Laurus Laboratories concall was today at 10:00 AM

"The big becoming bigger "

Here are the concall details

@unseenvalue @nid_rockz @punitbansal14 @saketreddy

"The big becoming bigger "

Here are the concall details

@unseenvalue @nid_rockz @punitbansal14 @saketreddy

Business Updates:

• Oncology business is expected to grow well.

• CRM manufacturing of API and ARV and Non ARV segment is seen good growth.

• Adding manufacturing facility for ARV and Non ARV.

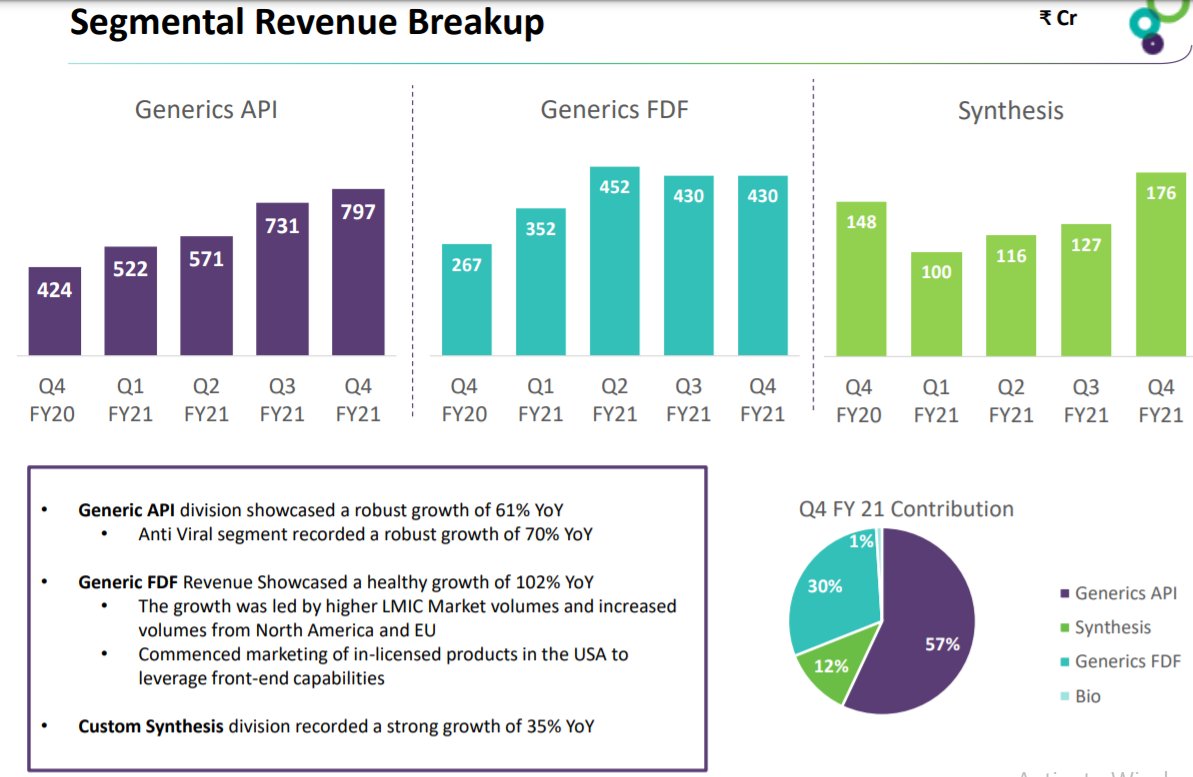

• Revenue share mentioned in image.

• Oncology business is expected to grow well.

• CRM manufacturing of API and ARV and Non ARV segment is seen good growth.

• Adding manufacturing facility for ARV and Non ARV.

• Revenue share mentioned in image.

• Acquire land at Vizag at existing facility for increasing capacity.

• Planning to buy land for Laurus Bio.

• Planning for separate Synthesis company as company is planning to expand well in these segment.

• Most of US sales is contract manufacturing

• Planning to buy land for Laurus Bio.

• Planning for separate Synthesis company as company is planning to expand well in these segment.

• Most of US sales is contract manufacturing

CAPEX:

• CAPEX spend is 700cr of which 50% is spend in API, 30% in FDF and 20% in Bio and Synthesis and further spending will be in similar ratio.

• Next 2 year CAPEX guidance is for 1500cr.

• Majority will got API, CRAMs and then formulation

• Bio will be allocated 60cr.

• CAPEX spend is 700cr of which 50% is spend in API, 30% in FDF and 20% in Bio and Synthesis and further spending will be in similar ratio.

• Next 2 year CAPEX guidance is for 1500cr.

• Majority will got API, CRAMs and then formulation

• Bio will be allocated 60cr.

• Most of the API investment in next 2 year will be in Non ARV and Non Oncology.

• Broad based Asset Turnover to be 1.5.

• It will be based on internal accrual.

• Broad based Asset Turnover to be 1.5.

• It will be based on internal accrual.

CSM:

• Co. have to multiple projects as until it is not started revenue is difficult to predict.

• Acquiring land for growth.

• Created a 100% subsidiary for Synthesis.

• FY 2023 onwards CSM expects to outpace grow more than other segment.

• Co. have to multiple projects as until it is not started revenue is difficult to predict.

• Acquiring land for growth.

• Created a 100% subsidiary for Synthesis.

• FY 2023 onwards CSM expects to outpace grow more than other segment.

Laurus Bio:

• Facility will be commercialize by next 2 week and Sept end entirely commercialize.

• Have order book for the capacity.

• Process of acquiring land

• Target of creating Million Litre fermentation capacity next year.

• Target- 2x the revenue for segment.

• Facility will be commercialize by next 2 week and Sept end entirely commercialize.

• Have order book for the capacity.

• Process of acquiring land

• Target of creating Million Litre fermentation capacity next year.

• Target- 2x the revenue for segment.

ARV and Non ARV:

• Non ARV to ARV Revenue Ratio: 60:40.

• Next year share expected to be remain same.

• Main focus will be in volume growth than on price growth.

• Certain molecules grew well.

• ARV share of company has been higher now, hence co. eyeing growth from non NRV.

• Non ARV to ARV Revenue Ratio: 60:40.

• Next year share expected to be remain same.

• Main focus will be in volume growth than on price growth.

• Certain molecules grew well.

• ARV share of company has been higher now, hence co. eyeing growth from non NRV.

Formulation:

• Majorly its is volume growth and product growth.

Covid:

• It wont be part of opportunity for company both in terms of vaccine and medicines.

• Majorly its is volume growth and product growth.

Covid:

• It wont be part of opportunity for company both in terms of vaccine and medicines.

Acquiring talent:

• Continuous focus remains to acquire talent. Company is setting benchmark in Pharma sector for stock option.

• Company is facing no challenge to acquire talent.

Laurus Result: bseindia.com/xml-data/corpf…

• Continuous focus remains to acquire talent. Company is setting benchmark in Pharma sector for stock option.

• Company is facing no challenge to acquire talent.

Laurus Result: bseindia.com/xml-data/corpf…

For more discussion on Equity analysis

Subscribe to our YouTube channel 😃

Link 🔗: youtube.com/channel/UCDmd6…

Subscribe to our YouTube channel 😃

Link 🔗: youtube.com/channel/UCDmd6…

• • •

Missing some Tweet in this thread? You can try to

force a refresh