1/ Thread: $GOOG 1Q’21 Update

Hey Google, what’s the best business capitalism has ever come up with?

Google: It’s our search business.

Here are my highlights from the earnings call and quarter.

Hey Google, what’s the best business capitalism has ever come up with?

Google: It’s our search business.

Here are my highlights from the earnings call and quarter.

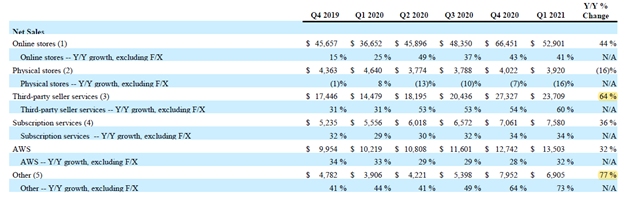

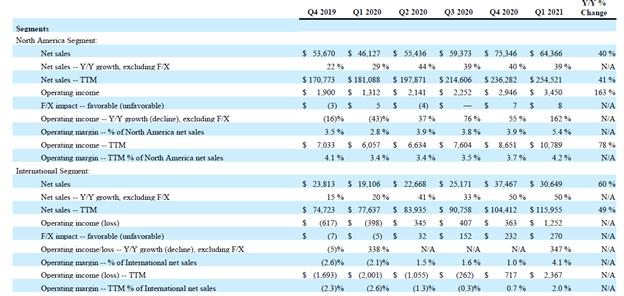

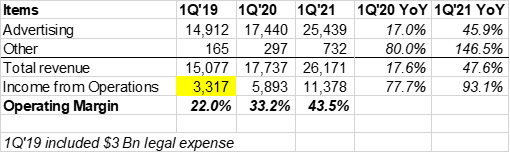

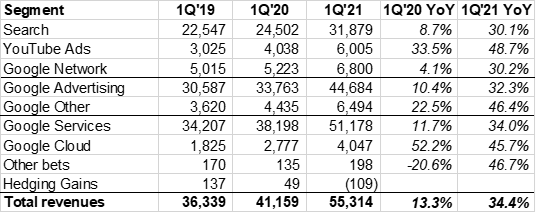

2/ I was starting to think the days of 25% topline growth were the stories from the yesteryears.

Well, Q1 revenues grew by 34%!

GOOG's *annual* topline in 2013 was $55 Bn. They just did the same in a quarter.

Search, YouTube, Cloud: GOOG is really firing on all cylinders here

Well, Q1 revenues grew by 34%!

GOOG's *annual* topline in 2013 was $55 Bn. They just did the same in a quarter.

Search, YouTube, Cloud: GOOG is really firing on all cylinders here

3/ Operating income more than doubled and margin expanded by a whopping ~1,000 bps.

This was driven by ~800 bps margin expansion in Services, and massive improvement in GCP’s operating losses.

This was driven by ~800 bps margin expansion in Services, and massive improvement in GCP’s operating losses.

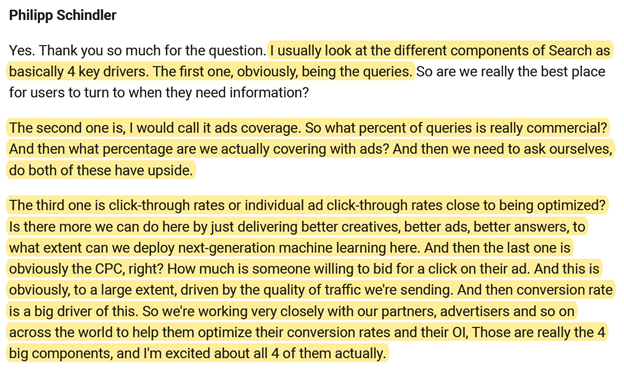

4/ What are the drivers for Google search?

I. Number of queries

II. Percentage of queries that have commercial potential

III. Click-through rates

IV. Cost Per Click (CPC)

Difficult to see how any of these drivers will be down in 3/5/10 years from now.

I. Number of queries

II. Percentage of queries that have commercial potential

III. Click-through rates

IV. Cost Per Click (CPC)

Difficult to see how any of these drivers will be down in 3/5/10 years from now.

5/ 77% respondents say they used YouTube to learn a new skill during 2020. Violative view rate* is down 70% (now 16-18 views per 100k views) over the last 4 years.

*It is the % of total views on YouTube videos that eventually get removed because of YouTube’s policy violations.

*It is the % of total views on YouTube videos that eventually get removed because of YouTube’s policy violations.

6/ “With over 2 billion monthly logged in users and over 1 billion hours of video watched every day, YouTube is offering advertisers efficient reach to large audiences”

“more 18- to 49-year-olds are actually watching YouTube than all linear TV combined.”

“more 18- to 49-year-olds are actually watching YouTube than all linear TV combined.”

7/ “DR was practically nonexistent on YouTube a few years ago. And it's now a large and fast-growing business, and we're just getting started, in my view.”

“And I think we're still scratching the surface on what's possible really with commercial intent on YouTube”

“And I think we're still scratching the surface on what's possible really with commercial intent on YouTube”

8/ “for Google Cloud, our approach to building the business has not changed. We remain focused on revenue growth, and we will continue to invest aggressively in products and our go-to-market organization given the opportunity we see.”

9/ Google will continue to invest in office space and will hire 10k people in 2021.

“We are looking at less density per employee. So even with a hybrid work environment, we will continue to need space.”

“We are looking at less density per employee. So even with a hybrid work environment, we will continue to need space.”

10/ Google buyback has increased >10x in just three years. Plenty of dry powder left.

Shareholders will sleep tight tonight.

Shareholders will sleep tight tonight.

https://twitter.com/willis_cap/status/1387167964802256902

End/ I will cover $SHOP and $FB tomorrow.

You will find all my twitter threads here: mbi-deepdives.com/twitter-thread…

You will find all my twitter threads here: mbi-deepdives.com/twitter-thread…

• • •

Missing some Tweet in this thread? You can try to

force a refresh