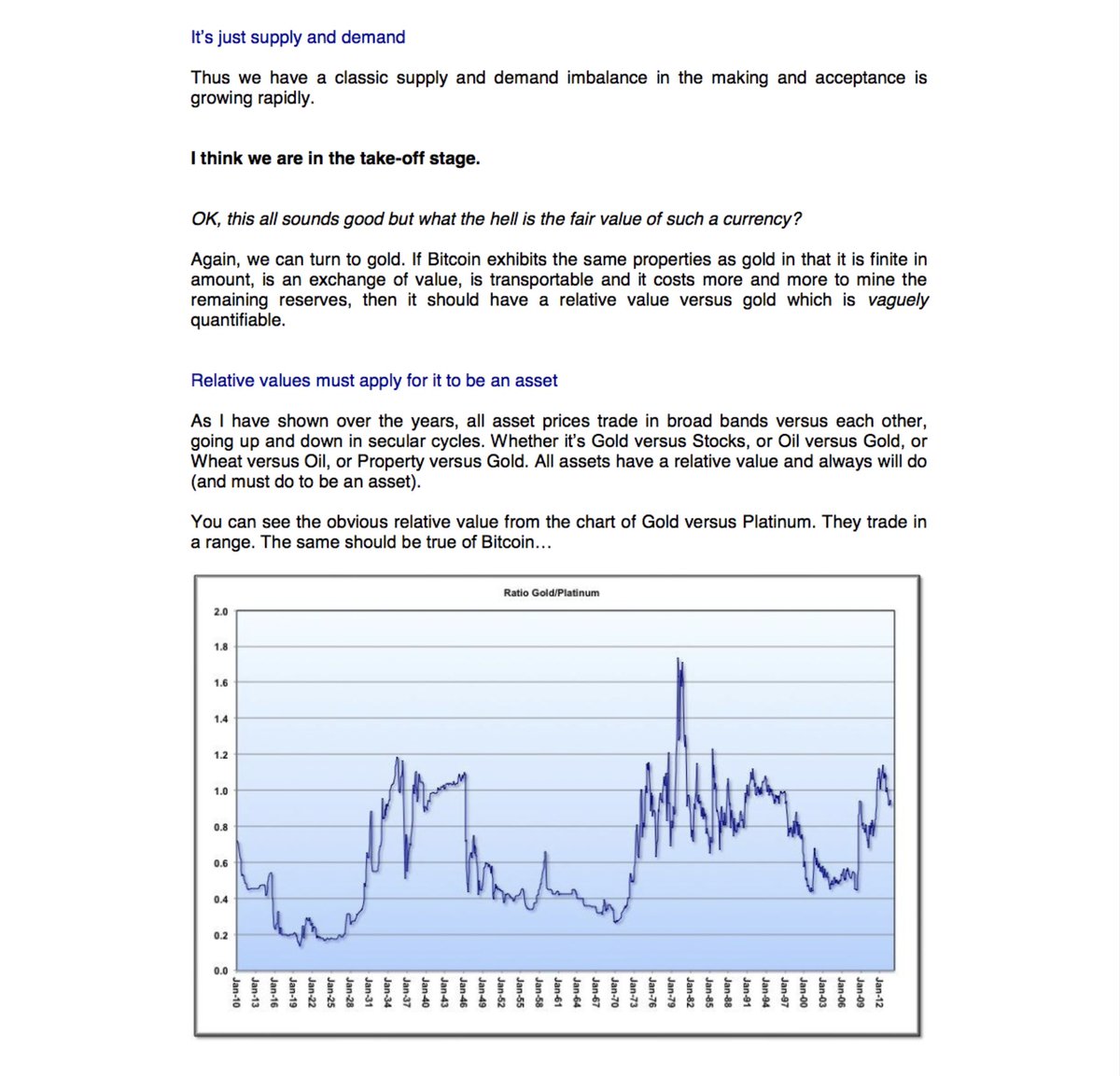

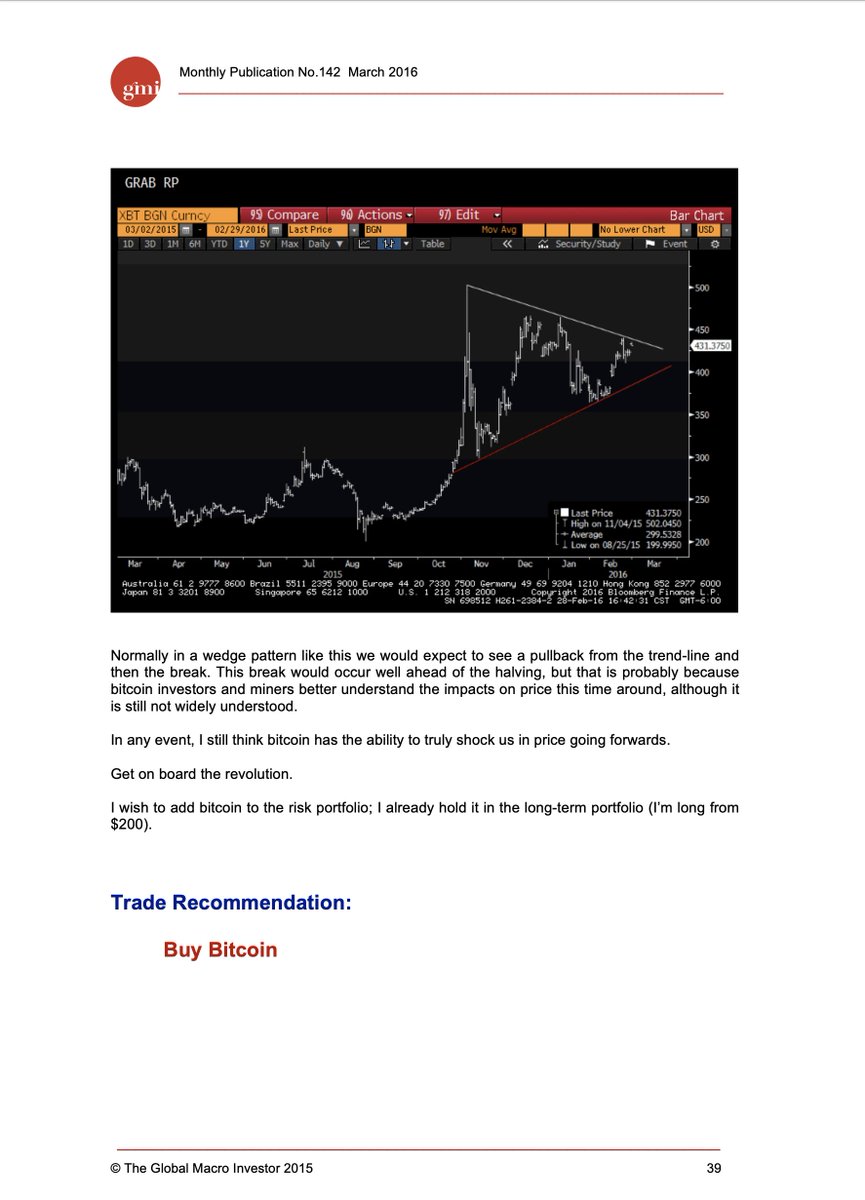

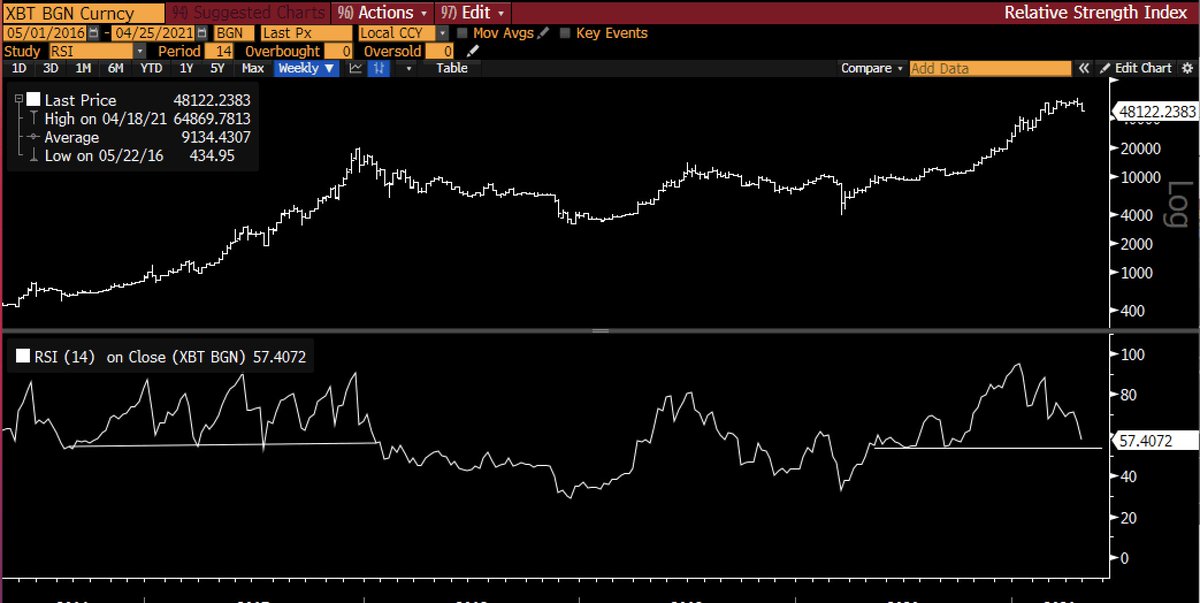

I fist bought Bitcoin in November 2013. Here is the original article where I applied rudimentary stock to flow analysis, later perfected by @100trillionUSD

My equivalence price target was 700 ounces of gold = one BTC. At currency prices that is around $1.3m.

My equivalence price target was 700 ounces of gold = one BTC. At currency prices that is around $1.3m.

It kind of created a stir back then and gave the first ever macro valuation model for BTC.

It was also based around adoption effects...

Obviously, I think it actually exceeds the gold relative valuation over time. This cycle might get it to the original fair value, maybe not.

It was also based around adoption effects...

Obviously, I think it actually exceeds the gold relative valuation over time. This cycle might get it to the original fair value, maybe not.

The only issue - I sold it in the fork wars FUD in 2017 for a 10x profit.

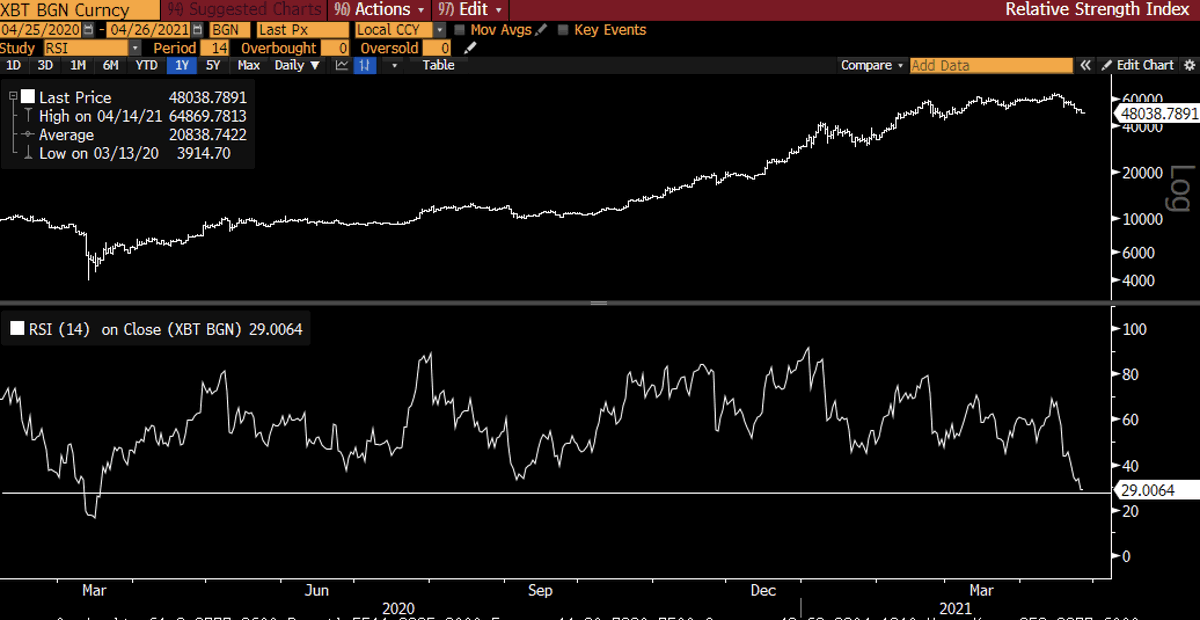

I then began to add it in June 2019 and went all in on the collapse in 2020.

I then began to add it in June 2019 and went all in on the collapse in 2020.

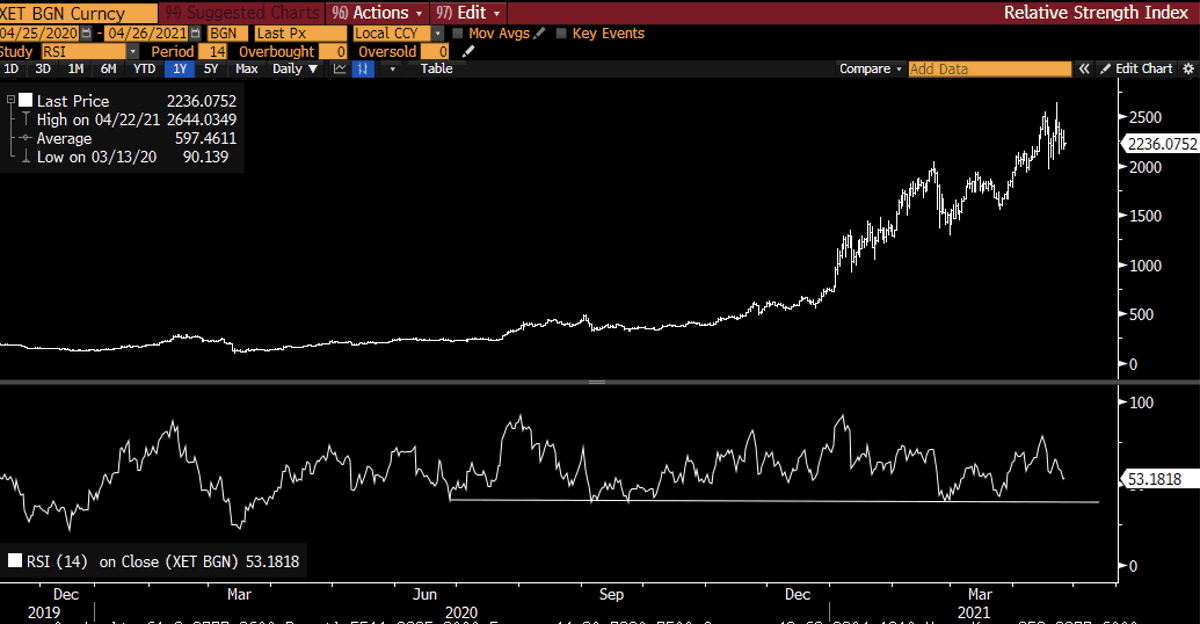

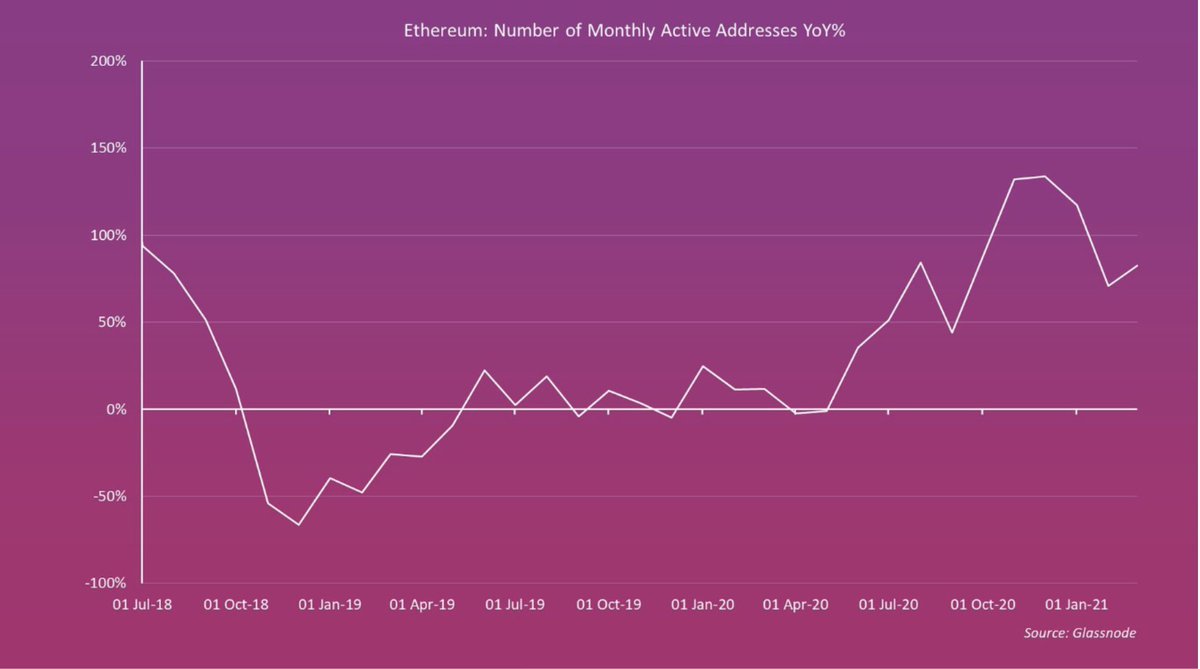

Then I began to add ETH and now have more ETH than bitcoin.

My rational has been made clear and public over time (although much later than those in GMI get to hear about it). I make it public to help people navigate the largest wealth redistribution in history.

My rational has been made clear and public over time (although much later than those in GMI get to hear about it). I make it public to help people navigate the largest wealth redistribution in history.

I want everyone to win - whether you are a bitcoin HODL'er, a ETH head or a crypto Degen.

I want us all to win.

I want us all to win.

I'm also very privately helping the worlds biggest hedge funds, asset management giants, family office, the worlds most famous artists and musicians, influencers, media businesses, executive search firm and others capitalize on one the biggest change to business models in history

What a fucking time to be alive!

I am so grateful to be in the position I'm in. Its all a bit bizarre. I used to be so private, but ho hum, it time to stand up and be counted.

The biggest wealth distribution in history is upon us.

I am so grateful to be in the position I'm in. Its all a bit bizarre. I used to be so private, but ho hum, it time to stand up and be counted.

The biggest wealth distribution in history is upon us.

Helping everyone, that will satisfy my mission.

That is why I set up Real Vision. That is why we launched Real Vision Crypto. The financial world we live in is complex but the risks have now been offset by the gigantic opportunities....

That is why I set up Real Vision. That is why we launched Real Vision Crypto. The financial world we live in is complex but the risks have now been offset by the gigantic opportunities....

GMI stands for Global Macro Investor but it could stand for "Gonna Make It!".

Good luck everyone. It's one hell of a ride. Savour the madness of it all. It's happening at lightening speed!

Good luck everyone. It's one hell of a ride. Savour the madness of it all. It's happening at lightening speed!

• • •

Missing some Tweet in this thread? You can try to

force a refresh