Shoutout to the Khosrowshahi family. Wealthy Iranian industrialists who had to flee during the revolution.

Dara Khosrowshahi, CEO of Uber: “We were all on the ground, terrified. That was when my mom said, ‘We’re leaving.’ I’ve never been back.”

Dara Khosrowshahi, CEO of Uber: “We were all on the ground, terrified. That was when my mom said, ‘We’re leaving.’ I’ve never been back.”

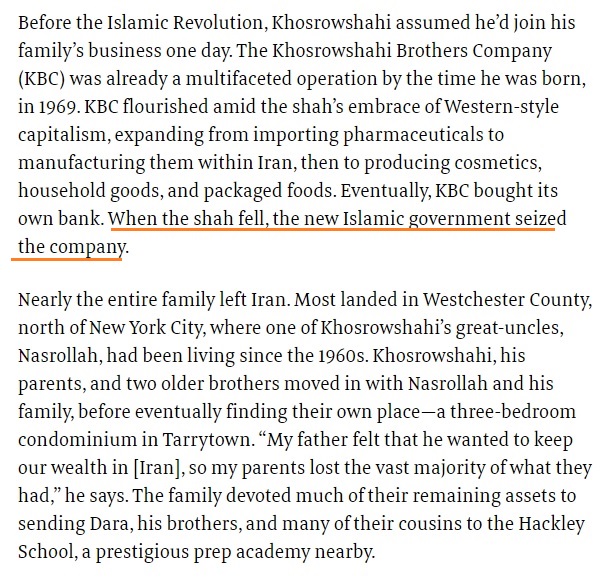

Ali Khosrowshahi had founded the Minoo Industrial Company in 1959, a manufacturer of cookies, chocolates, cosmetics, and pharmaceuticals.

Other family branches included Tolypers, a chemical company, and a construction company, the Khosrowshahi Brothers Company (KBC).

Other family branches included Tolypers, a chemical company, and a construction company, the Khosrowshahi Brothers Company (KBC).

“My father felt that he wanted to keep our wealth in [Iran], so my parents lost the vast majority of what they had.”

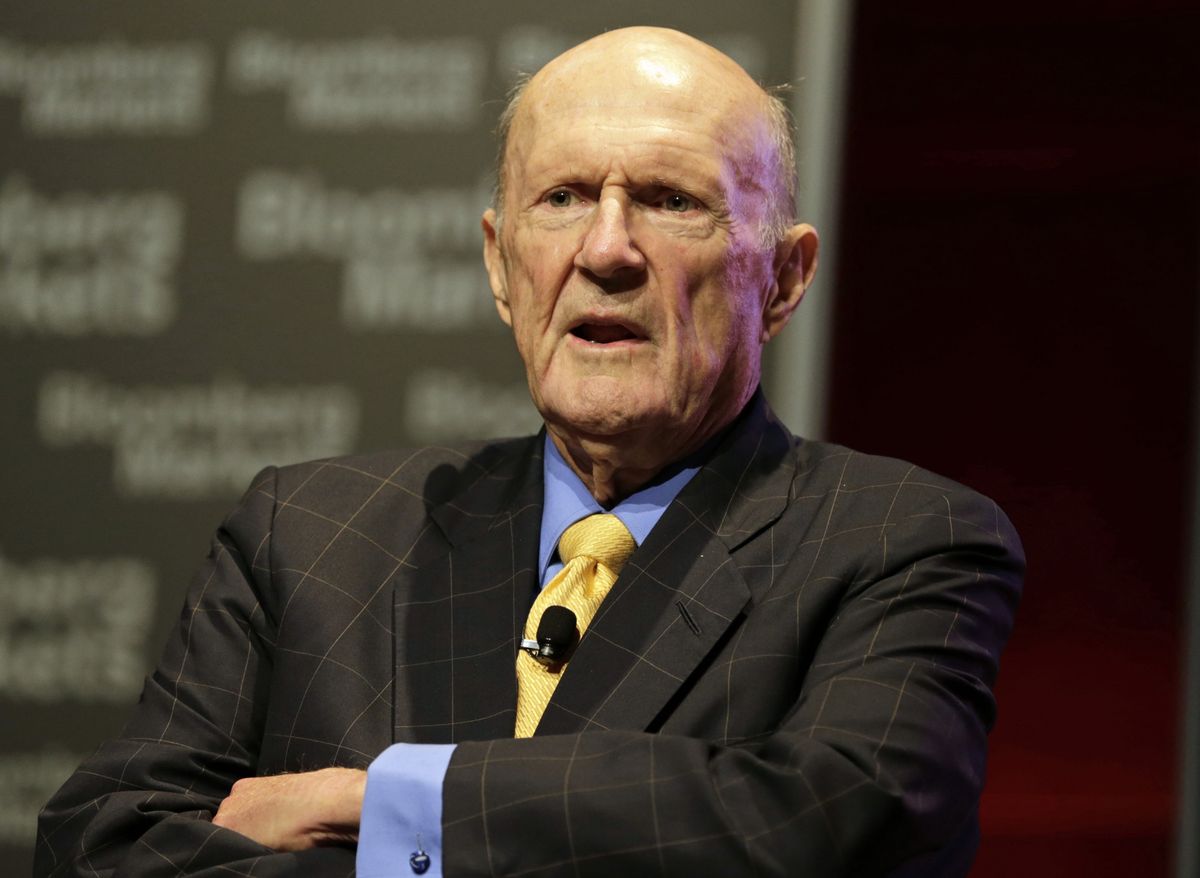

His Uncle Hassan Khosrowshahi who built Future Shop, a computer and electronics retail chain in Canada. Sold to Best Buy for C$580 million.

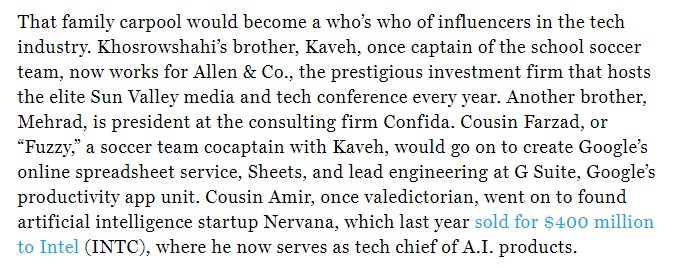

Hassan's children Golnar and Behzad who used the family office to incubate investment businesses in music rights (Reservoir Media) and healthcare royalties (DRI).

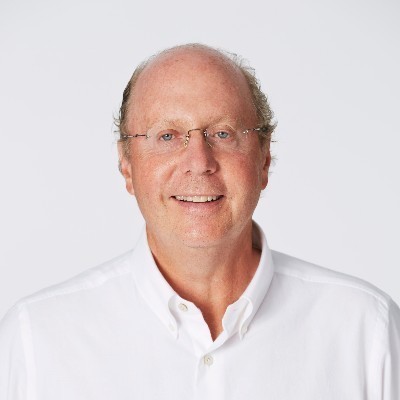

Then there's Dara's cousin Amir Khosrowshahi: co-founder of Nervana Systems, a software company sold to Intel for $350 million

Farzad "Fuzzy" K. built spreadsheets to model CDOs at JP Morgan. His web-based spreadsheet startup was acquired by Google and turned into Google Sheets.

Kaveh K. is a partner at Allen & Co. Lots more relatives in the tech world.

Kaveh K. is a partner at Allen & Co. Lots more relatives in the tech world.

“The network of our family has grown stronger now with so many younger cousins,” says Hadi, who organizes the family’s reunions, 100-person affairs with water balloon tosses and talent shows for attendees ranging in age from newborns to 90-year-olds.

“I saw my family losing everything, and you know what? We rebuilt a life.”

Further reading:

fortune.com/2017/11/17/ube…

boxnewsbox.com/the-most-succe…

fastcompany.com/90245381/how-d…

fortune.com/2017/11/17/ube…

boxnewsbox.com/the-most-succe…

fastcompany.com/90245381/how-d…

• • •

Missing some Tweet in this thread? You can try to

force a refresh