Usually when we see rising wages, the economy is growing. However, during the pandemic, composition and base effects make wage data harder to interpret 1/

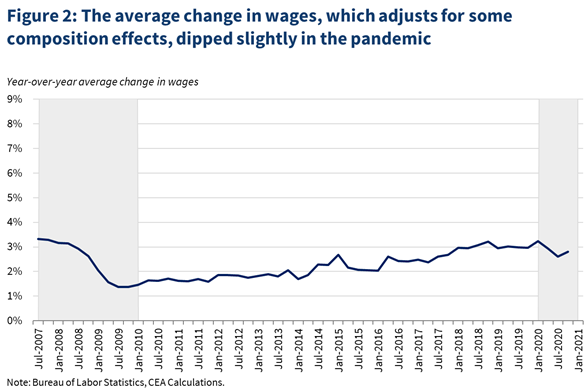

In April 2020, the Bureau of Labor Statistics (BLS) reported that year-over-year growth in average hourly earnings skyrocketed to about 8 percent—the highest observed since the series began in 2006. 2/

The sharp, one-month increase in reported average wages was because millions of relatively low-paid workers lost their jobs, while relatively high-paid workers remained employed. (composition effects) 3/

The BLS releases wage growth information as part of its Current Employment Statistics release: those data reflect the change in the average wage for private-sector workers, and so any change in the composition of who is employed affects the change in the average. 4/

That measure has consistently remained high throughout the pandemic because to-date employment in lower-paid jobs is still down more than in higher-paid jobs 5/

It is not unusual for the average wage to rise during recessions as lower wage workers are often more likely to be laid off than higher paid ones 6/

We can understand the impact of composition effects on average wages by analyzing a second BLS measure of hourly wage growth, the Employment Cost Index (ECI). 7/

The ECI keeps the mix of employment by industry and occupation constant across time, which prevents it from being affected by shifts between low- and high-wage jobs; that is, the ECI shows the average change in wages within industries and occupations. 8/

ECI does not show a spike during the pandemic, but rather that average wage growth had weakened slightly to 2.8 percent at the end of 2020 from 3 percent at the end of 2019. 9/

Different compositionally-adjusted wage data from @AtlantaFed also do not show an increase in wage growth during the pandemic. atlantafed.org/chcs/wage-grow… 10/

While average wage growth was unusually high during the pandemic, it may decline in the coming months because of: base and composition effects. These two factors will depress growth in average wages and could even drive the year-over-year change negative. 11/

Base effects are sudden rises or falls in measured growth due to the level of the starting value. Given the abnormally high average wage last spring we may see an unusually large decrease in the average wage this spring. 12/

In April 2021, we will compare the average wage to the average in the same month of last year, a time when average wages were relatively high because lower-paid workers had lost their jobs and were not counted in the average (as noted above). 13/

In fact, this mechanical decrease in average wages could be so large that year-over-year growth in average wages could turn negative as early as this month. 14/

The level of average wages in April 2020 was $30.07 an hour, while in March 2021 it was $29.96 an hour. While we do not have data for April 2021, March suggests a decrease in average wages year-over-year when calculated from the artificially high April 2020 average. 15/

To date during this economic slowdown, composition effects have increased the level of average wages. As the economy starts to recover and lower-paid jobs are added back, composition effects will likely work in the opposite direction, mechanically decreasing average wages. 16/

Composition effects could show up both across industry (e.g. the addition of more leisure and hospitality jobs, which tend to be lower paid) and within industry (e.g. hiring back the lower-paid workers within leisure and hospitality, who were more likely to get laid off). 17/

We explore the combined impact of these two mathematical factors with a purely illustrative exercise. 18/

This graph shows what wage growth would be assuming all industries return to their pre-pandemic employment levels as of Dec. 2021, the the employment recovery is evenly distributed over the next nine months; and average wages within industries are at March 2021 level. 19/

In other words, any changes in wages under this simulation are driven wholly by employment-composition effects. 20/

This exercise shows muted growth in average wages for the rest of this year, with the possibility that wage growth turns negative, particularly in April. 21/

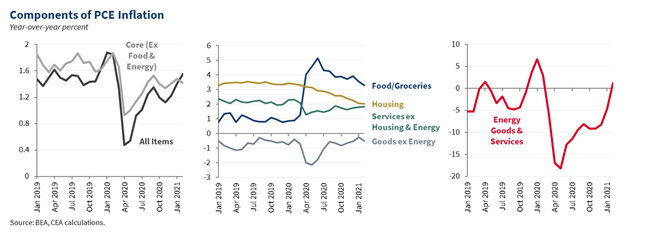

We note that wage growth this spring could be estimated to be even lower if it is adjusted for inflation because measured inflation will likely temporarily rise in the coming months, partly because of base effects (as discussed in a previous CEA blogpost). 22/

Given all these factors, it is possible that reported real average wages could fall faster than we’ve seen before. 23/

Importantly, these computational quirks should not be confused with the experience of the typical worker. 24/

Most workers did not receive historic raises in April of 2020, even though that is what average wages suggest. Likewise, the typical worker is not likely to experience the slowdown in wage growth that we expect to see in the upcoming data as the economy improves. 25/

The Administration is paying close attention to how these influences are affecting the economic data. As the economy returns to normal we expect these anomalies to gradually disappear. 26/

The full CEA blogpost is here: whitehouse.gov/briefing-room/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh