Ok this #CapitalGainsTax stuff warrants a thread because we're wading into what people misconstrue as "politics", but what I think of as "economic incentives"

As always, the reality is more nuanced than the narrative. I'll address the basics, feedback, & practical takeaways👇

As always, the reality is more nuanced than the narrative. I'll address the basics, feedback, & practical takeaways👇

1. Capital investment is the practice of putting your $ at risk in exchange for potential reward. Hence, risk/reward. The reward for putting your money at risk = "capital gains"

2. Types of capital investments you can make:

(a) OPERATING investment (Co. hires ppl, buys machines or builds houses)

(b) DIRECT investment (invest $ in Co. so they can hire ppl or buy machines)

(c) SECONDARY investments (buy from another person bc u think the value will go up)

(a) OPERATING investment (Co. hires ppl, buys machines or builds houses)

(b) DIRECT investment (invest $ in Co. so they can hire ppl or buy machines)

(c) SECONDARY investments (buy from another person bc u think the value will go up)

3. OPERATING and DIRECT investments directly drive economic growth/innovation. We absolutely should not discourage this. To the contrary, we should encourage this as much as we can.

4. SECONDARY investments don't directly fund growth, but they maintain efficient capital mkts that companies can use to raise capital.

Secondary investments are also the only way lower/middle class ppl can invest. Not many Joe Schmo's get in on Series A rounds.

Secondary investments are also the only way lower/middle class ppl can invest. Not many Joe Schmo's get in on Series A rounds.

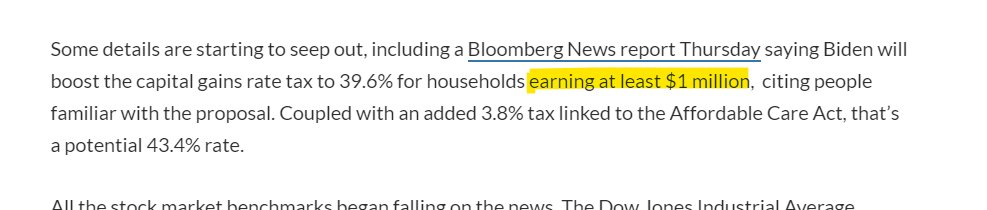

5. Valid feedback is many wealthy ppl get cap gains from SECONDARY investments & speculation which should be taxed higher.

Sure, but increasing LT cap gains is "throwing the baby out w the bathwater". It discourages ALL investments, not just SECONDARY.

Sure, but increasing LT cap gains is "throwing the baby out w the bathwater". It discourages ALL investments, not just SECONDARY.

6. If we want to tax the "rich", we need to be more targeted about it.

Inheritance taxes, ST cap gains, & income taxes make more sense. If u raise LT cap gains for the wealthy, at least only raise them on SECONDARY investments, not DIRECT investments. These fund growth.

Inheritance taxes, ST cap gains, & income taxes make more sense. If u raise LT cap gains for the wealthy, at least only raise them on SECONDARY investments, not DIRECT investments. These fund growth.

7. But we should be careful about overtaxing SECONDARY investments too bc this is how the majority of assets are managed.

Pension funds, asset mgrs, retirement accts, & normal investors all rely on SECONDARY public equities or real estate investments to grow wealth.

Pension funds, asset mgrs, retirement accts, & normal investors all rely on SECONDARY public equities or real estate investments to grow wealth.

8. Even if ur just trying to keep up with 2.5% inflation but the govt takes 50%+ of gains, you need to beat 5.0% annual returns just to keep up with inflation!

The narrative isn't as simple as "the rich can afford it". It burdens the full investing spectrum vs risk & inflation.

The narrative isn't as simple as "the rich can afford it". It burdens the full investing spectrum vs risk & inflation.

9. We should encourage investment > consumption. If cap gains is taxed the same as income, why would you put your earned cash at risk by reinvesting instead of just getting a dividend?

This is why cap gains tax rates are usually meaningfully lower than income tax rates.

This is why cap gains tax rates are usually meaningfully lower than income tax rates.

10. Here are examples to think abt:

If retiree invests their savings for 40 yrs & now constitutes "rich" at age 70, should you take 50% of their money?

If someone starts a small biz, creates jobs, & sells that biz for $10M after 40 years of hard work... should you take $5.3M?

If retiree invests their savings for 40 yrs & now constitutes "rich" at age 70, should you take 50% of their money?

If someone starts a small biz, creates jobs, & sells that biz for $10M after 40 years of hard work... should you take $5.3M?

11. Another thing that's confusing is why would you tie cap gains tax rates to income? Income is earned through wages and dividends, not investment portfolios. Makes absolutely no sense.

12. One practical takeaway is that Real Estate investing, with all its tax tricks, may become the most attractive asset class.

Many generational RE families use 1031 exchange & never sell, & thus never pay cap gains. They just keep borrowing $ against the properties

Many generational RE families use 1031 exchange & never sell, & thus never pay cap gains. They just keep borrowing $ against the properties

13. In summary, if this passes, I am most fearful about its effects on the incentives for entreprenuership, DIRECT investments, and equity markets.

I'm not making a comment about "taxing the rich", only that we clearly need to be more thoughtful this than bluntly raising rates

I'm not making a comment about "taxing the rich", only that we clearly need to be more thoughtful this than bluntly raising rates

14. To me, this isn't political, it's an unthoughtful move that affects our INVESTOR community. I grew up middle class to immigrant parents and worked my ass off (and still am). We're trying to use LT CAPITAL GAINS to grow our wealth & reach financial freedom.

• • •

Missing some Tweet in this thread? You can try to

force a refresh