Today's tweet thread is on how to make a collaborative spreadsheet of investors.

Yes, it's very tactical and mundane and seemingly simple, but it will make your fundraising go a lot further.

Read on >>

Yes, it's very tactical and mundane and seemingly simple, but it will make your fundraising go a lot further.

Read on >>

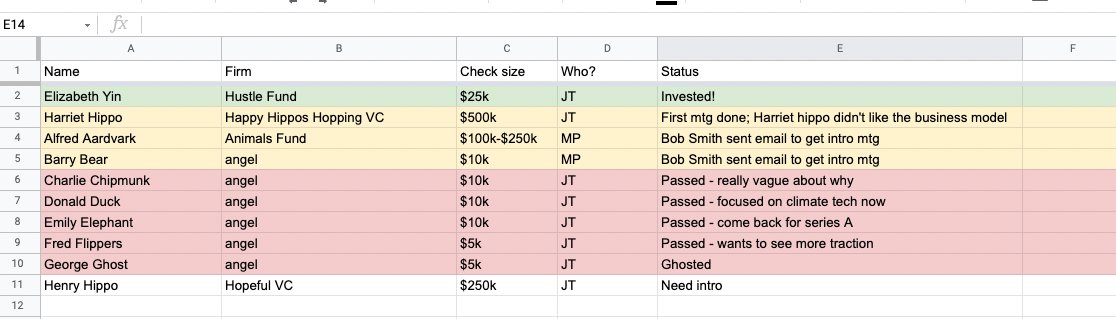

1) I made a template. Feel free to make a copy and use it for your own raise -- you will need MORE names than I have on this list:

docs.google.com/spreadsheets/d…

docs.google.com/spreadsheets/d…

2) It's good to have a collaborative sheet so that MANY people can help you with your fundraise. If you ask someone, "Can you intro me to investors?", that is not helpful.

There's no context on who you've already reached out to. Who you want to get in touch with? etc.

There's no context on who you've already reached out to. Who you want to get in touch with? etc.

3) In addition, if you want to run a fundraise process well, you need to plan on meeting LOTS of investors. That's a LOT to coordinate & there's no way you will stay on top of everything if your list is long and in your head.

More here:

elizabethyin.com/2016/09/04/my-…

More here:

elizabethyin.com/2016/09/04/my-…

4) So let's dissect this.

I have a column for Who. Unless you know a ton of investors directly, you will likely need to lean on other investors / founder-friends / etc for help getting intros.

The who column helps coordinate who is making an intro and where you still need help

I have a column for Who. Unless you know a ton of investors directly, you will likely need to lean on other investors / founder-friends / etc for help getting intros.

The who column helps coordinate who is making an intro and where you still need help

5) Status -- this is how you can keep track of where you are in your process w/ every investor.

In my process, I color code so I can see where to focus time -- ideally yellows -> green.

Red -- don't spend more time on.

No color code means not yet in the process / need intro

In my process, I color code so I can see where to focus time -- ideally yellows -> green.

Red -- don't spend more time on.

No color code means not yet in the process / need intro

6) Check size is a nice-to-have column, but it may help you understand which checks are priority and also your fundraising pipeline.

If you are doing your homework, you should know this info anyway to ensure you are pitching relevant investors.

If you are doing your homework, you should know this info anyway to ensure you are pitching relevant investors.

7) Give write access to everyone who is helping you so they can add to your list with more names / make comments on your existing list.

And change the status & write down who they can do intros to.

And change the status & write down who they can do intros to.

8) The more you make this a collaborative process, the easier your fundraising will be. You can lean on help from other people for names, intros, feedback on investors, and even nudges for investors who are still thinking about things.

9) This may seem incredibly simple, but I estimate 70% of the pre-seed fundraises I'm involved with don't do anything like this.

If you use this, you'll be a step ahead of most people.

If you use this, you'll be a step ahead of most people.

• • •

Missing some Tweet in this thread? You can try to

force a refresh