One of my favorite weekly FinTech newsletters made the claim that Stripe invented the PayFac category. The newsletter is a fantastic regular read, but this claim isn't true. Here's some background on the history of PayFac from someone who lived it.

1/

1/

2/ But first, how great is Privacy.com - 12 free cards a month, pay for other bells and whistles, always keep your online shopping safe.

And we're hiring. Stop reading about FinTech history and come create it with me, @bolingj, @CharlieKroll and all the others.

And we're hiring. Stop reading about FinTech history and come create it with me, @bolingj, @CharlieKroll and all the others.

3/ So back to PayFac.

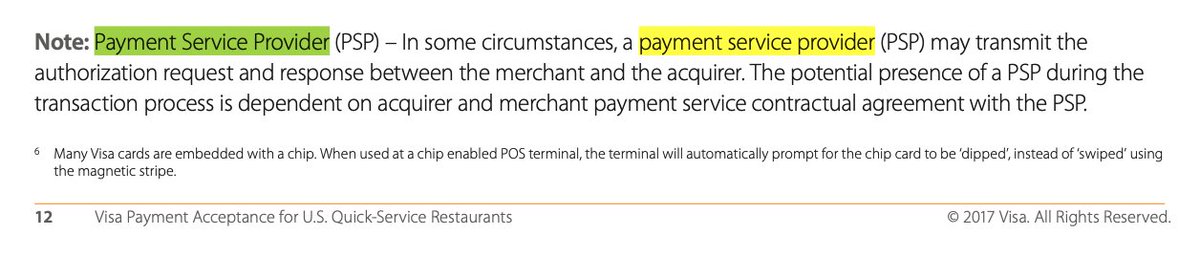

The term actually used to be called Payment Service Provider or "PSP." Here's a screenshot from a 2017 Visa product guide with some references to the old term.

The term actually used to be called Payment Service Provider or "PSP." Here's a screenshot from a 2017 Visa product guide with some references to the old term.

4/ PSPs could do all the things Payment Facilitators get to do now. Or more accurately, banks that sponsored PSPs had to do all the same oversight and control functions.

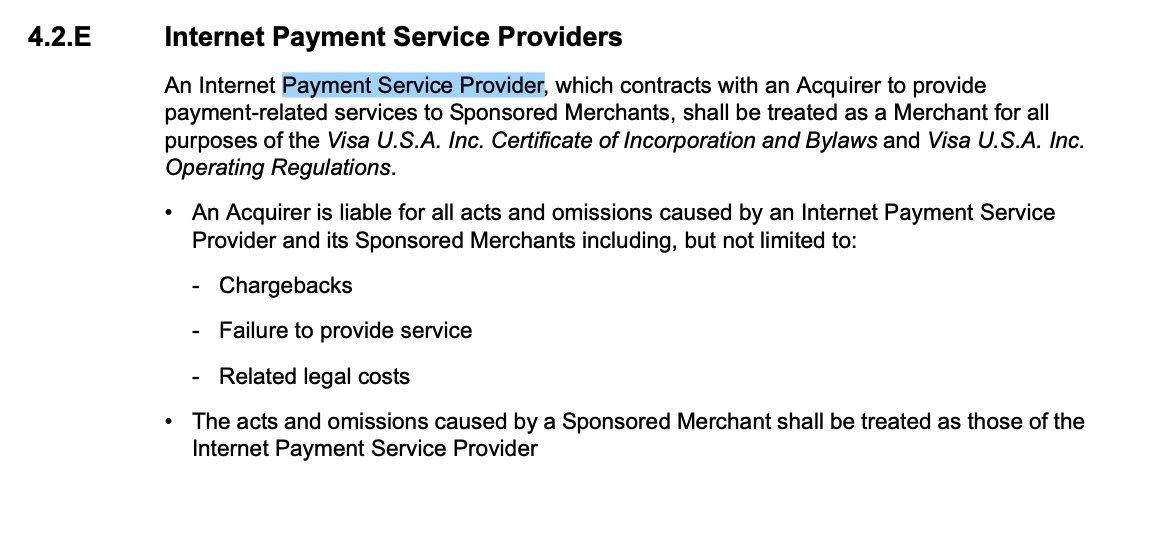

5/ I actually think PayPal pioneered the concept of PSPs. You can see evidence of that here in these 2008 Visa rules. The term is actually "Internet Payment Service Provider." And the 2008 date on this means the concept was getting thrown around pre-Stripe.

6/ So when did the name change? Sometime in the late 2010s. I remember being at Square and seeing the terminology start to shift. I forget who moved first, but eventually Visa, Mastercard and American Express all reclassified PSPs as Payment Facilitators in their rules.

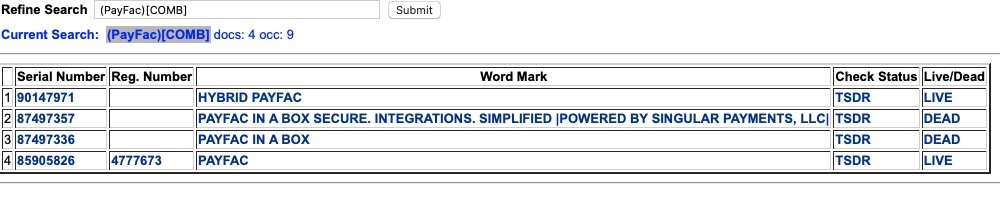

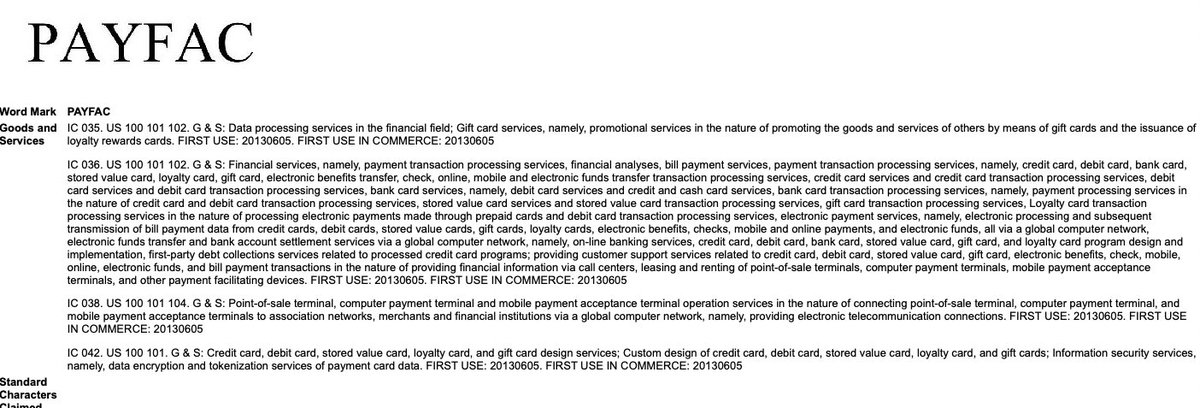

7/ Interestingly, companies like Stripe throw the term PayFac around quite a bit in formal marketing. But they may be steering into IP trouble from others.

8/ That's because Vantiv actually owns the trademark to the term "PayFac" and could look to force Stripe to remove it from their Website if they chose to do so.

9/ So the next time someone tells you Stripe pioneered the PayFac concept, you'll know better.

PayPal was arguably the first to operate a payment facilitator, then known as a PSP.

Vantiv actually pioneered the abbreviation a few years later.

PayPal was arguably the first to operate a payment facilitator, then known as a PSP.

Vantiv actually pioneered the abbreviation a few years later.

10/ If you enjoyed that nugget of Payments nerdery, you can get even more by coming to work with me! Check out our open roles at privacy.com/careers

11/ and back to the top --

https://twitter.com/regulatorynerd/status/1386438992741027840?s=20

12/ And adding on a good complimentary thread from the Very Good @peter of @getVGS

https://twitter.com/peter/status/1386509309257805825

13/ And another one from @paymentsexpert

https://twitter.com/paymentsexpert/status/1386521055280328709

• • •

Missing some Tweet in this thread? You can try to

force a refresh