The comments on this post 🤣😂😅

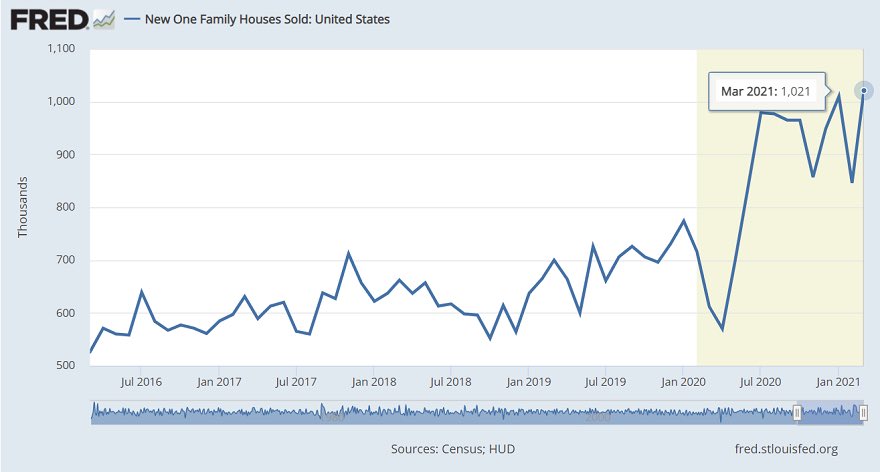

https://twitter.com/stlouisfed/status/1386366916609167366

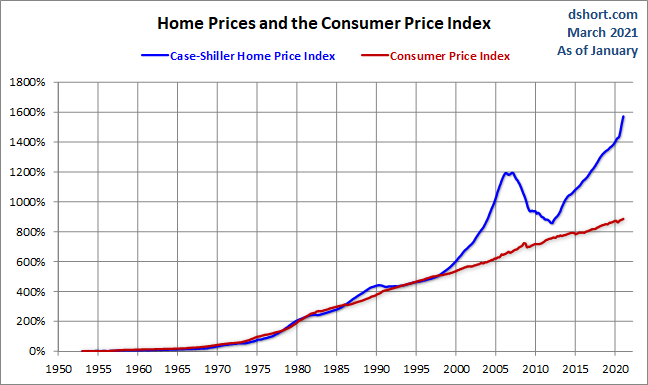

1/2 Each dip in the median sales price of new homes has been interpreted as the bubble popping for many years. For a while, when a clear trend of a median sales price declined, they were all in with the crash. However, (Remember Reading Is A Good Thing) they didn't know about

2/2 The impact of falling median sq ft of homes being solid impacting the price data. Like always, once a crash cult, always a crash cult, they never want to grow up; they want to be a crash cult kid forever. 😉

• • •

Missing some Tweet in this thread? You can try to

force a refresh