1/ Today the U.S. Consumer Financial Protection Bureau (“CFPB”) issued an advisory opinion about earned wage access products. If you’ve wondered what the legal skinny is on Dave, Earnin, Even and all the others -- this thread is for you.

files.consumerfinance.gov/f/documents/cf…

files.consumerfinance.gov/f/documents/cf…

2/ But first a word about Privacy.com. The safest and easiest way to shop online. Holiday deals are here :) So are hackers :(

Keep your bank card safe. Use Privacy cards instead. Free to use, easy to sign up.

And neobank builders will love our APIs and docs.

Keep your bank card safe. Use Privacy cards instead. Free to use, easy to sign up.

And neobank builders will love our APIs and docs.

3/ Back to earned wage access.

Lots of FinTech cos will give you early access to your wages. Some front ACH while the credit clears. Others give you money by the day, up to several times a month.

Lots of FinTech cos will give you early access to your wages. Some front ACH while the credit clears. Others give you money by the day, up to several times a month.

4/ What are these legally? Likely one of:

→ consumer credit

→ a “cash advance”

→ early extinguishment of an obligation

→ early release of ACH funds

→ consumer credit

→ a “cash advance”

→ early extinguishment of an obligation

→ early release of ACH funds

5/ Most of these products are going to be viewed by at least one regulator as credit. Since scale means offering them in most of the 50 states, this is the key needle for these products to thread.

6/ Lots of folks, including some bad lawyers, will tell you that offering a product without a fee means you aren’t offering credit.

This is false. In some states and in parts of federal law, even a product without a fee will be credit if it requires repayment at a later date.

This is false. In some states and in parts of federal law, even a product without a fee will be credit if it requires repayment at a later date.

7/ The fee is helpful for a different reason - whether you need a lending license. In some states, you can offer loans without a license if it falls under an interest rate threshold.

So a $0 fee product is still a loan, just not one you need a license or charter to offer.

So a $0 fee product is still a loan, just not one you need a license or charter to offer.

8/ There are other states where $0 fee loans are still considered credit, so you need a license to offer the product. Those states often have statutory language that says the regulators should apply the statutory text liberally. This means to catch and punish unlicensed lenders.

9/ One of the other hallmarks of a loan/credit is whether there is recourse against the person receiving the funds. If you give out free money, without an obligation for the person to repay, you can sometimes fit into the “not a loan” space.

10/ But no one gives money away without strings attached. So companies tend to dress up their “not loans” as something else like an assignment of wages, or some other receivable that can be papered over.

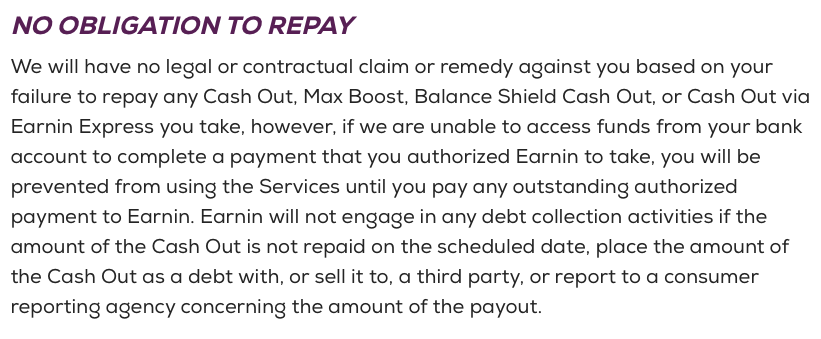

11/ Interestingly, none of Dave, Earnin or Even seem to be going that far in their models. Instead, their terms read as a plain, no cost “not loan.”

12/ I call out “extinguishment of an obligation” because this is what I think a true earned wage access product is. The employer is obligated to pay the employee. The employer, perhaps with a provider like Even, is advancing funds to the employee.

13/ The last type of early wage access is early release of ACH funds. Chime and some other neo banks do this. In full disclosure, so will BofA depending on your service tier.

14/ Why don’t all banks give you access to your payroll ACH funds on the day they’re sent from your company? The answer is a mix of history (read inertia), old regs and fraud/payment risks.

15/ Back in the day, banks could sit on all or most of your paycheck until the funds fully cleared. This was helpful when banks had to mail stacks of paper checks to each other to clear.

16/ Fraudsters would engage in check kiting, or presenting paper checks at bank branches and getting paid before the bank realized the account backing the check didn’t have enough funds.

17/ Banks put fraud holds on some of the funds from each check. Congress eventually entered the fray in 1987 and passed the Expedited Funds Availability Act.

Bankers thought it was garbage. See this fun 1989 article from the MSP Fed Bank.

minneapolisfed.org/article/1989/e…

Bankers thought it was garbage. See this fun 1989 article from the MSP Fed Bank.

minneapolisfed.org/article/1989/e…

18/ The law got updated again in 2003 when Congress modernized e-checks and ACH as payment and presentment methods for U.S. banks.

19/ The law currently requires banks to make at least $200 (indexed to inflation, so about $225 today) of your paycheck available the next day. The bank gets some limited rights to still put risk holds on your funds, such as if you frequently overdraft.

20/ Most banks run on outdated systems with outdated risk management. So some stick to the $200 next day timing, then give the rest the day after. Chime gives you everything same day, hence the 2 days early claim.*

*Chimers, please correct me if I’m wrong.

*Chimers, please correct me if I’m wrong.

21/ Okay, so to recap:

→ Most early paycheck products look like credit.

→ Chime speeds up ACH

→ Dave is banking for humans (but Dave is a bear?)

So what about the CFPB thing?

→ Most early paycheck products look like credit.

→ Chime speeds up ACH

→ Dave is banking for humans (but Dave is a bear?)

So what about the CFPB thing?

22/ The CFPB is saying that earned wage access products aren’t “credit” as that term is defined in federal Regulation Z. But it puts strings on its pronouncement.

23/ Strings (Part 1):

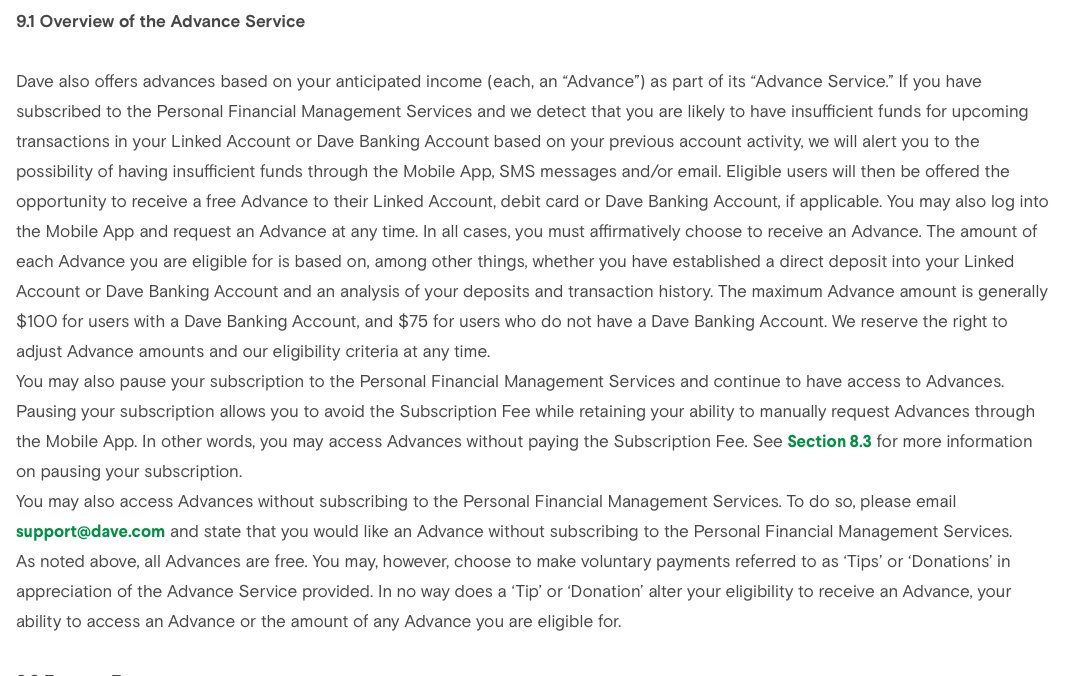

→ Have to contract with employers (so Dave = bad, Earnin and Even = maybe OK)

→ Amount of the advance can’t exceed the earned wages (all providers probably fine here)

→ No fees or tips allowed (so Dave = bad again, others = prob OK)

→ Have to contract with employers (so Dave = bad, Earnin and Even = maybe OK)

→ Amount of the advance can’t exceed the earned wages (all providers probably fine here)

→ No fees or tips allowed (so Dave = bad again, others = prob OK)

24/ Strings (Part 2):

→ Employee gets to choose account to receive the funds. If you give out a debit card, it needs to be V/MC/D/AMEX badged and allow some free ATM access.

→ CAN ONLY GET REPAID VIA PAYROLL DEDUCTION (problem for most)

→ Employee gets to choose account to receive the funds. If you give out a debit card, it needs to be V/MC/D/AMEX badged and allow some free ATM access.

→ CAN ONLY GET REPAID VIA PAYROLL DEDUCTION (problem for most)

25/ Strings (Part 3):

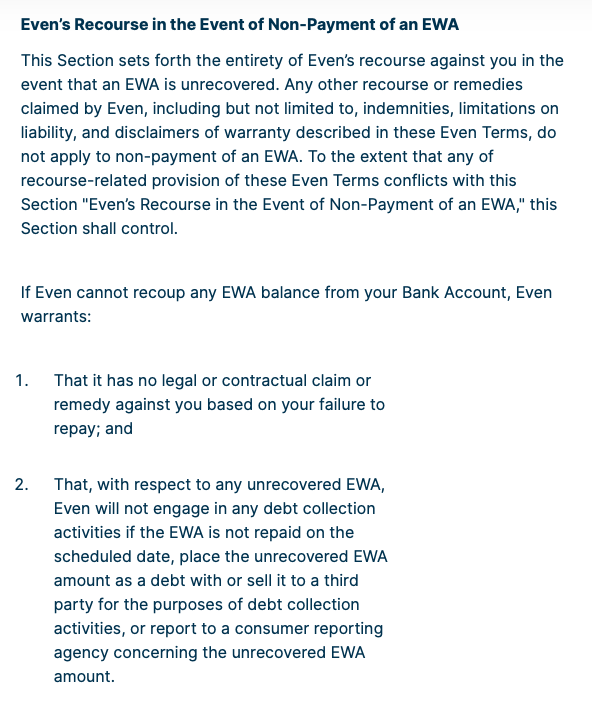

→ EWA provider has no legal claim to get repaid.

→ EWA provider discloses all of things upfront.

→ No credit assessment. Aka don’t dare touch FICO or CRA data.

→ EWA provider has no legal claim to get repaid.

→ EWA provider discloses all of things upfront.

→ No credit assessment. Aka don’t dare touch FICO or CRA data.

26/ So the CFPB is saying they won’t look to apply Reg Z if you contract directly with the employer (like Even and Walmart do), you don’t charge fees AND you get paid out of the payroll run.

27/ That last part is going to be problematic for most of the companies in this space, as many of them are direct-to-consumer and sweep direct deposit funds from the consumer’s bank account. The CFPB’s Footnote 16 says [no bueno] to this model.

28/ Interesting, Section C of the CFPB’s letter highlights a quirk about Reg Z and why I think this advisory -- by itself -- is a non-event.

You need more than four repayments to fall under Reg Z.

You need more than four repayments to fall under Reg Z.

29/ Legally, the Bureau staff did this right. You look to the definitions like "credit" first. But functionally, if the wage advance or EWA products only require one repayment, you get to the same outcome regardless of whether the product is deemed “credit” under Reg Z or not.

30/ If you are subject to Reg Z, you need to deal with various disclosures and sometimes apply an ability-to-pay test. That’s work (i.e., time, money, eng resources), and avoiding work is a good enough reason to not want Reg Z to apply.

31/ But if you can meet the Bureau’s standards under the new opinion and your product isn’t “credit” under Reg Z, arguably it also isn’t “credit” under fair lending laws and regs so you don’t need to comply with those either.

32/ Interestingly, the CFPB didn’t discuss whether the EWA products exempt from Reg Z are also exempt from Reg B (fair lending regs), but the pieces are there if an Even or Earnin wanted to weaponize this against their competitors.

33/ So let’s briefly recap:

→ Most wage advance products look like credit

→ the CFPB says some provider<>employer products aren’t credit

→ Reg Z probably doesn’t apply regardless

So why would someone ask the CFPB to opine?

→ Most wage advance products look like credit

→ the CFPB says some provider<>employer products aren’t credit

→ Reg Z probably doesn’t apply regardless

So why would someone ask the CFPB to opine?

34/ My thought is there is a larger policy project unfolding before our eyes. If the CFPB says its not credit, you can use that as precedent to ask New York, California or Ohio to reach the same conclusion.

35/ Some states have picked on early wage access providers, so I tip my hat to the policy folks and lawyers that thought to get the CFPB to weigh in. It was a nice chess move.

36/ Even, Earnin and other companies in this space provide a valuable service to consumers. I’m excited to see how these low- and no-fee providers evolve to improve worker financial well being.

37/ Do you work in this space? What do you think?

Do you want to work in this space? Most of these companies are hiring. So is Privacy. Check out our jobs page

angel.co/company/privac…

Do you want to work in this space? Most of these companies are hiring. So is Privacy. Check out our jobs page

angel.co/company/privac…

38/ And back to the start of the thread.

https://twitter.com/regulatorynerd/status/1333656145924296704?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh