GDP up 6.4% annual rate (it actually grew 1.6%) with large increases in consumption, biz fixed investment, housing & govt offset by a large reduction in inventories & increase in the trade deficit.

(US residents bought more stuff but a bunch came out of inventories and imports.)

(US residents bought more stuff but a bunch came out of inventories and imports.)

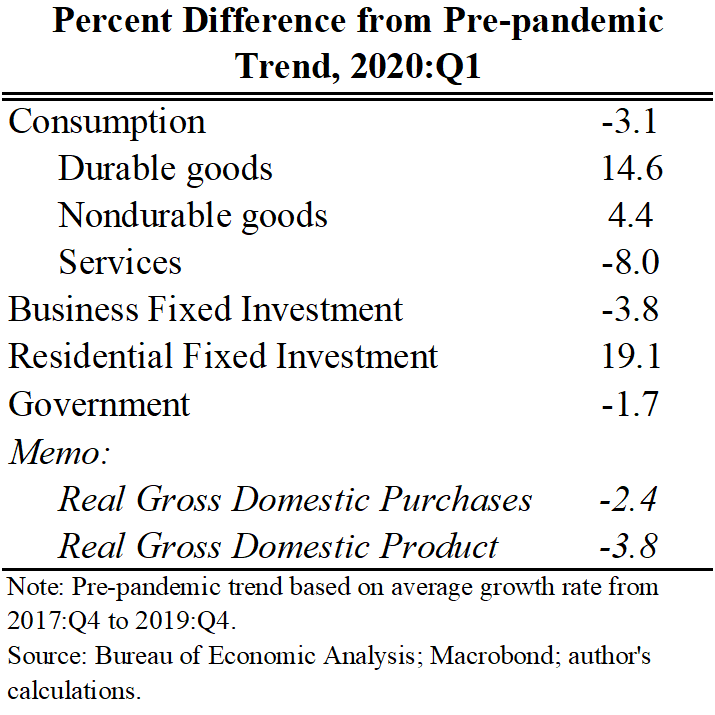

As a result, U.S. GDP was 3.8% below it's pre-pandemic trend in Q1.

Note, this is not an estimate of the output gap, I would suspect the output gap was somewhat smaller because of some scarring from pandemic (less investment, R&D, early retirements, deaths).

Note, this is not an estimate of the output gap, I would suspect the output gap was somewhat smaller because of some scarring from pandemic (less investment, R&D, early retirements, deaths).

The pattern of shortfalls from trend are wild:

Consumer durables 15% above trend in Q1 while services 8% below trend.

Business fixed investment still not recovered by residential investment booming.

Govt purchases below trend too (driven by S&L).

Consumer durables 15% above trend in Q1 while services 8% below trend.

Business fixed investment still not recovered by residential investment booming.

Govt purchases below trend too (driven by S&L).

But the wildest number of all is the 67% increase in disposable personal income at an annual rate (more like a 14% actual increase in Q1). That is the stimulus checks and UI at work.

That should provide a lot of fuel for the next few months/quarters/years.

That should provide a lot of fuel for the next few months/quarters/years.

All of this data is for Q1 which is far in the rear-view mirror. The growth rate is a weighted avg of growth in Nov, Dec, Jan, Feb & Mar--capturing the COVID surge.

The 3.8% shortfall from trend was for Q1 as a whole. Likely more like a 2-3% shortfall in March and 1-2% in April.

The 3.8% shortfall from trend was for Q1 as a whole. Likely more like a 2-3% shortfall in March and 1-2% in April.

• • •

Missing some Tweet in this thread? You can try to

force a refresh