1/n How much excesss liquidity has US monetary easing created? And how much inflation will it create?

The P-star model is a way to evaluate that.

The P-star model is a way to evaluate that.

2/n The P-star model is old-school monetarist thinking and was first presented in the 1989 in the article "M2 per unit of potential GNP as an anchor for the price level" by Jeffrey J. Hallman, Richard D. Porter and David H. Small

3/n

In the P-star model changes in inflation is explained by the difference between the actual price level (P) and what we could call the natural price level - or P-star - which is the implied price level given by the level of the broad money supply.

In the P-star model changes in inflation is explained by the difference between the actual price level (P) and what we could call the natural price level - or P-star - which is the implied price level given by the level of the broad money supply.

5/n

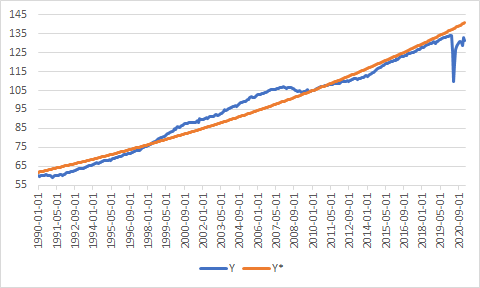

We can calculate V* and Y* by smoothing money-velocity and real GDP.

We can calculate V* and Y* by smoothing money-velocity and real GDP.

7/n

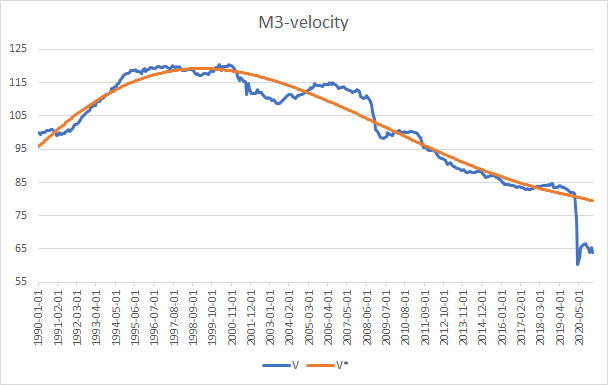

And this is how our monthly money-velocity series look like - based on M3 and Nominal Private Consumption Expenditure.

We see that the lockdowns have caused what we should expect to be a temporary collapse in V.

And this is how our monthly money-velocity series look like - based on M3 and Nominal Private Consumption Expenditure.

We see that the lockdowns have caused what we should expect to be a temporary collapse in V.

8/n

We can now use V* and Y* as well as the actual level of M3 in US to calculate P-star.

Lets first look at M3.

M3 is up more than 27% over the past year.

We can now use V* and Y* as well as the actual level of M3 in US to calculate P-star.

Lets first look at M3.

M3 is up more than 27% over the past year.

9/n

This has caused a sharp jump in P-star, which is now more than 13% above the actual US price level.

This has caused a sharp jump in P-star, which is now more than 13% above the actual US price level.

10/n

This p-gap can be closed in three different ways.

This p-gap can be closed in three different ways.

11/n

First, it might be that V* simply drops to V. This is possible but that would essentially imply that the 'excess' savings Americans now have in their bank accounts will stay in the bank accounts. I find that extremely unlikely.

First, it might be that V* simply drops to V. This is possible but that would essentially imply that the 'excess' savings Americans now have in their bank accounts will stay in the bank accounts. I find that extremely unlikely.

12/n

Second we could see the Federal Reserve move to tighten monetary policy dramatically so to reduce M3 to levels similar to 2019. This would cause a major US (and global) recession so I equally find that unlikely. At least in the near term.

Second we could see the Federal Reserve move to tighten monetary policy dramatically so to reduce M3 to levels similar to 2019. This would cause a major US (and global) recession so I equally find that unlikely. At least in the near term.

13/n

This leaves us with the third and final option - that inflation will pick up sharp so to close the p-gap. I find this to be the most likely scenario and I think it will happen very soon and fast.

This leaves us with the third and final option - that inflation will pick up sharp so to close the p-gap. I find this to be the most likely scenario and I think it will happen very soon and fast.

14/n

The question is how much should inflation pick up to close the p-gap? The answer is: A LOT.

The question is how much should inflation pick up to close the p-gap? The answer is: A LOT.

15/n

I have done a simulation of this by assuming M3 growth continue at the present trend for the rest of the year and then return to pre-2020 growth rates from early 2022,

I have done a simulation of this by assuming M3 growth continue at the present trend for the rest of the year and then return to pre-2020 growth rates from early 2022,

16/n

Assuming a continuation of the trends in V* and Y* we can then calculate P* for the coming years.

We see this implies a sharp jump in P* - some of this has already happened but it will continue in the coming months.

Assuming a continuation of the trends in V* and Y* we can then calculate P* for the coming years.

We see this implies a sharp jump in P* - some of this has already happened but it will continue in the coming months.

17/n

This will cause the cause the p-gap to widen. However, something have to give and if we assume that the p-gap has to close over time we need to see a pick up in the actual price level.

I here assume that inflation picks up so that the p-gap closes over 4-5 years.

This will cause the cause the p-gap to widen. However, something have to give and if we assume that the p-gap has to close over time we need to see a pick up in the actual price level.

I here assume that inflation picks up so that the p-gap closes over 4-5 years.

18/n

That gives us the following scenario for US inflation.

Or rather this is the kind of inflation NEEDED to close the p-gap in five years. If we don't get that we would need a monetary contraction.

That gives us the following scenario for US inflation.

Or rather this is the kind of inflation NEEDED to close the p-gap in five years. If we don't get that we would need a monetary contraction.

19/n

What this simulation tells us is that we should see a very, very sharp increase in US inflation in the coming months and inflation could be heading above 12% by the end of the year.

What this simulation tells us is that we should see a very, very sharp increase in US inflation in the coming months and inflation could be heading above 12% by the end of the year.

20/n

I must admit that this is a rather wild 'forecast' and I am hesitant to even calling it a forecast. However, I think there is a lot of truth to this. We have seen an expansion of the broad US money supply that we haven't seen since the Second World War...

I must admit that this is a rather wild 'forecast' and I am hesitant to even calling it a forecast. However, I think there is a lot of truth to this. We have seen an expansion of the broad US money supply that we haven't seen since the Second World War...

21/n

...and there is no reason to think that money demand will remain elevated. V is low because Americans have been restricted from consuming due to lockdowns. Once restrictions a lifted V will normalize and this will spark a very sharp increase in nominal aggregate demand.

...and there is no reason to think that money demand will remain elevated. V is low because Americans have been restricted from consuming due to lockdowns. Once restrictions a lifted V will normalize and this will spark a very sharp increase in nominal aggregate demand.

22/n

This will initially increase Y, but we will soon hit Y* and when that happens P will increase sharply and this process might already be underway.

This will initially increase Y, but we will soon hit Y* and when that happens P will increase sharply and this process might already be underway.

23/n

Once Americans realize inflation is back they will become even more eager to get rid of their cash (reduce bank deposits) and V will increase fast causing a further increase in P.

Once Americans realize inflation is back they will become even more eager to get rid of their cash (reduce bank deposits) and V will increase fast causing a further increase in P.

24/n

This does NOT imply that inflation will permanently be higher - rather it will be a ONE-OFF very sharp jump in the US price level and it could play out over a few months. What happens there after dependent on the @federalreserve's response.

This does NOT imply that inflation will permanently be higher - rather it will be a ONE-OFF very sharp jump in the US price level and it could play out over a few months. What happens there after dependent on the @federalreserve's response.

25/n

If the Fed is not careful this could cause a lot of damage to it's credibility and inflation expectations could jump a lot as well, which would put us in a more 70s style situation...

If the Fed is not careful this could cause a lot of damage to it's credibility and inflation expectations could jump a lot as well, which would put us in a more 70s style situation...

26/n

...but I should stress that that is not necessarily my forecast, but the risk of such scenario has gone up.

...but I should stress that that is not necessarily my forecast, but the risk of such scenario has gone up.

26/n

I admit that this all sounds a bit crazy, but it is on the other hand what markets are telling us as well.

Basically all assets have increase dramatically in the past six months - stocks prices, property prices and commodity prices.

I admit that this all sounds a bit crazy, but it is on the other hand what markets are telling us as well.

Basically all assets have increase dramatically in the past six months - stocks prices, property prices and commodity prices.

27/n

And all of these assets look way overvalued, which would imply that we should expect stocks prices, property prices and commodity prices to drop. However, what also could happen is that the NOMINAL economy expands as a result of a sharp jump in the general price level.

And all of these assets look way overvalued, which would imply that we should expect stocks prices, property prices and commodity prices to drop. However, what also could happen is that the NOMINAL economy expands as a result of a sharp jump in the general price level.

28/n

This graph illustrates such a scenario.

Here Nominal GDP jumps given the forecast for US inflation above. We compare that with US stock prices (here Wilshire 5000)

This graph illustrates such a scenario.

Here Nominal GDP jumps given the forecast for US inflation above. We compare that with US stock prices (here Wilshire 5000)

29/n

We see that stock prices have increased a lot more than NGDP, but if we keep stock prices at price levels and NGDP jumps as forecasted then the "gap" between NGDP and stock prices closes.

That is what the graph below shows.

We see that stock prices have increased a lot more than NGDP, but if we keep stock prices at price levels and NGDP jumps as forecasted then the "gap" between NGDP and stock prices closes.

That is what the graph below shows.

30/n

So a way to see the high level of stock prices is not that investors are overly optimistic about economic activity, but rather they foreseen a sharp increase in NGDP due to a sharp increase in the general price level.

Being invested in stocks is hence an inflation hedge.

So a way to see the high level of stock prices is not that investors are overly optimistic about economic activity, but rather they foreseen a sharp increase in NGDP due to a sharp increase in the general price level.

Being invested in stocks is hence an inflation hedge.

31/n

I fully realize this all seems a bit wild, but the scenario I have just painted is the only scenario in which we get a normalization of money-velocity and which can explain the level of stock market prices.

I fully realize this all seems a bit wild, but the scenario I have just painted is the only scenario in which we get a normalization of money-velocity and which can explain the level of stock market prices.

32/n

What we see here is essentially a stock market version of Dornbusch's overshooting model - we announce a massive monetary easing and the most flexible prices (stock prices) react immediately. The sticky prices react later.

What we see here is essentially a stock market version of Dornbusch's overshooting model - we announce a massive monetary easing and the most flexible prices (stock prices) react immediately. The sticky prices react later.

33/n

We have seen the impact of monetary easing on stock prices and property prices. In the very near future we will see the impact on US consumer prices and that could cause inflation to soon move into double-digit numbers.

We have seen the impact of monetary easing on stock prices and property prices. In the very near future we will see the impact on US consumer prices and that could cause inflation to soon move into double-digit numbers.

34/n

This all mean that the Fed quite soon will have to change it's rhetoric quite a bit and this WILL HAPPEN as unemployment soon will drop below 5% and inflation at the same time in the next couple of months move above 5%.

This all mean that the Fed quite soon will have to change it's rhetoric quite a bit and this WILL HAPPEN as unemployment soon will drop below 5% and inflation at the same time in the next couple of months move above 5%.

35/n

This will be a very tricky situation for investors - stocks is a inflation hedge and valuations can be justified if inflation picks up a lot (as I expect), but once the Fed slams the breaks things will become challenging.

This will be a very tricky situation for investors - stocks is a inflation hedge and valuations can be justified if inflation picks up a lot (as I expect), but once the Fed slams the breaks things will become challenging.

36/n

But similarly if the Fed allows 'price jump' to trigger a jump in longer-term inflation expectations we would be in for an even worse scenario.

But similarly if the Fed allows 'price jump' to trigger a jump in longer-term inflation expectations we would be in for an even worse scenario.

37/n

I don't say all this easily. This is what the numbers and my analysis is telling me. I for a long time have had the view that inflation was well-anchored and there wasn't a risk of a major spike in inflation due to monetary expansion, but I have changed my mind.

I don't say all this easily. This is what the numbers and my analysis is telling me. I for a long time have had the view that inflation was well-anchored and there wasn't a risk of a major spike in inflation due to monetary expansion, but I have changed my mind.

38/n

A year ago I was fully convinced that we would see a sharp drop in US unemployment. I was right about that. I am less convinced about the scenario spelled out above, but Friedman was right when he said "Inflation is always and everywhere a monetary"...

A year ago I was fully convinced that we would see a sharp drop in US unemployment. I was right about that. I am less convinced about the scenario spelled out above, but Friedman was right when he said "Inflation is always and everywhere a monetary"...

39/n

...and when you increase broad money growth by 27% over 12 months and there is no reason to think money demand has increased then you get inflation - a lot of inflation. Whether it will be double-digit inflation is less clear...

...and when you increase broad money growth by 27% over 12 months and there is no reason to think money demand has increased then you get inflation - a lot of inflation. Whether it will be double-digit inflation is less clear...

40/40

...but that US inflation will increase sharply in the coming months I have little doubt about. Get ready for the shock.

/The End.

...but that US inflation will increase sharply in the coming months I have little doubt about. Get ready for the shock.

/The End.

• • •

Missing some Tweet in this thread? You can try to

force a refresh