Overall I quite like the American Jobs Plan. It is a serious proposal that would help increase economic growth, ensure growth was more fair, and raise additional revenue in a broadly reasonable manner.

Much that I would love to add, a bit I would subtract. A thread.

Much that I would love to add, a bit I would subtract. A thread.

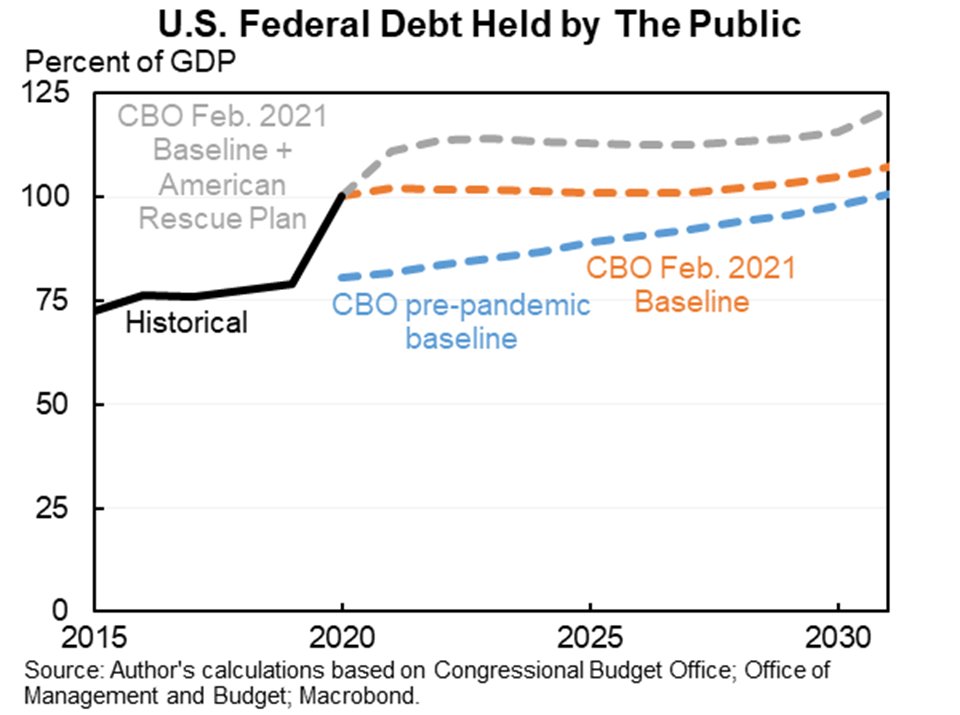

MACROECONOMIC/FISCAL. Given that interest rates are still too low & I'm worried about demand over the medium-term, $2T in *unpaid for* well-designed investments, some temporary, would be beneficial. As such I don't think this should all or even mostly be paid for.

As such, the decision about whether to keep the infrastructure proposals and corporate tax proposals together or to put them on different tracks should be more about legislative strategy than the perceived economic need to find offsets or pay for this particular bill.

Whatever inflation concerns you might have had about infusing ~$2T in the economy in a single year, the concerns about ~$200b/year with substantial advance notice to offset with monetary policy should be significantly less.

One still needs to be mindful that at full employment (and we'll get there at this pace of support), much of this public investment may replace private activity. So if the public is better than the private great. But if not, it's a problem. Need to carefully scrutinize.

Moreover, we don't have infinite fiscal space and I the investing in people and reducing poverty part of the agenda is incredibly important and still TK. So we will need offsets.

INFRASTRUCTURE. The investment proposals are substantial and generally appear to be thoughtful, including transportation, resilience, drinking water, and more. My biggest addition would be more user pays offsets like gas tax, VMT, airport fees, etc. I realize, those are hard...

CLIMATE. Again, I realize we all know this but it is important enough that it bears repeating: a carbon tax would be far and away the most important step we could take to address climate change. The proposal does a lot, especially in electricity and possibly light vehicles.

The most important part of the climate proposal is the Clean Electricity Standard. This is like a carbon price for the electricity sector, which is the sector which has most of the lower-hanging fruit for carbon reductions in the coming decades.

A lot of the spending on climate change seems reasonable but by itself it wouldn't come close to achieving the ambitious emissions reductions that are desired/needed. That is why holding on to the clean electricity standard and building on it are incredibly important.

RESEARCH. The $180 billion for research is one of the biggest pro-growth parts of the plan. It is also one of the areas of the plan that could easily be doubled or tripled and still be used well. (Full disclosure: my industry, broadly construed, benefits.)

MANUFACTURING. I don't like the Buy American and Jones Act enthusiasm in the plan. Those raise costs on Americans including businesses and interfere with our ability to access foreign markets. I can't judge the proposals for $300b in spending on manufacturing & small biz.

CORPORATE TAX. The US can definitely raise corporate rates to 28% and reform international taxation in a revenue raising manner. The international tax proposal are on the ambitious end of the spectrum and I would be more comforted if other countries did something like it.

On a minor and more technical note, I prefer an exemption for normal returns on actual activity. GILTI does that by exempting the first 10% of the return (QBAI) (Obama had something similar in his min tax proposal), this plan proposes to repeal it. I would consider retaining it.

I would want to see the specifics of the proposal for a 15 percent minimum tax on book income before having an opinion on it. I am unsure that it is workable/desirable but very open to changing my mind.

I hope permanent expensing and limitations on interest deductions is added. If you're an economist, eliminating the tax on the normal rate of return is exciting. If not, accepting that we'll have expanded depreciation in place much of the time so should fix the interest side too.

WHAT'S NEXT. This is only *part* of what the country needs. From a communications perspective it was reasonable to roll this part out separately (it's a lot to digest). But I hope we see a lot more on education, leave, poverty, etc--and that it is as/more prioritized as this.

• • •

Missing some Tweet in this thread? You can try to

force a refresh