SAME FRAUD

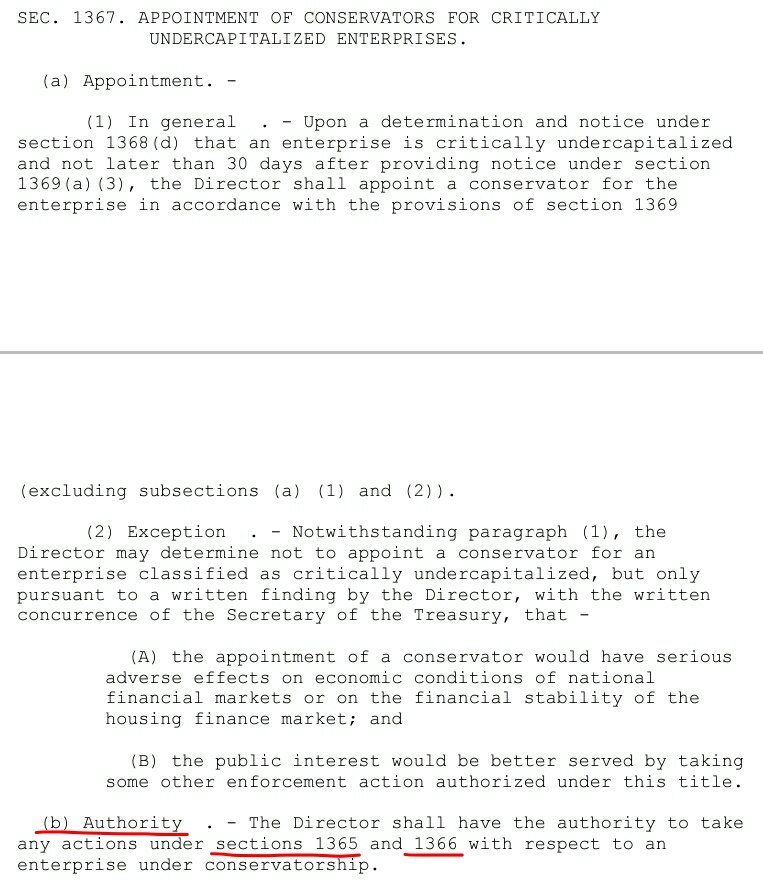

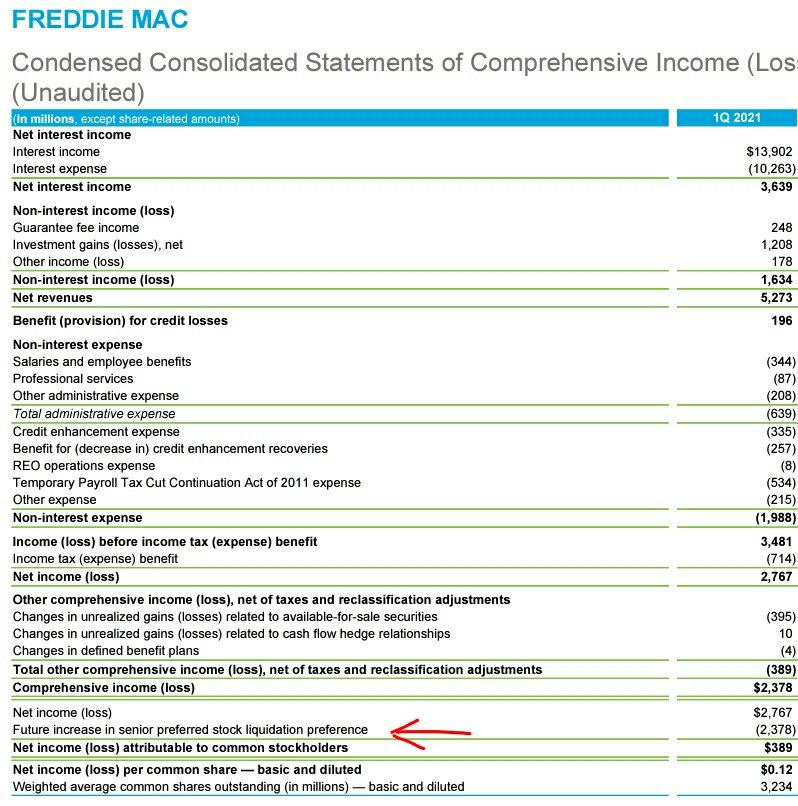

SPS increased for free can't appear on the Income Statement because it isn't an expense of the operations(no cost to us)

The line item now called:"Future increase in the SPS Liq Pref". Future? It's increased at the end of the quarter.#Fanniegate @TheJusticeDept @Scotus

SPS increased for free can't appear on the Income Statement because it isn't an expense of the operations(no cost to us)

The line item now called:"Future increase in the SPS Liq Pref". Future? It's increased at the end of the quarter.#Fanniegate @TheJusticeDept @Scotus

But we see in the balance sheet that it's NEVER recorded. Since the 4th amdnt to PA(Dec 2017),the SPS in the balance sheet don't match the real data(Fin Statement Fraud)in order to don't post the offset(Reduction of Retained Earnings,once Additional Paid-In Capital was exhausted)

Nothing is "for free". The money has to come from somewhere. If FnF increase the SPS for free(w/o getting the cash),there's an offset in other accts(shareholders' pocket)

SPS= $89.1b as of 3/31/2021. $91.4b in June, due to $2.4b NW in 1Q.

(Also, SPS must be issued, not increased)

SPS= $89.1b as of 3/31/2021. $91.4b in June, due to $2.4b NW in 1Q.

(Also, SPS must be issued, not increased)

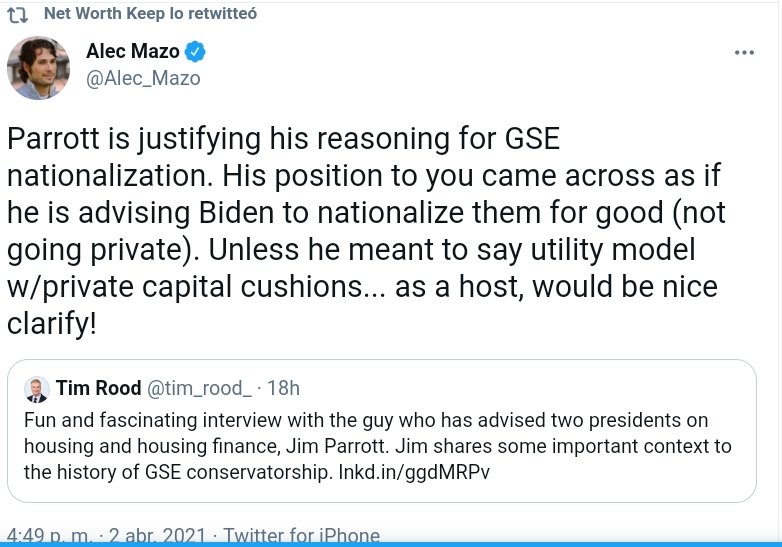

The fraud aims at attempting to fool the @Scotus Justices,as we saw in the @TheJusticeDept SG's letter and later,the Atty Thompson's reply that agreed w/ her statement,contending that FnF are building up Capital,when that's false because of the offset.The Capital remains the same

This compensation that the @USTreasury gets,is illegal in the Charter. It isn't a dividend. It's a "bonus" for no reason.A charge on the assets of FnF equal to the NW increase in the quarter, which is illegal because it violates the Fee Limitation clause.

I filed 5 SEC complaints

I filed 5 SEC complaints

ISSUANCE OF FULLY PAID-UP (OUT OF RESERVES) BONUS SHARES AT NO COST TO THE SHAREHOLDERS

We see instead:

-SPS are increased:Securities Fraud

-Not recorded on the bce sheet to avoid the offset. So,this handout to UST is being concealed

-Charge on the Income Statement

CHARTER-BARRED

We see instead:

-SPS are increased:Securities Fraud

-Not recorded on the bce sheet to avoid the offset. So,this handout to UST is being concealed

-Charge on the Income Statement

CHARTER-BARRED

(*)At no cost to the shareholders means that it isn't an expense during the quarter (Income Statement) because it's charged against existing reserves.

ANOTHER THEME

The SPS are increased at the end of the next quarter since day 1 of the PA, in order to match the day that FnF get the cash on the day of the draw on the @USTreasury's funding. It can't be recorded on the same quarter because there was no draw at the time.But now...

The SPS are increased at the end of the next quarter since day 1 of the PA, in order to match the day that FnF get the cash on the day of the draw on the @USTreasury's funding. It can't be recorded on the same quarter because there was no draw at the time.But now...

that there's no draw on the UST's funding commitment, there's no reason to delay the increase in SPS and it should've been increased on the day that the fact that caused the operation occurred (the NW increase). So,+$2.4b SPS to $91.4b on March 31 for @FreddieMac.@SEC_Enforcement

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh