How important is global capital for growth in developing countries?

Not as much as it is traditionally hyped in theory and practice

The reason?

Global capital is a double-edged sword. Its promise versus its perils must be carefully adjudicated

(thread)

Not as much as it is traditionally hyped in theory and practice

The reason?

Global capital is a double-edged sword. Its promise versus its perils must be carefully adjudicated

(thread)

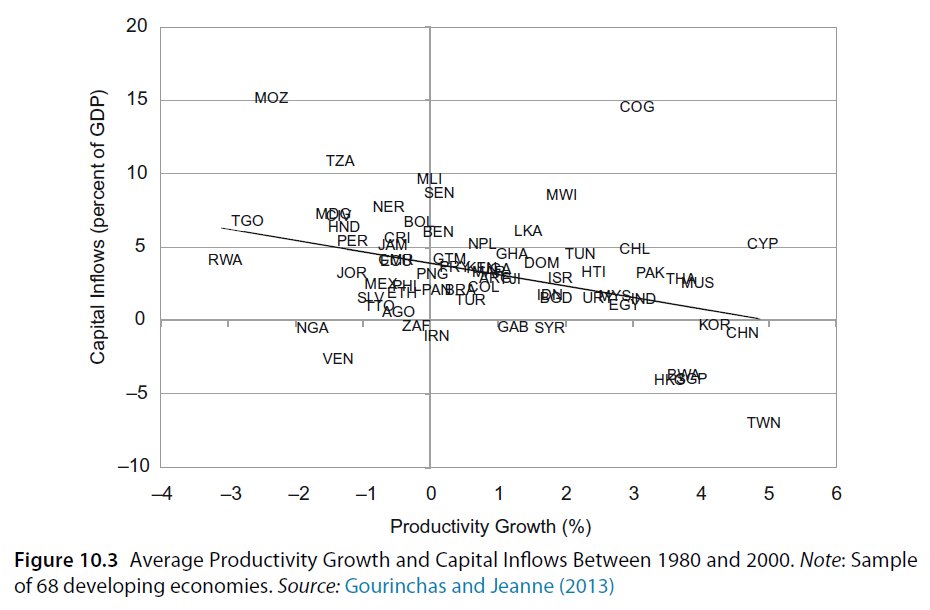

Correlation is not causation, but a useful fact to keep in mind is that developing countries with higher capital inflows tend to have *lower* growth

Countries like China with very low or negative net inflow tend to have the highest growth rate

Countries like China with very low or negative net inflow tend to have the highest growth rate

So should countries just ban capital from coming in?

Of course not.

The key is understanding what kind of capital is healthy versus unhealthy for the economy

kind of like figuring out healthy versus unhealthy food for the body

Of course not.

The key is understanding what kind of capital is healthy versus unhealthy for the economy

kind of like figuring out healthy versus unhealthy food for the body

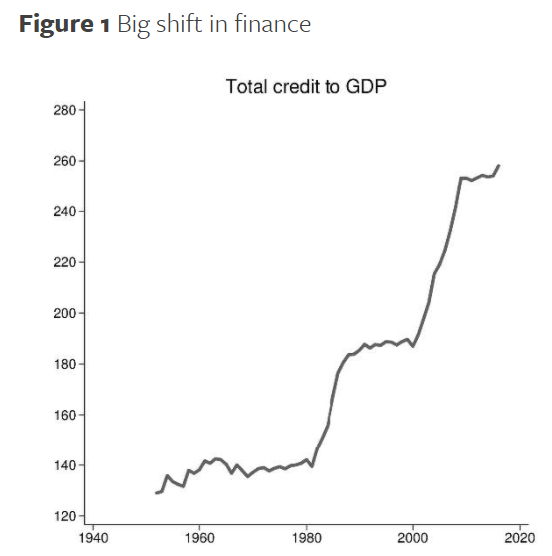

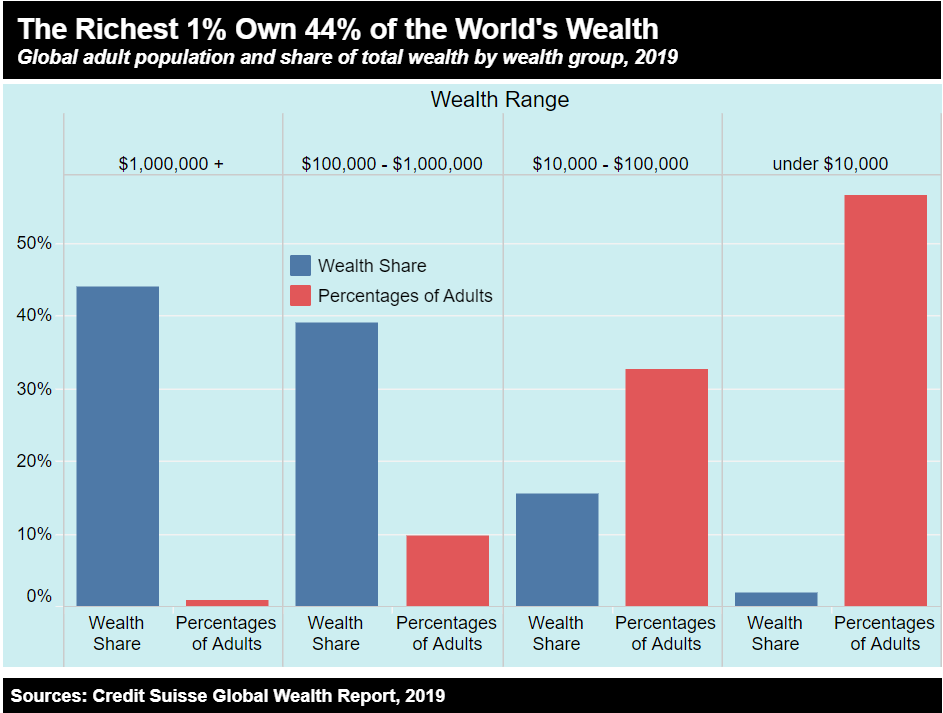

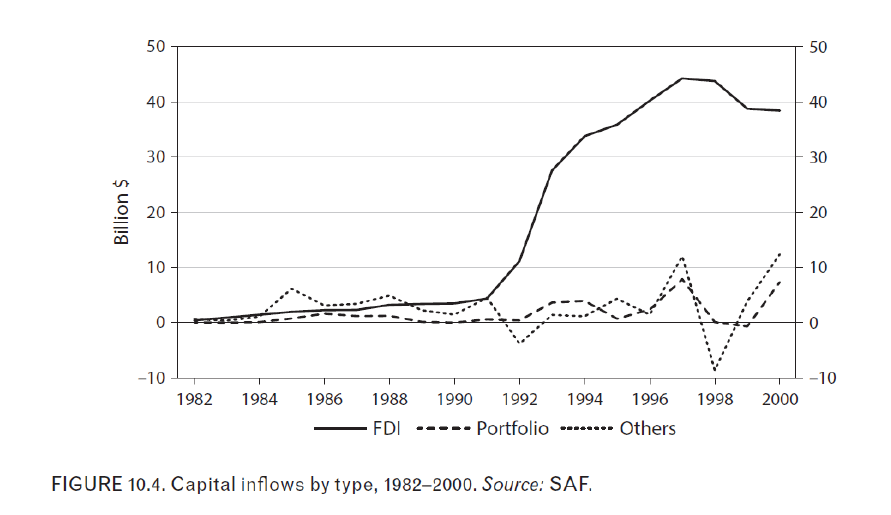

Global capital that goes in and out of developing countries quickly (portfolio flows, short-maturity debt) and capital that finances non-tradable sectors like real estate are examples of unhealthy capital

A large share of global flows can be of the unhealthy kind

And such global capital can be fickle

whiplashing the economy as it surges in and then out, often at inconvenient times as this terrific paper summarizes

helenerey.eu/AjaxRequestHan…

And such global capital can be fickle

whiplashing the economy as it surges in and then out, often at inconvenient times as this terrific paper summarizes

helenerey.eu/AjaxRequestHan…

Developing countries need intelligently designed prudential policies, e.g. capital controls, to protect themselves from the unhealthy capital

So what is healthy global capital?

It is the type of FDI that brings in new technology and skills that raise domestic productivity

So what is healthy global capital?

It is the type of FDI that brings in new technology and skills that raise domestic productivity

One way to think of healthy global capital is that countries are not importing capital, but rather technology and know-how

the capital is necessary only to give foreigners "skin in the game", so they work hard to boost domestic productivity

the capital is necessary only to give foreigners "skin in the game", so they work hard to boost domestic productivity

China essentially followed this playbook during the 90s and beyond, welcoming FDI in high-productivity sectors, while restricting other types of flows

Finally, once an economy develops sufficiently, its diet can change.

For more, you can watch my 30-minute presentation on "the promise and peril of global finance for development" given @CGDev

For more, you can watch my 30-minute presentation on "the promise and peril of global finance for development" given @CGDev

• • •

Missing some Tweet in this thread? You can try to

force a refresh