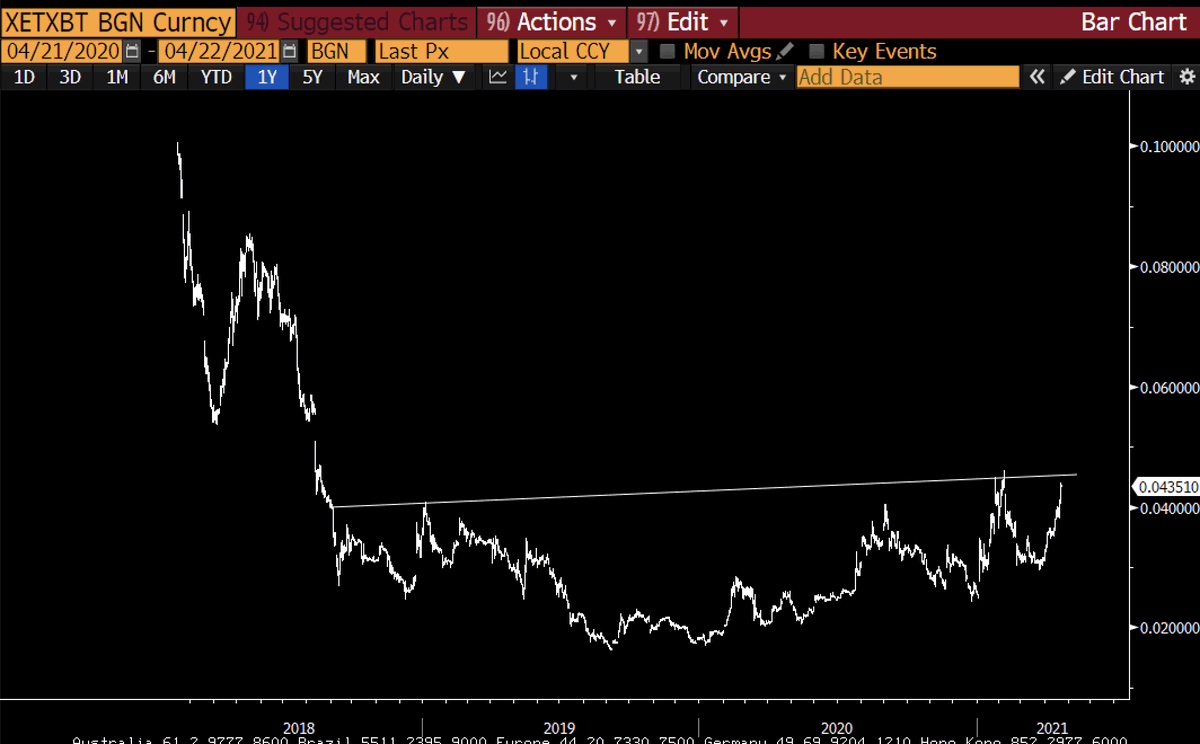

To be brutally honest, I stare at the chart of ETH/BTC and I see an enormous rounded bottom with potentially huge breakout just above....

When you price anything up in DeFi, NFT, community tokens or even metaverse worlds, everything is basically priced in ETH, including designers time etc. ETH is rapidly becoming the currency of the digital world and BTC is the pristine collateral and base layer.

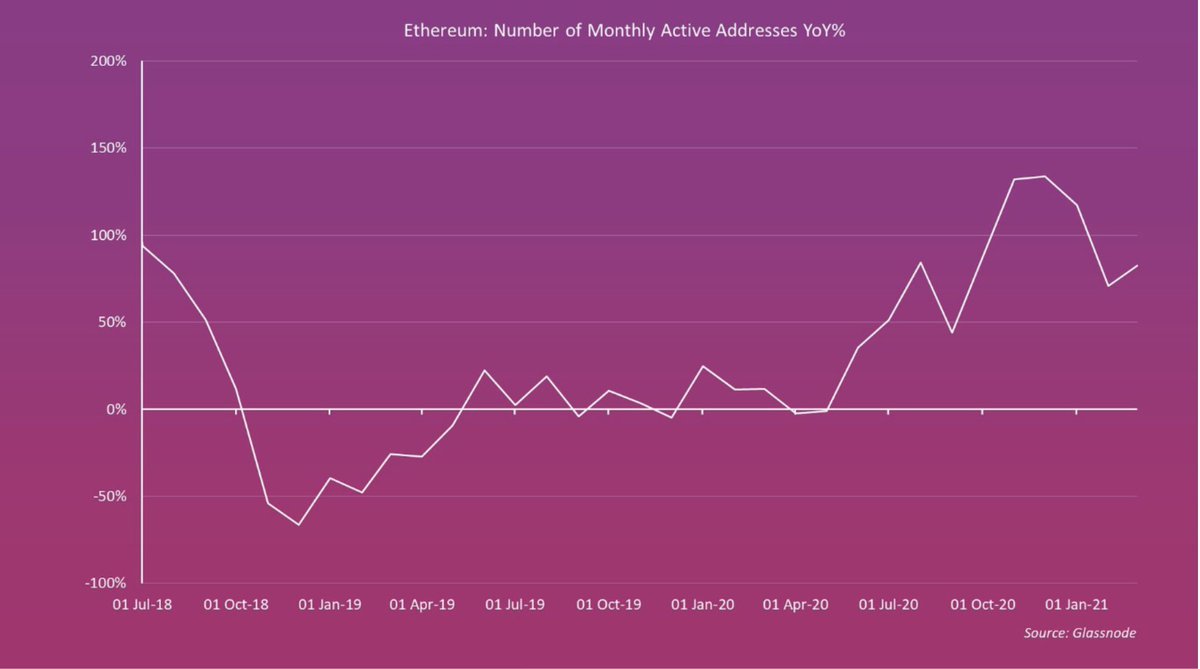

The ETH space is growing at 100% YoY (vs 50% YOY for BTC) and it is attracting a massive proportion of the developer talent and applications too.

At this point in the risk cycle and with ETH 2.0 coming (cheaper fees and less supply), I'm struggling to not sell all my BTC to move my entire core position to ETH.

To be clear - I'm a massive BTC bull, but I think ETH is the better asset allocation for performance right now.

To be clear - I'm a massive BTC bull, but I think ETH is the better asset allocation for performance right now.

Again, this is no attack on the SoV properties etc of BTC but overtime, ETH has outperformed since inception, which is a non-deniable fact and soon it will probably surpass its ATH vs BTC too

• • •

Missing some Tweet in this thread? You can try to

force a refresh