IndiaMart Intermesh concall was today at 3:30 PM

"Big Pond (Industry Scope) with few Big Fishes (less players) seems good. But Uncertainty and Fear of Competitor can also tamper down the growing size of Fish (stable growth)"

Here are the key insights 😀

"Big Pond (Industry Scope) with few Big Fishes (less players) seems good. But Uncertainty and Fear of Competitor can also tamper down the growing size of Fish (stable growth)"

Here are the key insights 😀

Business Updates:

• Total Traffic grew by 44%.

• 80 Millions every month which was 52 Million last year same month.

• For beginning of this quarter company came to pre covid level and in quarter end there is 4000 net addition and supplier base of 1,52,000.

• Total Traffic grew by 44%.

• 80 Millions every month which was 52 Million last year same month.

• For beginning of this quarter company came to pre covid level and in quarter end there is 4000 net addition and supplier base of 1,52,000.

• Company is continue focusing on acquisition as well.

• 1070 crores QIP was successful in Q4 which will be utilized for expansion.

• 1070 crores QIP was successful in Q4 which will be utilized for expansion.

Industry Size:

• India is still at the nascent stage in online business.

• Co. has been implementing other innovation ideas for which ARPU of the companies has increased, however company identifies the ideas, implement it and there are certain failures which company eliminates.

• India is still at the nascent stage in online business.

• Co. has been implementing other innovation ideas for which ARPU of the companies has increased, however company identifies the ideas, implement it and there are certain failures which company eliminates.

Increasing customer:

• Company has reduce the packages. Around 5 years back company has annual charges, and now the company has brought up monthly charges and also eliminated the one time set up charges as well.

• Main focus is to atleast bring customer for one month trail

• Company has reduce the packages. Around 5 years back company has annual charges, and now the company has brought up monthly charges and also eliminated the one time set up charges as well.

• Main focus is to atleast bring customer for one month trail

QIP:

• Company will invest in organic growth strategy, implement ideas thought by company.

• Company wants to advance in the adjacency.

• Company also focusing on acquisition.

• Company will invest in organic growth strategy, implement ideas thought by company.

• Company wants to advance in the adjacency.

• Company also focusing on acquisition.

Client Acquisition:

• Previously all the clients comes from one-on-one meet.

• Now the company has telephone, channel partners and via other software

Renewal:

• Company do need to spend on sales for renewal but now these cost has been down to 50%.

• Previously all the clients comes from one-on-one meet.

• Now the company has telephone, channel partners and via other software

Renewal:

• Company do need to spend on sales for renewal but now these cost has been down to 50%.

Slowdown in Sales:

• 1/3 of the customer is monthly customer. During pandemic these monthly customer went away and now they have again came back.

• While annual customer has paid annually which are again paying on December.

• Covid has brought uncertainty in mind of customer.

• 1/3 of the customer is monthly customer. During pandemic these monthly customer went away and now they have again came back.

• While annual customer has paid annually which are again paying on December.

• Covid has brought uncertainty in mind of customer.

Covid:

• Buyers topline has grew 42%, which is not monetization, as India market is free for sales.

• On Customer side company there has been problems due to Covid.

• Revenue is 20 months moving average which didn't came in covid.

• Buyers topline has grew 42%, which is not monetization, as India market is free for sales.

• On Customer side company there has been problems due to Covid.

• Revenue is 20 months moving average which didn't came in covid.

Sales Team:

• Q1 & Q2 company did no hire any sales team and in Q3 due to cases the company started hiring from Dec but there is still slow in hiring as uncertainty is still there.

• Current focus is on health of the staff.

• Q1 & Q2 company did no hire any sales team and in Q3 due to cases the company started hiring from Dec but there is still slow in hiring as uncertainty is still there.

• Current focus is on health of the staff.

Minority base acquisition:

• Most of the acquisition is too small in current scale, hence company don't want to include as early in every new business.

• Hence company will have minority based acquisition.

• Most of the acquisition is too small in current scale, hence company don't want to include as early in every new business.

• Hence company will have minority based acquisition.

B2B SME Market:

• There are certain B2B SME market, however this is better for Indiamart.

• As industry is saturated and when more players coming in will add more customers in the industry, which is more better for the company.

• There are certain B2B SME market, however this is better for Indiamart.

• As industry is saturated and when more players coming in will add more customers in the industry, which is more better for the company.

USP:

• Digitization is difficult for the business as well.

• Verticals do not help, as there no buyers and seller of certain product.

• Customer are getting the personalized service.

• However the industry size has such scope there there are space of many players well.

• Digitization is difficult for the business as well.

• Verticals do not help, as there no buyers and seller of certain product.

• Customer are getting the personalized service.

• However the industry size has such scope there there are space of many players well.

Geographic Diversification:

• Major sales is from metro cities and then tier 2 cities.

• Tier 3 and Tier 4 are mostly the customer of the suppliers hence most growth is expected in Tier 1 cities only.

• Major sales is from metro cities and then tier 2 cities.

• Tier 3 and Tier 4 are mostly the customer of the suppliers hence most growth is expected in Tier 1 cities only.

Churn Rate:

• Platinum Customer: Company has less than 6% churn rate, while Platinum service has detoriaited 10%.

• Gold customer: 12% customer customer

•Silver: 24% churn rate, while service has improved by 10%.

• Platinum Customer: Company has less than 6% churn rate, while Platinum service has detoriaited 10%.

• Gold customer: 12% customer customer

•Silver: 24% churn rate, while service has improved by 10%.

Customer Diversifaction:

• Less than 1 year customer are 33%.

• 1-3 year customer are 30%

• 40% of customer is more than 3 year.

Second wave of customer can turn difficult.

• Less than 1 year customer are 33%.

• 1-3 year customer are 30%

• 40% of customer is more than 3 year.

Second wave of customer can turn difficult.

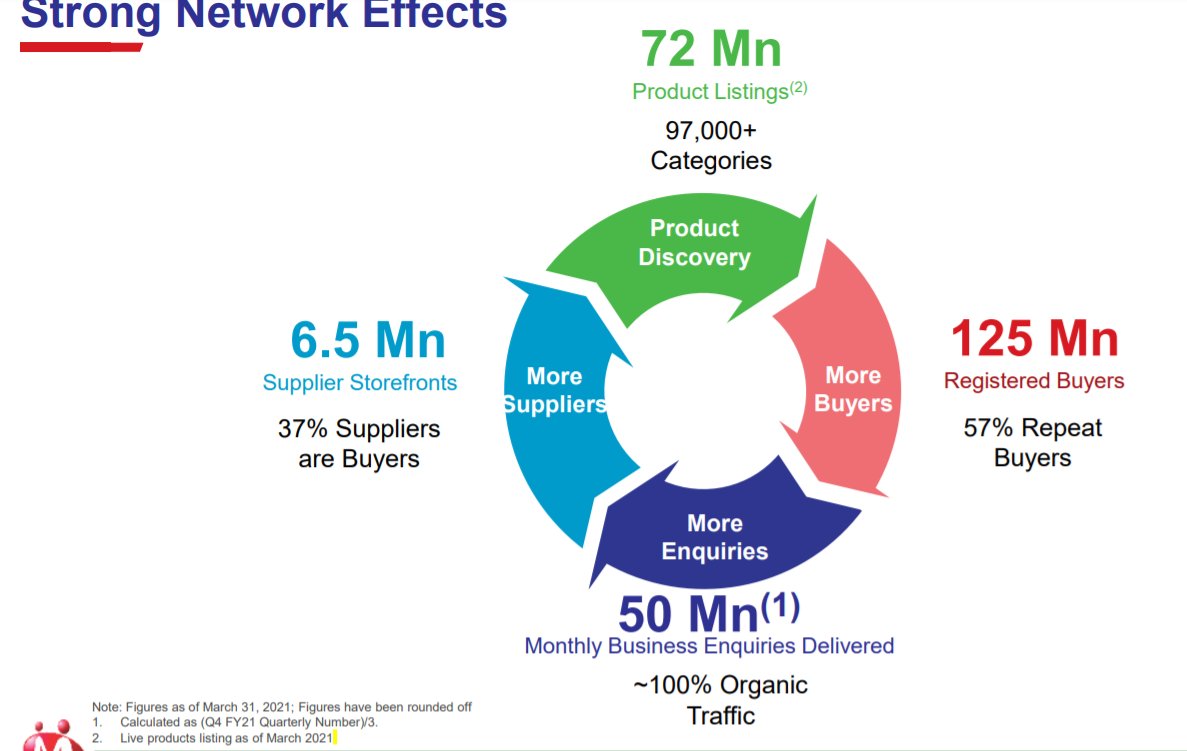

Justdial Entrance in B2B:

• Entry of other players, will only help the marketplace.

• B2B is driven by networking effect, hence they may have some customer share, but this will grow industry.

• As of now none of customer are saying that they are shifting to Justdial.

• Entry of other players, will only help the marketplace.

• B2B is driven by networking effect, hence they may have some customer share, but this will grow industry.

• As of now none of customer are saying that they are shifting to Justdial.

Investment:

• Category Development, Acquisition is the focus of investment for which company expect 25% of the revenue growth every year.

Customer:

• 6.5 Million suppliers are registered on customer, now all are GST verified.

• 99% of customer is GST verfied.

• Category Development, Acquisition is the focus of investment for which company expect 25% of the revenue growth every year.

Customer:

• 6.5 Million suppliers are registered on customer, now all are GST verified.

• 99% of customer is GST verfied.

How Growth of 25%?

• With 5% qoq customer growth and 10% ARPU growth, company has to have 30,000 addition to have 25% growth, which is not possible

Margin Expectation:

• These margins are no sustainable and may drop till 35% as the uncertainty gets end.

• With 5% qoq customer growth and 10% ARPU growth, company has to have 30,000 addition to have 25% growth, which is not possible

Margin Expectation:

• These margins are no sustainable and may drop till 35% as the uncertainty gets end.

One Month Free Model:

• People can try and get the leads on freemium model, hence acquisition is not a problem, but retention is the problem, due to lack of Indian eco-system, SME units which are lacking to afford prices.

• People can try and get the leads on freemium model, hence acquisition is not a problem, but retention is the problem, due to lack of Indian eco-system, SME units which are lacking to afford prices.

For more discussion on Equity analysis

Subscribe to our YouTube channel 😃

Link 🔗: youtube.com/channel/UCDmd6…

Subscribe to our YouTube channel 😃

Link 🔗: youtube.com/channel/UCDmd6…

Error:

Gold Customer: 12% customer churn rate with Gold Service has been decreased by 12%.

Gold Customer: 12% customer churn rate with Gold Service has been decreased by 12%.

• • •

Missing some Tweet in this thread? You can try to

force a refresh