Risk and return are two sides of the same coin.

Generally, the higher the expected return of an investment, the higher the risk it carries.

In this week’s recap, we expanded our analytics to drill down on the performance and risk across the major sectors of crypto markets.

1/

Generally, the higher the expected return of an investment, the higher the risk it carries.

In this week’s recap, we expanded our analytics to drill down on the performance and risk across the major sectors of crypto markets.

1/

Top Assets – Performance

Top assets based on market capitalization experienced a sharp decline during the weekend.

However, most assets rebounded quickly ending the week in positive territory.

Leaders: $UNI, $ETH, and $ADA

Laggards: $DOT, $LTC, and $LINK

Top assets based on market capitalization experienced a sharp decline during the weekend.

However, most assets rebounded quickly ending the week in positive territory.

Leaders: $UNI, $ETH, and $ADA

Laggards: $DOT, $LTC, and $LINK

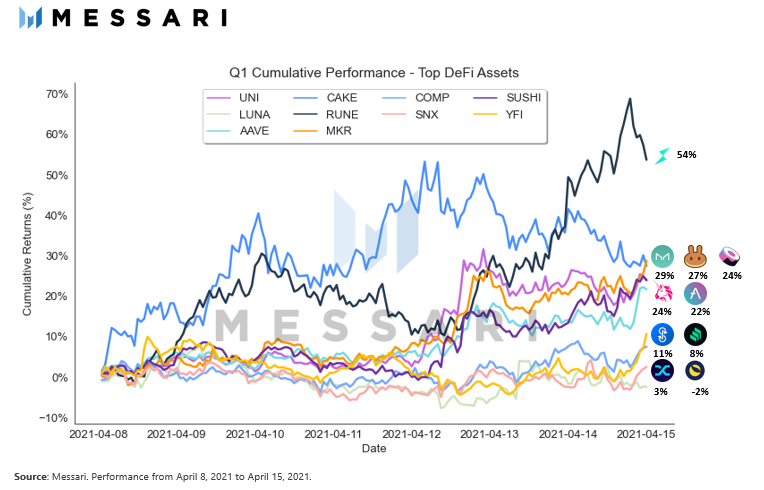

DeFi – Risk (volatility)

Volatility across most DeFi assets has seen a steady decline since the beginning of March.

$MKR experience an uptick in April shooting the token’s volatility to 9.8% making it the most volatile asset of the group on a rolling basis.

Volatility across most DeFi assets has seen a steady decline since the beginning of March.

$MKR experience an uptick in April shooting the token’s volatility to 9.8% making it the most volatile asset of the group on a rolling basis.

Smart Contract Platforms – Correlations

Over the past 30 days, $SOL has become increasingly uncorrelated with the rest of the assets in the smart contract sector.

On a weekly basis, the correlation continued to decrease reaching levels as low as -45%.

Over the past 30 days, $SOL has become increasingly uncorrelated with the rest of the assets in the smart contract sector.

On a weekly basis, the correlation continued to decrease reaching levels as low as -45%.

Top Assets – Correlation with Bitcoin

Correlations with #Bitcoin across all assets have picked up since the beginning of March.

A notable exception is $DOGE which saw an abrupt decrease in the middle of April because of its skyrocketing performance.

Correlations with #Bitcoin across all assets have picked up since the beginning of March.

A notable exception is $DOGE which saw an abrupt decrease in the middle of April because of its skyrocketing performance.

Check out the full piece to read about all these analytics across several sectors including:

-Top Assets

-DeFi

-Currencies

-Smart Contract Platforms

-Decentralized Exchanges

-Web-3

👇🏻

messari.io/article/weekly…

-Top Assets

-DeFi

-Currencies

-Smart Contract Platforms

-Decentralized Exchanges

-Web-3

👇🏻

messari.io/article/weekly…

• • •

Missing some Tweet in this thread? You can try to

force a refresh