Haven't done one of these in a while: what happened in the crypto markets today?

A thread about the past and the future.

A thread about the past and the future.

For the past week or so, crypto has been on a tear. It's risen slowly but steadily from the mid-$50s to new highs over $65k, seemingly without a ton of fanfare. Amidst excitement over the COIN direct listing, parts of this seemed almost inevitable.

The COIN listing came and went. And it's hard to say that it was anything but a pretty big disappointment vs. the market's hopes (and, certainly, amidst the market's hype-driven rally).

https://twitter.com/AlamedaTrabucco/status/1382357672347897857?s=20

And, as I noted in that thread, crypto started crashing. But it didn't reverse all its gains! Might this signal that a lot of the rally was "organic" or whatever, and wasn't going to revert?

Maybe! But if you were paying attention, there were clues to the contrary.

Maybe! But if you were paying attention, there were clues to the contrary.

All throughout this big rally, there were a few weird things going on. Almost all the inflows were happening on futures platforms, and in particular on futures platforms with HUGE leverage, and where that huge leverage has historically led to big liquidiations ...

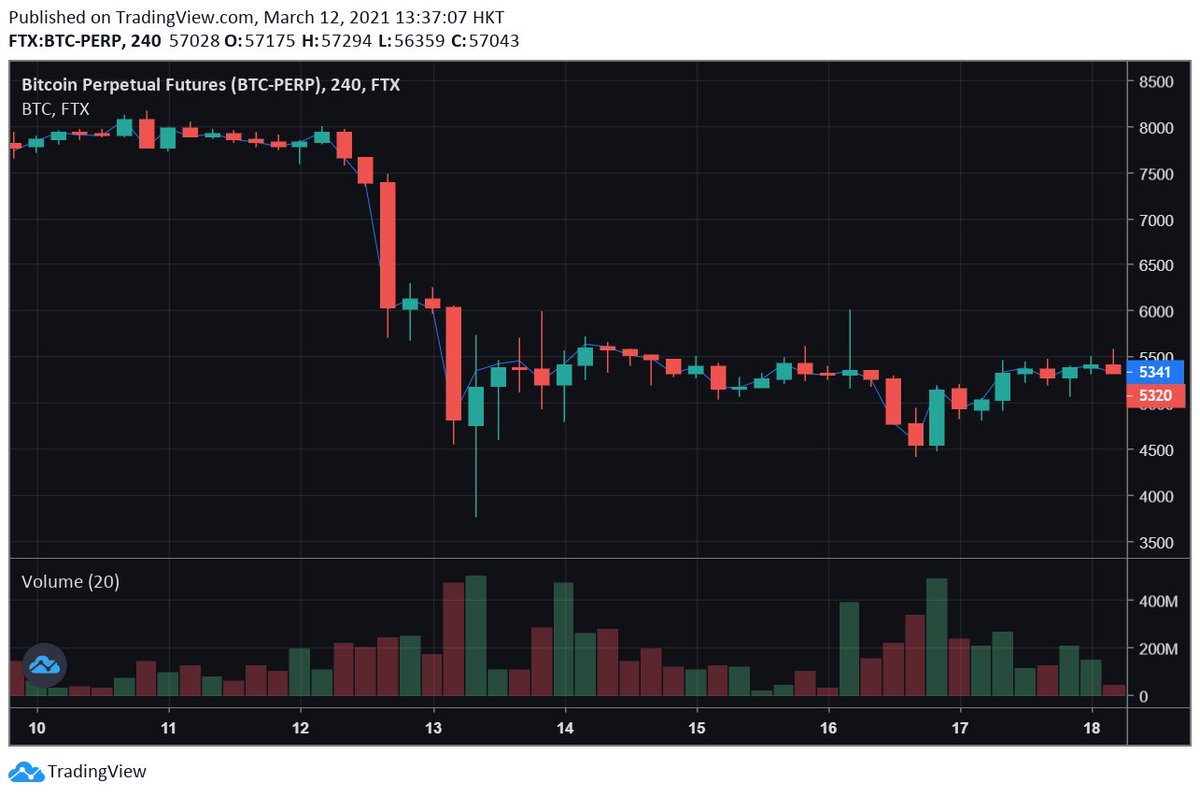

... sorta like the ones that happened on Thanksgiving 2020 ;)

https://twitter.com/AlamedaTrabucco/status/1332036760939896832?s=20

Futures premia have been REALLY high -- I'm sure everyone's heard how high the funding has gotten for various perpetuals products, and that signifies a TON of super aggressive buying going on -- Alameda has basically just been selling perps vs. buying spot for HUGE size lately.

And the same is true for quarterlies, and really just the whole market. Here's a graph of a bunch of BTC futures premia to spot over the last few weeks (annualized) -- heading into COIN things got *really* aggressive across the board! But it's been elevated for a while

Moreover, open interest for a ton of contracts was REALLY going up -- for BTC, but, in some cases, even moreso for various altcoins. Here's a random few hour period of the OI of XRP perps on binance -- most periods lately where we pulled this looked similar :P

So, futures have been at -- vs. the recent past -- unprecedentedly high premia, and OIs are skyrocketing. What does this set up?

If things keep going up and up and up? Well, nothing. A bunch of aggro buyers who it turned out were right.

But what about if there's a reason for a small downturn? A reason like, IDK, a super-hyped listing causing a rally and then falling short of the hype?

But what about if there's a reason for a small downturn? A reason like, IDK, a super-hyped listing causing a rally and then falling short of the hype?

I've seen a lot of complex theories for why crypto *started* crashing, but I don't think you really need 'em. BTC rallied from 60k -> 65k in the days pre-COIN, fell to 62k quickly, and then ... well, fell to 60k over the next weekend. Kinda no biggie and exactly what I'd expect?

And so crypto falling a bit makes sense. What does that mean for all the super aggro levered longs?

The same thing it always means -- they're getting liquidated. Many billions of $ did today!

The same thing it always means -- they're getting liquidated. Many billions of $ did today!

And, as we've said, it wasn't just perps where the big buyers were -- it was everywhere. In per day basis, most futures were close to each other, but that means quarterlies are at way higher premia -- and fall a TON more when the market crashes.

https://twitter.com/lawmaster/status/1383655305058217988?s=20

I talked on Thanksgiving about how low liquidity exacerbated the impact of the liquidations -- the same is true (though less so, on average) on weekends. With the quantity of liquidations we saw (HUGE, but explained by the OI increases) and weekend liquidity ...

... a fall to $50k is pretty much exactly what I'd expect. Futures ended up at GIANT discounts, in some cases (see Larry's thread above, e.g.) in part also because of low liquidity -- fewer big players with big bankrolls to swoop in and close the gaps.

(Again, I've seen some complex theories about this, but many billions of $ got liquidated on a weekend after a price move -- there were not many bids relative to that, and a 15% crash + a lot more for some less liquid products is just about right.)

Alameda was there, though! We bought a TON of 'em, and even slowed down at various points to maximize our prices. The limiting factor was our capacity to hedge, and lemme tell you, our capacity to hedge (by selling spot) started out GIANT!

We then prioritized freeing capital from margin and whatnot to sell more and kept doing the trade, but this is the sort of reason why these things don't just evaporate immediately -- crypto margin is REALLY inefficient compared to tradfi margin with prime brokers.

So! Over time (around an hour, a.k.a. the BTC block speed), the spreads started closing more, and the market rallied back somewhat -- again, just what we expect post-giant liquidations. Since NO ONE wanted to sell anything that cheap, of course they'll buy back.

Note, BTW, altcoins had similar movement but with (mostly) >1 beta, again as usual. XRP, for instance, fell a LOT today, because its OI increases were WAY higher vs. (weekend :P) liquidity than e.g. BTC's. That means it has way stronger momentum-y moves, as we keep seeing.

So, what next? Basically depends on whether the pre-COIN rally is "real" -- if so, the people who got liquidated (and others) *should* buy more s.t. the markets keep recovering. If not, who knows!

It's super valuable to learn from past events in crypto. It's all so idiosyncratic, that when we as traders are blessed with a big opportunity which is similar to one we've seen before, we have a BIG advantage over the market. And this was basically just Thanksgiving again!

Next time premia and OIs are way up and there's some organic reversion? Alameda will know what to do, and now so will you!

Oh I definitely linked to the wrong thread here LOL, I meant to this:

Sorry Larry + Roshun!

https://twitter.com/roshunpatel/status/1383780215894073350?s=20

Sorry Larry + Roshun!

• • •

Missing some Tweet in this thread? You can try to

force a refresh