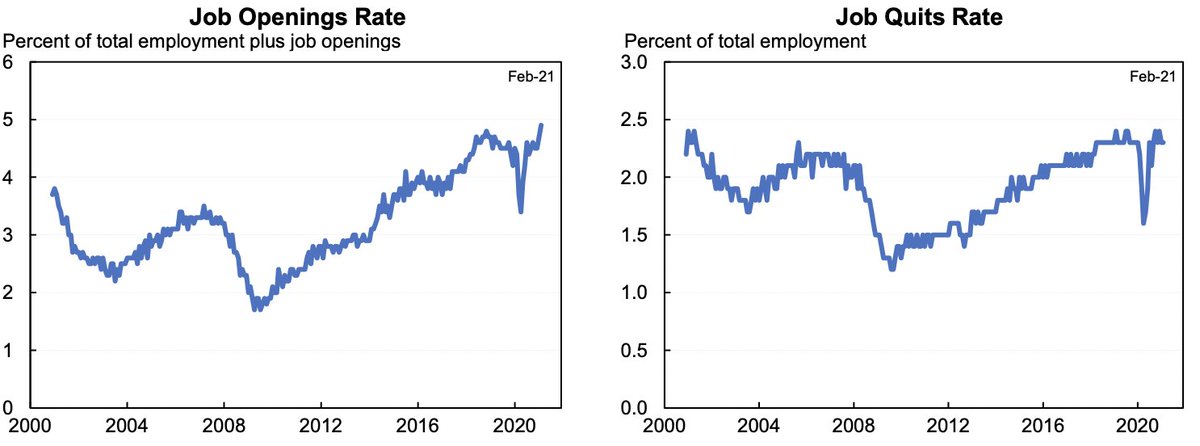

The general view is that labor market in February or March 2021 had a lot more slack than it did in 2019. That is probably right and if the only data you had was the unemployment rate, employment rate or jobs it would seem true.

But if instead the only data you had was on labor market flows from JOLTS you would think the economy was much hotter in February 2021 than in 2019, in fact you might think it was the hottest in decades. (@nick_bunker)

Between these two, if all you had was the data on composition-adjusted wage growth from the Atlanta Fed you would note that wage growth was roughly the same as 2019 and was highest for the lowest-income workers. So labor market not much looser than 2019. atlantafed.org/chcs/wage-grow…

Finally, there is labor force participation. While the UR has fallen, LFPR has been flat & is actually slightly down from last summer. Is this supply (fear of virus, schools closed or UI) or demand (workers discouraged by lack of good jobs)? Above suggests more the former.

This is relevant because if you think the economy had a lot of slack in February/March then it has a long way to go.

But if you think that in Feb/Mar the labor market was already tight then as lots more jobs are added in the next months (hopefully) what will that do?

But if you think that in Feb/Mar the labor market was already tight then as lots more jobs are added in the next months (hopefully) what will that do?

I lean a lot towards the (commonsense) view that the pandemic didn't change the fundamentals of the labor market overnight and it was perfectly fine/good when UR was 3.5% and LFPR was higher in 2019 and anything short of that is evidence of slack.

But the data does not line up nearly as clearly as I would like to be 100% certain of this story, a point that @greg_ip made in an excellent article I somehow missed last week (he had a lot of the above points too). wsj.com/articles/the-j…

I mostly think we're seeing a crazy period of demand and supply rising rapidly, various imbalances between the timing and sectors, so everything hard to interpret and go with the unemployment rate (or realistic unemployment rate that Willie Powell and I use). But only mostly.

The two bad scenarios that worry me are:

1. Overheating if supply does not fully return but demand more than fully returns.

2. We get back to trend output but not trend employment because wages are higher but fewer people hired and those that are more productivity.

1. Overheating if supply does not fully return but demand more than fully returns.

2. We get back to trend output but not trend employment because wages are higher but fewer people hired and those that are more productivity.

I'm broadly OK with the stance of policy but am nervous that more people aren't nervous and debating these issues and processing a range of data with an open mind. Better outcomes come from livelier debates than the one we're having right now on this topic.

And an addendum, I should have included this, it is the number of unemployed per job opening and it does indeed remain elevated (although not nearly as elevated as you might think from the terrible employment rate in February).

https://twitter.com/nick_bunker/status/1387866891834859524?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh