1/8 Thread: Phil Fisher's investing philosophy

If Ben Graham popularized "value investing", Phil Fisher was the OG of "growth investing". Buffett even characterized his philosophy as "85% Graham and 15% Fisher".

Just read a good piece on Fisher. Some quick notes.

If Ben Graham popularized "value investing", Phil Fisher was the OG of "growth investing". Buffett even characterized his philosophy as "85% Graham and 15% Fisher".

Just read a good piece on Fisher. Some quick notes.

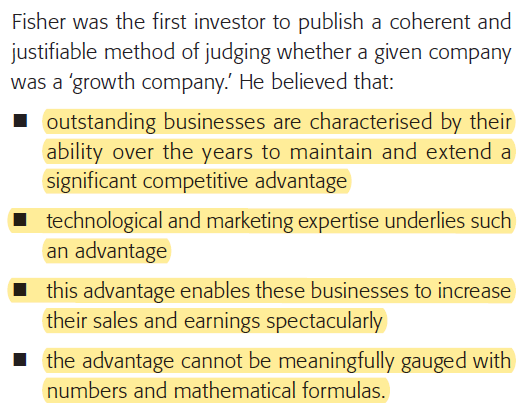

2/8 Here's how Fisher defined "growth company". The last point really stands out:

"the advantage cannot be meaningfully gauged with numbers and mathematical formulas."

"the advantage cannot be meaningfully gauged with numbers and mathematical formulas."

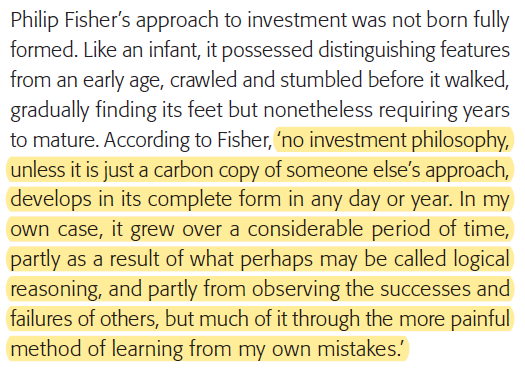

3/8 "no investment philosophy, unless it is just a carbon copy of someone else’s approach, develops in its complete form in any day or year. In my own case, it grew over a considerable period of time"

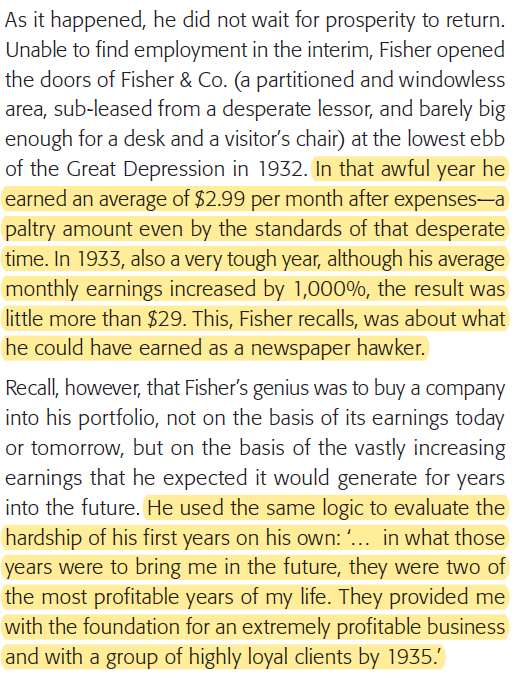

4/8 Fisher started his firm after losing his job during Great Depression. In 1932, he was making $2.99/month, equivalent of newspaper hawker's wages.

Yet Fisher considered those two years "most profitable years" since he was able to build a strong foundation for his business.

Yet Fisher considered those two years "most profitable years" since he was able to build a strong foundation for his business.

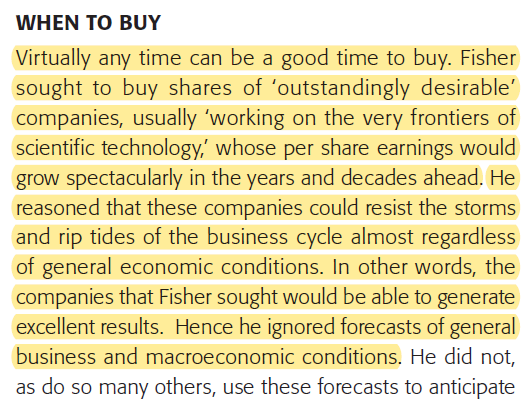

5/8 When is a good time to buy?

"virtually any time"

Fisher had a deep aversion to macro forecasts. He didn't mince his words on the futility of such an endeavor.

"virtually any time"

Fisher had a deep aversion to macro forecasts. He didn't mince his words on the futility of such an endeavor.

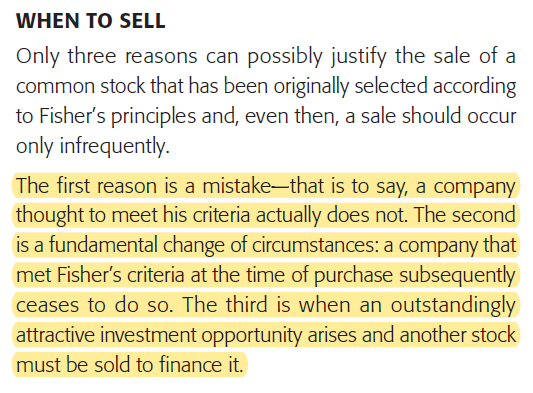

6/8 When is a good time to sell?

Fisher provides only three reasons to sell (preferably infrequently). See image.

Note that Fisher never had more than 17 companies in his portfolio, usually <10, and top 3 often was 75% of his AUM.

Fisher provides only three reasons to sell (preferably infrequently). See image.

Note that Fisher never had more than 17 companies in his portfolio, usually <10, and top 3 often was 75% of his AUM.

7/8 A good adage to remember:

"there are enough spectacular opportunities among established companies that ordinary individual investors should make it a rule never to buy into a promotional enterprise."

"there are enough spectacular opportunities among established companies that ordinary individual investors should make it a rule never to buy into a promotional enterprise."

8/8 Link to the full piece: aksjefokus.no/wp-content/upl…

All my twitter threads: mbi-deepdives.com/twitter-thread…

All my twitter threads: mbi-deepdives.com/twitter-thread…

• • •

Missing some Tweet in this thread? You can try to

force a refresh