Super League and Super Villains [Thread]

WTF is the Super League?

European breakaway competition with 15 core teams and 5 qualifying teams. Core teams don't face relegation. They will each receive €3.5bn for "infrastructure investment plans"

Super League also saved money with a website resembling a Tumblr post

European breakaway competition with 15 core teams and 5 qualifying teams. Core teams don't face relegation. They will each receive €3.5bn for "infrastructure investment plans"

Super League also saved money with a website resembling a Tumblr post

The headlines will belong to Florentino Perez, Andrea Agnelli and Joel Glazer but the real architect of the renegade league is methodically crafted by a guy you probably never heard of...

Charlie Stillitano (aka Champagne Charlie)

Charlie Stillitano (aka Champagne Charlie)

Charlie belongs to no club or league. He's an incredibly well connected mercenary with the sole aim of commercializing European football in the US.

He's also the Chairman of Relevent Sports Group - a football events & media company. The Vince McMahon football equivalent.

He's also the Chairman of Relevent Sports Group - a football events & media company. The Vince McMahon football equivalent.

Charlie was on one the first guys on the scene when the US "soccer" league was launched in the early 90s.

Then he started booking high profile matches. He set up Man United vs. Real Madrid in 2014 at Michigan Stadium. The attendance?

Over 109,000 fans - a record attendance

Then he started booking high profile matches. He set up Man United vs. Real Madrid in 2014 at Michigan Stadium. The attendance?

Over 109,000 fans - a record attendance

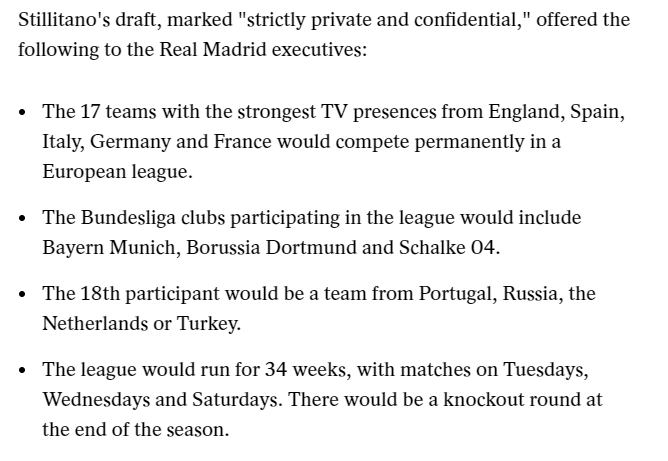

Charlie was at the inception of the cartel in 2015 when he sent out a mail to Real Madrid's executives with the game plan.

Upfront Charlie and the bandits knew FIFA and UEFA had limited powers to stop the clubs as it could be construed as a violation of EU competition law.

Upfront Charlie and the bandits knew FIFA and UEFA had limited powers to stop the clubs as it could be construed as a violation of EU competition law.

Florentino Perez (Real Madrid President) loves the idea. of an independent league. His eyes flash up Euro signs.

Key Capital Partners- a Madrid based boutique investment bank- gets involved in structuring & drafting the initial term sheet.

Key Capital Partners- a Madrid based boutique investment bank- gets involved in structuring & drafting the initial term sheet.

Now Perez has to assemble the team of Capitalism Avengers- which is a remarkably easy sell. Game plan is to plug in the wildly successful, commercial model of US sports into European football

"First you get the money, then you get the power, then you get the woman"- Tony Montana

"First you get the money, then you get the power, then you get the woman"- Tony Montana

Manchester United - easy sell

Malcolm Glazer bought the Tampa Bay Buccaneers in 1995 for $192m; today the team is worth more over $1bn.

The Glazers go on to turn the Bucs into a money printing machine. Brady & Gronk won the last SuperBowl at the franchise.

Malcolm Glazer bought the Tampa Bay Buccaneers in 1995 for $192m; today the team is worth more over $1bn.

The Glazers go on to turn the Bucs into a money printing machine. Brady & Gronk won the last SuperBowl at the franchise.

Arsenal - easy sell

Stan Kroenke owns the LA Rams and the Denver Nuggets. He moved the Rams back to LA and proceeded to build the SoFi stadium which costs over $5bn.

Stan is married to Ann Walton (the Walton family). Solid reminder to marry people in your tax bracket.

Stan Kroenke owns the LA Rams and the Denver Nuggets. He moved the Rams back to LA and proceeded to build the SoFi stadium which costs over $5bn.

Stan is married to Ann Walton (the Walton family). Solid reminder to marry people in your tax bracket.

Spurs - easy sell

Joe Lewis (ENIC group) is the OG forex trader. He tag teamed with Soros to break the pound in the early 90s. His personal art collection is over $1bn.

Daniel Levy (Chairman) locked in a NFL stadium deal with Spurs. The Falcons are expected to play in October.

Joe Lewis (ENIC group) is the OG forex trader. He tag teamed with Soros to break the pound in the early 90s. His personal art collection is over $1bn.

Daniel Levy (Chairman) locked in a NFL stadium deal with Spurs. The Falcons are expected to play in October.

Liverpool - easy sell

John Henry is an OG trader. Made racks in the 1980s from his trading firm J.W Henry & Co

Bought the Boston Red Sox in 2002 for $380m & delivered a World Series win after 86 years

Fenway Sports owns New England Sports Network & Nascar's Roush Fenway Racing

John Henry is an OG trader. Made racks in the 1980s from his trading firm J.W Henry & Co

Bought the Boston Red Sox in 2002 for $380m & delivered a World Series win after 86 years

Fenway Sports owns New England Sports Network & Nascar's Roush Fenway Racing

Chelsea - easy sell

Few people have thrown as much money into European football than Roman Abramovich. COVID has also hit Abramovich's personal fortune hard - he's down £2.4bn.

Committing to the Super League comes at the right time to balance the books.

Few people have thrown as much money into European football than Roman Abramovich. COVID has also hit Abramovich's personal fortune hard - he's down £2.4bn.

Committing to the Super League comes at the right time to balance the books.

Man City - easy sell

The template for global domination in football. The City Football Group is carving out an empire. More importantly, they want an empire they can control.

The template for global domination in football. The City Football Group is carving out an empire. More importantly, they want an empire they can control.

What about the Spanish & Italian teams?

If you thought your personal financial situation was dire - wait until you see their books. Government intervention, corruption scandals and fiscal mismanagement have left clubs starved for capital.

They're barely surviving.

If you thought your personal financial situation was dire - wait until you see their books. Government intervention, corruption scandals and fiscal mismanagement have left clubs starved for capital.

They're barely surviving.

What about PSG?

PSG is owned by Qatar With the World Cup coming up, they would be apprehensive of damaging their relationship with FIFA.

They also have a stake in Bein Sports & paid A LOT of cash to broadcast Champions League fixtures.

PSG is owned by Qatar With the World Cup coming up, they would be apprehensive of damaging their relationship with FIFA.

They also have a stake in Bein Sports & paid A LOT of cash to broadcast Champions League fixtures.

JP Morgan is funding the set up of the Super League with roughly $6bn. It's common for investment banks to fund projects through a combination of term debt, acquisition finance & working capital facilities.

This is cash available to use and not always cash actually spent.

This is cash available to use and not always cash actually spent.

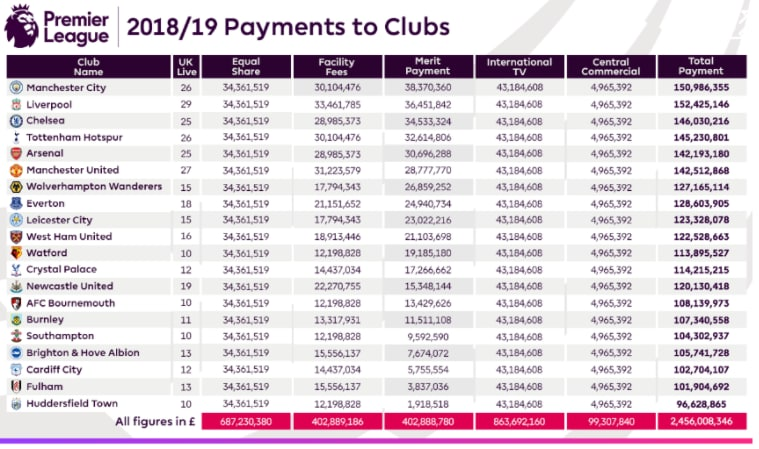

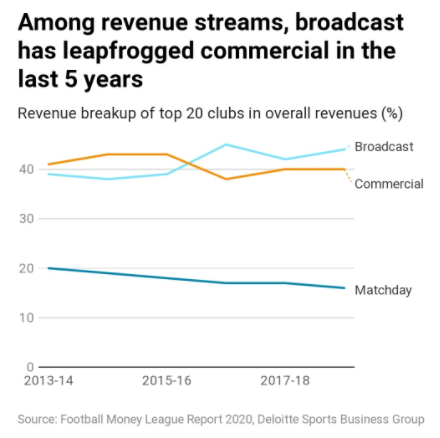

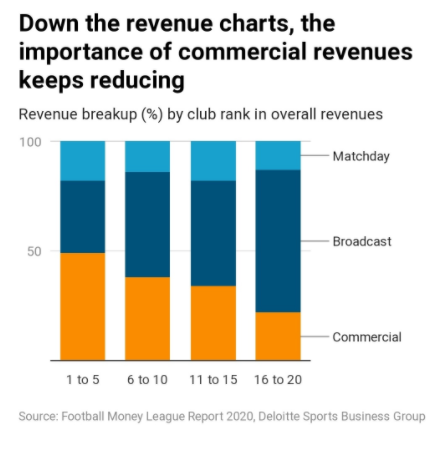

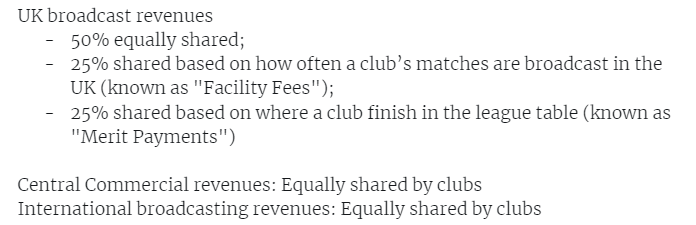

Broadcast revenue dominates modern football

Owning broadcast rights is the holy grail. Even more lucrative: contracts are typically tiered for different levels of access. This is why it's difficult to have rights to every single EPL game

A €3.5bn sign-on bonus can stretch far!

Owning broadcast rights is the holy grail. Even more lucrative: contracts are typically tiered for different levels of access. This is why it's difficult to have rights to every single EPL game

A €3.5bn sign-on bonus can stretch far!

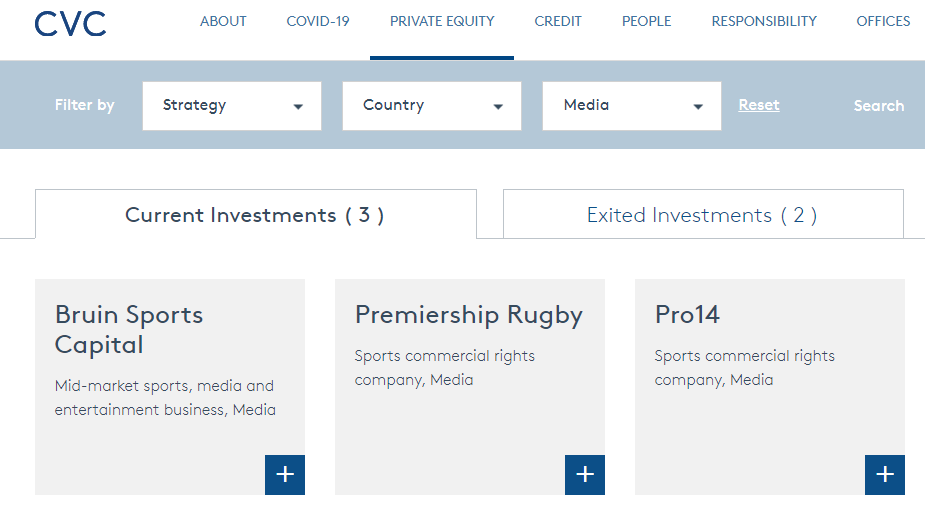

Big Sport is an asset class. The likes of CVC Capital has signaled a strong push into private equity in rugby. Roc Nation is aggressively signing top talent.

Over 50% of the owners of EPL clubs are corporate investors, private equity firms and hedge funds

Big Sport = Big Money

Over 50% of the owners of EPL clubs are corporate investors, private equity firms and hedge funds

Big Sport = Big Money

Cartels have existed long before the Super League - OPEC has been controlling oil prices for years. Cartels are sparked as a response to sluggish monopolies, complacency and rudderless leadership.

FIFA is guilty on all three accounts.

FIFA is guilty on all three accounts.

The Super League is winning over club owners through incentives. FIFA/ UEFA will likely respond through punishment - sanctions & penalties.

International trade & foreign policy has proven time and again, utilizing punishments when you aren't in full control is a losing strategy.

International trade & foreign policy has proven time and again, utilizing punishments when you aren't in full control is a losing strategy.

In the late 70s, Kerry Packer formed a renegade cricket league to circumvent broadcast rules at the time. The league didn't last long but it sparked innovation in cricket.

More importantly, the dislocation was the much needed jolt to align incentives across everyone.

More importantly, the dislocation was the much needed jolt to align incentives across everyone.

The Super League is the culmination of years of mind blowing transfer fees, introducing owners with no club allegiance & an obsession with commercial deals.

Football heritage doesn't have a price. It's a religion.

This is the great reset.

Football heritage doesn't have a price. It's a religion.

This is the great reset.

I know this should be obvious (but in case it isn't) that's €3.5bn carved up across teams

There's another twist. As far as the Bundesliga goes - guess who was part of the core team forming the Super League in 2016? (No, it's not Rebekah Vardy...)

None other than Karl-Heinz Rummenigge (Bayern Chairman).

Today he takes the reigns at UEFA.

None other than Karl-Heinz Rummenigge (Bayern Chairman).

Today he takes the reigns at UEFA.

https://twitter.com/iMiaSanMia/status/1384144810974453766?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh