Pricing out a generation of home buyers thesis has been used since 1996 a lot, and home sales rarely go below 4,000,000.

However, even just over 4%, higher rates will cool down the markets just like they did in the past. The same thing happened in 2013/2014 & 2018/2019. Healthy!

However, even just over 4%, higher rates will cool down the markets just like they did in the past. The same thing happened in 2013/2014 & 2018/2019. Healthy!

https://twitter.com/DianaOlick/status/1387470898014396420

The days of saying the Fed needs to aggressively hike rates to create a buying oppurnutiy for stocks from investors who are mostly long is coming to an end. President Trump showed us all the true colors of a lot of conservatives 😉😎 Feel the Market, Baby!

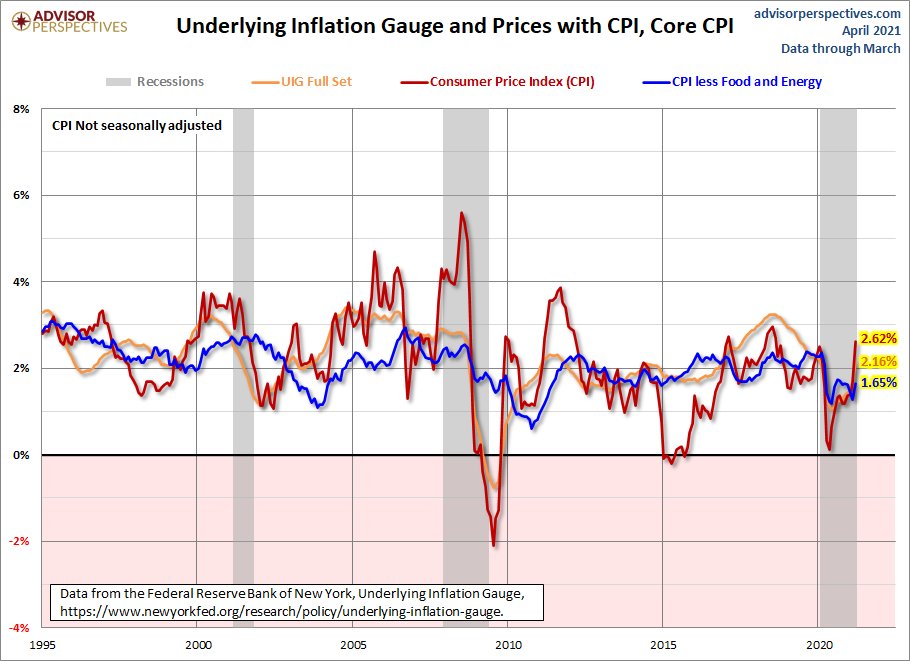

Conservatives saying, look, there is no inflation was hilarious. Why are you hiking? Because Trump was President was classic Fintwit. Just be mindful of this.

#NeverForget

The mother of all gold bugs wanted to join the Fed to cut rates down to zero to help the economy.

If you haven't gotten the memo, this group is a giant fraudulent trolling dollar crash cult group. A few stayed true to their gold bugs ways, and for that, I give ❤️

The mother of all gold bugs wanted to join the Fed to cut rates down to zero to help the economy.

If you haven't gotten the memo, this group is a giant fraudulent trolling dollar crash cult group. A few stayed true to their gold bugs ways, and for that, I give ❤️

• • •

Missing some Tweet in this thread? You can try to

force a refresh