2013 was an interesting year, and I have referred to that period in some talking points with 2020/2021 data.

https://twitter.com/RickPalaciosJr/status/1388516089752014849

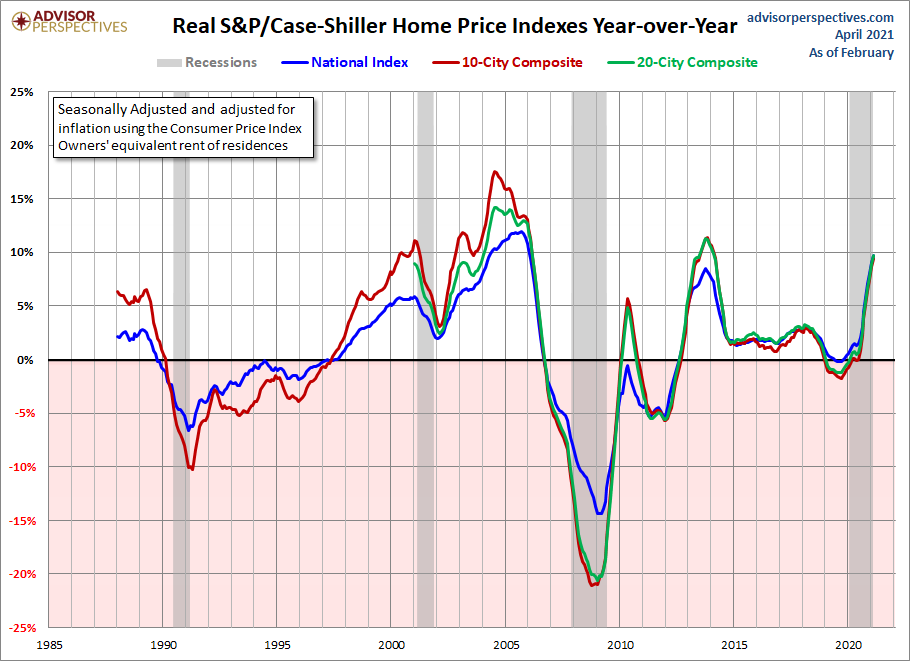

1. The price growth in 2013 was not warranted at all; we simply didn't have the right demographics for housing sales to grow that much, but the market itself cooled pricing down as rates went over 4%, the rate of growth pricing fell.

2. That 1.60% -3% move in the 10-year yield created a noticeable softening in demand, and in 2014, purchase application data trended negative on average 20% year over year. It created a solid bottom for us to work from.

3. Higher mortgage rates impact demand, but at what level does it really create a problem? 2018 5% rates were a problem for the builders back then as we had a supply shock. Not too bad for the existing home sales market, which lost roughly 190,000 in sales year over year.

4. Existing home sales only ended in 2020 at 5,640,000, roughly 130,000 more sales than in 2017. It's not like we have a booming speculative demand curve going on here, we should end the year slightly higher in 2021 than 2020.

That is the frustrating part of 2021, demand is fine, but it isn't a credit booming year. Total inventory levels are just too low, and it's creating unhealthy price gains, with highly qualified home buyers buying homes more now than ever bloomberg.com/news/audio/202…

As always, the housing bubble talk created a wave of untalented professional grifters in housing over the years, mostly anti central bank fanatics. They just had the biggest whiff ever in history and now can't explain what is going on. Not a bubble but not a healthy market.

It is what it is; Mother Demographics and the United States of America just knocked out the bubble boys popping their bubble and forcing them to answer why they were wrong since 2012. 🇺🇸💪🏽📈🔥

When you keep it so simple, this group actually believed you could have a 76.5% price crash in a calendar year with the best housing demographics ever and the lowest mortgage rates. This is almost as bad as the dollar collapse people (Mostly the same boomers) 😎🥂😉

The fear should have been, coming from the weakest housing recovery ever into the years 2020-2024, that price growth can talk off in an unhealthy way. This is going on now, this is why I say, this is a very unhealthy housing market. loganmohtashami.com/2021/02/23/hom…

However, because we don't have a credit bubble, we have limits, which means sales growth is limited, and price growth should cool down when rates rise.loganmohtashami.com/2021/04/14/hom…

As I have pointed out many times, it's scarce to have existing home sales below 4,000,000 post-1996. If you're a bubble crash person, you need this to happen; you need to create a model to get you there and stay down for some time while inventory blows up higher like before.

Forbearance was never going to be this for them either. Only in America, we have people that believe demand can be stable and have a bubble crash in the same year. It's crazy to think this way, but these people are nuts housingwire.com/articles/is-th…

Now we are about to have the 2nd wave of jobs growth that will take another wave of people off Forbearance. Now you all can see why I created the Forbearance Crash Bros last year. It was a desperate hope for these Bros. loganmohtashami.com/2021/04/02/ame…

Again, unhealthy marketplace because it's not a bubble. We just have to take this one month at a time and see what happens when rates rise. The builders are more at risk here than in the existing home sales marketplace.

housingwire.com/articles/this-…

housingwire.com/articles/this-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh