El riesgo y el rendimiento son dos caras de la misma moneda.

En el resumen de esta semana, ampliamos nuestro análisis para explorar el rendimiento y el riesgo en los principales sectores del mercado de criptomonedas

1/

En el resumen de esta semana, ampliamos nuestro análisis para explorar el rendimiento y el riesgo en los principales sectores del mercado de criptomonedas

1/

Activos Principales - Rendimiento

Los principales activos basados en la capitalización de mercado experimentaron una fuerte caída durante el fin de semana.

Sin embargo, la mayoría de los activos se recuperaron rápidamente terminando la semana en territorio positivo.

Los principales activos basados en la capitalización de mercado experimentaron una fuerte caída durante el fin de semana.

Sin embargo, la mayoría de los activos se recuperaron rápidamente terminando la semana en territorio positivo.

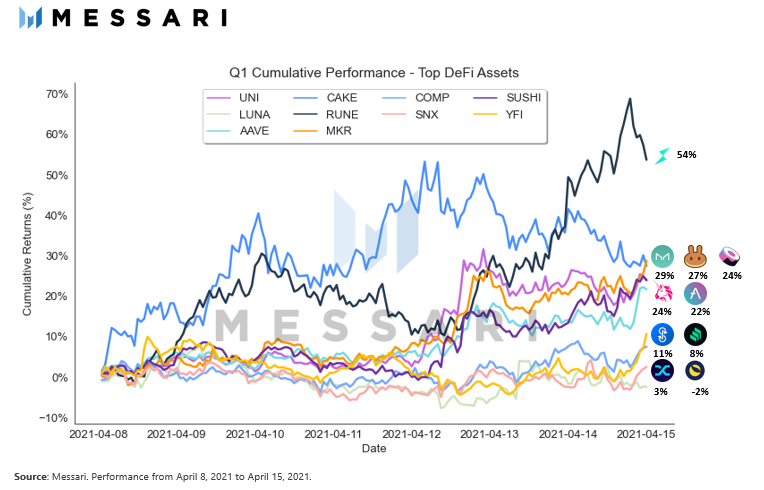

DeFi - Riesgo (volatilidad)

La volatilidad en la mayoría de los activos de DeFi ha experimentado una disminución constante desde principios de marzo.

En abril, la volatilidad de $MKR aumentó hasta el 9.8%, lo que la convierte en el activo más volátil del grupo.

La volatilidad en la mayoría de los activos de DeFi ha experimentado una disminución constante desde principios de marzo.

En abril, la volatilidad de $MKR aumentó hasta el 9.8%, lo que la convierte en el activo más volátil del grupo.

Plataformas - Correlaciones

Durante los últimos 30 días, $SOL se ha vuelto cada vez menos correlacionado con el resto de los activos en el sector.

Semanalmente, la correlación continuó disminuyendo alcanzando niveles tan bajos como -45%.

Durante los últimos 30 días, $SOL se ha vuelto cada vez menos correlacionado con el resto de los activos en el sector.

Semanalmente, la correlación continuó disminuyendo alcanzando niveles tan bajos como -45%.

Activos Principales - Correlación con Bitcoin

Las correlaciones con #Bitcoin en todos los activos se han recuperado desde principios de marzo.

Una excepción es $DOGE, que experimentó una disminución abrupta a mediados de abril debido a su desempeño vertiginoso.

Las correlaciones con #Bitcoin en todos los activos se han recuperado desde principios de marzo.

Una excepción es $DOGE, que experimentó una disminución abrupta a mediados de abril debido a su desempeño vertiginoso.

Consulte el artículo para leer sobre este análisis en los siguientes sectores:

- Activos Principales

- DeFi

- Monedas

- Protocolos de intercambio descentralizado (DEX)

- Web-3

Atención: el artículo está escrito en inglés.

👇🏻

messari.io/article/weekly…

- Activos Principales

- DeFi

- Monedas

- Protocolos de intercambio descentralizado (DEX)

- Web-3

Atención: el artículo está escrito en inglés.

👇🏻

messari.io/article/weekly…

• • •

Missing some Tweet in this thread? You can try to

force a refresh