Great interview with tech startup CEO (and Miami Mayor) @FrancisSuarez 🧵:

nytimes.com/2021/04/29/opi…

nytimes.com/2021/04/29/opi…

I've never heard a politician who had me smiling and nodding the whole time. Some reasons why:

Suarez says he's talking to local universities as well as courting engineering schools (including Stanford) to open campuses in the state and increase STEM graduates🏆

Suarez says he's talking to local universities as well as courting engineering schools (including Stanford) to open campuses in the state and increase STEM graduates🏆

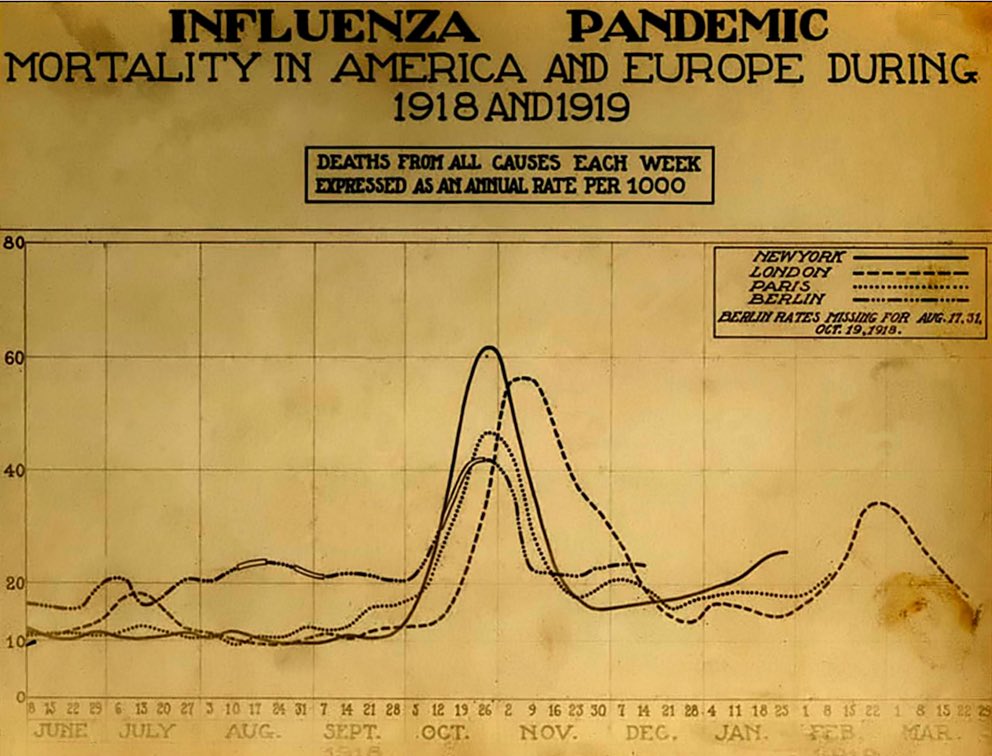

He understands that taxes don't create wealth. Rather, it's free enterprise and human ingenuity that do. In short, technological progress. It was the industrial revolution--many waves of it--that painted this picture of exponential wealth:

He's spot-on in understanding major issues like immigration (we need many more people to be successful), job creation, climate change and that more housing supply = lower prices.

What a breath of fresh air. Mayor @FrancisSuarez, don't change.

What a breath of fresh air. Mayor @FrancisSuarez, don't change.

I wrote a bit about what's happening:

hellerhs.com/post/could-mia…

hellerhs.com/post/could-mia…

And about progress (including another topic Suarez touched on: New York's insanely expensive subway-mile):

hellerhs.com/post/how-shoul…

hellerhs.com/post/how-shoul…

One last thing: crypto. Suarez smartly seized the moment, put the Bitcoin whitepaper on the city’s website, and is focused on this future industry as a huge job creator—which it will be. Massive opportunity to turn Miami into a crypto economy powerhouse.

miamigov.com/Government/Cit…

miamigov.com/Government/Cit…

"The prestige growth he's catalyzed may not show up in Miami's GDP or population numbers for a while, but it's the kind of energy you see in an early Clubhouse or Ethereum — and the kind you always bet on."

Great piece by @balajis:

1729.com/miami/

Great piece by @balajis:

1729.com/miami/

"He's the first American politician that's using social media not to dunk on half his constituents, but to grow the pie for all of them."

🔥🔥🔥

🔥🔥🔥

• • •

Missing some Tweet in this thread? You can try to

force a refresh