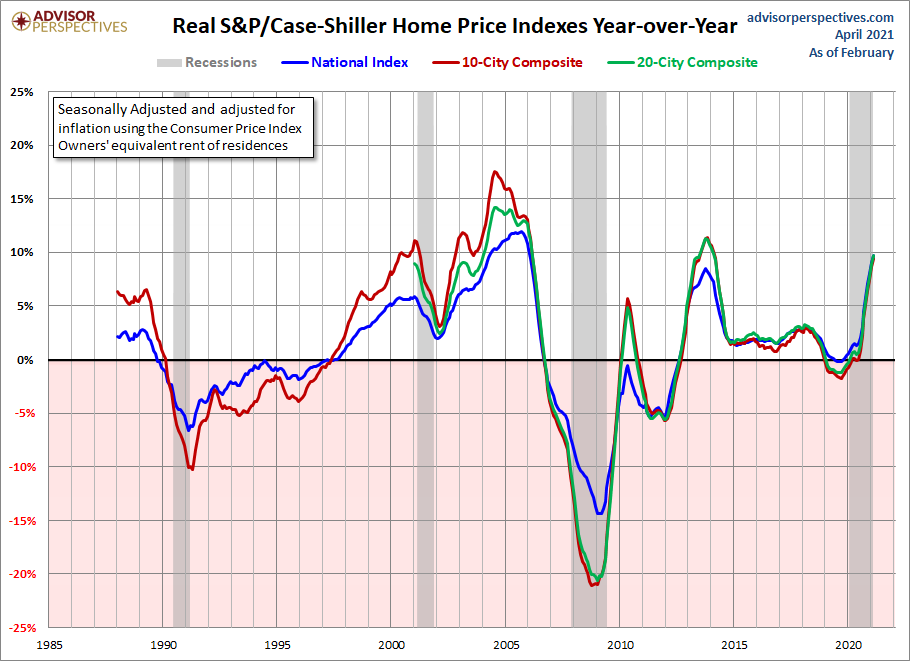

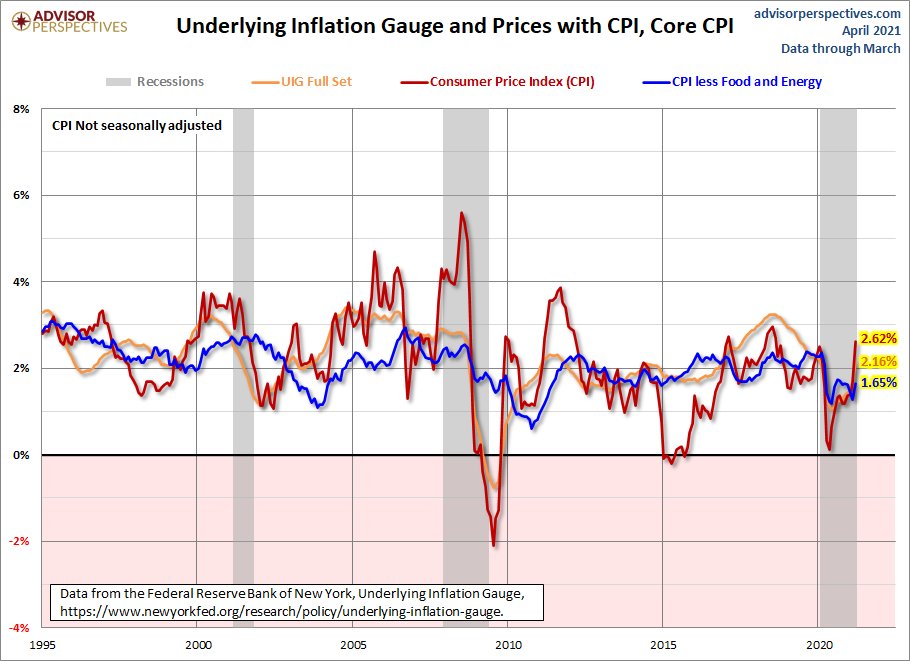

Years 2020-2024 was just going to be different than years 2008 -2019

https://twitter.com/DavidSchawel/status/1387910636051517446

No credit speculation, no exotic loan debt structure, no booming mortgage demand, it's not a bubble folks, it's just Americans wanting somewhere to live housingwire.com/articles/this-…

Which means price growth should slow down loganmohtashami.com/2021/04/14/hom…

Until then, this is a very unhealthy housing market. @mattmiller1973 @ptsweeney

bloomberg.com/news/audio/202…?

bloomberg.com/news/audio/202…?

• • •

Missing some Tweet in this thread? You can try to

force a refresh