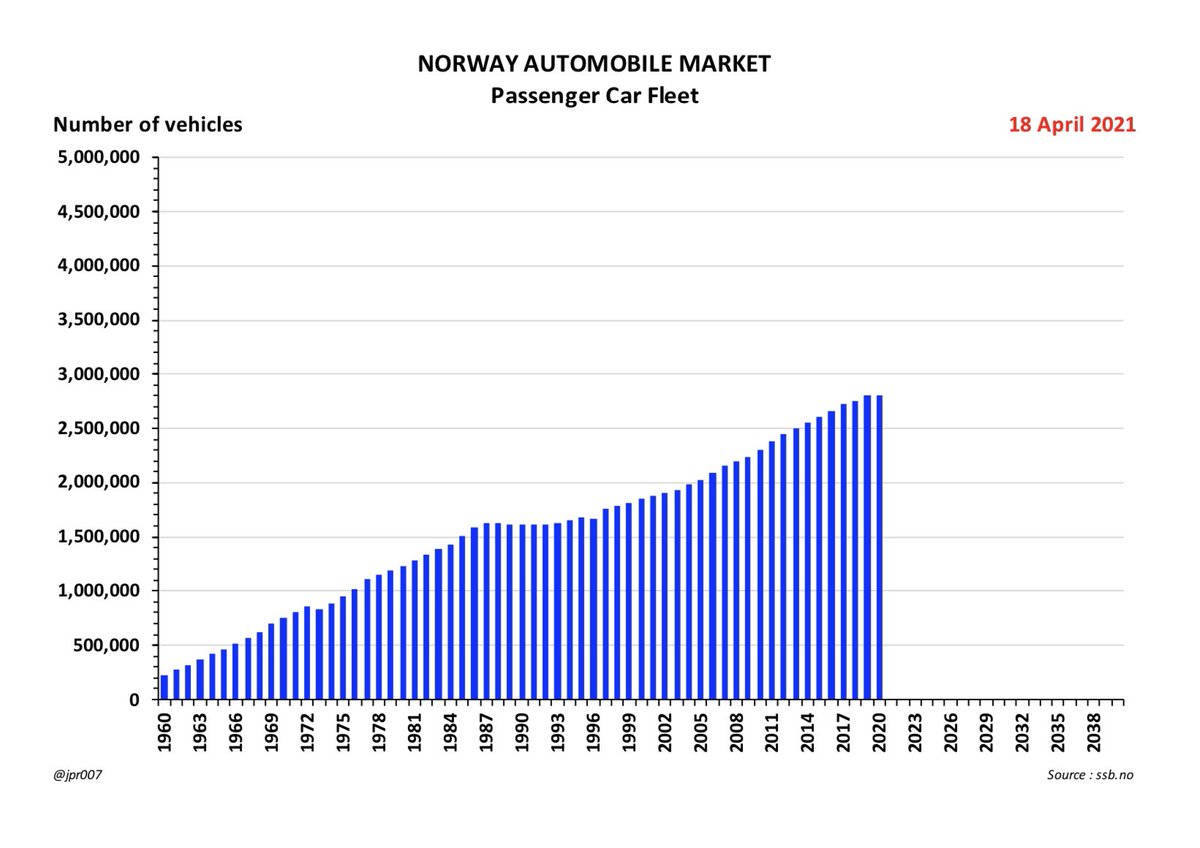

3. Norway has moved fast on EVs and is well ahead of others, but it still shows a significant annual Supply deficit relative to Natural Demand

This Red triangle represents a Supply shortfall of about 300,000 new vehicles that could be needed by the national fleet by 2028

This Red triangle represents a Supply shortfall of about 300,000 new vehicles that could be needed by the national fleet by 2028

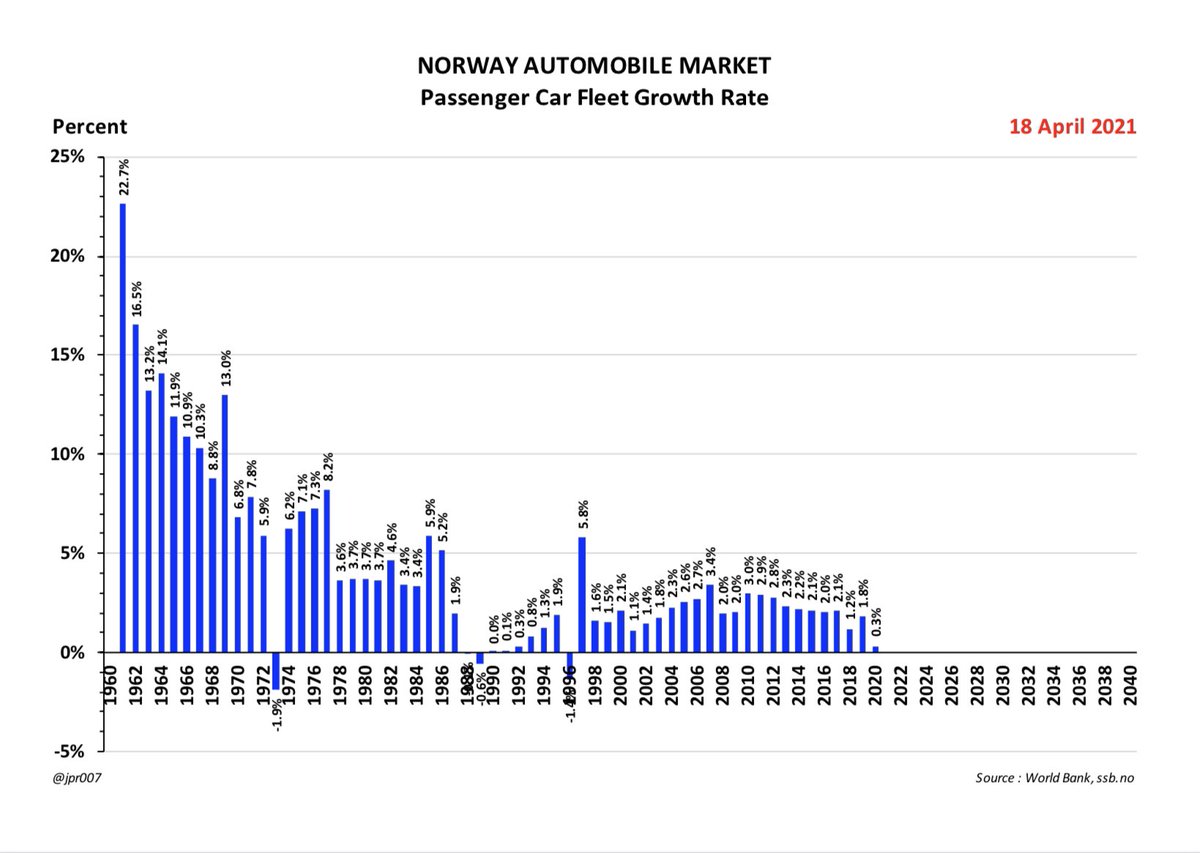

5. Norway continues to represent the best illustration of the EV Transition that can be expected in other countries

Slow Movers and Late Comers should expect to feel more pain than Norway as their shortfall trough during the Valley Of Death era will be deeper

Slow Movers and Late Comers should expect to feel more pain than Norway as their shortfall trough during the Valley Of Death era will be deeper

• • •

Missing some Tweet in this thread? You can try to

force a refresh