😅😂🤣

I am telling you man, people can't let go of the cash-out data because it's a the hope and the dream of another housing crash

I am telling you man, people can't let go of the cash-out data because it's a the hope and the dream of another housing crash

https://twitter.com/WinfieldSmart/status/1385545981287190530

It's so different this time around, but the blood lust for something negative on Twitter is too good to pass up. Since I knew people would use the cash-out data this way, I already got ahead of that housingwire.com/articles/are-w…

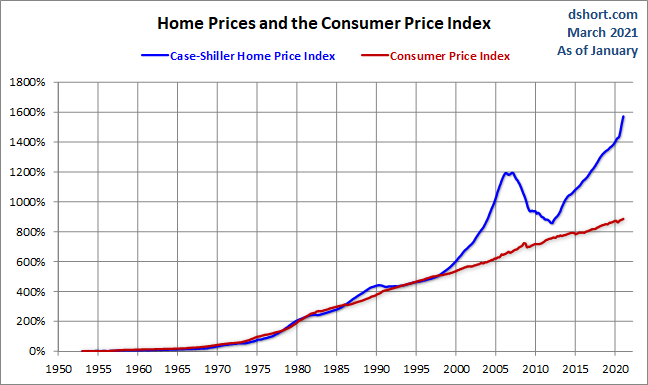

To be very fair to everyone. They don't have the financial background to know how different it is. This is basically a 2.0 version of people using nominal home prices getting back to 2006 levels and calling for the crash, which was a favorite of crash cult twitter.

3 simple things to remember

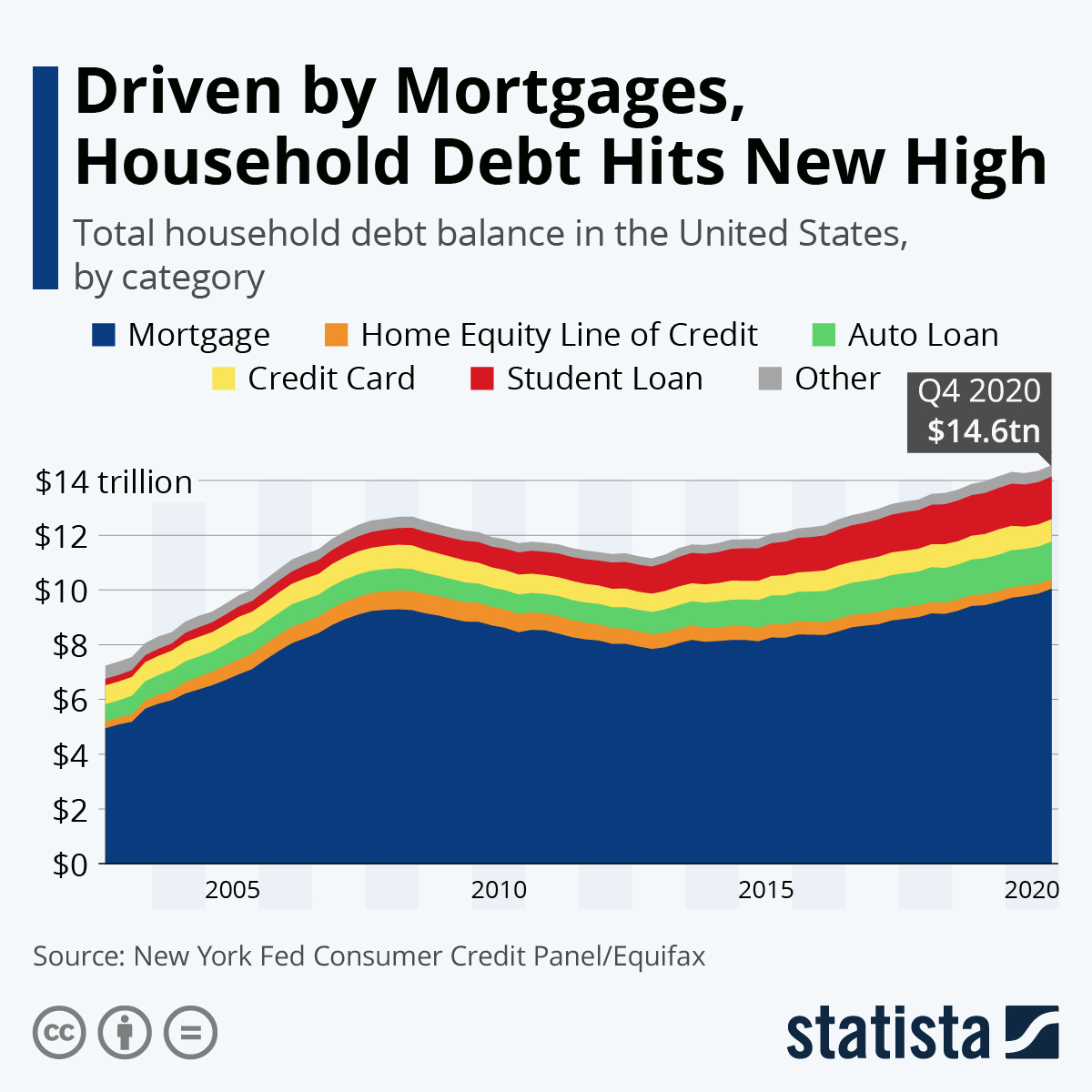

1. Cash flow of owners now is excellent, especially the recent data.

2. (Most important) No exotic loan debt structures, very vanilla

3. Fixed low debt cost vs. rising wages + nested equity.

1. Cash flow of owners now is excellent, especially the recent data.

2. (Most important) No exotic loan debt structures, very vanilla

3. Fixed low debt cost vs. rising wages + nested equity.

We have other things to worry about with housing, but cash-out data isn't it. bloomberg.com/news/audio/202…?

3 More charts.

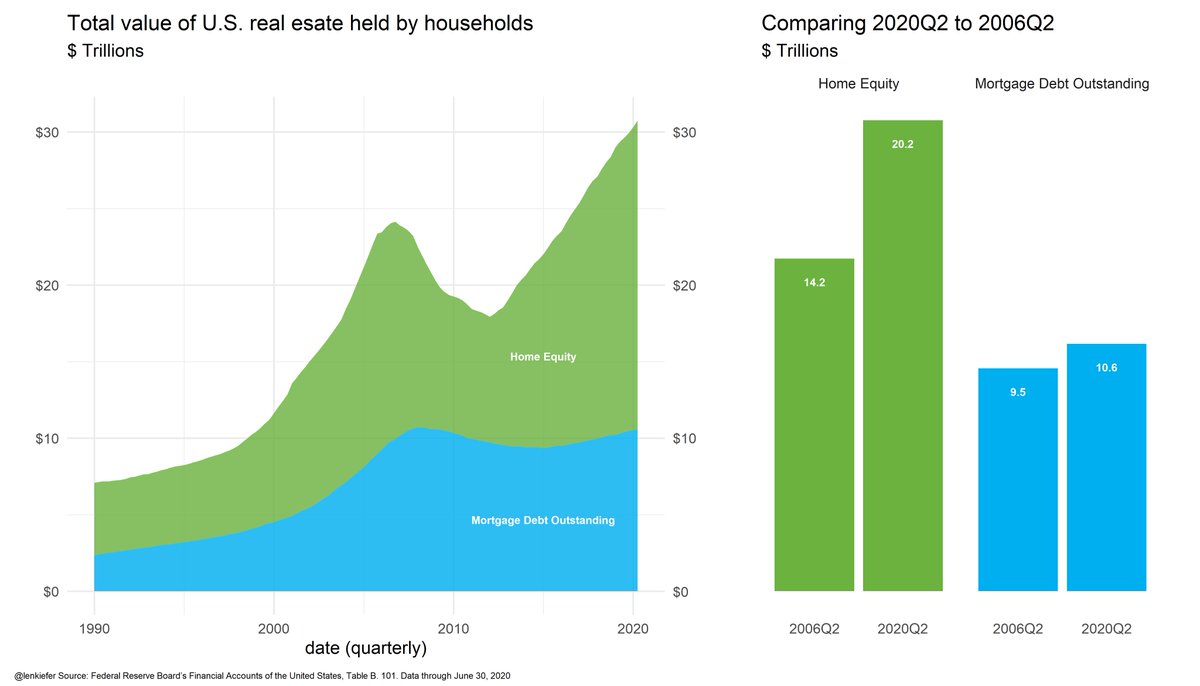

1. Mortgage debt hasn't had much growth from the previous peak. This runs in line with my weakest housing recovery thesis from 2008-2019. We don't have a speculative credit bubble.

1. Mortgage debt hasn't had much growth from the previous peak. This runs in line with my weakest housing recovery thesis from 2008-2019. We don't have a speculative credit bubble.

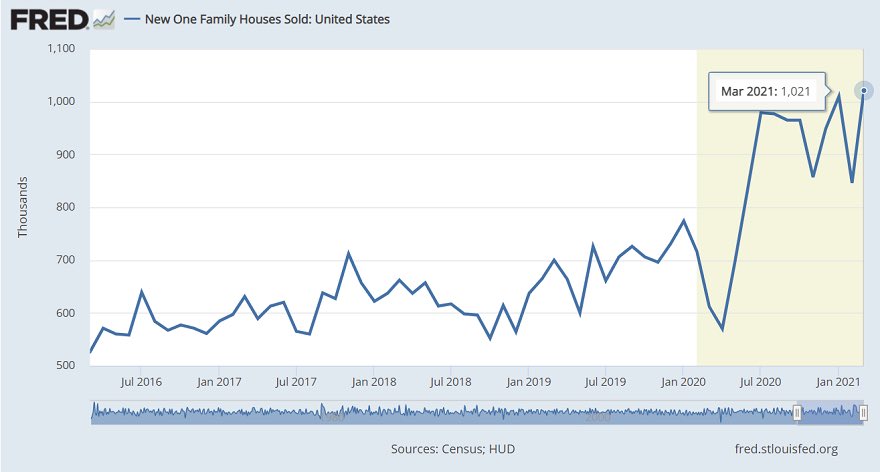

2. This is very key; 2018-2021 data looks nothing like 2002-2005. This is a good thing, not a bad thing. Demand is legit, and these owners have good financial profiles.

"To paraphrase Rutherford for economics models, if models don’t include demographics and productivity, they might as well be stamp collecting. As it turns out, we have a lot of philatelists in housing economics – I call them the housing bubble boys."

This is why I stressed that the Housing Bubble Boys 2.0 will go down in the history of having the biggest whiff call ever for many years. To go from a 74.7% bubble crash to having the best sector in the economy, ouch. housingwire.com/articles/its-o…

People should have always worried about home prices taking off in an unhealthy way, not a housing bubble crash. If 2020 & 2021 hasn't shown you this, then they all played you like a sucker; kudos to them.

loganmohtashami.com/2021/02/23/hom…

loganmohtashami.com/2021/02/23/hom…

• • •

Missing some Tweet in this thread? You can try to

force a refresh