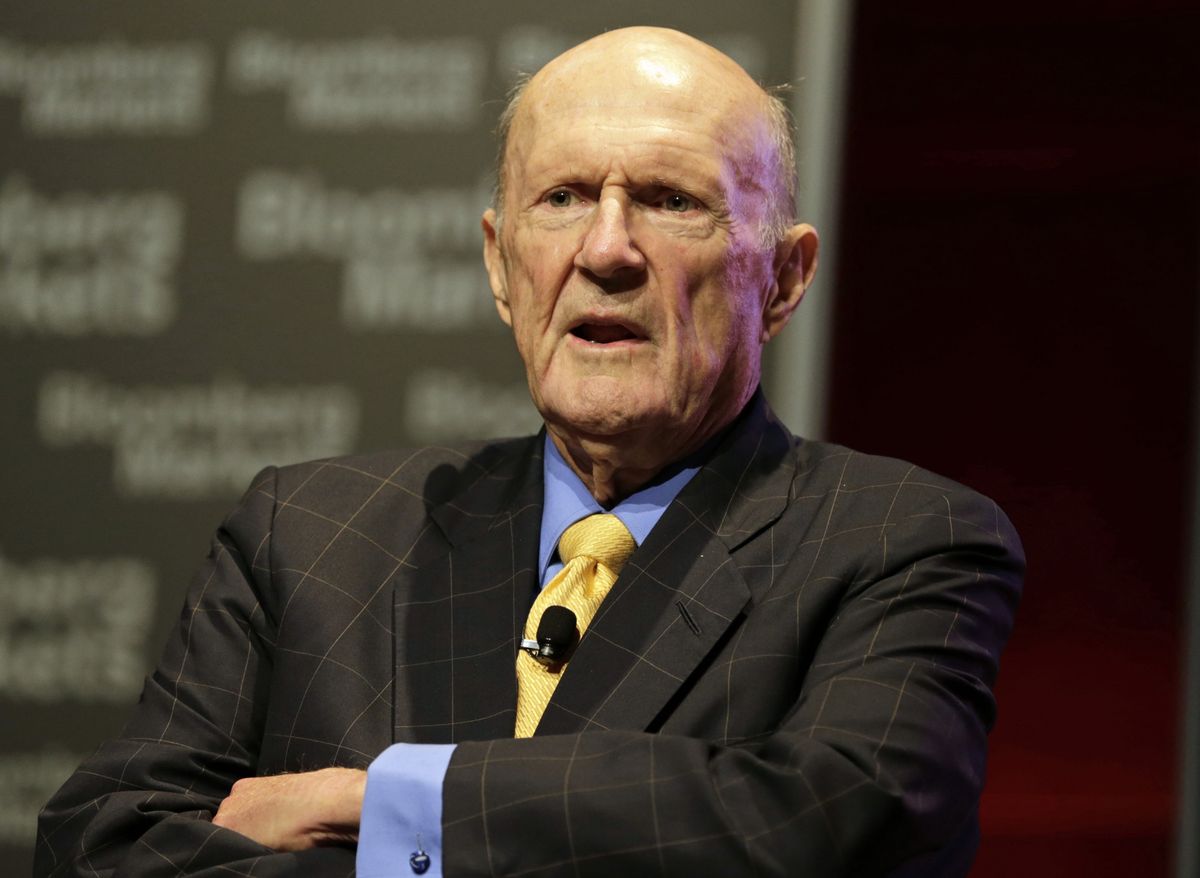

Paul Tudor Jones: "One of my no. 1 rules as an investor is as soon as my manager, if I find out that a manager is going through divorce, I redeem immediately. Because the emotional distraction that comes from divorce is so overwhelming..."

...The idea that you could think straight for 60 seconds and be able to make a rational decision is impossible, particularly when their kids are involved. You can automatically subtract 10 to 20% from any manager if he is going through divorce.”

Soros had a self-described burn-out and “kind of identity crisis” after his first divorce which was right before Jim Rogers left as his partner.

Ackman got divorced around the time he held the bag on $VRX?

Ackman got divorced around the time he held the bag on $VRX?

Marc Rich blew $170 million trying to corner zinc the year his wife filed for divorce.

Other examples come to mind?

Can say from my own divorce: the years after I was angry, resentful, miserable. That was the lens through which I saw the world - and markets.

“Whatever you look for in markets, you will find.”

“Whatever you look for in markets, you will find.”

"their resignations seemed precipitated by the divorce. That caused us to think boards had a responsibility to have a grasp on the married lives of their CEOs."

https://twitter.com/fcminaker/status/1388227609809416192

• • •

Missing some Tweet in this thread? You can try to

force a refresh